South Dakota Plan of Merger and Reorganization by and among Digital Insight Corp., Black Transitory Corp. and nFront, Inc.

Description

How to fill out Plan Of Merger And Reorganization By And Among Digital Insight Corp., Black Transitory Corp. And NFront, Inc.?

Have you been within a place in which you will need papers for both enterprise or individual functions nearly every day? There are tons of legal file web templates available on the net, but finding ones you can trust is not simple. US Legal Forms offers a large number of kind web templates, just like the South Dakota Plan of Merger and Reorganization by and among Digital Insight Corp., Black Transitory Corp. and nFront, Inc., that happen to be composed to meet state and federal requirements.

Should you be already informed about US Legal Forms site and have a free account, merely log in. Following that, it is possible to acquire the South Dakota Plan of Merger and Reorganization by and among Digital Insight Corp., Black Transitory Corp. and nFront, Inc. template.

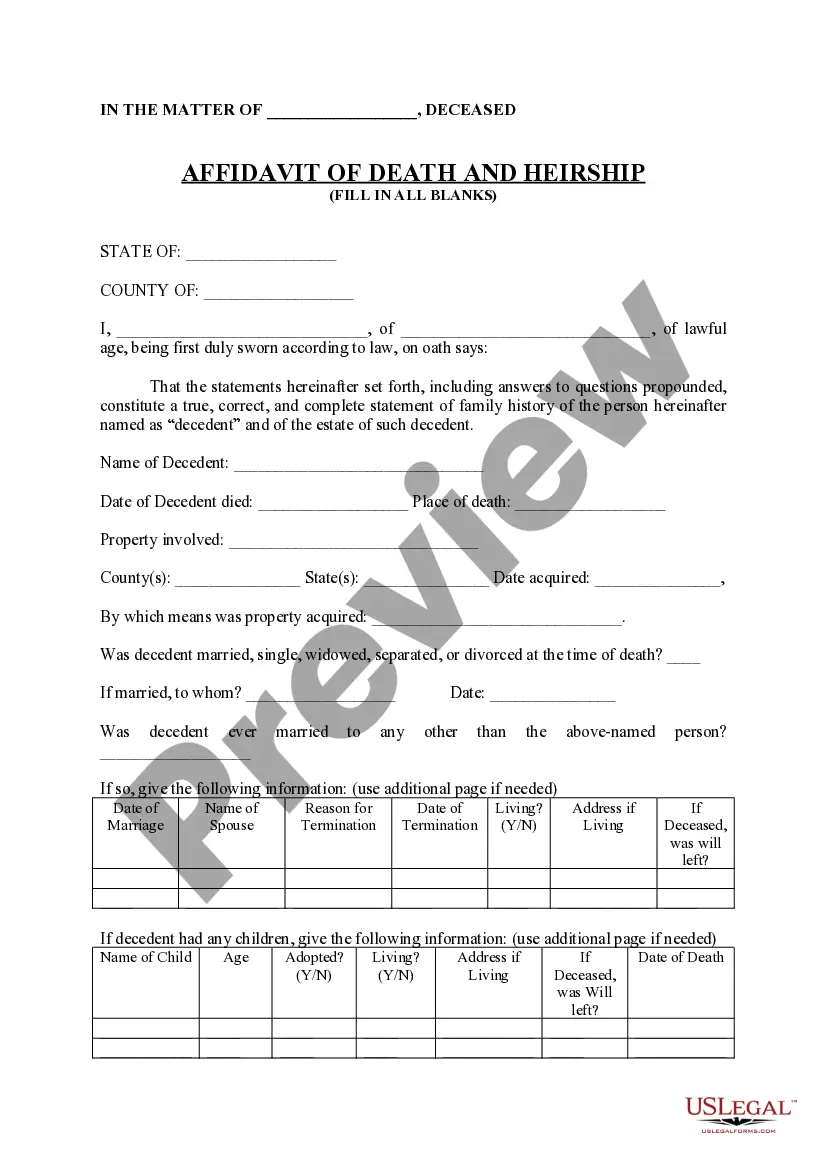

Should you not have an account and need to begin to use US Legal Forms, adopt these measures:

- Get the kind you need and make sure it is for your right metropolis/region.

- Utilize the Preview key to check the shape.

- Browse the explanation to actually have selected the correct kind.

- In the event the kind is not what you`re seeking, utilize the Search industry to find the kind that suits you and requirements.

- When you get the right kind, click Get now.

- Pick the costs program you want, fill in the specified info to generate your money, and pay money for the order using your PayPal or Visa or Mastercard.

- Choose a convenient document format and acquire your backup.

Get all of the file web templates you may have bought in the My Forms food list. You may get a additional backup of South Dakota Plan of Merger and Reorganization by and among Digital Insight Corp., Black Transitory Corp. and nFront, Inc. anytime, if necessary. Just go through the essential kind to acquire or print out the file template.

Use US Legal Forms, by far the most extensive variety of legal forms, to conserve time and stay away from faults. The service offers appropriately created legal file web templates that can be used for an array of functions. Make a free account on US Legal Forms and initiate generating your life easier.