This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Tennessee Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased

Description

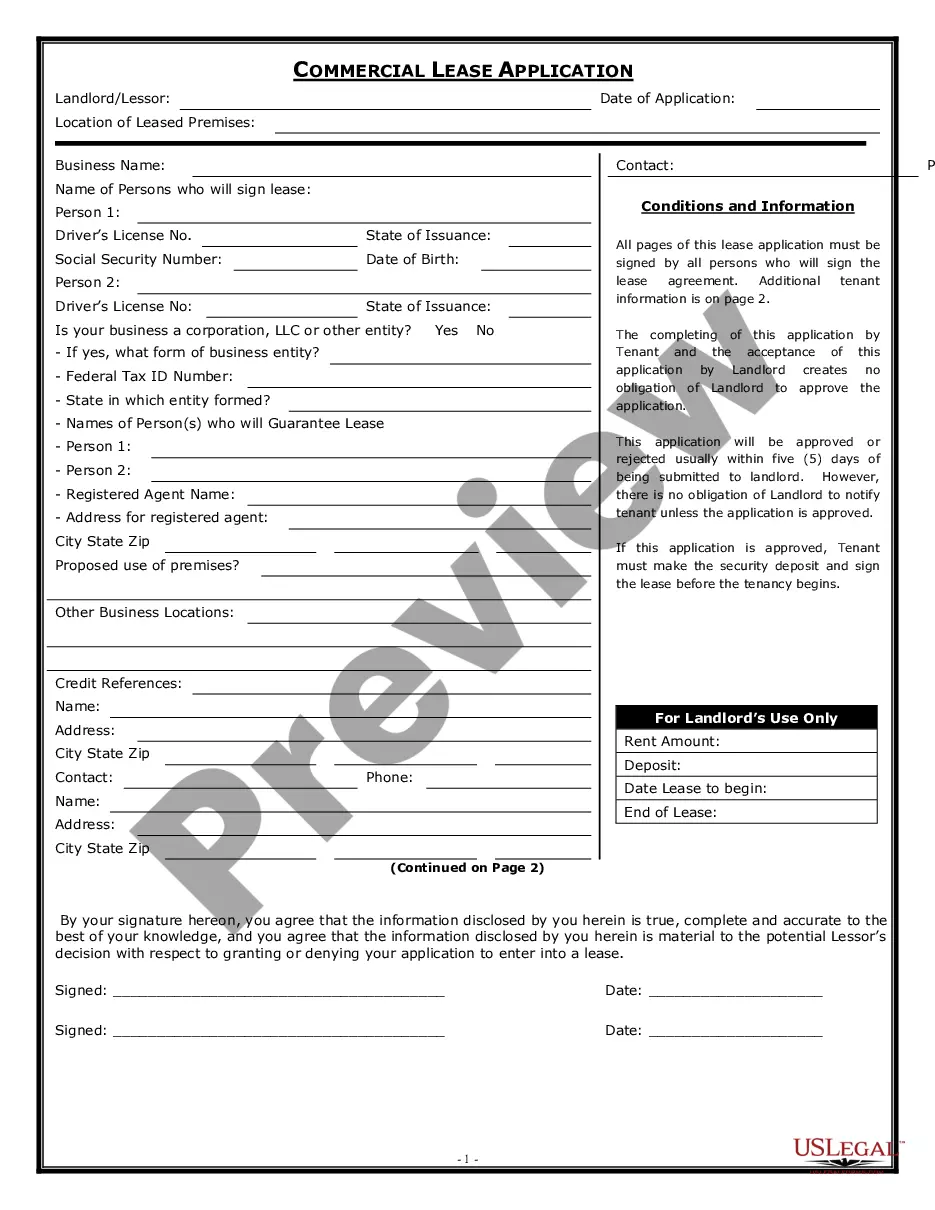

How to fill out Bill Of Sale And Assumption Of Debt Secured By The Personal Property Being Purchased?

You can dedicate numerous hours online searching for the valid document template that fulfills the federal and state requirements you desire.

US Legal Forms offers a vast array of lawful forms that are reviewed by experts.

You can conveniently acquire or print the Tennessee Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased through the service.

First, ensure that you have chosen the correct document template for your selected jurisdiction. Review the form details to confirm you have picked the appropriate form. If available, utilize the Preview option to view the document template as well.

- If you have an account with US Legal Forms, you may Log In and select the Obtain button.

- Then, you can complete, modify, print, or sign the Tennessee Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased.

- Every legal document template you purchase is yours indefinitely.

- To obtain another copy of any document acquired, navigate to the My documents section and select the appropriate option.

- If you are visiting the US Legal Forms website for the first time, follow these straightforward instructions below.

Form popularity

FAQ

Personal property in Tennessee refers to any movable property that is not permanently attached to land or buildings. This includes items like cars, furniture, and equipment owned by individuals or businesses. Understanding the nuances of personal property is essential, especially when you are preparing a Tennessee Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased.

Yes, a handwritten bill of sale is legal in Tennessee as long as it includes all necessary information about the transaction. However, a more formal document is often recommended for clarity and legal protection. When recording a Tennessee Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased, having clear terms can greatly reduce misunderstandings between parties.

In Tennessee, tangible personal property includes any physical items that can be seen, touched, or moved. This encompasses goods like machinery, furniture, vehicles, and equipment that individuals own. Understanding what qualifies as tangible personal property is crucial when drafting a Tennessee Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased to ensure proper documentation of assets.

Yes, Tennessee imposes a personal property tax on specific types of tangible personal property. This tax applies to items like vehicles, equipment, and other assets that an individual may own. It's important to understand your tax obligations to ensure compliance and avoid penalties on your Tennessee Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased.

Yes, a bill of sale can be legal without notarization in Tennessee. As long as it contains the proper information about the transaction, it serves its purpose effectively. To make it more binding and reliable, consider using a Tennessee Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased as a standard template available through platforms like US Legal Forms.

No, a bill of sale does not have to be notarized in Tennessee for the transfer of most personal property. However, documenting the sale with a detailed Tennessee Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased can provide peace of mind. It can also simplify any potential disputes that may arise in the future.

In Tennessee, a notarized bill of sale is not required for most personal property transactions. However, if you are dealing with a vehicle, it’s wise to get it notarized to add an extra layer of protection. By using a Tennessee Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased, you can clearly outline the terms and enhance the document's legitimacy.

The advantages of a Tennessee Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased are significant. This document provides legal protection during transactions, offering clarity and accountability. Additionally, it can facilitate a smoother transfer of title and ownership. With proper documentation, both parties can feel confident that their interests are safeguarded.

Many individuals seek a Tennessee Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased to establish proof of ownership. This document serves as an essential legal record for both buyers and sellers. It protects parties involved in the transaction, detailing the terms and conditions agreed upon. Ultimately, a bill of sale can help prevent disputes and ensure everyone is clear about their rights.

Personal property in Tennessee refers to movable items that are not fixed to real estate. This can include vehicles, furniture, electronics, and other tangible assets. When documenting a sale, such as a Tennessee Bill of Sale and Assumption of Debt Secured by the Personal Property Being Purchased, it's essential to clearly identify which items are covered in your agreement. If you need guidance on preparing your bill of sale, uslegalforms can provide you with valuable resources.