South Dakota Farm Lease or Rental - Crop Share

Description

How to fill out Farm Lease Or Rental - Crop Share?

You have the capability to dedicate time online to search for the legal document template that fulfills the federal and state requirements you desire. US Legal Forms offers an extensive collection of legal templates that are vetted by professionals.

You can download or print the South Dakota Farm Lease or Rental - Crop Share from our service.

If you already possess a US Legal Forms account, you may Log In and then click the Obtain button. Subsequently, you can complete, modify, print, or sign the South Dakota Farm Lease or Rental - Crop Share. Every legal document template you acquire is yours indefinitely. To obtain another copy of any downloaded form, go to the My documents tab and click on the corresponding button.

Select the format of the document and download it to your device. Make adjustments to your document if necessary. You can complete, edit, and sign and print the South Dakota Farm Lease or Rental - Crop Share. Obtain and print numerous document templates using the US Legal Forms site, which provides the largest selection of legal forms. Utilize expert and state-specific templates to meet your business or personal requirements.

- If you are visiting the US Legal Forms site for the first time, follow the straightforward instructions listed below.

- First, confirm that you have chosen the correct document template for the location/region you select. Review the document description to ensure you have selected the proper form. If available, utilize the Review button to examine the document template as well.

- To locate another version of the document, use the Search field to find the template that meets your criteria and needs.

- Once you have identified the template you wish to use, click on Get now to continue.

- Choose the pricing plan you prefer, enter your credentials, and register for an account on US Legal Forms.

- Complete the payment. You can use your credit card or PayPal account to pay for the legal document.

Form popularity

FAQ

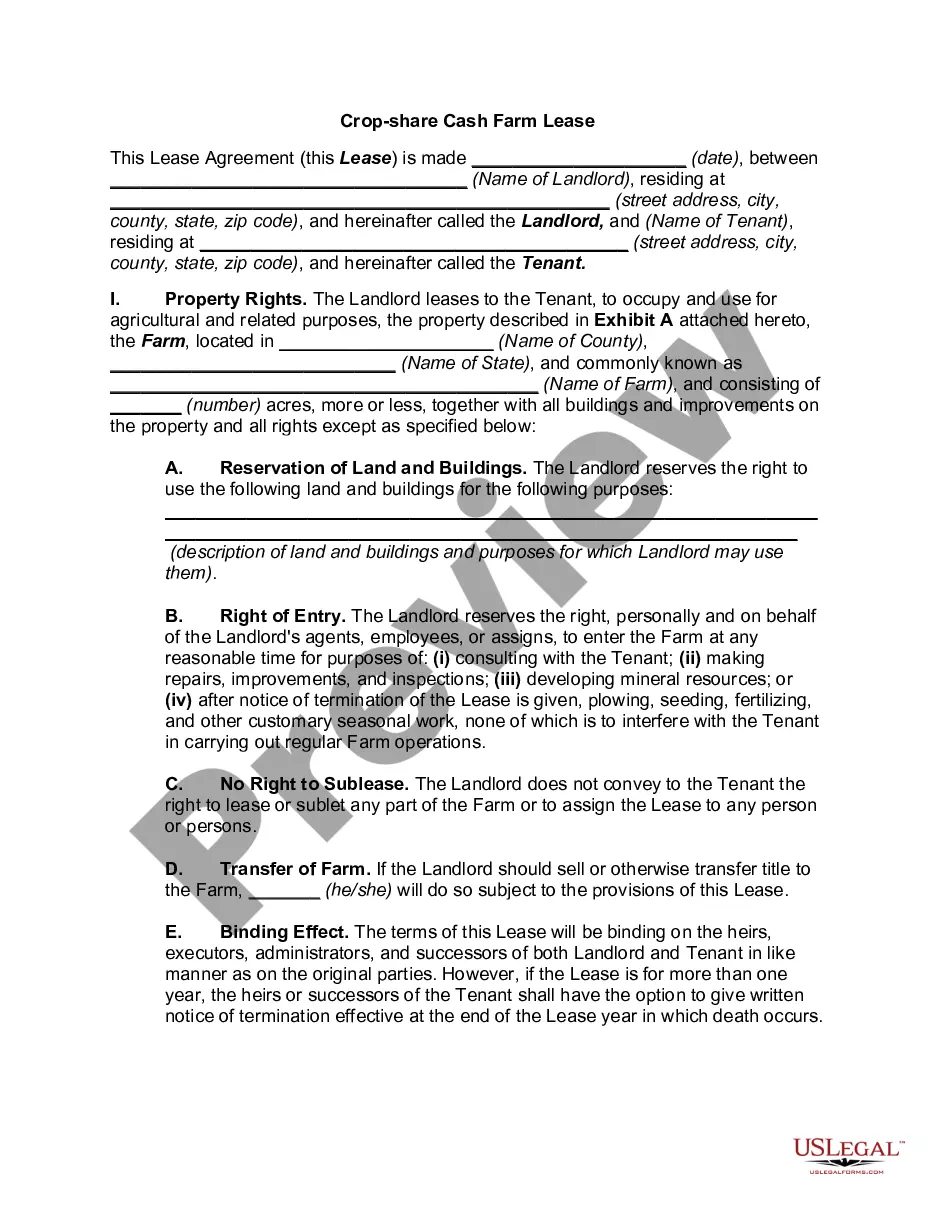

A farm lease is a written agreement between a landowner and a tenant farmer. Through a farm lease, the landowner grants the tenant farmer the right to use the farm property. Key terms of basic leases include the length of the lease, rent amounts and frequency of payment, how to renew or end the lease, and more.

While farmland may stretch far and wide, farmers and ranchers themselves make up just 1.3% of the employed US population, totaling around 2.6 million people. Today, there are about 2 million farms in operation in the US, a steep decline from 1935, when the number of farms peaked at nearly 7 million.

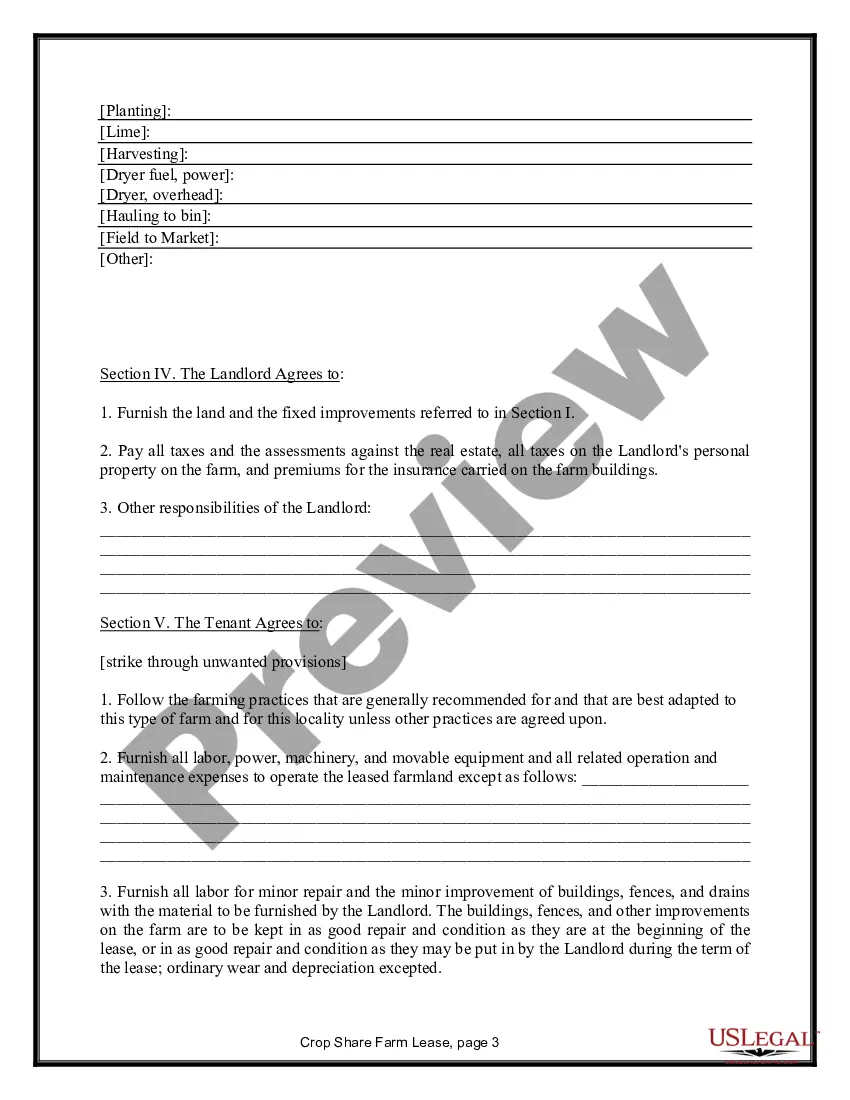

Tenant farming, agricultural system in which landowners contribute their land and a measure of operating capital and management while tenants contribute their labour with various amounts of capital and management, the returns being shared in a variety of ways.

With a land lease agreement (also known as a ground lease), you purchase the home but rent the land. One of the main advantages is the lower price of this unique arrangement. One of the main disadvantages is that you will not be able to build valuable equity in the land on which you live.

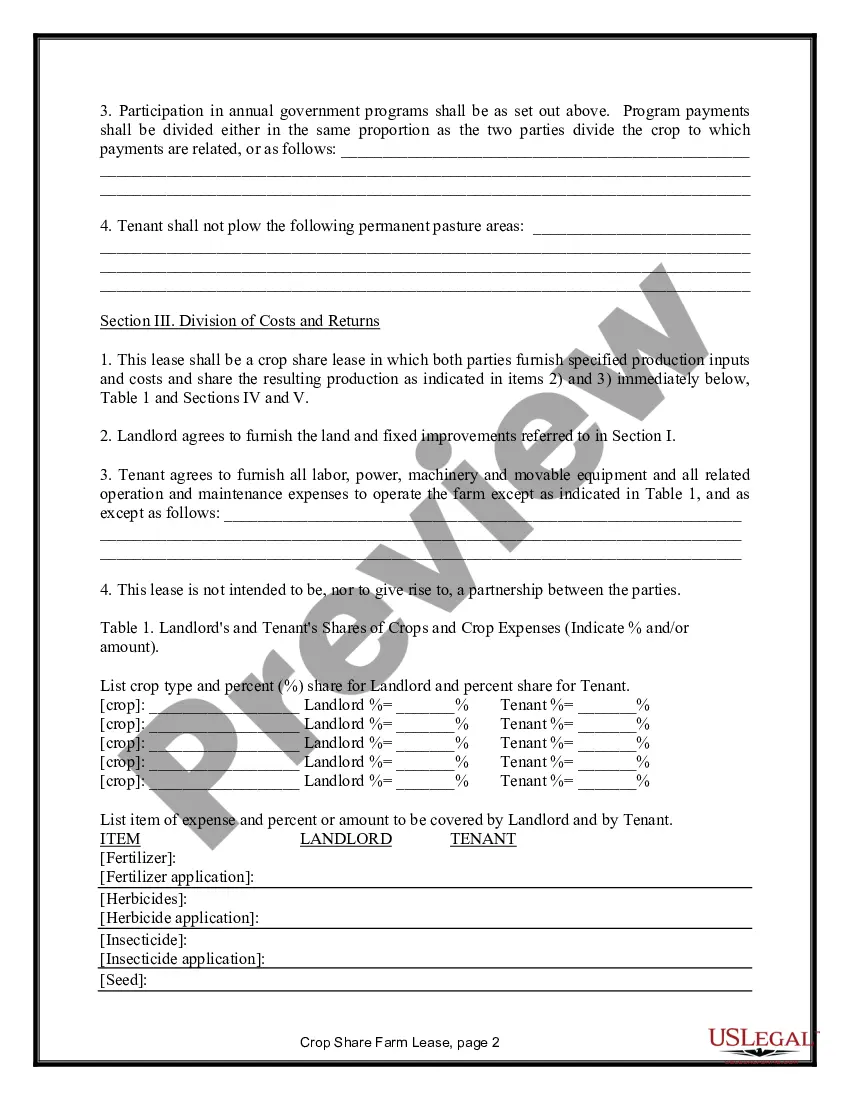

Crop-share arrangements refer to a method of leasing crop land where the production (crop) is shared between the landowner and the operator. Other income items, such as government payments and crop residue, are also often shared as are some of the production expenses.

The advantages of the first are that the tenant in many cases is free to manage the farm as he pleases, and as a long-time proposition he may pay less rent than under crop-sharing arrangements. The chief disadvantage is that the tenant agrees to pay a definite sum before he knows what his income will be.

Farmland has historically been a good investment. Unfortunately, not many investors have been able to benefit from this asset class, given the high upfront costs of buying farmland.

Most farmers find that a combination of both ownership and leasing is desirable, especially when capital is limited. For many new farmers, especially in areas where land is quite expensive, leasing land is often the best option.

The traditional share arrangement for a grain crop like corn or wheat is one-third to the landowner and two-thirds to the tenant. Usually, the expenses paid, and crop received, are equal to the share i.e. the landowner would pay one-third of the expenses and receive one-third of the crop.