A South Dakota Revenue Sharing Agreement (RSA) refers to a legally binding contract between parties involved in the licensing and custom modification of software in the state of South Dakota. This agreement outlines the terms and conditions under which the revenues generated from software licensing and customization activities will be shared among the parties involved. Keywords: South Dakota, Revenue Sharing Agreement, income, licensing, custom modification, software The South Dakota Revenue Sharing Agreement is crucial for both software developers and entities that provide licensing and customization services, as it ensures a fair and transparent distribution of income. This agreement helps establish clear guidelines and rules for revenue sharing to avoid any conflicts or disputes in the future. Types of South Dakota Revenue Sharing Agreements to Income from the Licensing and Custom Modification of Software: 1. Standard Revenue Sharing Agreement: This type of RSA serves as a baseline agreement, providing a general framework for revenue sharing. It specifies the percentage of revenue each party will receive based on their contributions, such as software development, licensing services, or customization efforts. 2. Royalty-based Revenue Sharing Agreement: In this variation of the RSA, the income distribution is based on royalties. Parties involved receive a specific percentage of the revenue generated from software licensing and custom modification activities. The percentage may vary depending on factors like the popularity of the software, the extent of customization, and market demand. 3. Performance-based Revenue Sharing Agreement: This type of RSA ties the income distribution to the performance of the software in the market. Parties involved receive a share of the revenue based on predefined performance metrics, such as the number of software licenses sold, customer satisfaction ratings, or revenue growth. 4. Customized Revenue Sharing Agreement: As the name suggests, this type of RSA is tailored to the unique needs and preferences of the parties involved. It allows for flexible income distribution structures, taking into account factors like specific contributions, investments, and risks undertaken by each party. 5. Exclusive Licensing Revenue Sharing Agreement: In certain cases, parties may enter into an exclusive licensing agreement, granting one party the sole right to license and customize the software. Under this type of RSA, the income generated from licensing and customization activities is shared exclusively between the software developer and the authorized licensee based on agreed-upon terms and conditions. In conclusion, the South Dakota Revenue Sharing Agreement outlines the terms and conditions for income distribution from software licensing and custom modification activities. These agreements can take various forms, such as standard, royalty-based, performance-based, customized, or exclusive licensing agreements, catering to the specific needs of the parties involved.

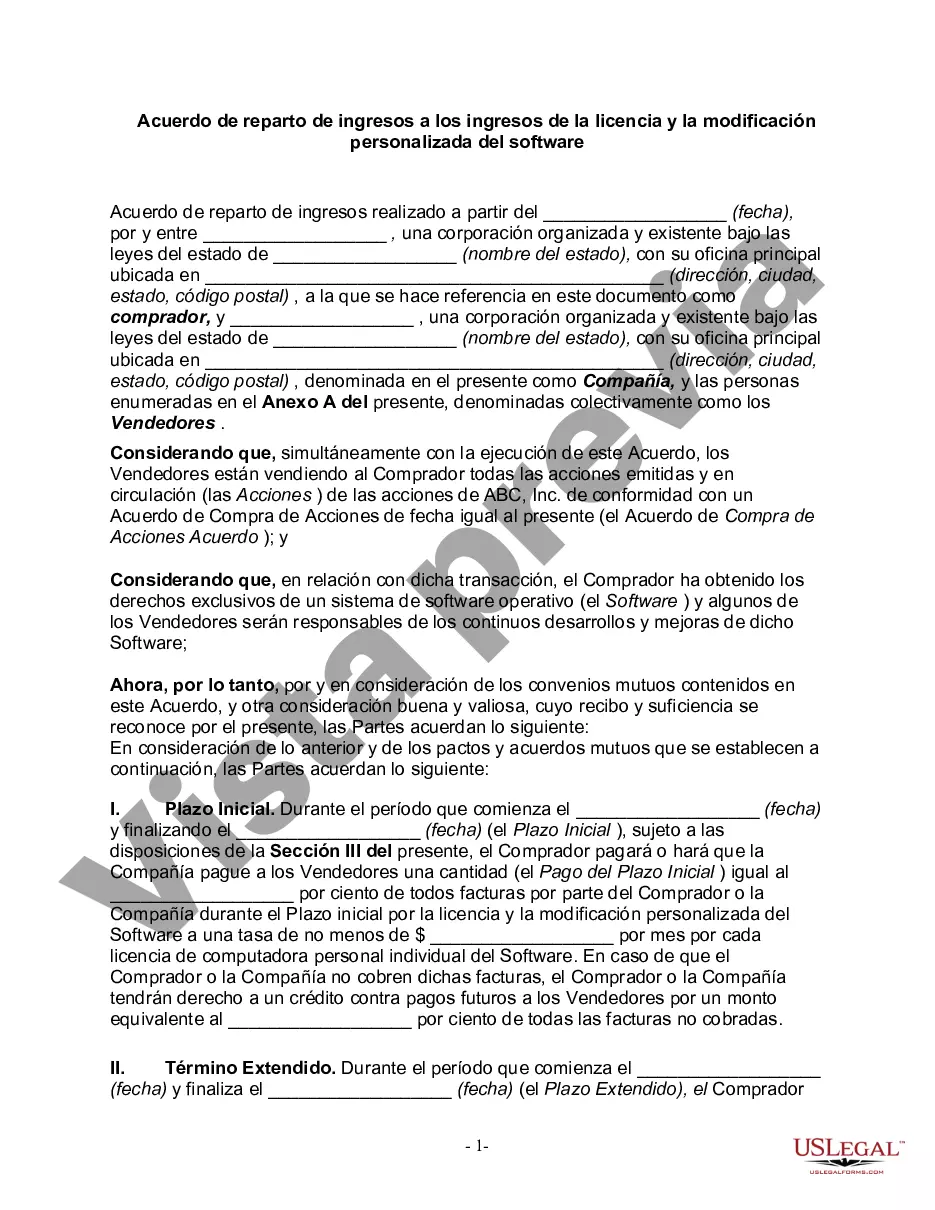

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.South Dakota Acuerdo de reparto de ingresos a los ingresos de la licencia y la modificación personalizada del software - Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software

Description

How to fill out South Dakota Acuerdo De Reparto De Ingresos A Los Ingresos De La Licencia Y La Modificación Personalizada Del Software?

Choosing the best legitimate file design could be a battle. Of course, there are tons of layouts available on the net, but how would you find the legitimate develop you require? Take advantage of the US Legal Forms web site. The service offers 1000s of layouts, such as the South Dakota Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software, which you can use for enterprise and private requires. All of the forms are inspected by specialists and meet up with federal and state demands.

In case you are previously signed up, log in to your account and click the Acquire key to find the South Dakota Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software. Make use of your account to appear throughout the legitimate forms you possess ordered previously. Visit the My Forms tab of your own account and have one more copy from the file you require.

In case you are a brand new customer of US Legal Forms, listed below are easy instructions that you should follow:

- Very first, ensure you have chosen the appropriate develop to your metropolis/area. You can look over the shape utilizing the Review key and look at the shape outline to make certain it is the right one for you.

- When the develop fails to meet up with your requirements, take advantage of the Seach industry to find the proper develop.

- Once you are positive that the shape is suitable, go through the Acquire now key to find the develop.

- Pick the rates plan you need and enter the required information and facts. Create your account and pay for an order with your PayPal account or Visa or Mastercard.

- Opt for the file formatting and download the legitimate file design to your system.

- Complete, modify and produce and sign the attained South Dakota Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software.

US Legal Forms is definitely the greatest local library of legitimate forms for which you will find various file layouts. Take advantage of the service to download skillfully-produced paperwork that follow state demands.