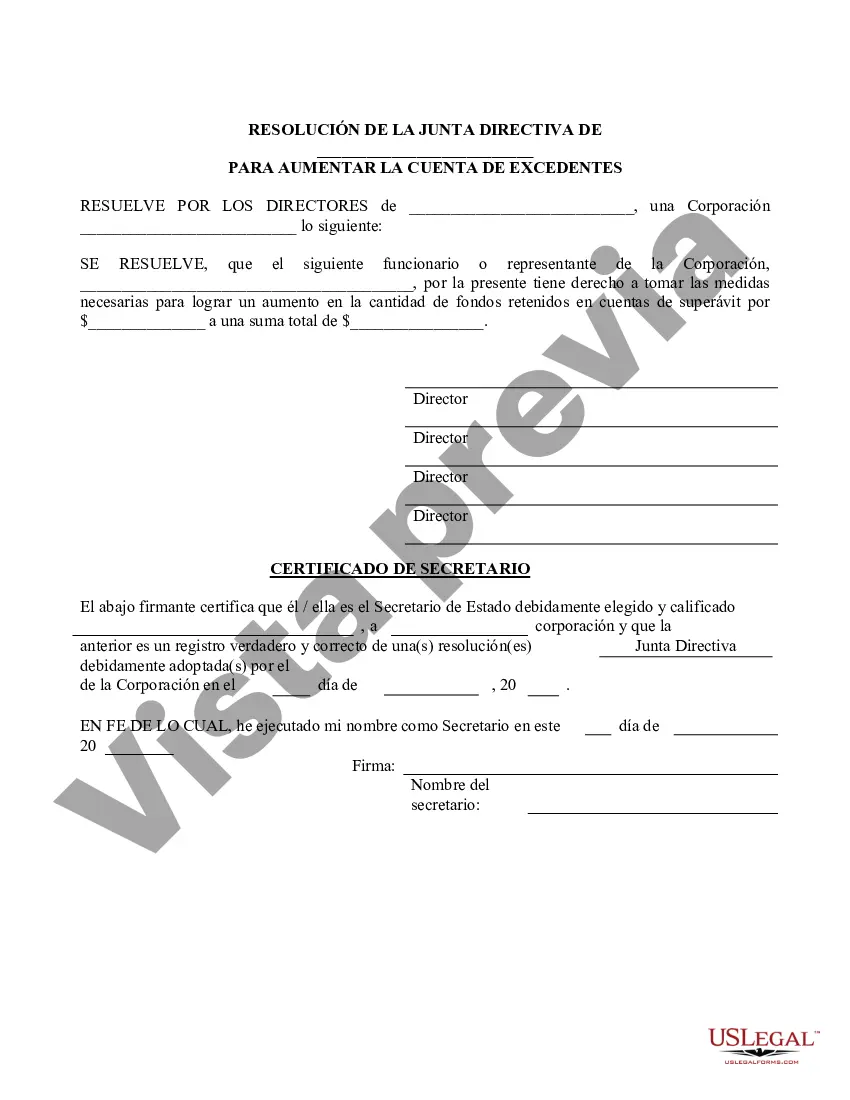

The Tennessee Increase Surplus Account — Resolution For— - Corporate Resolutions is a legal document used by corporations in the state of Tennessee to formally document and approve the increase of surplus funds or retained earnings for the company. This resolution form plays a crucial role in ensuring compliance with state laws and regulations and maintaining transparent financial records. Keywords: Tennessee, Increase Surplus Account, Resolution Form, Corporate Resolutions, legal document, corporations, state of Tennessee, surplus funds, retained earnings, compliance, laws, regulations, financial records. In Tennessee, corporations are required to follow specific procedures and obtain the approval of their shareholders or board of directors to increase the surplus account of the company. The surplus account, also known as retained earnings, represents the cumulative profits of the company that have not been distributed as dividends or allocated to other accounts. The Increase Surplus Account — Resolution For— - Corporate Resolutions provides a structured format for corporations to outline the details of the proposed increase in surplus account. It typically contains important information such as the name and registered office address of the corporation, the date of the resolution, and a statement clarifying the purpose of the resolution. The form also includes the specific amount by which the surplus account is to be increased, along with any additional instructions or conditions that may be necessary. This ensures that the increase is in line with the corporation's financial goals and objectives. Moreover, the resolution form serves as a written record of the decision made by the corporation's shareholders or board of directors. By requiring formal approval through this document, the corporation establishes accountability, transparency, and legal compliance. Different Types of Tennessee Increase Surplus Account — Resolution For— - Corporate Resolutions: 1. Standard Increase Surplus Account Resolution Form: This is the most common type used by corporations in Tennessee to increase their surplus accounts and retain earnings. 2. Special Increase Surplus Account Resolution Form: This form is used when a corporation needs to specify unique conditions or restrictions regarding the increase in the surplus account. For example, a corporation may outline that the increased surplus funds will be allocated to a specific project or investment. 3. Shareholder Approval Increase Surplus Account Resolution Form: Some corporations may require approval from their shareholders to increase the surplus account. This form is used to document and obtain the necessary shareholder approval for the resolution. Overall, the Tennessee Increase Surplus Account — Resolution For— - Corporate Resolutions is a crucial legal document that ensures compliance and transparency in the financial operations of corporations.

The Tennessee Increase Surplus Account — Resolution For— - Corporate Resolutions is a legal document used by corporations in the state of Tennessee to formally document and approve the increase of surplus funds or retained earnings for the company. This resolution form plays a crucial role in ensuring compliance with state laws and regulations and maintaining transparent financial records. Keywords: Tennessee, Increase Surplus Account, Resolution Form, Corporate Resolutions, legal document, corporations, state of Tennessee, surplus funds, retained earnings, compliance, laws, regulations, financial records. In Tennessee, corporations are required to follow specific procedures and obtain the approval of their shareholders or board of directors to increase the surplus account of the company. The surplus account, also known as retained earnings, represents the cumulative profits of the company that have not been distributed as dividends or allocated to other accounts. The Increase Surplus Account — Resolution For— - Corporate Resolutions provides a structured format for corporations to outline the details of the proposed increase in surplus account. It typically contains important information such as the name and registered office address of the corporation, the date of the resolution, and a statement clarifying the purpose of the resolution. The form also includes the specific amount by which the surplus account is to be increased, along with any additional instructions or conditions that may be necessary. This ensures that the increase is in line with the corporation's financial goals and objectives. Moreover, the resolution form serves as a written record of the decision made by the corporation's shareholders or board of directors. By requiring formal approval through this document, the corporation establishes accountability, transparency, and legal compliance. Different Types of Tennessee Increase Surplus Account — Resolution For— - Corporate Resolutions: 1. Standard Increase Surplus Account Resolution Form: This is the most common type used by corporations in Tennessee to increase their surplus accounts and retain earnings. 2. Special Increase Surplus Account Resolution Form: This form is used when a corporation needs to specify unique conditions or restrictions regarding the increase in the surplus account. For example, a corporation may outline that the increased surplus funds will be allocated to a specific project or investment. 3. Shareholder Approval Increase Surplus Account Resolution Form: Some corporations may require approval from their shareholders to increase the surplus account. This form is used to document and obtain the necessary shareholder approval for the resolution. Overall, the Tennessee Increase Surplus Account — Resolution For— - Corporate Resolutions is a crucial legal document that ensures compliance and transparency in the financial operations of corporations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.