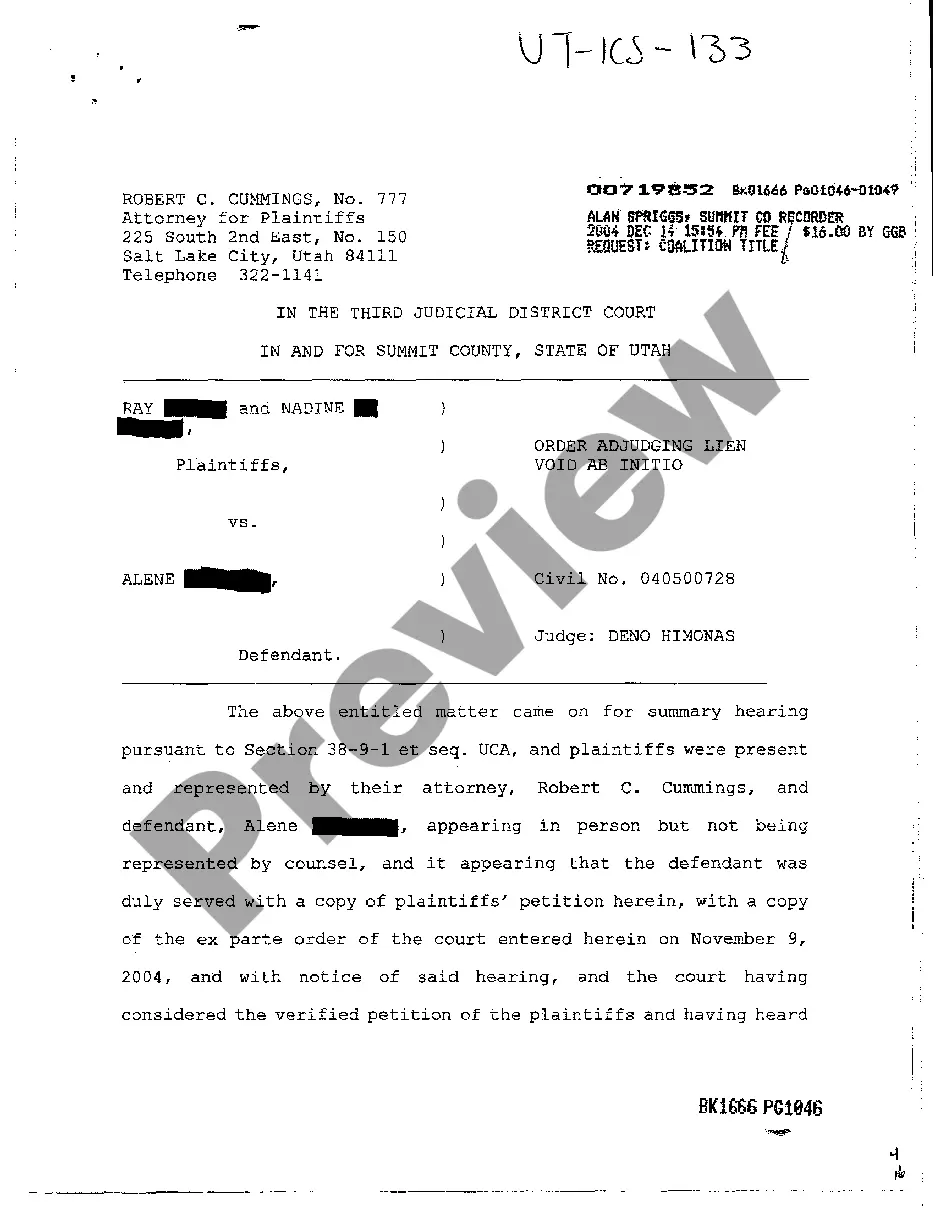

Official Workers' Compensation form in pdf format.

Tennessee Wage Statement for Workers' Compensation

Description

How to fill out Tennessee Wage Statement For Workers' Compensation?

Access to top quality Tennessee Wage Statement for Workers' Compensation templates online with US Legal Forms. Prevent days of misused time seeking the internet and lost money on forms that aren’t updated. US Legal Forms offers you a solution to just that. Get above 85,000 state-specific authorized and tax templates that you can download and complete in clicks in the Forms library.

To find the example, log in to your account and click Download. The file will be saved in two places: on your device and in the My Forms folder.

For individuals who don’t have a subscription yet, have a look at our how-guide below to make getting started easier:

- Find out if the Tennessee Wage Statement for Workers' Compensation you’re looking at is appropriate for your state.

- See the form using the Preview option and browse its description.

- Visit the subscription page by clicking on Buy Now button.

- Choose the subscription plan to continue on to sign up.

- Pay out by credit card or PayPal to complete creating an account.

- Select a favored format to save the document (.pdf or .docx).

You can now open up the Tennessee Wage Statement for Workers' Compensation template and fill it out online or print it and get it done yourself. Consider mailing the papers to your legal counsel to make sure all things are filled in correctly. If you make a error, print out and complete sample once again (once you’ve created an account every document you download is reusable). Make your US Legal Forms account now and get access to much more templates.

Form popularity

FAQ

Tennessee workers' comp laws provide compensation for lost or reduced wages due to your inability to work.Temporary total disability benefits are two-thirds of your average weekly wage at the time of your injury, subject to a statutory maximum. As of July 1, 2017, the maximum weekly benefit is $992.20.

The answer is that workers' comp pays a part of lost wages, but not the full amount. These wages are paid as disability income benefits.

An injured worker's wage paid is 66 2/3%. The weekly payment minimum is $112.80. The weekly maximum is $752, 100% of the Tennessee state average weekly wage. Maximum period of payments is 400 weeks and the maximum amount payable is $300,800.

Workers Compensation Calculator Most often, benefits are calculated and paid based on the average weekly wage. This is calculated by multiplying the employee's daily wage by the number of days worked in a full year. That number is then divided by 52 weeks to get the average weekly wage.

A workers' compensation insurance policy is based on payroll, regardless of whether the employee is full-time, part-time, temporary or seasonal. Begin with the gross payroll for each employee. Tips for Calculating Payroll: Gross payroll for each employee can be rounded to the nearest $1,000.

The compensation period is determined by multiplying 450 weeks times the assigned impairment rating or 180 days after the employee reaches maximum medical improvement, whichever is later.If the employee lacks a high school diploma or GED, then the employee's resulting award is multiplied by 1.45.

For workers' compensation purposes, payroll or remuneration means money or substitutes for money. Your premium calculations include the following as remuneration: Wages or salaries including retroactive wages or salaries.