A trust is the legal relationship between one person, the trustee, having an equitable ownership or management of certain property and another person, the beneficiary, owning the legal title to that property. The beneficiary is entitled to the performance of certain duties and the exercise of certain powers by the trustee, which performance may be enforced by a court of equity. Most trusts are founded by the persons (called trustors, settlors and/or donors) who execute a written declaration of trust which establishes the trust and spells out the terms and conditions upon which it will be conducted. The declaration also names the original trustee or trustees, successor trustees or means to choose future trustees.

A Tennessee Trust Agreement to Hold Funds for a Minor Resulting from Settlement of a Personal Injury Action is a legal document that establishes a trust to hold and manage funds awarded to a minor as a result of a personal injury lawsuit. This agreement ensures the proper management and distribution of the settlement funds to protect the minor's best interests. A Tennessee Trust Agreement typically contains the following key components: 1. Trustee: A trustee is appointed to oversee the trust and manage the funds on behalf of the minor. The trustee must act in the best interests of the minor and follow the terms outlined in the agreement. 2. Settlement Funds: The agreement specifies the amount and source of the settlement funds that will be held in the trust for the minor's benefit. These funds are typically derived from a legal settlement or judgment resulting from a personal injury lawsuit. 3. Purpose of the Trust: The trust agreement outlines the specific purpose of the trust, which is to provide for the minor's current and future needs, such as education, healthcare, housing, and other expenses necessary for their well-being. 4. Terms and Conditions: The agreement includes specific terms and conditions that the trustee must abide by when managing and distributing the funds. This may include restrictions on how the funds can be used and the circumstances under which distributions can be made. 5. Investment and Management of Funds: The trustee is responsible for investing and managing the funds prudently to ensure their growth and preservation. The agreement may outline guidelines for investment strategies and specify any limitations or preferences regarding investment choices. Different types of Tennessee Trust Agreements to Hold Funds for Minors resulting from personal injury actions may include variations based on specific circumstances, such as: a) Structured Settlement Trust: This type of agreement establishes a trust that provides for periodic payments to the minor over a set period or for their lifetime, rather than a lump-sum distribution. This arrangement aims to provide financial stability and control over the funds to ensure the minor's long-term needs are met. b) Special Needs Trust: In cases where the minor has special needs or disabilities, a special needs trust may be established. This trust is designed to preserve the minor's eligibility for government assistance programs while allowing the trust assets to supplement their care and quality of life. c) Guardian Managed Trust: If a guardian is appointed to manage the minor's affairs, a guardian managed trust may be created. This agreement outlines the responsibilities and limitations of the guardian when it comes to managing and distributing the settlement funds on behalf of the minor. In conclusion, a Tennessee Trust Agreement to Hold Funds for a Minor Resulting from Settlement of a Personal Injury Action is a vital document that safeguards the financial future of a minor who has received a settlement in a personal injury lawsuit. It outlines the terms, conditions, and responsibilities of the trustee and establishes guidelines for the proper management and distribution of the funds to meet the minor's current and future needs. Different types of trust agreements may exist to cater to specific circumstances and requirements.A Tennessee Trust Agreement to Hold Funds for a Minor Resulting from Settlement of a Personal Injury Action is a legal document that establishes a trust to hold and manage funds awarded to a minor as a result of a personal injury lawsuit. This agreement ensures the proper management and distribution of the settlement funds to protect the minor's best interests. A Tennessee Trust Agreement typically contains the following key components: 1. Trustee: A trustee is appointed to oversee the trust and manage the funds on behalf of the minor. The trustee must act in the best interests of the minor and follow the terms outlined in the agreement. 2. Settlement Funds: The agreement specifies the amount and source of the settlement funds that will be held in the trust for the minor's benefit. These funds are typically derived from a legal settlement or judgment resulting from a personal injury lawsuit. 3. Purpose of the Trust: The trust agreement outlines the specific purpose of the trust, which is to provide for the minor's current and future needs, such as education, healthcare, housing, and other expenses necessary for their well-being. 4. Terms and Conditions: The agreement includes specific terms and conditions that the trustee must abide by when managing and distributing the funds. This may include restrictions on how the funds can be used and the circumstances under which distributions can be made. 5. Investment and Management of Funds: The trustee is responsible for investing and managing the funds prudently to ensure their growth and preservation. The agreement may outline guidelines for investment strategies and specify any limitations or preferences regarding investment choices. Different types of Tennessee Trust Agreements to Hold Funds for Minors resulting from personal injury actions may include variations based on specific circumstances, such as: a) Structured Settlement Trust: This type of agreement establishes a trust that provides for periodic payments to the minor over a set period or for their lifetime, rather than a lump-sum distribution. This arrangement aims to provide financial stability and control over the funds to ensure the minor's long-term needs are met. b) Special Needs Trust: In cases where the minor has special needs or disabilities, a special needs trust may be established. This trust is designed to preserve the minor's eligibility for government assistance programs while allowing the trust assets to supplement their care and quality of life. c) Guardian Managed Trust: If a guardian is appointed to manage the minor's affairs, a guardian managed trust may be created. This agreement outlines the responsibilities and limitations of the guardian when it comes to managing and distributing the settlement funds on behalf of the minor. In conclusion, a Tennessee Trust Agreement to Hold Funds for a Minor Resulting from Settlement of a Personal Injury Action is a vital document that safeguards the financial future of a minor who has received a settlement in a personal injury lawsuit. It outlines the terms, conditions, and responsibilities of the trustee and establishes guidelines for the proper management and distribution of the funds to meet the minor's current and future needs. Different types of trust agreements may exist to cater to specific circumstances and requirements.

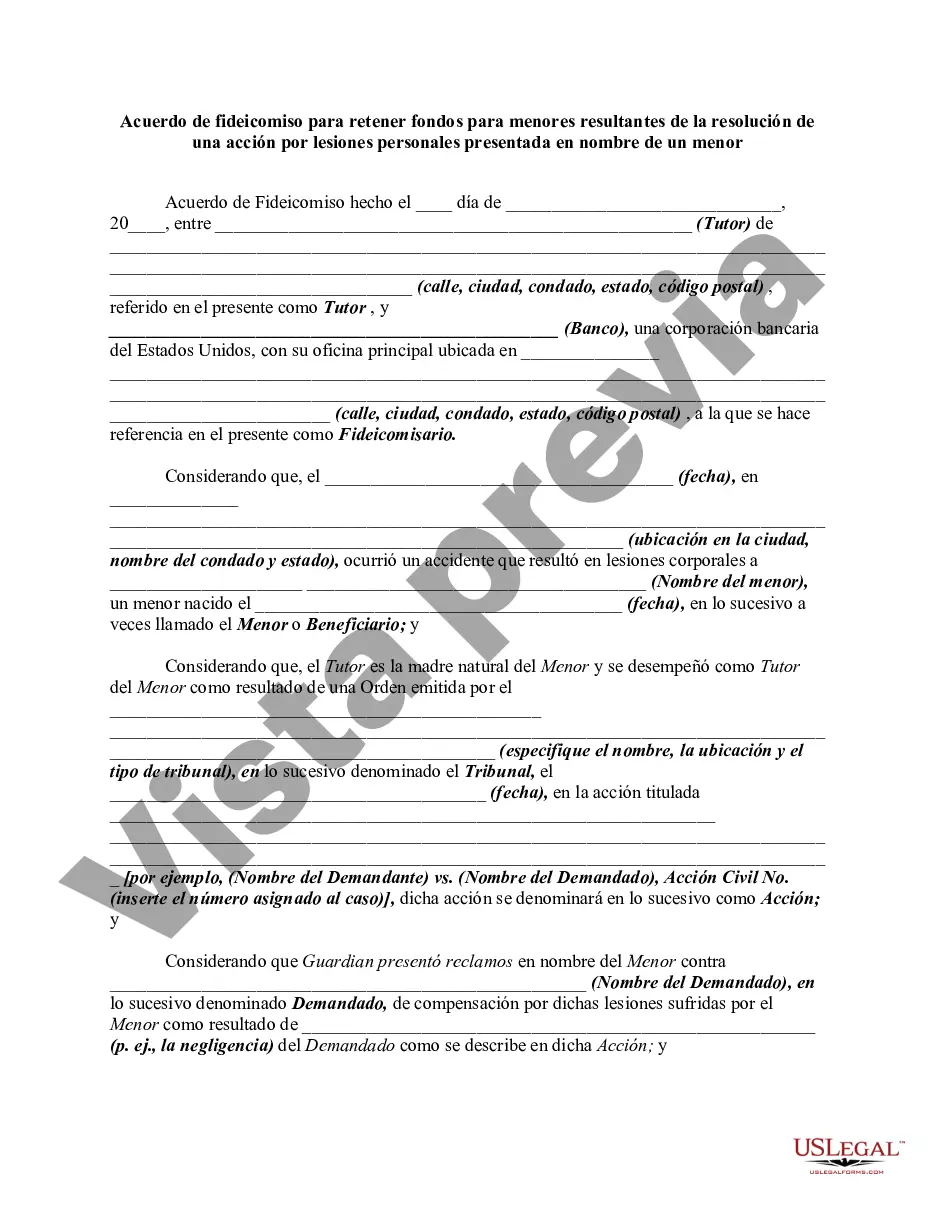

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.