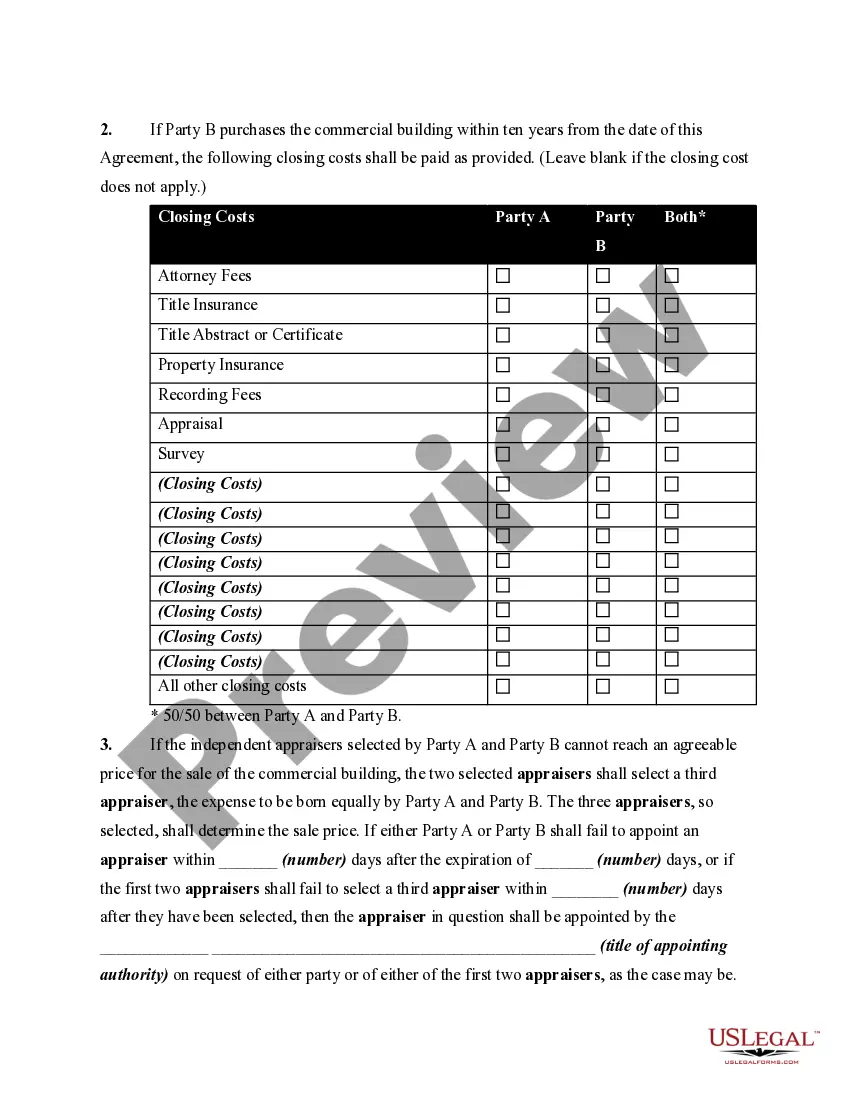

This Agreement between Partners for Future Sale of Commercial Building is used to provide for the future sale of a commercial building by giving one party the opportunity to purchase the commercial building any time in the next ten years from the date of this agreement, or by both parties agreeing to sell the commercial building outright to a third party and equally splitting the proceeds at the end of the ten-year period.

Tennessee Agreement between Partners for Future Sale of Commercial Building

Description

How to fill out Agreement Between Partners For Future Sale Of Commercial Building?

You might spend time online trying to locate the appropriate document format that fulfills the state and federal regulations you need.

US Legal Forms provides a vast array of legal templates that are reviewed by professionals.

You can conveniently download or print the Tennessee Agreement between Partners for Future Sale of Commercial Building from my service.

First, ensure you have chosen the correct document format for the region/city you select. Review the form description to confirm you have selected the right document. If available, use the Preview button to review the document format as well.

- If you already have a US Legal Forms account, you can Log In and click on the Download button.

- Next, you can complete, modify, print, or sign the Tennessee Agreement between Partners for Future Sale of Commercial Building.

- Every legal document format you purchase is yours indefinitely.

- To obtain another copy of a purchased form, visit the My documents tab and click on the corresponding button.

- If this is your first time using the US Legal Forms site, follow the simple instructions below.

Form popularity

FAQ

An agreement to do something in the future is a legal document that outlines commitments made by parties for actions to be taken at a later date. Such agreements often include specific terms regarding timelines and responsibilities. For those entering into a Tennessee Agreement between Partners for Future Sale of Commercial Building, this type of agreement ensures both partners are aligned on their goals and expectations.

Setting up a partnership agreement involves several critical steps. Begin by discussing and agreeing on the nature of your partnership, roles, and financial contributions. Incorporate essential elements into a written document, specifying terms for profit sharing and conflict resolution. Utilize the Tennessee Agreement between Partners for Future Sale of Commercial Building available on US Legal Forms for a comprehensive outline to help you succeed.

To write a business agreement between partners, start by clearly outlining each partner's roles and responsibilities. Include key terms such as profit sharing, decision-making processes, and conditions for exiting the partnership. Consider using the Tennessee Agreement between Partners for Future Sale of Commercial Building template from US Legal Forms, which provides a structured approach to creating effective legal documents.

The three main requirements for a legally binding contract include an offer, acceptance, and consideration. Each element serves a crucial role; without an offer, there is no basis for acceptance, and without consideration, there is no value exchanged. This structure is vital for a Tennessee Agreement between Partners for Future Sale of Commercial Building to ensure that all parties are protected and obligations are clear.

An agreement typically becomes a binding contract when all parties explicitly agree to the terms. This often occurs when one party makes an offer, and the other party accepts it, with mutual understanding and intent to create a legal obligation. For a Tennessee Agreement between Partners for Future Sale of Commercial Building, clear written communication helps solidify the binding nature of the agreement.

In Tennessee, a contract becomes legally binding when it contains several key elements. Firstly, there must be an offer and acceptance between the parties involved. Additionally, there must be consideration, meaning something of value must be exchanged. Finally, both parties must have the legal capacity to enter into the contract, ensuring the validity of a Tennessee Agreement between Partners for Future Sale of Commercial Building.

Yes, partnerships in Tennessee are required to file certain documents with the Secretary of State. This filing typically involves registering the partnership and ensuring compliance with state regulations. By taking this step, partners can safeguard their interests and establish a clear Tennessee Agreement between Partners for Future Sale of Commercial Building. Utilizing services like uslegalforms can simplify this process, making it easier for you to focus on your business goals.

To create a simple partnership agreement, you should begin with the names of the partners, followed by the purpose of the partnership and the roles of each partner. It's important to clearly detail the terms regarding profits, losses, and decision-making processes. By using a user-friendly platform like uslegalforms, you can easily draft a Tennessee Agreement between Partners for Future Sale of Commercial Building to ensure all bases are covered.

An agreement to sell in the future is a contract that outlines the terms for a planned sale of property or assets at a later date. This type of agreement is particularly relevant in a partnership context, ensuring all parties are aligned on expectations for the sale. A properly structured Tennessee Agreement between Partners for Future Sale of Commercial Building can help partners plan and execute this process efficiently.

To write a simple business agreement, start by outlining the basic terms, including the parties involved, purpose, obligations, and duration of the agreement. Use clear, straightforward language to describe each party’s roles. A Tennessee Agreement between Partners for Future Sale of Commercial Building should be easy to understand, ensuring all parties can refer back to it without confusion.