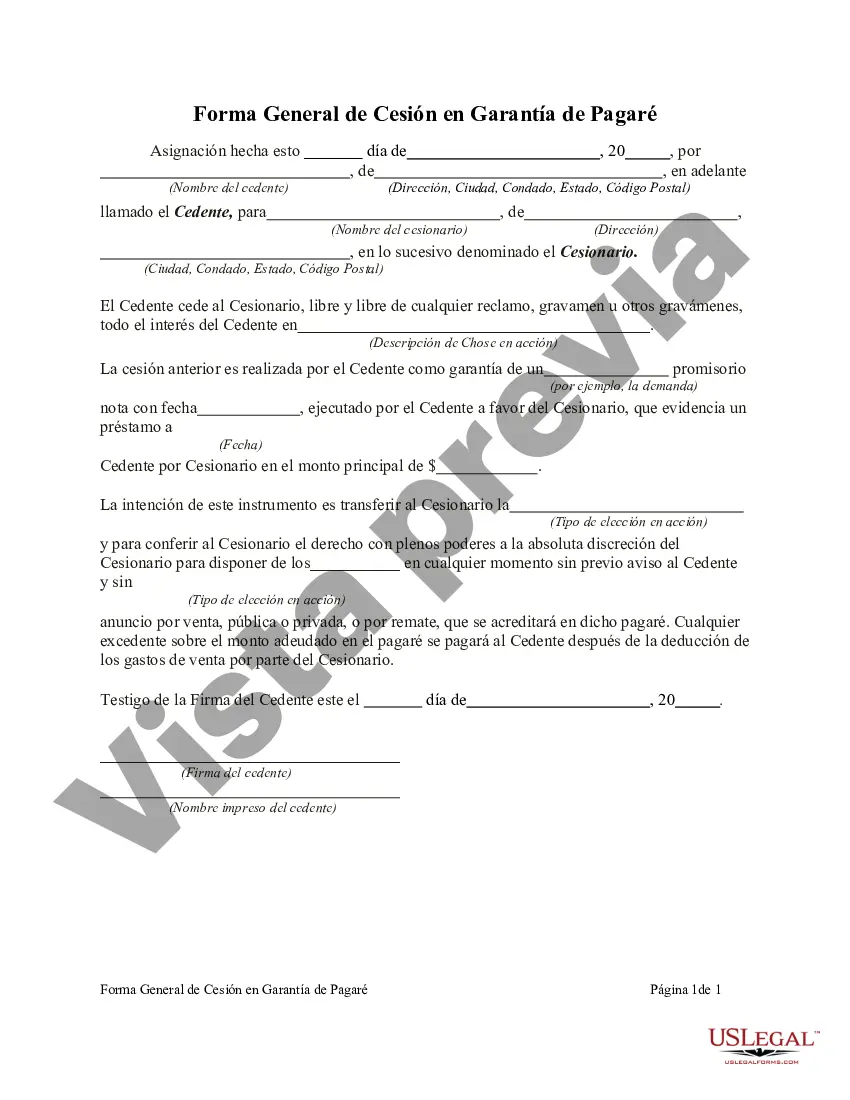

The South Dakota General Form of Assignment as Collateral for Note is a legal document that establishes the transfer of rights, ownership, or interest in a specific collateral item to secure payment or performance of a promissory note. This assignment serves as a guarantee for the lender that if the borrower fails to meet their obligations, the assigned collateral will be used to cover the debts owed. There are various types of South Dakota General Form of Assignment as Collateral for Note, including: 1. Real Estate Assignment: This type of assignment is commonly used when the collateral for the note is a property or piece of real estate. The borrower transfers the legal ownership rights of the property to the lender, providing security for the repayment of the loan. 2. Personal Property Assignment: When the collateral for the note consists of personal property such as vehicles, equipment, or valuable assets, this form of assignment is used. The borrower assigns their ownership rights over the specific personal property to the lender to secure the note. 3. Accounts Receivable Assignment: In cases where the borrower has outstanding accounts receivable owed to them, this form of assignment is utilized. The borrower assigns their right to receive payment from their clients or customers to the lender, ensuring that the lender will be repaid from the proceeds of the assigned accounts. 4. Intellectual Property Assignment: If the collateral for the note includes intellectual property, such as patents, trademarks, or copyrights, this type of assignment is employed. The borrower transfers their ownership or rights to the specific intellectual property to the lender, protecting the lender's interests if there is a default. 5. Investment Assignment: In situations where the borrower's collateral for the note involves investments such as stocks, bonds, or mutual funds, this form of assignment is used. The borrower assigns their ownership rights over the investments to the lender, allowing the lender to liquidate or use the investments to recover the outstanding debt. It is important to note that the specific terms and conditions of the South Dakota General Form of Assignment as Collateral for Note may vary based on the agreement between the borrower and the lender. However, the fundamental purpose of this legal document remains consistent across different types of collateral — to provide security for the repayment of a promissory note.

The South Dakota General Form of Assignment as Collateral for Note is a legal document that establishes the transfer of rights, ownership, or interest in a specific collateral item to secure payment or performance of a promissory note. This assignment serves as a guarantee for the lender that if the borrower fails to meet their obligations, the assigned collateral will be used to cover the debts owed. There are various types of South Dakota General Form of Assignment as Collateral for Note, including: 1. Real Estate Assignment: This type of assignment is commonly used when the collateral for the note is a property or piece of real estate. The borrower transfers the legal ownership rights of the property to the lender, providing security for the repayment of the loan. 2. Personal Property Assignment: When the collateral for the note consists of personal property such as vehicles, equipment, or valuable assets, this form of assignment is used. The borrower assigns their ownership rights over the specific personal property to the lender to secure the note. 3. Accounts Receivable Assignment: In cases where the borrower has outstanding accounts receivable owed to them, this form of assignment is utilized. The borrower assigns their right to receive payment from their clients or customers to the lender, ensuring that the lender will be repaid from the proceeds of the assigned accounts. 4. Intellectual Property Assignment: If the collateral for the note includes intellectual property, such as patents, trademarks, or copyrights, this type of assignment is employed. The borrower transfers their ownership or rights to the specific intellectual property to the lender, protecting the lender's interests if there is a default. 5. Investment Assignment: In situations where the borrower's collateral for the note involves investments such as stocks, bonds, or mutual funds, this form of assignment is used. The borrower assigns their ownership rights over the investments to the lender, allowing the lender to liquidate or use the investments to recover the outstanding debt. It is important to note that the specific terms and conditions of the South Dakota General Form of Assignment as Collateral for Note may vary based on the agreement between the borrower and the lender. However, the fundamental purpose of this legal document remains consistent across different types of collateral — to provide security for the repayment of a promissory note.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.