South Dakota Promissory Note Payable on a Specific Date is a legally binding agreement between two parties, commonly referred to as the borrower and the lender. This financial instrument outlines the terms and conditions under which the borrower promises to repay a specified amount of money to the lender on a predetermined date. The South Dakota Promissory Note Payable on a Specific Date acts as a written promise to repay a loan, typically with interest, within a specific timeframe. It serves as evidence of the debt owed and provides legal protection for both parties involved. There are different types of Promissory Notes under the South Dakota law, including: 1. Secured Promissory Note: This type of note requires the borrower to provide collateral, such as real estate or personal property, to secure the loan. In the event of default, the lender can seize and sell the collateral to recover the outstanding debt. 2. Unsecured Promissory Note: Unlike a secured note, an unsecured note does not require collateral. This type of note relies solely on the borrower's promise to repay the loan, making it riskier for the lender. 3. Installment Promissory Note: This note divides the loan amount into a series of smaller payments or installments, which are paid over a specified period. Each installment consists of principal and interest, allowing the borrower to repay the loan gradually. 4. Demand Promissory Note: With a demand note, the lender has the right to request repayment of the entire loan amount at any time, without specifying a fixed maturity date. This type of note offers flexibility for both parties, allowing the lender to call in the debt and the borrower to repay it as per their financial situation. South Dakota Promissory Note Payable on a Specific Date is a powerful tool that provides legal recourse for both borrowers and lenders in the event of default or any disputes. It outlines the loan amount, interest rate, repayment terms, and penalties for non-payment. It is essential to ensure that all terms are clearly stated, and both parties fully understand their obligations before signing the note. To summarize, a South Dakota Promissory Note Payable on a Specific Date is a legally binding agreement that establishes the terms and conditions for repaying a loan within a specific timeframe. There are different types of promissory notes available, including secured, unsecured, installment, and demand notes. It is crucial for both borrowers and lenders to understand the implications and seek legal advice if needed before entering into such agreements.

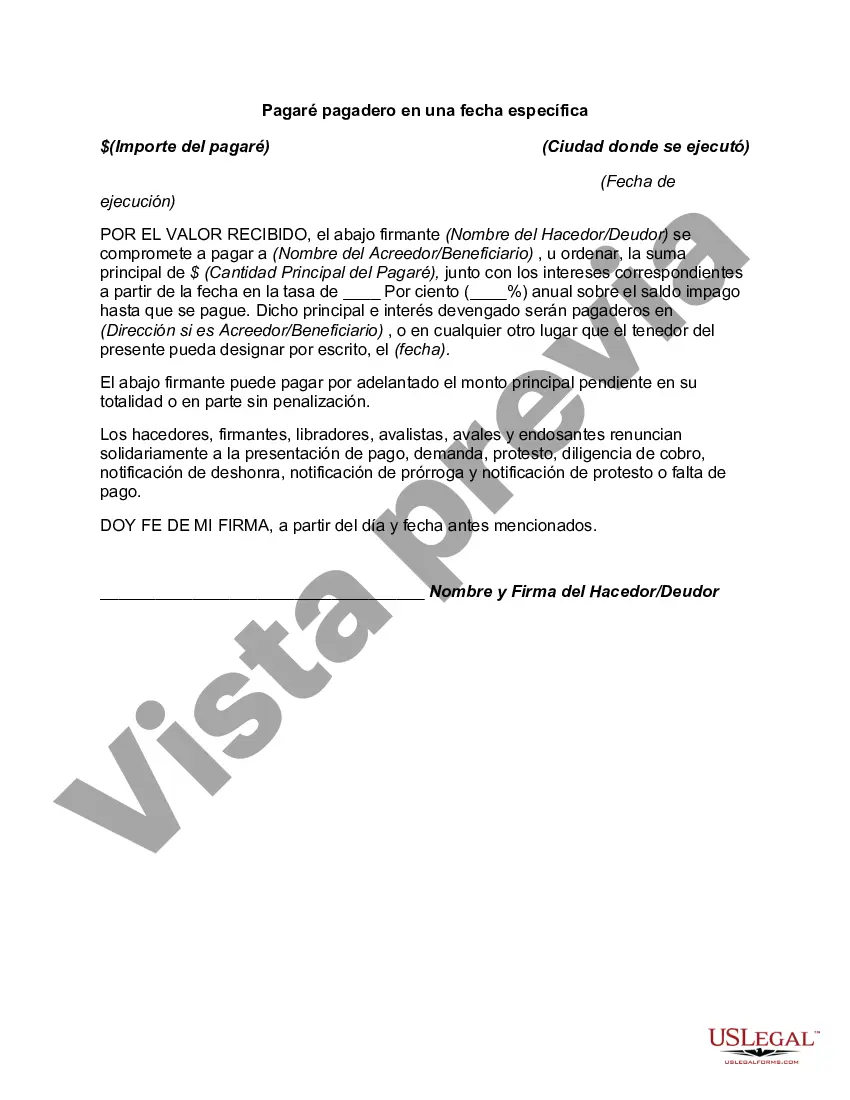

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.South Dakota Pagaré pagadero en una fecha específica - Promissory Note Payable on a Specific Date

Description

How to fill out South Dakota Pagaré Pagadero En Una Fecha Específica?

US Legal Forms - one of many largest libraries of lawful forms in the USA - delivers an array of lawful file templates you are able to acquire or print. Making use of the website, you will get a large number of forms for enterprise and person uses, sorted by categories, states, or search phrases.You can find the latest types of forms just like the South Dakota Promissory Note Payable on a Specific Date within minutes.

If you already have a monthly subscription, log in and acquire South Dakota Promissory Note Payable on a Specific Date in the US Legal Forms catalogue. The Download key will appear on each form you look at. You have accessibility to all in the past downloaded forms inside the My Forms tab of the accounts.

If you want to use US Legal Forms initially, allow me to share straightforward instructions to obtain started off:

- Be sure to have selected the correct form for your city/area. Select the Preview key to review the form`s articles. See the form information to actually have chosen the appropriate form.

- In case the form doesn`t match your requirements, utilize the Search discipline near the top of the display to obtain the one who does.

- When you are content with the form, verify your selection by simply clicking the Acquire now key. Then, opt for the pricing strategy you want and provide your credentials to sign up for the accounts.

- Approach the purchase. Make use of bank card or PayPal accounts to complete the purchase.

- Choose the file format and acquire the form on your own system.

- Make adjustments. Fill out, edit and print and indication the downloaded South Dakota Promissory Note Payable on a Specific Date.

Each template you put into your money lacks an expiry particular date and is also yours permanently. So, in order to acquire or print one more duplicate, just proceed to the My Forms portion and click in the form you need.

Obtain access to the South Dakota Promissory Note Payable on a Specific Date with US Legal Forms, one of the most considerable catalogue of lawful file templates. Use a large number of professional and state-distinct templates that satisfy your company or person requires and requirements.