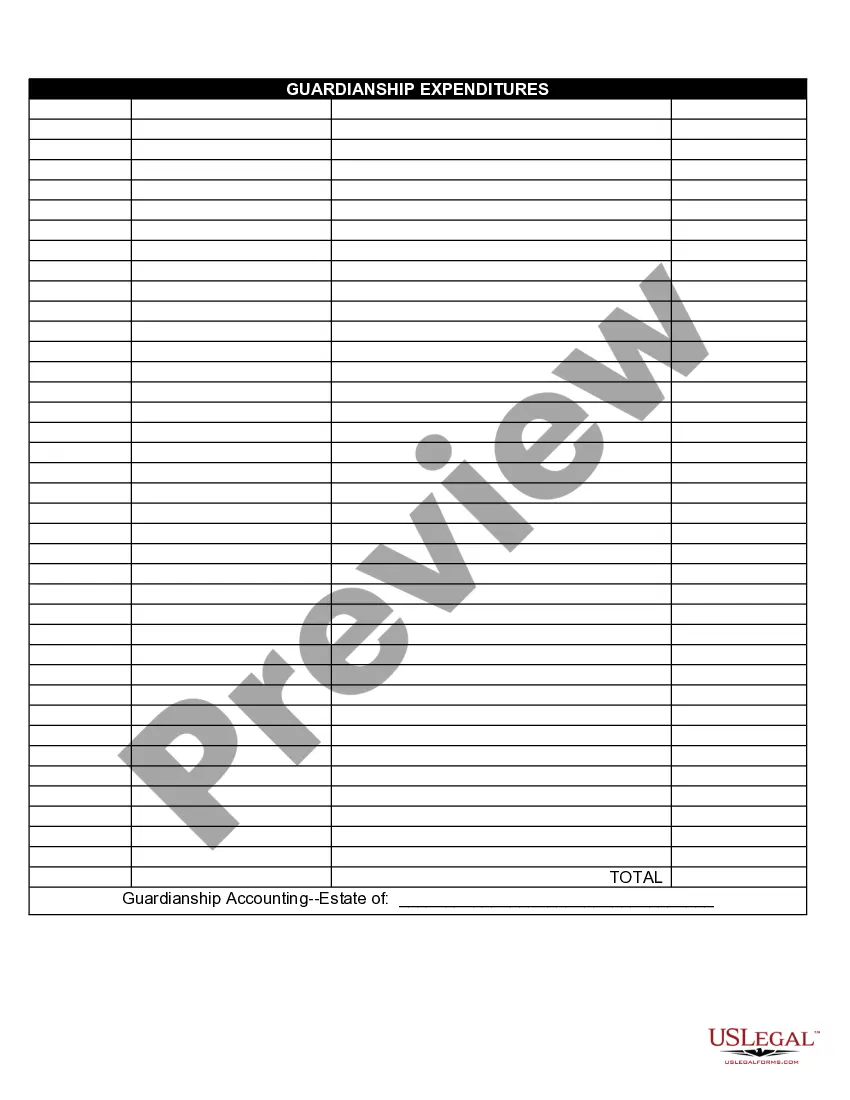

South Dakota Guardianship Expenditures

Description

How to fill out Guardianship Expenditures?

Have you been in a situation in which you will need paperwork for possibly enterprise or individual purposes just about every day time? There are plenty of lawful file layouts available online, but getting versions you can rely on is not effortless. US Legal Forms gives a huge number of form layouts, just like the South Dakota Guardianship Expenditures, which are published to meet state and federal needs.

If you are previously acquainted with US Legal Forms web site and get an account, just log in. Following that, you may acquire the South Dakota Guardianship Expenditures web template.

Unless you come with an account and wish to begin to use US Legal Forms, follow these steps:

- Get the form you want and make sure it is for your proper metropolis/region.

- Make use of the Preview switch to check the form.

- Read the explanation to ensure that you have selected the appropriate form.

- If the form is not what you`re seeking, make use of the Look for area to discover the form that suits you and needs.

- Whenever you get the proper form, click Buy now.

- Opt for the prices prepare you need, fill in the necessary details to create your bank account, and buy your order utilizing your PayPal or bank card.

- Choose a practical file formatting and acquire your backup.

Locate all of the file layouts you have purchased in the My Forms menus. You can obtain a additional backup of South Dakota Guardianship Expenditures at any time, if needed. Just select the essential form to acquire or print out the file web template.

Use US Legal Forms, by far the most comprehensive selection of lawful kinds, to conserve efforts and steer clear of faults. The support gives skillfully produced lawful file layouts which can be used for a range of purposes. Generate an account on US Legal Forms and start producing your life easier.

Form popularity

FAQ

The appointment of a guardian or conservator of a protected person does not constitute a general finding of legal incompetence unless the court so orders, and the protected person shall otherwise retain all rights which have not been granted to the guardian or conservator, with the exception of the ability to create an ...

Under South Dakota law, a ?guardian? has authority over personal and healthcare decisions while a ?conservator? has authority over the protected person's property and financial affairs.

A South Dakota Guardian of Minor Power of Attorney Form enables parents to empower an agent with the ability and authority to safeguard the well-being of their children when they are otherwise unavailable or unattainable.

If a Guardian and Conservator is seeking to terminate the guardianship/conservatorship, the Guardian and Conservator must include the Final Report (UJS 142) and Final Accounting with Objection Notice (UJS 141). SDCL 29A-5-401, 29A-5-403.

Under South Dakota law, the temporary guardianship or conservatorship of a minor child cannot be longer than 6 months, and the temporary guardianship or conservatorship of a protected person cannot be longer than 90 days, unless extended for an additional 90 days by court order.