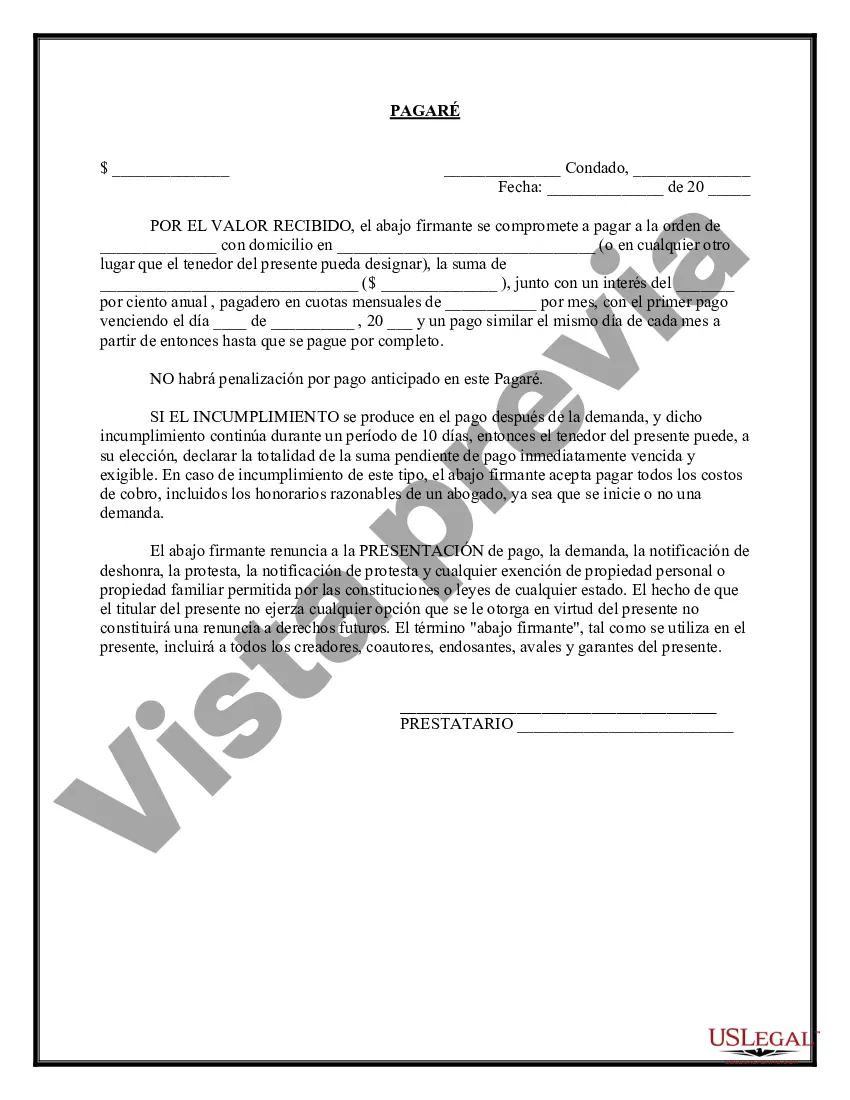

A Tennessee Promissory Note with Installment Payments is a legally binding document that outlines the terms and conditions of a loan agreement between a lender (often a financial institution or an individual) and a borrower. This type of promissory note specifically pertains to loans in the state of Tennessee and is used when the borrower agrees to repay the loan through a series of installment payments. The Tennessee Promissory Note with Installment Payments includes several crucial details to ensure clarity and protect the rights of both parties involved. It typically includes the following information: 1. Parties Involved: The names, addresses, and contact details of both the lender and the borrower are essential. This section ensures that all parties are identified and can be easily contacted for any communication or legal purposes. 2. Loan Amount and Interest: This section states the total amount of the loan provided by the lender to the borrower. It also specifies the interest rate, whether it's fixed or variable, and how it will be calculated (e.g., simple interest or compound interest). 3. Installment Schedule: The promissory note will outline a detailed schedule of repayment, specifying the due dates of each installment payment, and the amount to be paid on each date. This helps both parties keep track of their obligations. 4. Late Fees and Penalties: In the case of a late payment or default, the promissory note may describe any penalties or late fees that the borrower may incur. This section ensures that the borrower understands the consequences of not adhering to the agreed-upon payment schedule. 5. Collateral and Security: In certain cases, the lender may require the borrower to provide collateral as a security measure. The details of collateral, such as property or assets involved, will be mentioned in this section. 6. Prepayment and Acceleration: Some promissory notes may include provisions regarding prepayment options, allowing the borrower to repay the loan in full before the due date. Additionally, an acceleration clause may exist, enabling the lender to demand immediate repayment of the full loan amount if the borrower breaches any of the terms mentioned in the note. Types of Tennessee Promissory Notes with Installment Payments: 1. Real Estate Promissory Note: This type of promissory note is specific to loans related to real estate transactions, such as mortgages and land contracts. 2. Personal Loan Promissory Note: This note is commonly used for personal loans between individuals, such as relatives or friends. 3. Business Loan Promissory Note: This type of promissory note is used for loans involving business entities, outlining the terms and conditions for business-related transactions. In conclusion, a Tennessee Promissory Note with Installment Payments is a legal document that establishes a loan agreement with specific repayment terms. It is crucial to understand the terms mentioned in the note thoroughly to avoid any legal complications.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Tennessee Pagaré con pagos a plazos - Promissory Note with Installment Payments

Description

How to fill out Tennessee Pagaré Con Pagos A Plazos?

US Legal Forms - one of many greatest libraries of authorized types in America - delivers a wide array of authorized document templates you are able to acquire or produce. Making use of the web site, you will get 1000s of types for business and person uses, sorted by groups, says, or keywords.You will discover the most up-to-date types of types just like the Tennessee Promissory Note with Installment Payments within minutes.

If you currently have a registration, log in and acquire Tennessee Promissory Note with Installment Payments in the US Legal Forms catalogue. The Acquire key can look on every develop you perspective. You have accessibility to all earlier saved types inside the My Forms tab of your bank account.

If you want to use US Legal Forms the first time, listed here are simple instructions to help you started off:

- Be sure to have chosen the correct develop for your city/region. Click on the Preview key to examine the form`s content. Browse the develop explanation to actually have chosen the appropriate develop.

- In case the develop doesn`t satisfy your specifications, take advantage of the Research field towards the top of the screen to find the one who does.

- If you are pleased with the form, confirm your choice by clicking on the Acquire now key. Then, pick the prices plan you favor and offer your references to sign up for an bank account.

- Process the transaction. Make use of credit card or PayPal bank account to perform the transaction.

- Choose the file format and acquire the form on your own system.

- Make modifications. Complete, change and produce and indication the saved Tennessee Promissory Note with Installment Payments.

Each and every format you put into your bank account does not have an expiry day which is yours eternally. So, in order to acquire or produce one more backup, just proceed to the My Forms segment and click about the develop you will need.

Get access to the Tennessee Promissory Note with Installment Payments with US Legal Forms, by far the most substantial catalogue of authorized document templates. Use 1000s of skilled and status-distinct templates that satisfy your organization or person requirements and specifications.