In Tennessee, a triple net lease is a popular type of commercial real estate lease agreement that places a significant amount of financial responsibility on the tenant. Under this lease structure, the tenant agrees to pay not only the base rent but also the operating expenses, property taxes, and insurance fees associated with the property. This type of lease is typically favored by landlords who want to shift the burden of maintaining and operating the property to the tenant. One of the key advantages of a Tennessee triple net lease for commercial real estate is that it provides stable and predictable income for the landlord. By passing on the expenses to the tenant, the landlord can accurately forecast their cash flow and minimize the risk of unexpected costs. Additionally, this model allows the tenant to have more control over the property and the ability to customize it according to their business needs. There are different variations of the Tennessee triple net lease that can be tailored to specific situations and tenant preferences. Here are some notable types: 1. Single-tenant lease: This is the most common form of a triple net lease, where a single tenant leases the entire commercial property. In this arrangement, the tenant is responsible for all expenses related to the property, including maintenance, repairs, property taxes, insurance, and utilities. 2. Multi-tenant lease: In this scenario, multiple tenants share the same commercial property. Each tenant is responsible for their proportionate share of the operating expenses, property taxes, and insurance based on their rented space. This type of lease is often observed in shopping centers or office buildings. 3. Bond lease: A bond lease is a variation where the tenant purchases a bond to cover their share of the operating expenses, property taxes, and insurance. Instead of paying directly, the tenant holds the bond, which acts as collateral against their responsibilities. This provides additional security to the landlord in case the tenant defaults on their obligations. Tennessee triple net leases are known for being long-term agreements, typically spanning 10 to 15 years or more. They offer benefits to both landlords and tenants, allowing for stable income and increased control for the landlord, and the flexibility to operate and customize the space for the tenant. It is crucial for both parties to carefully negotiate and review the lease terms to ensure a fair and mutually beneficial arrangement.

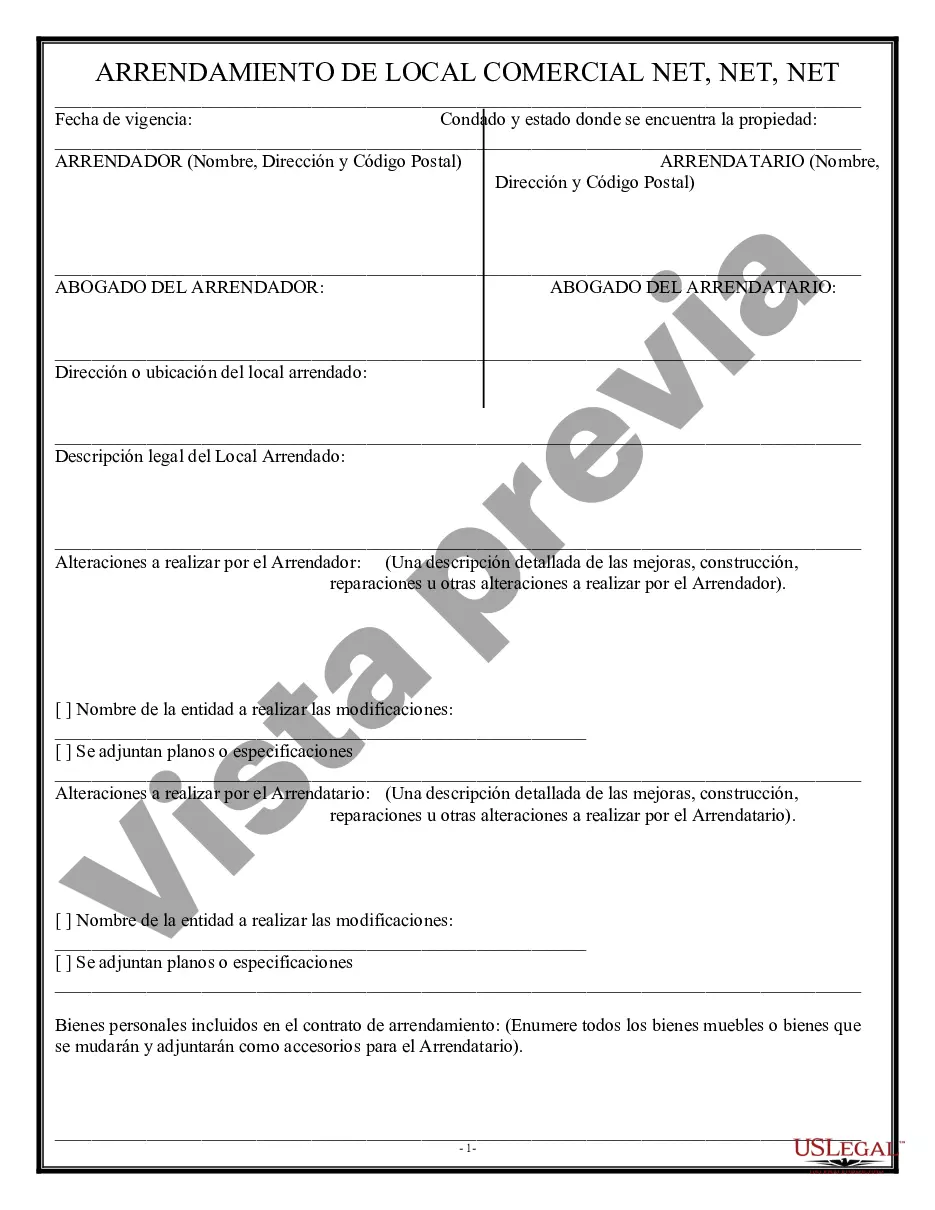

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Tennessee Arrendamiento neto triple para bienes raíces comerciales - Triple Net Lease for Commercial Real Estate

Description

How to fill out Tennessee Arrendamiento Neto Triple Para Bienes Raíces Comerciales?

You may spend hours on the Internet trying to find the legal document web template which fits the state and federal specifications you want. US Legal Forms offers 1000s of legal forms that are reviewed by specialists. It is possible to down load or printing the Tennessee Triple Net Lease for Commercial Real Estate from my assistance.

If you have a US Legal Forms profile, you can log in and then click the Obtain key. Afterward, you can full, edit, printing, or sign the Tennessee Triple Net Lease for Commercial Real Estate. Every legal document web template you acquire is the one you have forever. To get yet another version of the obtained form, proceed to the My Forms tab and then click the related key.

Should you use the US Legal Forms site the very first time, keep to the simple instructions under:

- First, be sure that you have chosen the right document web template for that region/metropolis of your choosing. Look at the form explanation to ensure you have picked out the correct form. If readily available, make use of the Preview key to appear from the document web template as well.

- If you would like discover yet another version from the form, make use of the Search discipline to get the web template that meets your needs and specifications.

- When you have identified the web template you need, click Buy now to move forward.

- Choose the prices plan you need, enter your credentials, and register for a merchant account on US Legal Forms.

- Full the deal. You should use your bank card or PayPal profile to fund the legal form.

- Choose the format from the document and down load it to your gadget.

- Make adjustments to your document if possible. You may full, edit and sign and printing Tennessee Triple Net Lease for Commercial Real Estate.

Obtain and printing 1000s of document templates making use of the US Legal Forms web site, that offers the largest assortment of legal forms. Use professional and express-specific templates to tackle your small business or individual needs.