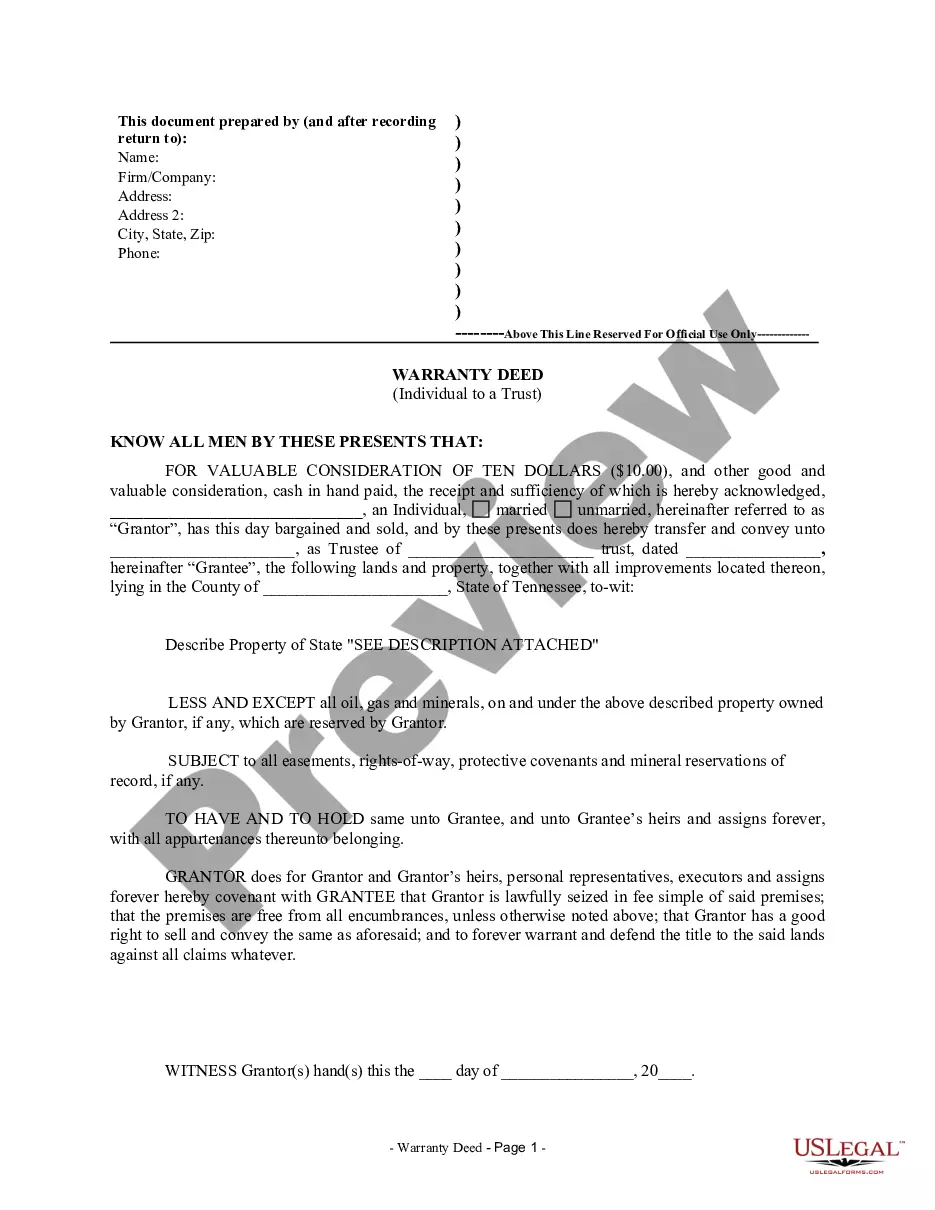

This form is a Warranty Deed where the grantor is an individual and the grantee is a trust. Grantor conveys and warrant the described property to trustee of trust less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Tennessee Warranty Deed from Individual to a Trust

Description

Key Concepts & Definitions

Warranty Deed from Individual to a Trust: A legal document where property ownership is transferred from an individual to a trust. A warranty deed ensures the grantor (seller) guarantees they own clear title to the property and have the right to transfer it to the grantee (buyer), in this case, a trust.

Step-by-Step Guide

- Determine the Type of Trust: Verify that the trust is capable of holding property, as defined in the trust agreement.

- Prepare the Deed: Have a real estate attorney draft the warranty deed to ensure all specifics of the transfer are legally accurate and include all necessary legal descriptions of the property.

- Sign the Deed: The individual (grantor) needs to sign the deed in the presence of a notary public to authenticate it.

- Record the Deed: File the warranty deed with the local county office to officially record the transfer and held in public record.

Risk Analysis

- Incorrect Trustee: Transferring property to a trust must be to the correct trustee(s) as named by the trust. Incorrect designations can lead to legal disputes or invalid transfers.

- Property Liens: Ensure the property is free of any liens or encumbrances, which could complicate the transfer process and the trust's assets liabilities.

- Legal Compliance: Since laws vary by state, ensure compliance with local statutes concerning property transfer to trusts.

Key Takeaways

- Ensure Accuracy: Verify all the legal descriptions and trustee details meticulously to avoid future legal problems.

- Legal Assistance: Consulting with a real estate attorney can safeguard against legal pitfalls.

- Record Keeping: Proper documentation and recording of the deed are crucial for maintaining clear and undisputed property title under the trust.

Common Mistakes & How to Avoid Them

- Failing to Verify Trust Details: Always cross-reference trust documents to confirm correct trustee names and trust capacity to hold property.

- Omitting Legal Requirements: Each state may have specific notarization, witness, and filing requirements. Ensure all are met to avoid invalidating the deed.

FAQ

- Who needs to sign a warranty deed transferring property into a trust? The individual transferring the property must sign it, usually in the presence of a notary.

- Can any type of property be transferred into a trust? Generally, yes, but it depends on the terms specified within the trust agreement.

- Is it expensive to transfer property to a trust? Costs can vary depending on legal fees and recording charges, but consider them an investment in protecting the asset under the trust.

How to fill out Tennessee Warranty Deed From Individual To A Trust?

Access to high quality Tennessee Warranty Deed from Individual to a Trust samples online with US Legal Forms. Prevent hours of misused time browsing the internet and dropped money on files that aren’t up-to-date. US Legal Forms gives you a solution to exactly that. Get more than 85,000 state-specific legal and tax forms you can save and complete in clicks in the Forms library.

To find the example, log in to your account and then click Download. The document is going to be stored in two places: on the device and in the My Forms folder.

For people who don’t have a subscription yet, have a look at our how-guide below to make getting started simpler:

- Find out if the Tennessee Warranty Deed from Individual to a Trust you’re considering is suitable for your state.

- View the sample using the Preview function and read its description.

- Visit the subscription page by simply clicking Buy Now.

- Select the subscription plan to go on to register.

- Pay out by card or PayPal to finish making an account.

- Pick a preferred file format to save the document (.pdf or .docx).

You can now open the Tennessee Warranty Deed from Individual to a Trust sample and fill it out online or print it out and do it yourself. Take into account giving the papers to your legal counsel to ensure all things are completed correctly. If you make a mistake, print and fill application once again (once you’ve made an account every document you save is reusable). Create your US Legal Forms account now and get access to much more samples.

Form popularity

FAQ

A warranty deed protects property owners from future claims that someone else actually owns a portion (or all) of their property, while trustee deeds protect lenders when borrowers default on their mortgage loans.

How To Establish A Trust. You will need to retain an estate attorney to draft and execute your trust document. For a simple revocable or irrevocable trust, it may cost anywhere from $2,000 $5,000.

Take the signed and notarized quitclaim deed to your county recorder's office to complete the transfer of title into your revocable trust. Check in two to four weeks to ensure it has been recorded. Include the address of the property on the asset list addendum attached to your trust.

Obtain a California grant deed from a local office supply store or your county recorder's office. Complete the top line of the deed. Indicate the grantee on the second line. Enter the trustees' names and addresses.

A trustee deed offers no such warranties about the title.

The advantages of placing your house in a trust include avoiding probate court, saving on estate taxes and possibly protecting your home from certain creditors. Disadvantages include the cost of creating the trust and the paperwork.

To transfer real estate (also called real property) into your living trust, you must prepare and sign a new deed, transferring ownership. You can usually fill out a new deed yourself.

Determine the Current Title and Vesting to Your Property. Prepare a Deed. Be Aware of Your Lender and Title Insurance. Prepare a Preliminary Change of Ownership Report. Execute Your Deed. Record Your Deed. Wait for the Deed to be Returned. Keep the Property in the Trust.

In the context of a California mortgage transaction, a trust deed also transfer ownership. Only this time, the title is being placed in the hands of a third-party trustee, who holds the property on behalf of the lender and the homeowner-borrower until the mortgage is paid.