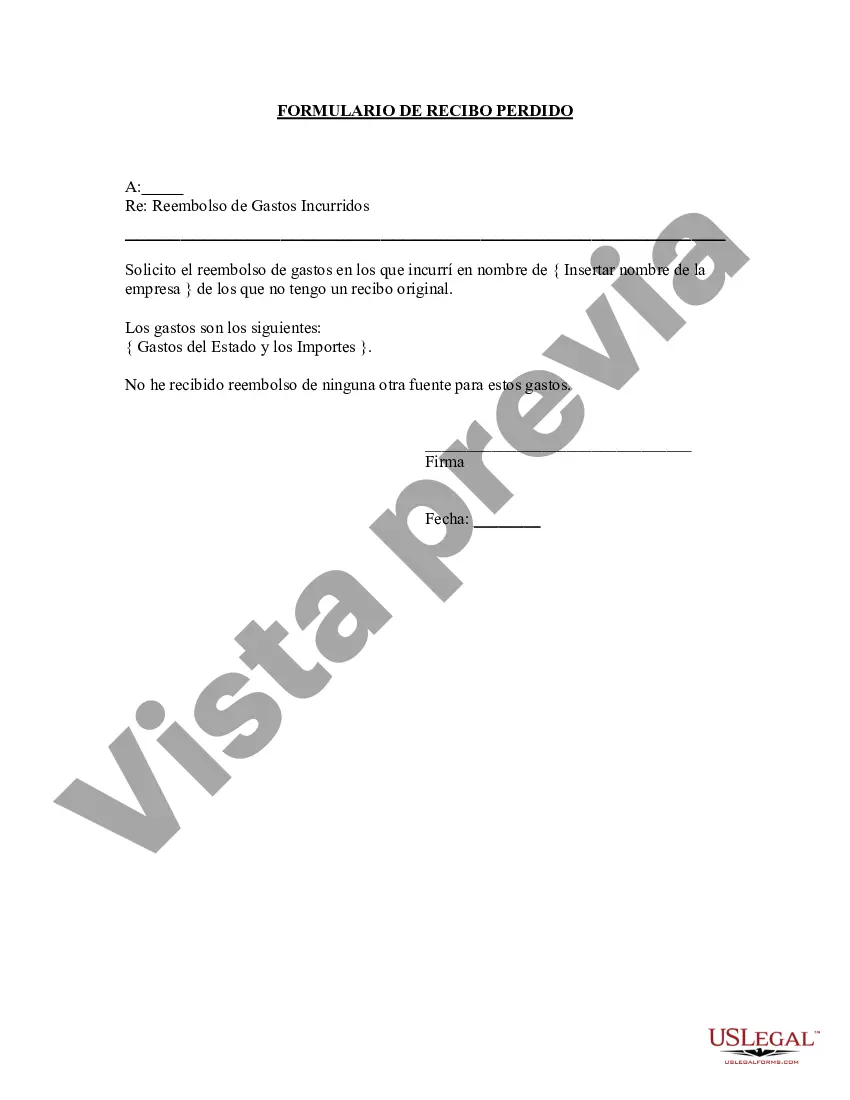

The South Dakota Lost Receipt Form is a document designed to help individuals or businesses who have misplaced or lost their original receipts for tax or reimbursement purposes. It is crucial to keep accurate records of expenses, but in case a receipt is misplaced or damaged, this form acts as a substitute to provide evidence of the transaction. This form is mainly used in South Dakota, a state located in the Midwestern region of the United States. It is particularly significant for taxpayers, employees seeking reimbursement, or individuals required to submit proof of expenses for any official purpose. The Lost Receipt Form ensures that individuals can still claim their expenses even without the original receipt. Keywords: South Dakota, Lost Receipt Form, tax, reimbursement, accurate records, expenses, substitute, evidence, transaction, Midwestern region, taxpayers, employees, reimbursement, proof, official purpose. In addition to the general South Dakota Lost Receipt Form, there may be variations or specific forms based on the purpose or organization involved. Some notable variations include: 1. South Dakota Lost Receipt Form for Tax Purposes: Specifically designed for individuals who need to provide a substitute receipt for tax-related claims. This form aids in ensuring accurate reporting and compliance with tax regulations. 2. South Dakota Lost Receipt Form for Employee Reimbursement: This particular form is used by employees seeking reimbursement from their employer for business-related expenses they have incurred but are unable to produce the original receipt. 3. South Dakota Lost Receipt Form for Expense Accountability: This form is mainly used by organizations or agencies requiring their employees or members to provide an alternative receipt in case of lost or missing receipts for expenses incurred on official business. 4. South Dakota Lost Receipt Form for Government Entities: Government entities or departments may have their own version of the Lost Receipt Form to address specific regulations, procedures, or reporting requirements applicable to their operations. Keywords: South Dakota, Lost Receipt Form, tax purposes, reimbursement, employee, substitute receipt, accurate reporting, compliance, regulations, business-related expenses, expense accountability, organization, agency, government entities, departments, procedures, reporting requirements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.South Dakota Formulario de recibo perdido - Lost Receipt Form

Description

How to fill out South Dakota Formulario De Recibo Perdido?

Are you in a situation where you will need files for sometimes organization or personal purposes nearly every time? There are tons of authorized papers web templates available online, but discovering ones you can trust is not simple. US Legal Forms provides a huge number of form web templates, such as the South Dakota Lost Receipt Form, that are created to fulfill federal and state specifications.

Should you be previously familiar with US Legal Forms web site and possess a free account, simply log in. Following that, you may obtain the South Dakota Lost Receipt Form web template.

If you do not have an bank account and want to begin using US Legal Forms, follow these steps:

- Find the form you need and make sure it is to the proper city/county.

- Make use of the Review switch to review the shape.

- See the outline to actually have selected the right form.

- In the event the form is not what you are looking for, use the Look for discipline to obtain the form that meets your needs and specifications.

- If you obtain the proper form, simply click Get now.

- Select the rates prepare you would like, complete the specified information and facts to produce your bank account, and buy an order utilizing your PayPal or Visa or Mastercard.

- Select a hassle-free paper structure and obtain your version.

Get every one of the papers web templates you possess purchased in the My Forms food list. You can get a additional version of South Dakota Lost Receipt Form whenever, if required. Just go through the essential form to obtain or printing the papers web template.

Use US Legal Forms, one of the most comprehensive assortment of authorized varieties, to save time and prevent faults. The assistance provides skillfully manufactured authorized papers web templates which you can use for a range of purposes. Generate a free account on US Legal Forms and commence producing your daily life easier.