Tennessee Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner

Description

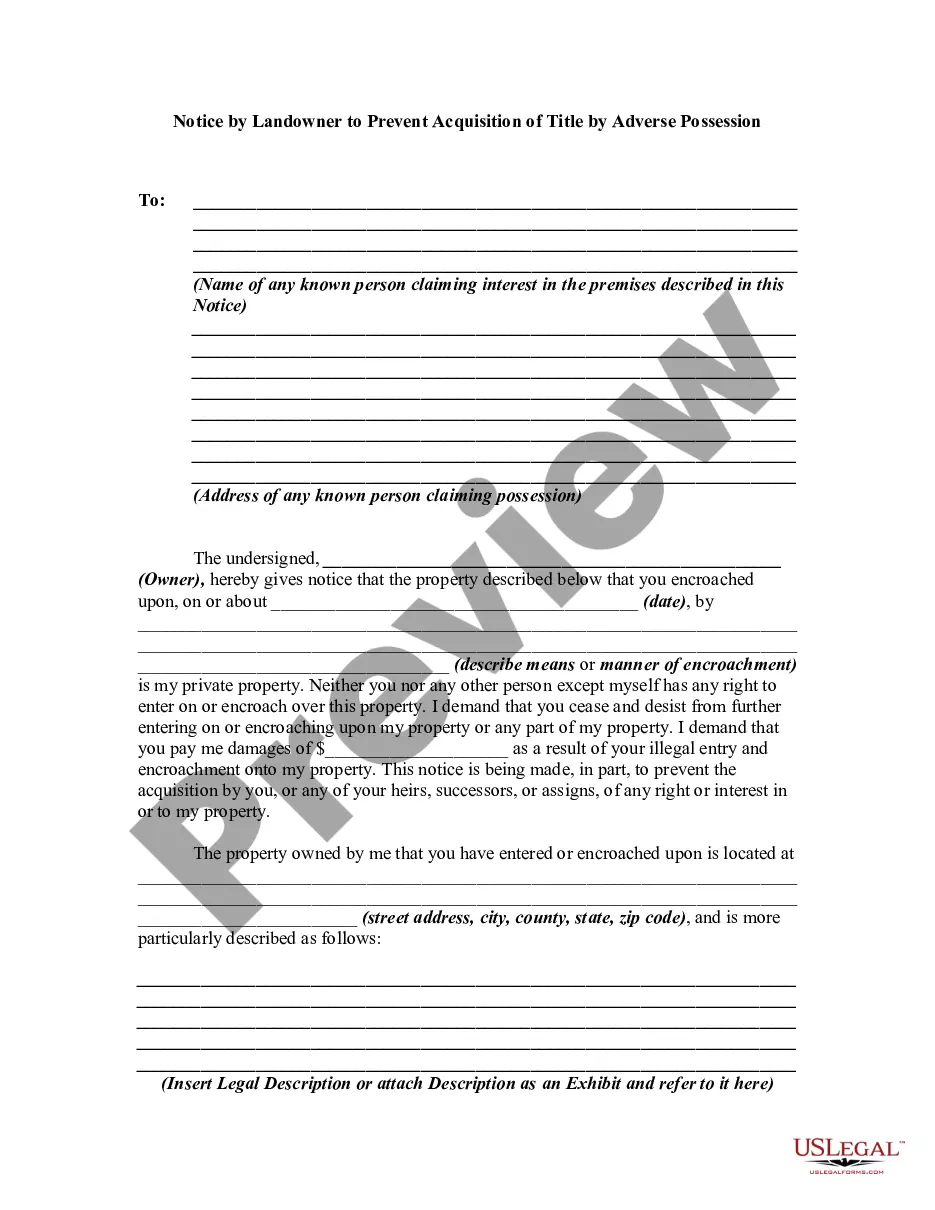

How to fill out Agreement To Dissolve And Wind Up Partnership With Sale To Partner By Retiring Partner?

Are you presently in a circumstance where you need documents for both commercial or personal purposes almost every day.

There are numerous legal document templates accessible online, but locating versions you can rely on isn't easy.

US Legal Forms offers thousands of form templates, such as the Tennessee Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner, which are designed to meet federal and state requirements.

If you find the correct form, click Acquire now.

Choose a payment plan you prefer, enter the required details to create your account, and pay for the transaction using your PayPal or credit card.

- If you are currently familiar with the US Legal Forms site and possess an account, simply Log In.

- After that, you can download the Tennessee Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for your correct state/region.

- Use the Preview button to review the form.

- Check the description to ensure that you've selected the appropriate form.

- If the form isn't what you're looking for, use the Research section to find the form that fits your requirements.

Form popularity

FAQ

A retired partner may remain liable for debts incurred after their retirement if contracts are not explicitly altered to release them from liability. This is often dictated by the provisions of the Tennessee Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner, which should clearly address such liabilities.

Dissolution is the act of ending the partnership agreement, while winding up refers to the subsequent process of concluding business affairs. Essentially, dissolution occurs first, followed by winding up to ensure all debts are settled and assets are distributed appropriately under a Tennessee Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner.

Dissolution in a partnership is the legal process in which a business partnership ceases to exist. This process involves settling accounts, distributing assets, and addressing outstanding debts. The Tennessee Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner provides a framework for achieving this dissolution smoothly.

A retired partner generally remains liable for obligations incurred before their retirement unless otherwise stated in the Tennessee Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner. Properly drafting this agreement can clarify liability issues and safeguard the retired partner's interests.

To close a partnership in Tennessee, partners must follow legal and procedural guidelines, including filing a final tax return and settling debts. Creating a Tennessee Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner can help streamline the process by outlining each partner's responsibilities and liabilities during closure.

Dissociation refers to an individual's voluntary exit from the partnership, while dissolution signifies the complete termination of the partnership business itself. Although a partner may dissociate, the partnership could continue unless it decides to dissolve. Understanding these concepts is crucial when dealing with a Tennessee Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner.

Removing a partner typically requires mutual consent and a review of the existing partnership agreement. It is advisable to document this change formally to avoid potential disputes later. The Tennessee Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner can facilitate this removal by laying out the necessary terms and conditions.

Winding up of a partnership is the process that occurs after the partnership has officially dissolved. It involves resolving all outstanding obligations, selling partnership assets, and distributing any remaining profits among the partners. Ensuring clarity in a Tennessee Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner can streamline this process.

Dissolution of a partnership refers to the formal end of the partnership agreement. Winding up is the process of settling debts, distributing assets, and completing outstanding business activities. Together, these steps are essential to finalize the termination of operations in accordance with a Tennessee Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner.

A retired partner may still face liability for debts incurred by the partnership before their retirement. Even after retiring, the terms of the Tennessee Agreement to Dissolve and Wind up Partnership with Sale to Partner by Retiring Partner can dictate how liabilities are handled. It is crucial to properly execute this agreement to ensure that liability is adequately addressed.