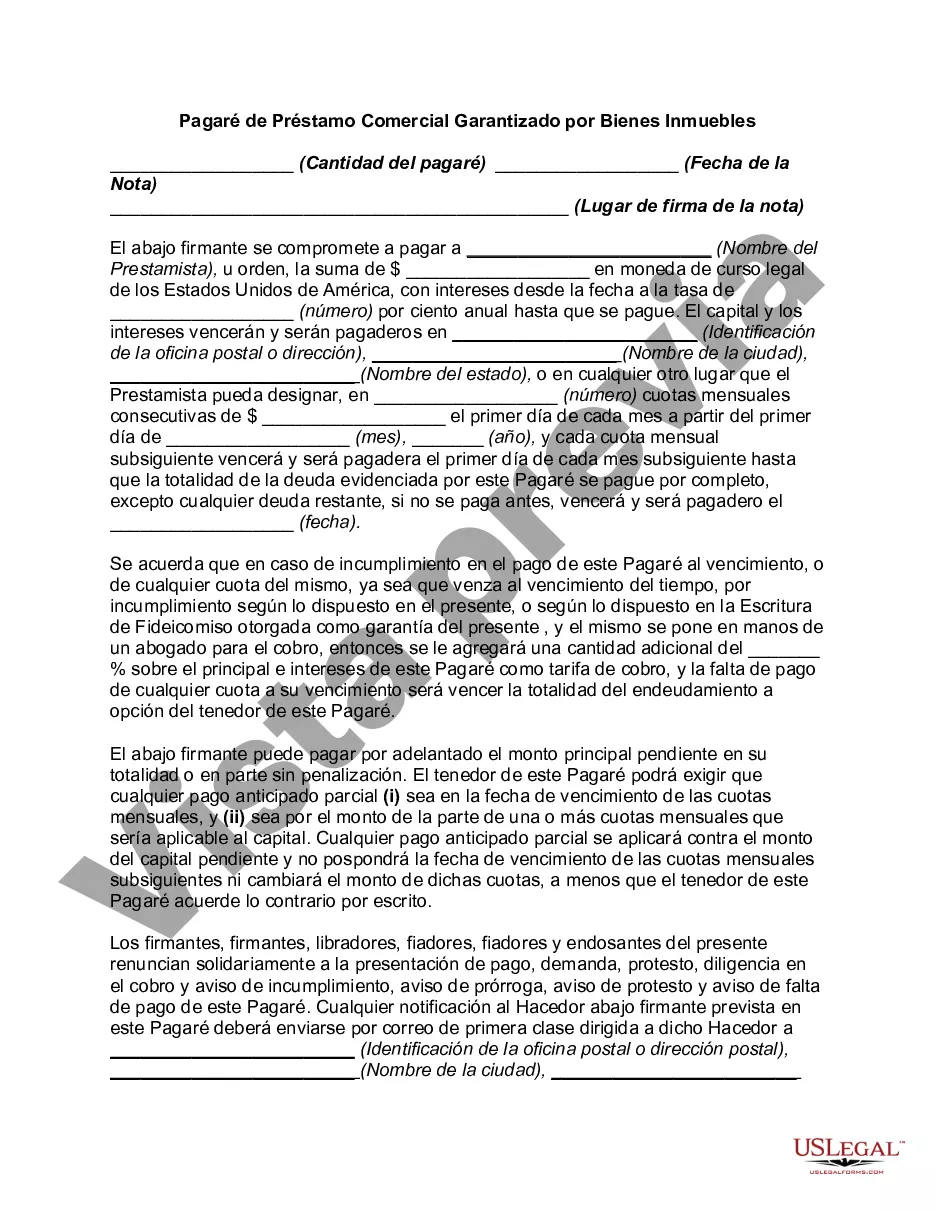

A South Dakota Promissory Note for a Commercial Loan Secured by Real Property is a legally binding document that outlines the terms and conditions of a commercial loan between a lender and a borrower in the state of South Dakota. This type of promissory note is specifically designed for commercial loans where the borrower pledges real property as collateral to secure the loan. The South Dakota Promissory Note for a Commercial Loan Secured by Real Property should include important details such as the names and addresses of both the lender and borrower, the loan amount, the interest rate, repayment terms, and any applicable late fees or penalties. It is crucial to include a thorough description of the real property being used as collateral, including its legal description, address, and any related documentation like the property deed or title. In South Dakota, there may be different types of Promissory Notes for Commercial Loans Secured by Real Property, depending on the specific circumstances of each transaction. Some common variations include: 1. Short-term Promissory Note: This type of promissory note is typically used for loans with a shorter repayment term, usually up to 1 year. It may be suitable for smaller commercial loans or financing requirements that are expected to be satisfied within a relatively short period. 2. Long-term Promissory Note: This type of promissory note is suitable for larger commercial loans, with repayment terms extending beyond 1 year. Long-term notes are often utilized for significant real estate investments or long-term business expansion projects. 3. Fixed-rate Promissory Note: This type of promissory note specifies a fixed interest rate that remains constant throughout the loan's term. It provides borrowers with stability, as they know exactly how much interest they will pay over the loan's duration, regardless of changing market conditions. 4. Adjustable-rate Promissory Note: This type of promissory note includes an adjustable interest rate that can fluctuate over time. The interest rate is usually linked to a specified financial index, such as the Prime Rate or the Treasury Bill rate, and may adjust annually or at predetermined intervals. 5. Balloon Promissory Note: A balloon note is characterized by regular payments based on a fixed amortization schedule for a designated period, usually between 5 and 7 years. After that initial period, a significant final payment (the balloon payment) becomes due. Balloon notes are often employed when the borrower anticipates refinancing, selling the property, or accumulating sufficient funds to repay the loan by the balloon date. It is important for both lenders and borrowers in South Dakota to consult with legal professionals and ensure compliance with state laws and regulations when drafting or entering into a Promissory Note for a Commercial Loan Secured by Real Property.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.South Dakota Pagaré de Préstamo Comercial Garantizado por Bienes Inmuebles - Promissory Note for Commercial Loan Secured by Real Property

Description

How to fill out South Dakota Pagaré De Préstamo Comercial Garantizado Por Bienes Inmuebles?

US Legal Forms - one of several most significant libraries of legal forms in the States - delivers a wide range of legal document web templates it is possible to download or print out. Utilizing the site, you will get a large number of forms for company and individual functions, sorted by categories, claims, or keywords and phrases.You can find the newest types of forms such as the South Dakota Promissory Note for Commercial Loan Secured by Real Property in seconds.

If you currently have a monthly subscription, log in and download South Dakota Promissory Note for Commercial Loan Secured by Real Property in the US Legal Forms library. The Acquire option will show up on each type you see. You have access to all in the past saved forms inside the My Forms tab of your bank account.

In order to use US Legal Forms the first time, listed here are basic guidelines to help you started:

- Make sure you have picked the correct type to your city/state. Click the Review option to examine the form`s articles. Read the type information to actually have chosen the right type.

- If the type doesn`t satisfy your demands, make use of the Lookup field on top of the screen to find the one which does.

- If you are pleased with the form, validate your option by visiting the Purchase now option. Then, select the prices plan you prefer and offer your qualifications to sign up for an bank account.

- Process the deal. Utilize your credit card or PayPal bank account to accomplish the deal.

- Find the structure and download the form on the system.

- Make modifications. Load, change and print out and signal the saved South Dakota Promissory Note for Commercial Loan Secured by Real Property.

Each template you included with your bank account lacks an expiry date and is your own property eternally. So, in order to download or print out an additional duplicate, just check out the My Forms section and then click around the type you require.

Obtain access to the South Dakota Promissory Note for Commercial Loan Secured by Real Property with US Legal Forms, by far the most extensive library of legal document web templates. Use a large number of specialist and express-distinct web templates that meet your small business or individual needs and demands.

Form popularity

FAQ

A promissory note is the document that sets forth the terms of a loan's repayment. A promissory note can be secured with a pledge of collateral, which is something of value that can be seized if a borrower defaults.

As when applying for a traditional mortgage, a promissory note is signed which obligates the buyer to make principal and interest payments according to a preset schedule. Should the buyer default on payments, the seller can foreclose on the property and sell the home.

As part of the home loan mortgage process, you can expect to execute both a legally binding mortgage and mortgage promissory note, which work toward complementary purposes.

Secured Promissory Notes The property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.

A mortgage is a loan secured by property that is used as collateral, which the lender can seize if the borrower defaults on the loan. The promissory note is exactly what it sounds like the borrower's written, signed promise to repay the loan.

A secured promissory note, as the name partially implies, is secured by some form of property (i.e. collateral), while an unsecured promissory note does not involve collateral. If the borrower defaults on a Secured Promissory Note, the lender gets to keep the collateral (the property that was used to secure the loan).

A Secured Promissory Note is a legal agreement that requires a borrower to provide security for a loan. With this lending document, the borrower puts forth their personal property or real estate as collateral if the loan isn't repaid.

A Promissory Note may be secured or unsecured. In case of a secured note, the borrower will be required to provide a collateral such as property, goods, services, etc., in the event that they fail to repay the borrowed amount.

Generally, a Secured Promissory Note will be secured using an additional document. If the property being used as collateral is personal property, the Note will be secured using a Security Agreement. If the property being used as collateral is real property, the Note will be secured using a Deed of Trust.