This type of form may be used in connection with a credit counseling seminar which also includes individual credit counseling. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Tennessee Agreement for Credit Counseling Services is a legally binding document that outlines the terms and conditions between a consumer and a credit counseling agency. It is designed to provide assistance to individuals in managing their debts and improving their financial situations. Tennessee has specific regulations and requirements related to credit counseling services, and the agreement ensures compliance with these laws. Keywords: Tennessee, Agreement for Credit Counseling Services, consumer, credit counseling agency, debts, financial situations, regulations, requirements, compliance. There are two main types of Tennessee Agreement for Credit Counseling Services: 1. Initial Enrollment Agreement: This type of agreement establishes the initial relationship between the consumer and the credit counseling agency. It outlines the services offered, such as budgeting assistance, debt management plans, and financial education. Additionally, it specifies the fees involved, including any setup fees, administrative charges, or monthly maintenance fees. The agreement also highlights the consumer's responsibilities, including providing accurate financial information and making timely payments. 2. Debt Management Plan (DMP) Agreement: After the initial enrollment, if the consumer decides to participate in a debt management plan, a separate agreement is created. This agreement outlines the terms and conditions specific to the DMP. It includes details such as the duration of the plan, negotiated interest rates and reduced payments, scheduled payment due dates, and any associated fees. The DMP agreement also specifies the consequences of late or missed payments and the potential impact on the consumer's credit score. Additional keywords: Debt Management Plan, budgeting assistance, financial education, setup fees, administrative charges, monthly maintenance fees, accurate financial information, timely payments, negotiated interest rates, reduced payments, scheduled payment due dates, consequences of late or missed payments, credit score. It is crucial for both the consumer and the credit counseling agency to carefully review and understand the Tennessee Agreement for Credit Counseling Services before signing. This ensures transparency and protects the rights and interests of all parties involved. It is advisable to seek legal advice if needed, especially if there are specific concerns or questions about the agreement's terms and conditions.The Tennessee Agreement for Credit Counseling Services is a legally binding document that outlines the terms and conditions between a consumer and a credit counseling agency. It is designed to provide assistance to individuals in managing their debts and improving their financial situations. Tennessee has specific regulations and requirements related to credit counseling services, and the agreement ensures compliance with these laws. Keywords: Tennessee, Agreement for Credit Counseling Services, consumer, credit counseling agency, debts, financial situations, regulations, requirements, compliance. There are two main types of Tennessee Agreement for Credit Counseling Services: 1. Initial Enrollment Agreement: This type of agreement establishes the initial relationship between the consumer and the credit counseling agency. It outlines the services offered, such as budgeting assistance, debt management plans, and financial education. Additionally, it specifies the fees involved, including any setup fees, administrative charges, or monthly maintenance fees. The agreement also highlights the consumer's responsibilities, including providing accurate financial information and making timely payments. 2. Debt Management Plan (DMP) Agreement: After the initial enrollment, if the consumer decides to participate in a debt management plan, a separate agreement is created. This agreement outlines the terms and conditions specific to the DMP. It includes details such as the duration of the plan, negotiated interest rates and reduced payments, scheduled payment due dates, and any associated fees. The DMP agreement also specifies the consequences of late or missed payments and the potential impact on the consumer's credit score. Additional keywords: Debt Management Plan, budgeting assistance, financial education, setup fees, administrative charges, monthly maintenance fees, accurate financial information, timely payments, negotiated interest rates, reduced payments, scheduled payment due dates, consequences of late or missed payments, credit score. It is crucial for both the consumer and the credit counseling agency to carefully review and understand the Tennessee Agreement for Credit Counseling Services before signing. This ensures transparency and protects the rights and interests of all parties involved. It is advisable to seek legal advice if needed, especially if there are specific concerns or questions about the agreement's terms and conditions.

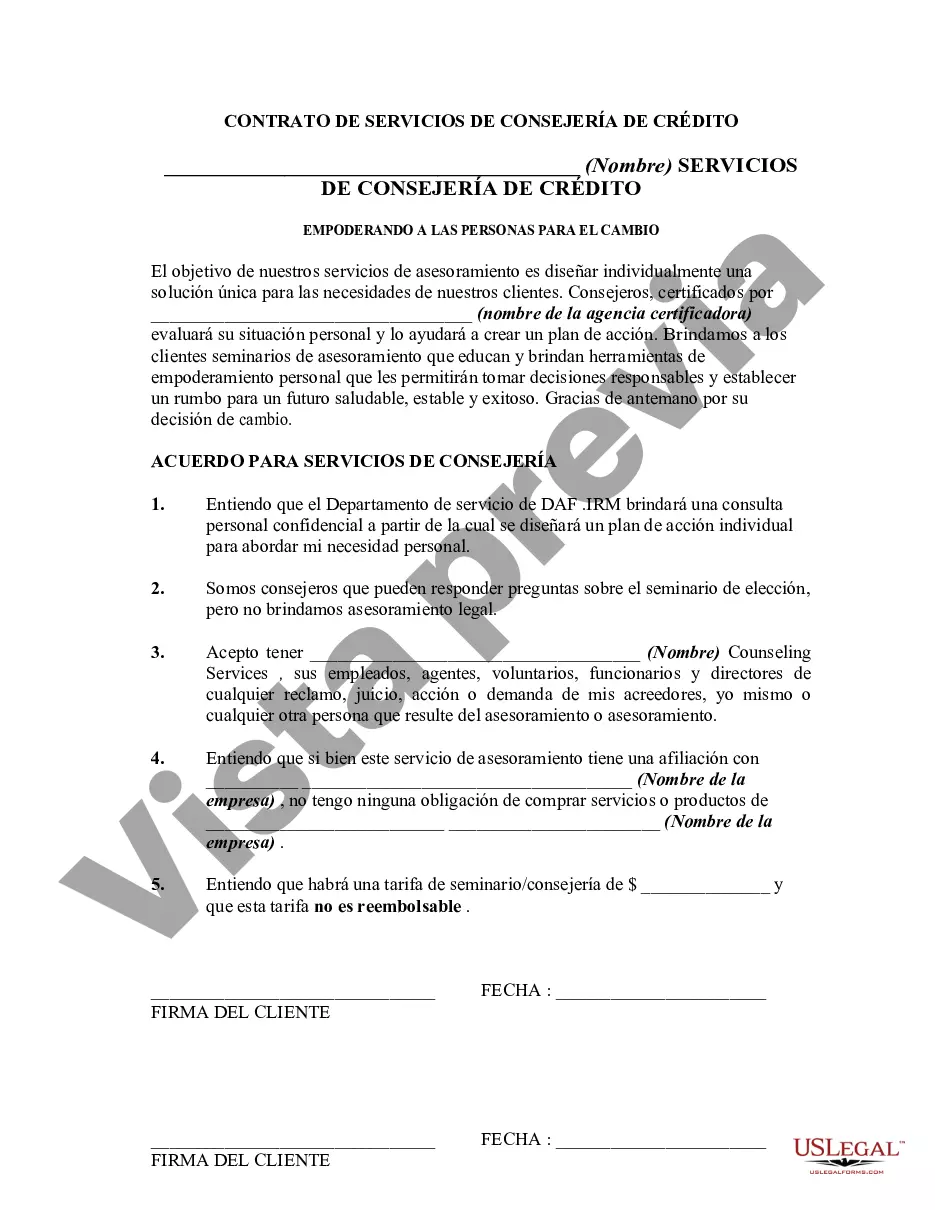

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.