Title: Understanding the South Dakota Agreement that Statement of Account is True, Correct and Settled Introduction: The South Dakota Agreement that Statement of Account is True, Correct and Settled is a legally binding contract that ensures all financial statements or accounts provided are accurate, complete, and closed. This agreement holds utmost importance as it helps ensure transparency and trust in financial dealings. In South Dakota, there are primarily two types of agreements related to this context: the South Dakota Account Statement Agreement and the South Dakota Account Settlement Agreement. 1. South Dakota Account Statement Agreement: The South Dakota Account Statement Agreement is a legally enforceable contract between two parties, often between a creditor and debtor, but can be applicable in various financial scenarios. This agreement serves as a confirmation that the provided financial statement accurately represents the accounts or transactions in question. The statement includes all relevant details such as balances, transactions, interest, and fees, among others. By signing this agreement, both parties acknowledge the accuracy and completeness of the statement, thereby facilitating a mutual understanding of the financial position. 2. South Dakota Account Settlement Agreement: The South Dakota Account Settlement Agreement is an agreement that ensures the complete settlement of any outstanding financial obligations. This agreement primarily occurs when a debtor and a creditor reach a settlement to resolve an existing debt issue. Through this agreement, the parties establish that the statement of account provided is true, correct, and contains all necessary details regarding the settlement. It helps avoid any future disputes and provides a legal framework for resolving financial matters. Importance and Key Considerations: — Accuracy and Transparency: These agreements help establish trust by ensuring the accuracy and transparency of financial statements and settlement processes. — Legal Protection: By signing these agreements, both parties gain legal protection in case of any future disputes or misunderstandings. — Record Keeping: The agreements serve as official records, providing evidence of the financial dealings and settlement terms. In conclusion, the South Dakota Agreement that Statement of Account is True, Correct and Settled is a crucial legal instrument in financial transactions within the state. It helps maintain transparency, trust, and clear communication between parties involved in financial obligations. Whether it is a South Dakota Account Statement Agreement or a South Dakota Account Settlement Agreement, their proper execution safeguards the interests of both the creditor and debtor.

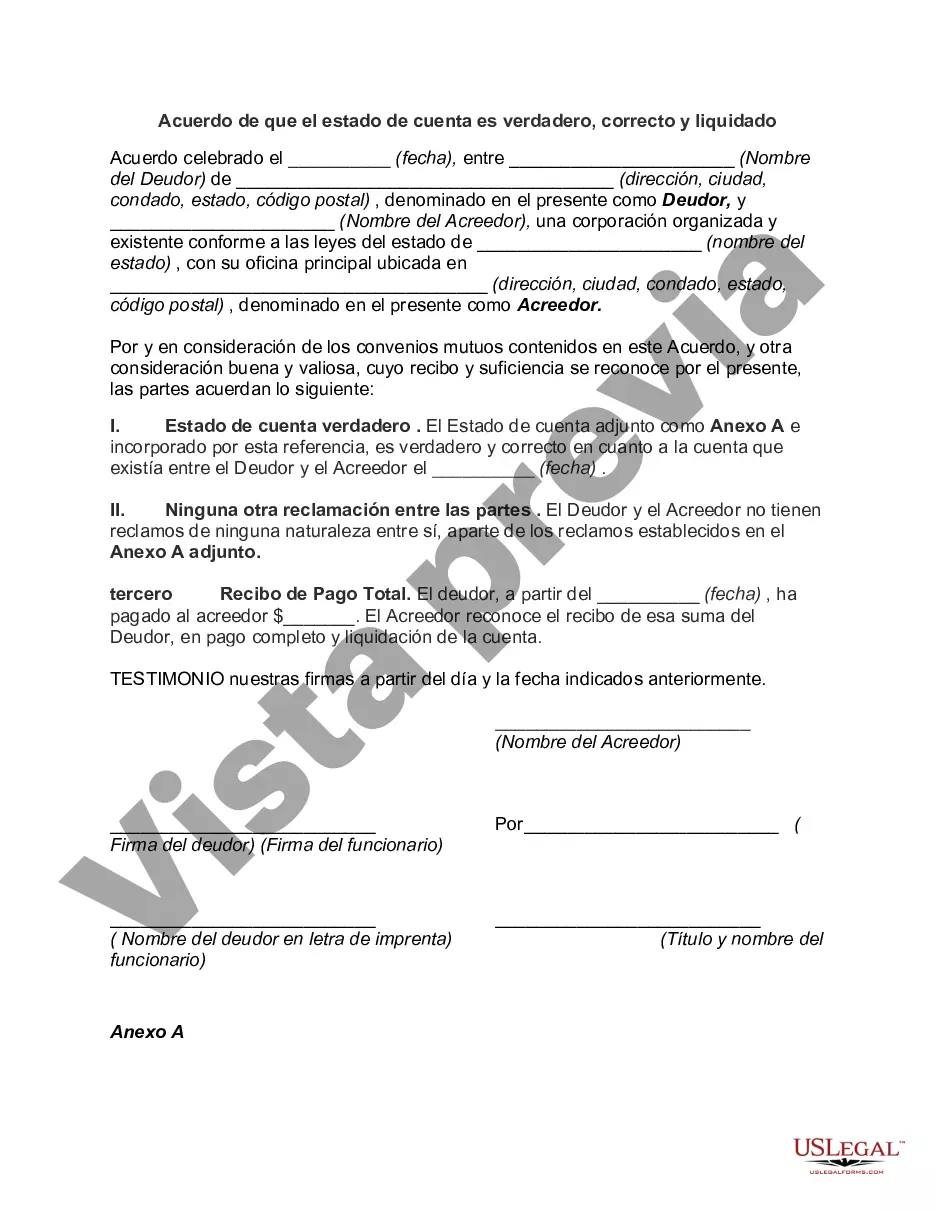

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.South Dakota Acuerdo de que el estado de cuenta es verdadero, correcto y liquidado - Agreement that Statement of Account is True, Correct and Settled

Description

How to fill out South Dakota Acuerdo De Que El Estado De Cuenta Es Verdadero, Correcto Y Liquidado?

If you need to full, down load, or print out lawful record layouts, use US Legal Forms, the biggest assortment of lawful varieties, which can be found on the Internet. Use the site`s easy and hassle-free look for to find the documents you want. A variety of layouts for company and personal functions are sorted by groups and states, or search phrases. Use US Legal Forms to find the South Dakota Agreement that Statement of Account is True, Correct and Settled within a few mouse clicks.

Should you be previously a US Legal Forms consumer, log in for your profile and click on the Download switch to have the South Dakota Agreement that Statement of Account is True, Correct and Settled. You can even access varieties you in the past downloaded in the My Forms tab of your own profile.

If you are using US Legal Forms the very first time, follow the instructions below:

- Step 1. Make sure you have selected the shape for the right town/nation.

- Step 2. Use the Preview solution to examine the form`s information. Never forget about to see the explanation.

- Step 3. Should you be unhappy together with the form, take advantage of the Lookup field at the top of the screen to find other models from the lawful form web template.

- Step 4. Once you have discovered the shape you want, select the Acquire now switch. Choose the costs strategy you choose and add your accreditations to sign up on an profile.

- Step 5. Approach the financial transaction. You can utilize your bank card or PayPal profile to accomplish the financial transaction.

- Step 6. Select the format from the lawful form and down load it on your product.

- Step 7. Full, revise and print out or indication the South Dakota Agreement that Statement of Account is True, Correct and Settled.

Each lawful record web template you acquire is yours forever. You have acces to each form you downloaded with your acccount. Click on the My Forms segment and decide on a form to print out or down load again.

Remain competitive and down load, and print out the South Dakota Agreement that Statement of Account is True, Correct and Settled with US Legal Forms. There are many expert and status-specific varieties you can use to your company or personal demands.