South Dakota Term Sheet - Series A Preferred Stock Financing of a Company

Description

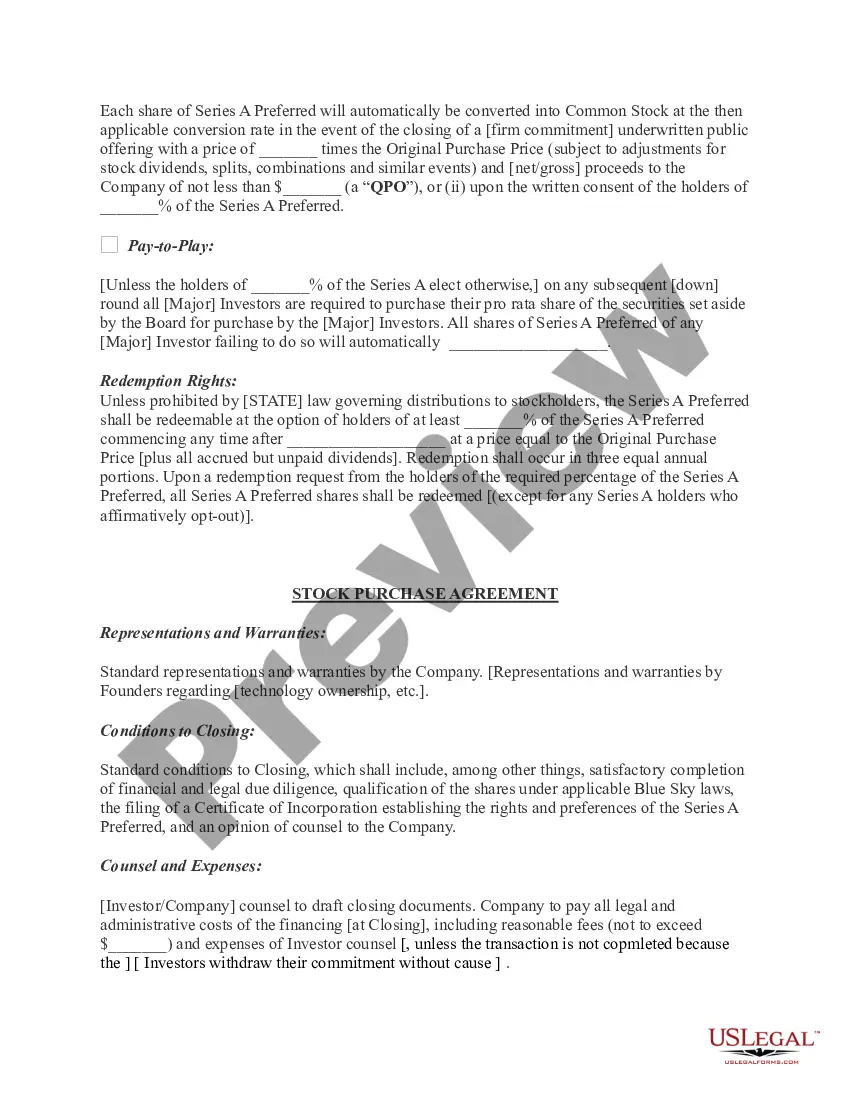

The Term Sheet is not a commitment to invest, and is conditioned on the completion of the conditions to closing set forth.

How to fill out Term Sheet - Series A Preferred Stock Financing Of A Company?

Choosing the right legal document design might be a have difficulties. Obviously, there are a lot of templates accessible on the Internet, but how will you discover the legal develop you want? Make use of the US Legal Forms website. The services gives a huge number of templates, like the South Dakota Term Sheet - Series A Preferred Stock Financing of a Company, that can be used for organization and personal requires. All of the types are checked out by pros and satisfy federal and state requirements.

Should you be previously authorized, log in to your profile and then click the Download key to obtain the South Dakota Term Sheet - Series A Preferred Stock Financing of a Company. Use your profile to check from the legal types you may have purchased in the past. Visit the My Forms tab of your profile and have one more copy of your document you want.

Should you be a fresh user of US Legal Forms, here are simple directions that you can adhere to:

- Initial, ensure you have selected the correct develop to your town/county. You may look through the shape utilizing the Preview key and read the shape information to make certain it will be the best for you.

- If the develop does not satisfy your preferences, utilize the Seach area to obtain the right develop.

- When you are certain that the shape is proper, click the Acquire now key to obtain the develop.

- Choose the costs strategy you desire and enter in the necessary info. Make your profile and buy your order using your PayPal profile or credit card.

- Opt for the document formatting and obtain the legal document design to your system.

- Total, change and produce and indication the received South Dakota Term Sheet - Series A Preferred Stock Financing of a Company.

US Legal Forms will be the most significant collection of legal types for which you can discover various document templates. Make use of the company to obtain professionally-made papers that adhere to condition requirements.

Form popularity

FAQ

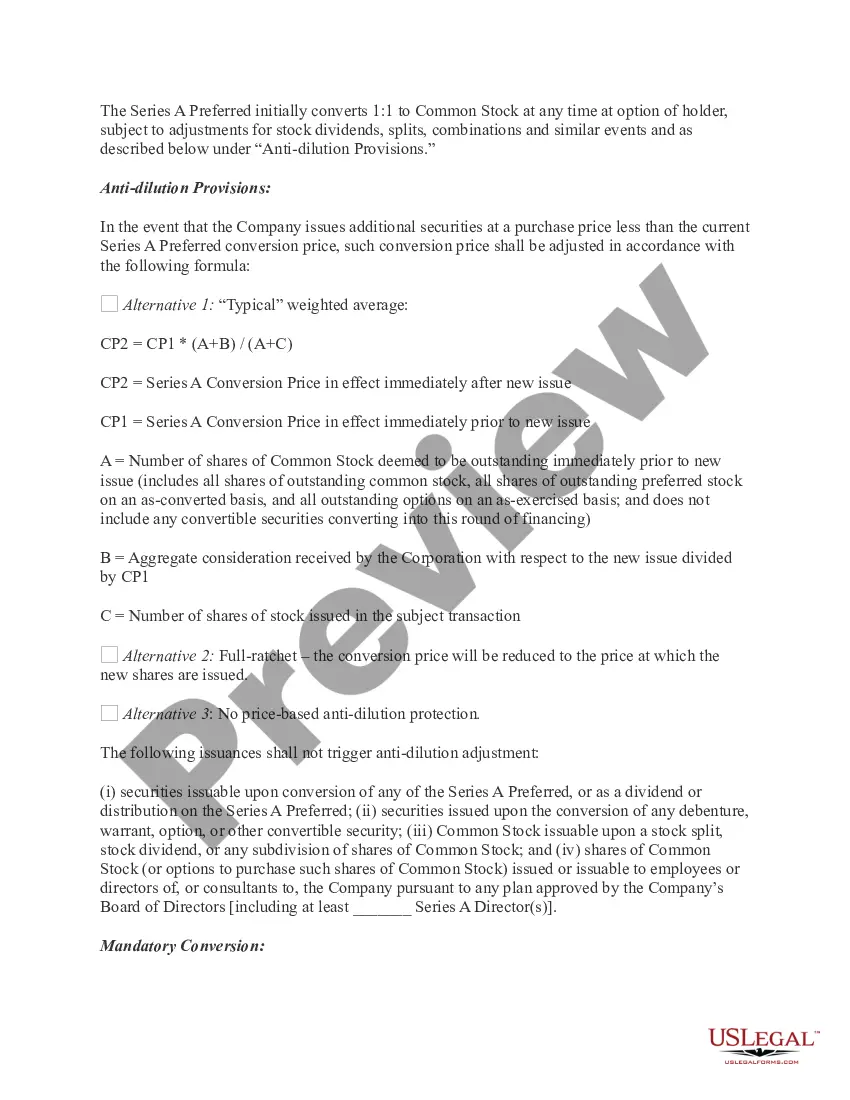

Preferred stock is a type of stock that has characteristics of both stocks and bonds. Like bonds, preferred shares make cash payouts, often at a higher yield than bonds, while offering higher dividend returns and less risk than common stock.

The first round of stock offered during the seed or early stage round by a portfolio company to the venture investor or fund. This stock is convertible into common stock in certain cases such as an IPO or the sale of the company.

Preference shares, more commonly referred to as preferred stock, are shares of a company's stock with dividends that are paid out to shareholders before common stock dividends are issued. If the company enters bankruptcy, preferred stockholders are entitled to be paid from company assets before common stockholders.

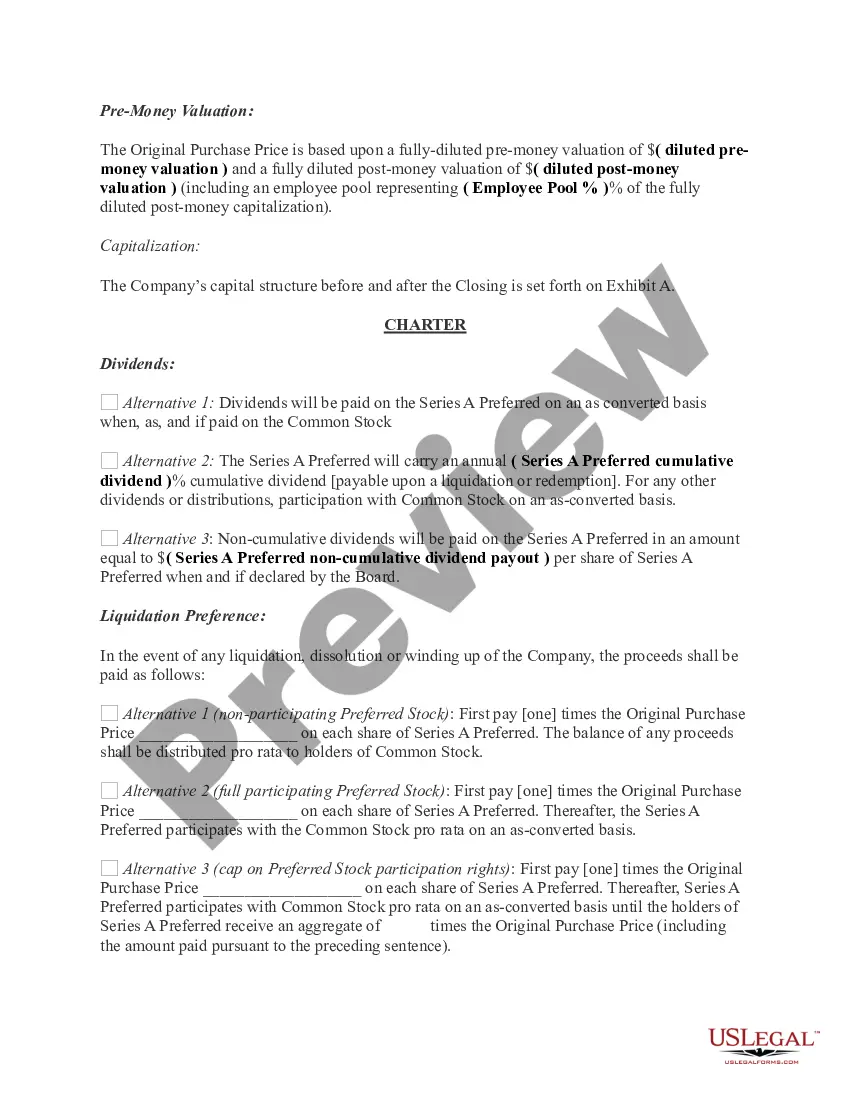

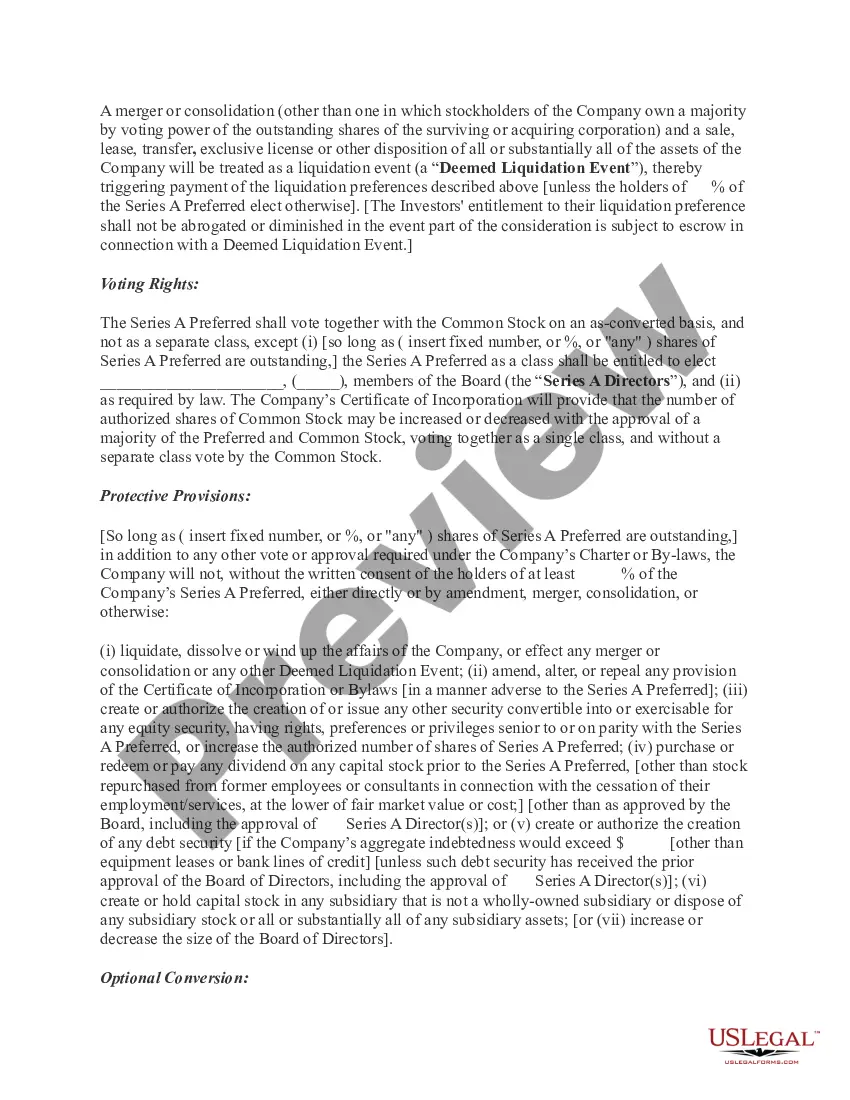

What is a Term Sheet? A term sheet is a nonbinding bullet-point document that outlines the material terms and conditions of a potential business agreement. The purpose of a term sheet is to outline the terms upon which the venture debt provider is willing to make the investment.

But no matter who the investor is, a term sheet will always contain six key components, including: A valuation. An estimate of what a company is worth as an investment opportunity. ... Securities being issued. ... Board rights. ... Investor protections. ... Dealing with shares. ... Miscellaneous provisions.

What Is a Term Sheet? A term sheet is a nonbinding agreement that shows the basic terms and conditions of an investment. The term sheet serves as a template and basis for more detailed, legally binding documents.

Term sheets for venture capital financings include detailed provisions describing the terms of the preferred stock being issued to investors. Some terms are more important than others. The following brief description of certain material terms divides them into two categories: economic terms and control rights.

The first round of stock made available to the public by a startup is referred to as Series A preferred stock. This type of stock is generally offered for purchase during the seed stage of a new startup and can be converted into common stock in the event of an initial public offering or sale of the company.

ANSWER: A Pre-approval differs from Pre-qualification in commercial lending in that the ?Pre-approval? or Term Sheet/Letter of Interest is issued after a preliminary underwriting determination has been made.

What Is a Term Sheet? A term sheet is a nonbinding agreement that shows the basic terms and conditions of an investment. The term sheet serves as a template and basis for more detailed, legally binding documents.