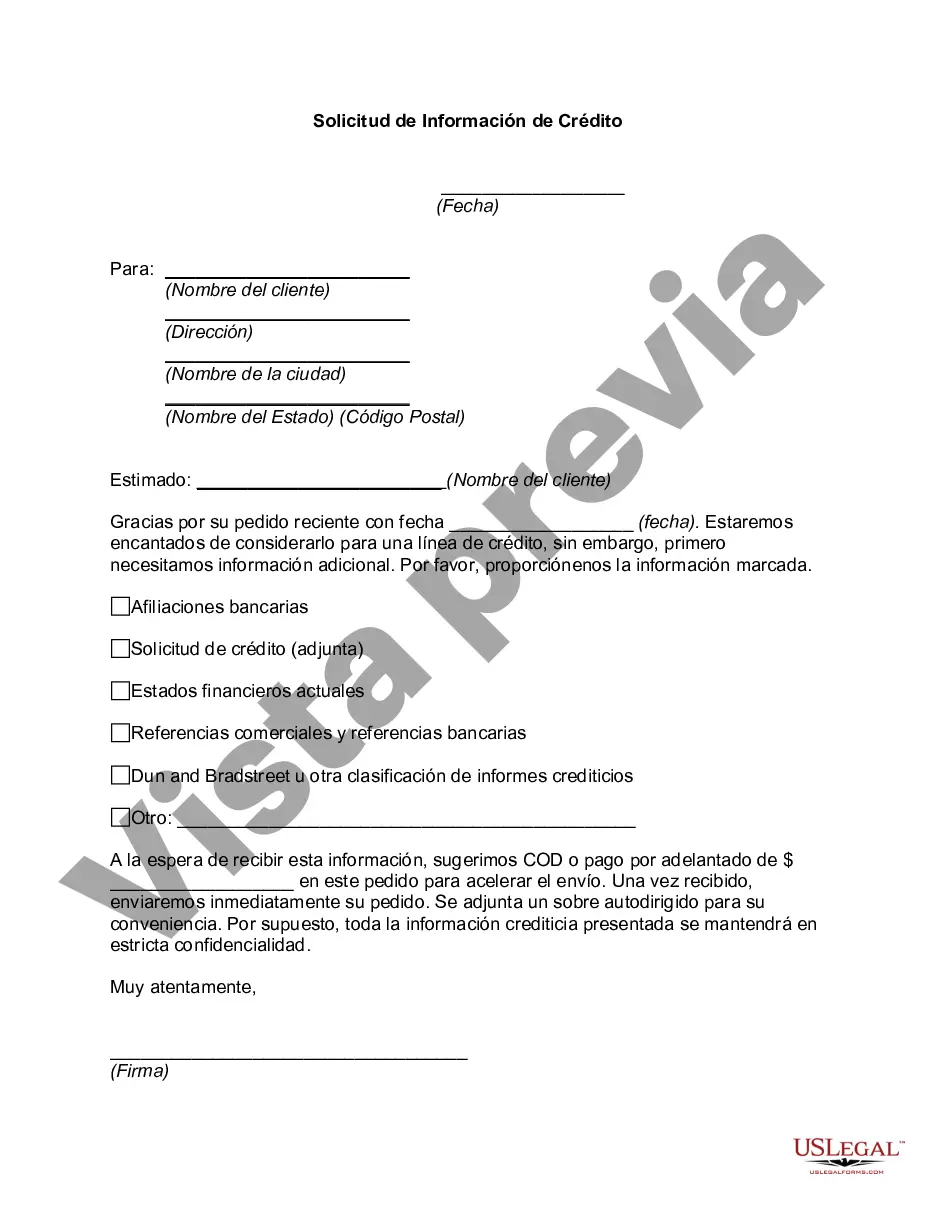

Title: Understanding South Dakota Credit Information Request: Types and Detailed Description Introduction: South Dakota Credit Information Request is a crucial process that allows individuals to access their credit reports and assess their financial standing. This comprehensive guide aims to provide a detailed description of what a South Dakota Credit Information Request entails, including its key components and potential types available. By examining this request, individuals can better understand their creditworthiness and take necessary measures for financial well-being. Key Keywords: South Dakota Credit Information Request, credit report, financial standing, creditworthiness, types Detailed Description: 1. What is a South Dakota Credit Information Request? — A South Dakota Credit Information Request is a formal procedure through which individuals can obtain essential financial information compiled by credit reporting agencies operating in South Dakota. — This request involves accessing credit reports that contain vital data related to an individual's borrowing history, credit accounts, payment records, and overall creditworthiness. 2. Key Components of a South Dakota Credit Information Request: — Personal Information: The request requires individuals to provide their full name, current and previous addresses, date of birth, and Social Security number to verify their identity. — Credit Report Access: By submitting the necessary identification details and paying a nominal fee, individuals can access their credit reports from authorized credit reporting agencies. — Document Authentication: South Dakota Credit Information Request might involve providing supplementary documents, such as a copy of a government-issued ID or proof of residency, to further validate the request. 3. Importance of South Dakota Credit Information Request: — Credit Assessment: By reviewing credit reports, individuals can gain a clear overview of their credit history, including any negative factors affecting their credit score like late payments, delinquencies, or accounts in collections. — Financial Planning: Understanding creditworthiness enables individuals to make informed decisions regarding future financial activities, such as applying for loans, mortgages, or seeking credit extensions. — Identity Theft Protection: Regularly accessing credit reports allows individuals to identify potential signs of identity theft, detect fraudulent activities, and take necessary steps to mitigate such risks. 4. Types of South Dakota Credit Information Requests: — Annual Credit Report Request: Individuals are entitled to one free credit report annually from each of the three major credit reporting agencies (Equifax, Experian, TransUnion) as mandated by federal law. This request type helps provide a comprehensive overview of credit history. — Additional Credit Report Requests: Apart from the free annual credit report request, individuals can also request additional credit reports for a fee to monitor their credit standing more frequently. These requests are useful for regular credit monitoring purposes. Conclusion: A South Dakota Credit Information Request is an important process that allows individuals to access their credit reports and understand their financial standing. By recognizing the significance of creditworthiness and utilizing the various types of credit information requests available, individuals can make informed decisions regarding their financial future. Regularly reviewing credit reports aids in identifying potential issues and ensures proactive protection against identity theft, while supporting effective financial planning and management.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.South Dakota Solicitud de Información de Crédito - Credit Information Request

Description

How to fill out South Dakota Solicitud De Información De Crédito?

It is possible to invest hours online looking for the legitimate papers template that suits the state and federal specifications you will need. US Legal Forms offers a large number of legitimate varieties which are evaluated by specialists. You can actually download or produce the South Dakota Credit Information Request from our support.

If you currently have a US Legal Forms bank account, you are able to log in and click the Down load option. Afterward, you are able to comprehensive, change, produce, or indicator the South Dakota Credit Information Request. Each legitimate papers template you acquire is yours for a long time. To get an additional duplicate of any bought develop, proceed to the My Forms tab and click the corresponding option.

Should you use the US Legal Forms web site for the first time, keep to the easy instructions under:

- Initial, make certain you have chosen the right papers template for the area/metropolis of your choice. Read the develop explanation to ensure you have chosen the proper develop. If available, make use of the Preview option to look throughout the papers template as well.

- In order to locate an additional edition in the develop, make use of the Lookup field to get the template that meets your requirements and specifications.

- Once you have found the template you desire, click on Purchase now to move forward.

- Select the rates plan you desire, key in your references, and sign up for your account on US Legal Forms.

- Total the deal. You can utilize your charge card or PayPal bank account to purchase the legitimate develop.

- Select the formatting in the papers and download it for your device.

- Make alterations for your papers if required. It is possible to comprehensive, change and indicator and produce South Dakota Credit Information Request.

Down load and produce a large number of papers themes using the US Legal Forms web site, that provides the greatest variety of legitimate varieties. Use professional and state-specific themes to handle your company or specific requirements.