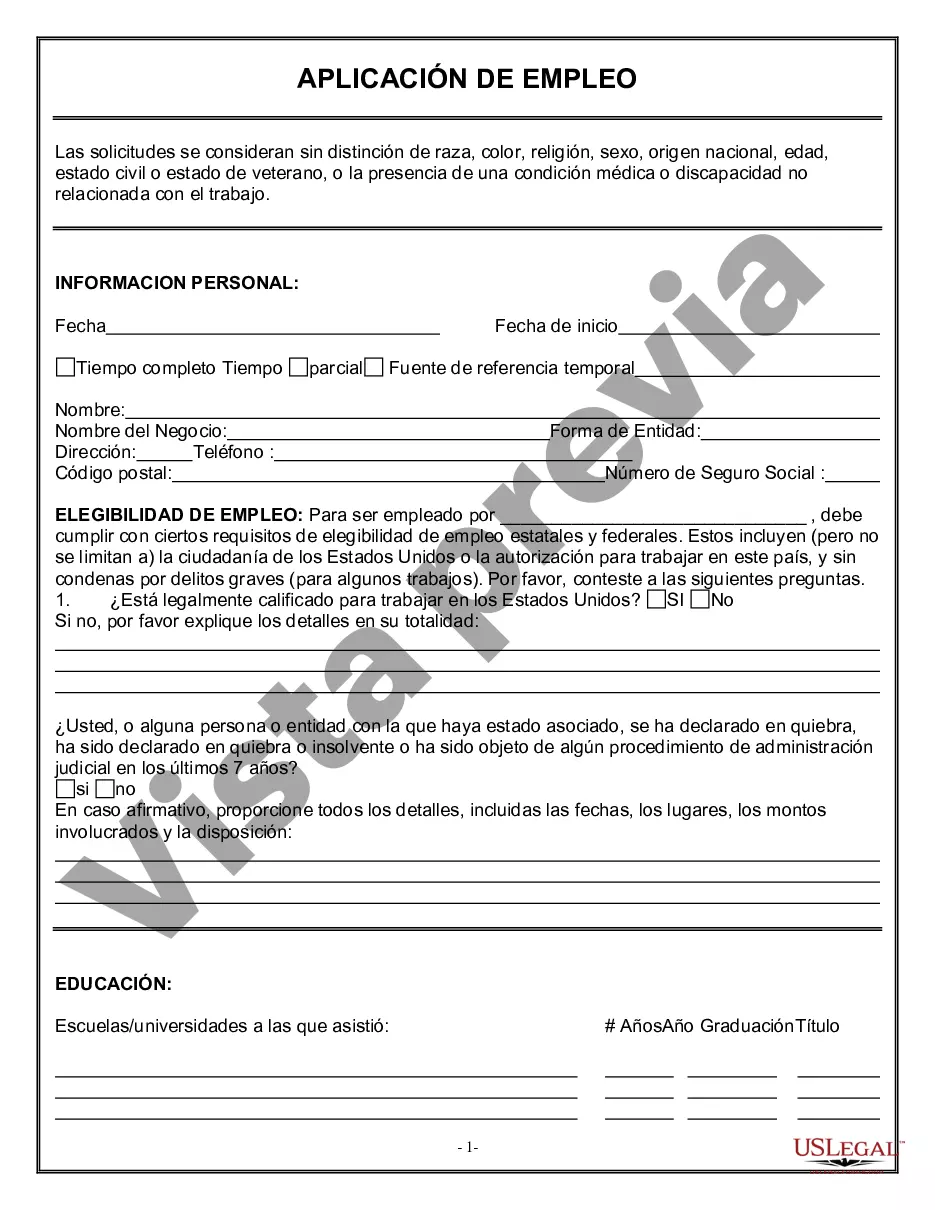

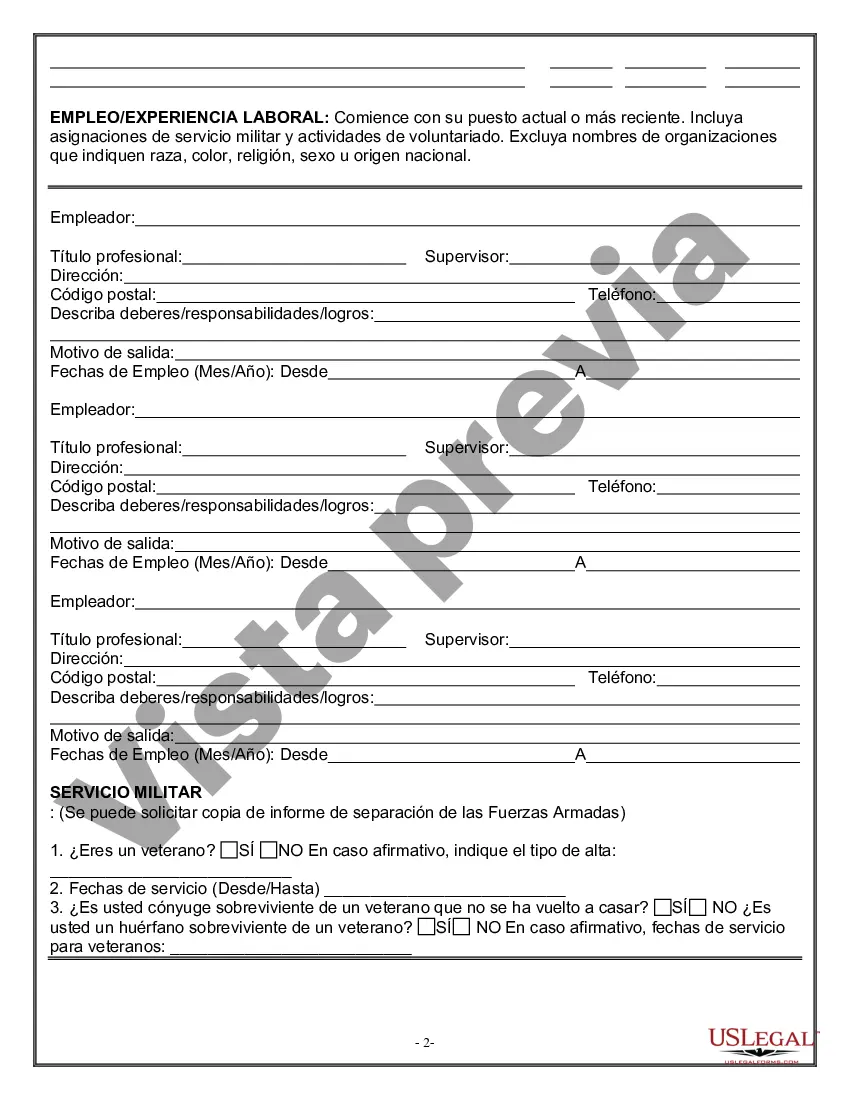

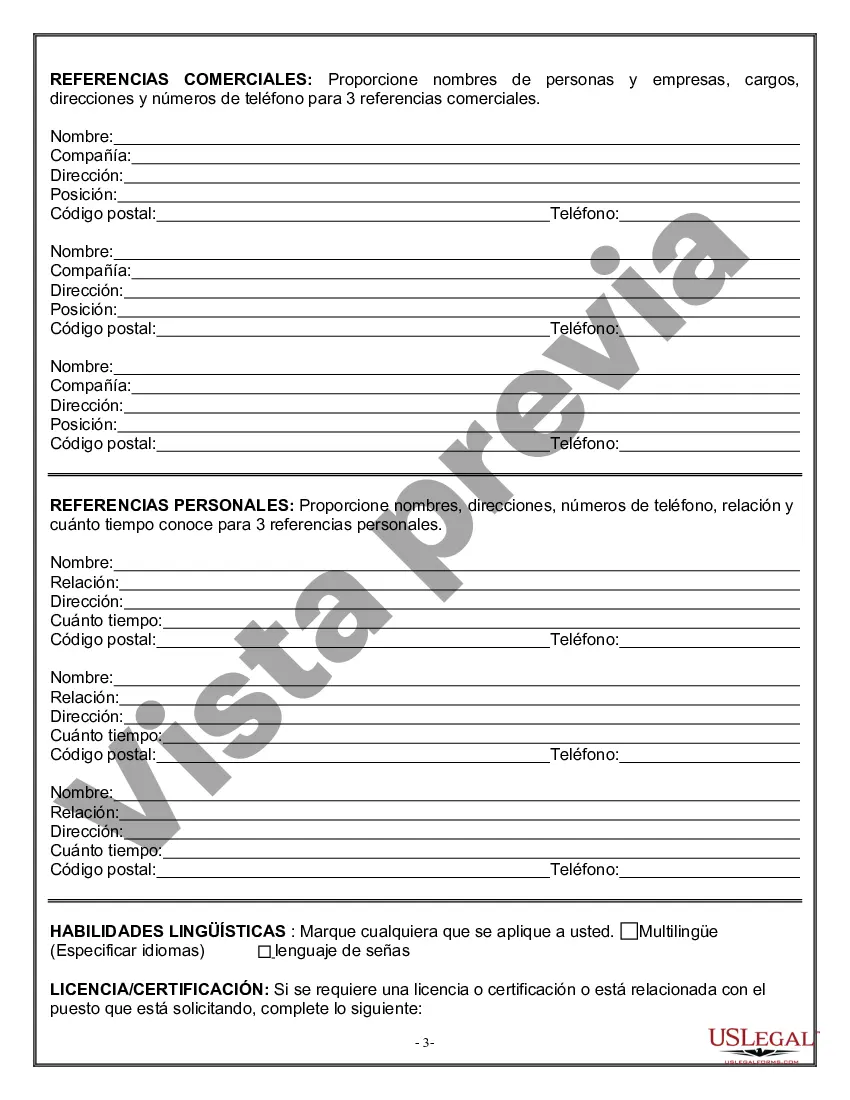

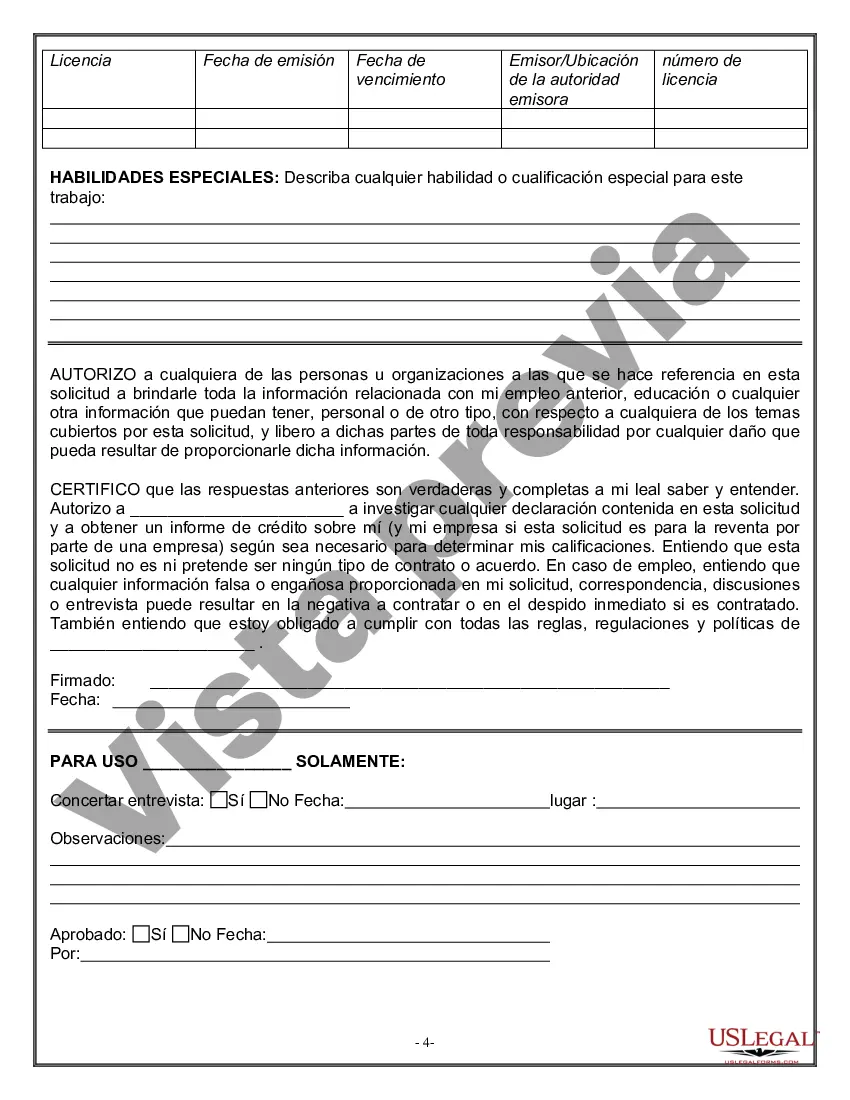

The Tennessee Employment Application for Accountant is a comprehensive document designed to gather essential information from individuals applying for accounting positions in the state of Tennessee. This application form serves as a standard tool for employers to screen and evaluate potential candidates based on their qualifications, skills, and experience in the field of accounting. The application begins by requesting basic personal information such as the applicant's full name, address, contact details, and social security number. It may also ask for the applicant's driver's license number and information about their eligibility to work in the United States. Moving on, the form delves into the applicant's educational background, where they are required to provide details of their highest level of education completed, including the institution's name, years attended, degree obtained, and major area of study. This section may also allow candidates to disclose additional relevant certifications or specialized training they have acquired throughout their academic journey. The subsequent section focuses on the applicant's work experience. Here, individuals are given the opportunity to list their previous employers, job titles, dates of employment, and a brief description of their responsibilities and achievements. It is common for the form to request information from the most recent employment to the oldest one, highlighting the applicant's career progression in the accounting field. To assess the applicant's accounting proficiency, the application may feature a dedicated section that prompts candidates to detail their knowledge and skills in various accounting practices. This could include areas such as financial statement preparation, budgeting, auditing, tax compliance, payroll processing, and financial analysis. Candidates may be required to indicate their level of expertise in these areas, using terms such as "basic," "intermediate," or "advanced." Additionally, the application might inquire about the applicant's proficiency in using accounting software or relevant computer applications commonly used in the industry. This could involve the use of keywords such as QuickBooks, Excel, SAP, or industry-specific software like Sage. The Tennessee Employment Application for Accountant may also feature sections related to professional memberships, references, and any criminal history disclosure requirements mandated by state law. It is worth mentioning that although this description provides a general overview of what a Tennessee Employment Application for Accountant may include, it is always advisable to consult the specific application form provided by the employer or the Tennessee state government's official website for the most accurate and up-to-date information. As for different types of Tennessee Employment Applications for Accountant, it is possible that variations exist depending on the industry or position sought. Employers might tailor the application to include specific accounting requirements related to sectors such as financial services, government organizations, healthcare, or non-profit organizations, among others.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Tennessee Solicitud de Empleo para Contador - Employment Application for Accountant

Description

How to fill out Tennessee Solicitud De Empleo Para Contador?

Are you presently in the placement that you require papers for both company or person purposes almost every day time? There are tons of lawful record themes available on the net, but discovering kinds you can trust isn`t effortless. US Legal Forms offers thousands of form themes, just like the Tennessee Employment Application for Accountant, which are created to fulfill federal and state requirements.

Should you be presently informed about US Legal Forms website and also have an account, just log in. Following that, it is possible to download the Tennessee Employment Application for Accountant template.

Unless you provide an bank account and need to begin using US Legal Forms, adopt these measures:

- Get the form you want and ensure it is for the right town/region.

- Use the Preview button to check the form.

- Browse the description to actually have selected the right form.

- If the form isn`t what you`re searching for, make use of the Search industry to find the form that suits you and requirements.

- If you get the right form, simply click Buy now.

- Pick the rates prepare you need, fill in the required info to produce your money, and pay money for the transaction making use of your PayPal or charge card.

- Decide on a hassle-free paper file format and download your copy.

Locate all the record themes you may have bought in the My Forms menu. You can get a more copy of Tennessee Employment Application for Accountant any time, if required. Just click the necessary form to download or print the record template.

Use US Legal Forms, probably the most extensive collection of lawful forms, to save lots of efforts and prevent faults. The service offers appropriately created lawful record themes that you can use for a variety of purposes. Produce an account on US Legal Forms and start generating your daily life a little easier.