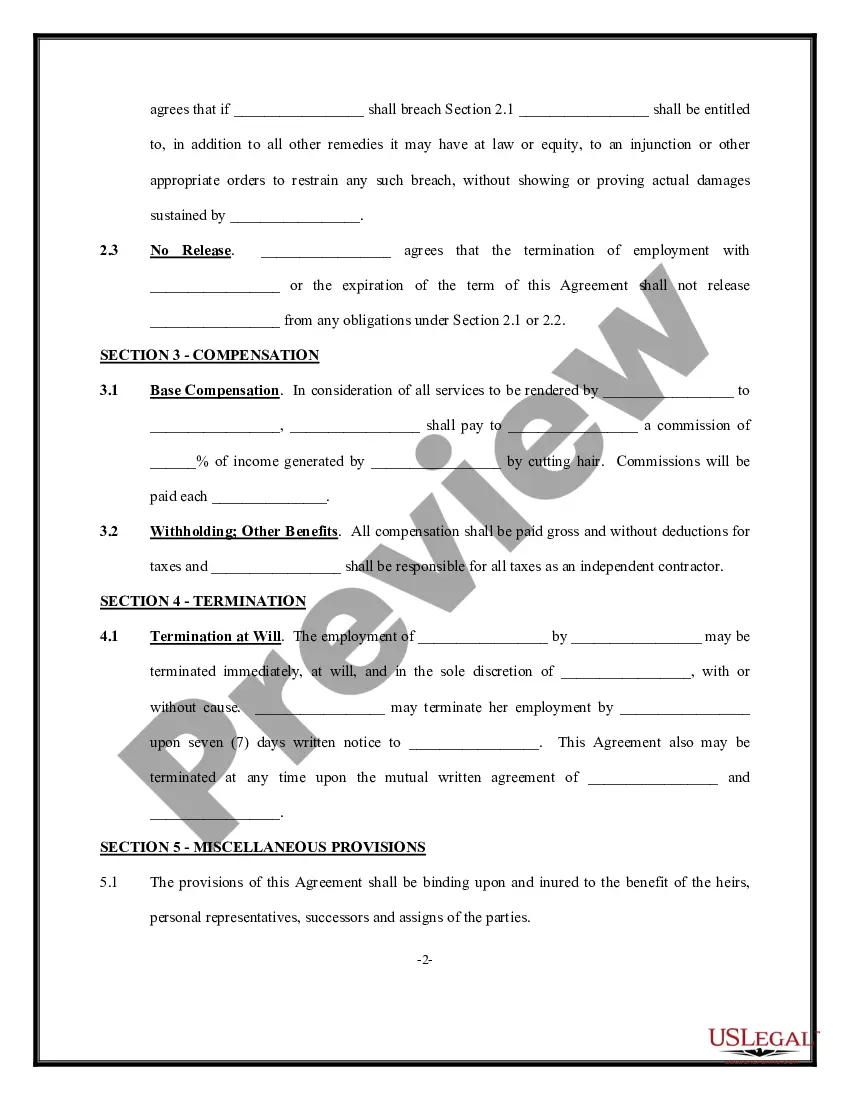

South Dakota Independent Contractor Agreement for Hair Stylist

Description

How to fill out Independent Contractor Agreement For Hair Stylist?

Choosing the best legal record web template can be quite a have a problem. Naturally, there are a variety of layouts available on the net, but how will you get the legal type you will need? Make use of the US Legal Forms web site. The assistance offers a large number of layouts, like the South Dakota Independent Contractor Agreement for Hair Stylist, that you can use for business and personal requires. Each of the kinds are examined by specialists and meet up with state and federal requirements.

When you are presently registered, log in to your bank account and click on the Obtain switch to have the South Dakota Independent Contractor Agreement for Hair Stylist. Make use of bank account to appear throughout the legal kinds you have acquired earlier. Go to the My Forms tab of the bank account and acquire yet another copy from the record you will need.

When you are a brand new customer of US Legal Forms, here are basic instructions so that you can follow:

- Initially, ensure you have selected the proper type to your town/area. You may examine the form while using Review switch and browse the form information to make certain it is the right one for you.

- If the type will not meet up with your needs, take advantage of the Seach field to get the appropriate type.

- When you are certain that the form is proper, select the Buy now switch to have the type.

- Opt for the costs program you would like and enter the required info. Create your bank account and buy the order utilizing your PayPal bank account or bank card.

- Pick the document formatting and acquire the legal record web template to your product.

- Full, edit and produce and indication the acquired South Dakota Independent Contractor Agreement for Hair Stylist.

US Legal Forms may be the biggest local library of legal kinds for which you can find various record layouts. Make use of the service to acquire appropriately-created paperwork that follow status requirements.

Form popularity

FAQ

Self-employed salon owners and independent contractors should include any tips they personally receive in the income they report on their tax returns. And if you receive payments through online payment services such as PayPal, you might receive a 1099-K.

Reporting Income and EarningsIf you rent space in a salon, the owners may send you a 1099-MISC showing your earnings for the year. Not every salon does this, so it's important to keep records of your own. That's particularly true for cash payments, as you don't have checks or credit-card receipts to remind you.

If the stylist is employed by a hair studio, which pays them an hourly wage, then the company withholds taxes. If the stylist rents a booth in a hair salon, or is self-employed, then they file taxes differently. When taxes are withheld from wages, the employee files taxes based on income found on a W-2 form.

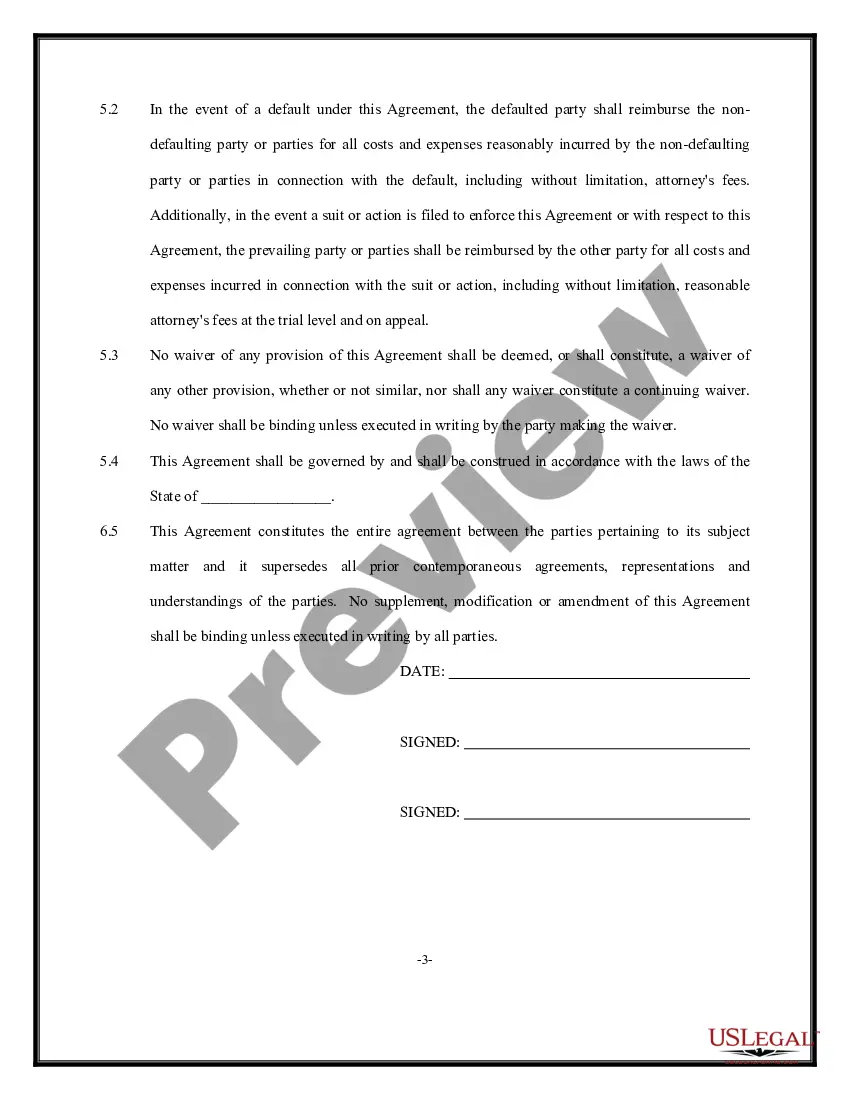

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

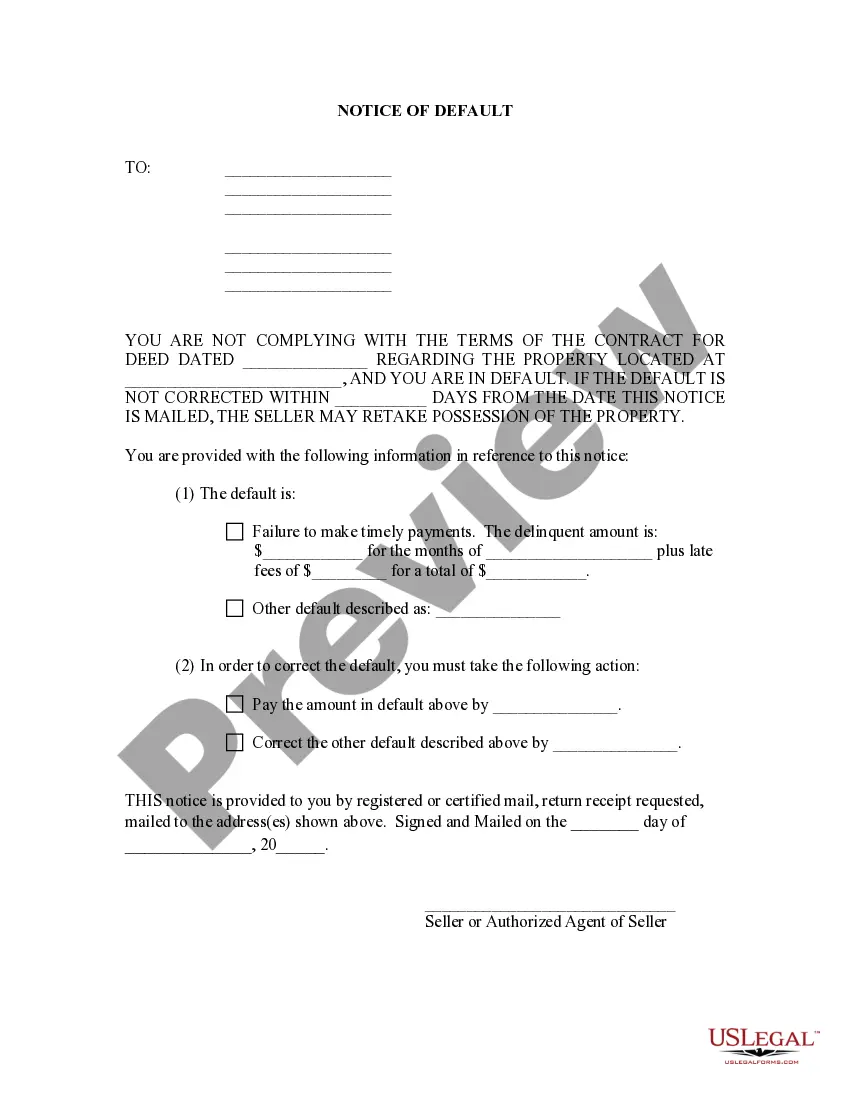

What the service is and how much the contractor will be paid. If the client/customer will cover expenses or provide resources. When the contract will end. If either party will be penalized for things such as late payments or unfinished work.

An Independent Contractor Agreement is a written contract that outlines the terms and conditions of the working arrangement between an independent contractor and client, including: A description of the services provided. Terms and length of the project or service.

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

They have a dress code to follow, behavioral or procedural policies are in place, they need to arrive on time and their prices are determined by the salon owner. In this structure stylists are paid their agreed upon commission split throughout the year and then are handed a 1099 to file on their own.

Here are some steps you may use to guide you when you write an employment contract:Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.Employment.More items...?