Tennessee Agreement for Sale of Business — SolProprietorshiphi— - Asset Purchase The Tennessee Agreement for Sale of Business — SolProprietorshiphi— - Asset Purchase is a legally binding document that outlines the terms and conditions governing the sale of a sole proprietorship business in Tennessee. This agreement serves as a roadmap for both the seller and the buyer, ensuring a smooth and fair transaction while protecting the rights and interests of both parties. In this type of agreement, the seller agrees to transfer the assets of the business to the buyer in exchange for a specified amount of money or other agreed-upon consideration. The assets may include equipment, inventory, licenses, contracts, intellectual property, and goodwill associated with the business. This agreement allows for the transfer of these assets while preserving the liabilities and obligations of the sole proprietorship with the seller. Essential provisions included in the agreement cover various aspects of the sale, such as: 1. Purchase Price: Clearly states the agreed-upon purchase price for the business assets. 2. Payment Terms: Outlines the payment method, whether it's a lump sum, installments, or other negotiated terms. 3. Asset Description: Provides a comprehensive list and description of the assets being transferred with the business. 4. Seller's Representations: Details the seller's guarantees concerning the business and assets, ensuring they have the legal right to sell and that all information provided is accurate. 5. Buyer's Representations: States that the buyer has conducted due diligence and accepts the business and assets as-is. 6. Adjustments: Includes provisions for adjustments to the purchase price based on factors like inventory valuation or outstanding liabilities. 7. Non-competition and Non-solicitation: Restricts the seller from engaging in competition or soliciting employees or customers of the business for a certain period of time. 8. Closing Terms: Outlines the procedures and obligations of both parties during the closing process, including the transfer of licenses, contracts, and other necessary documents. It is important to note that different types or variations of this agreement may exist based on specific circumstances or requirements. For instance, there may be instances where a Tennessee Agreement for Sale of Business — SolProprietorshiphi— - Asset Purchase with Seller Financing is employed, allowing the buyer to make payments over time directly to the seller, instead of obtaining external financing. To ensure the legality and enforceability of the agreement, it is advisable for both parties to seek legal counsel to review and customize the agreement according to their unique situation. Additionally, any amendments or modifications to the agreement should be made in writing and signed by both parties to avoid any misunderstandings or disputes in the future. In conclusion, the Tennessee Agreement for Sale of Business — SolProprietorshiphi— - Asset Purchase is a vital document for individuals or entities involved in buying or selling a sole proprietorship business in Tennessee. It provides a clear framework for the transfer of assets and protects the rights and obligations of both the seller and the buyer.

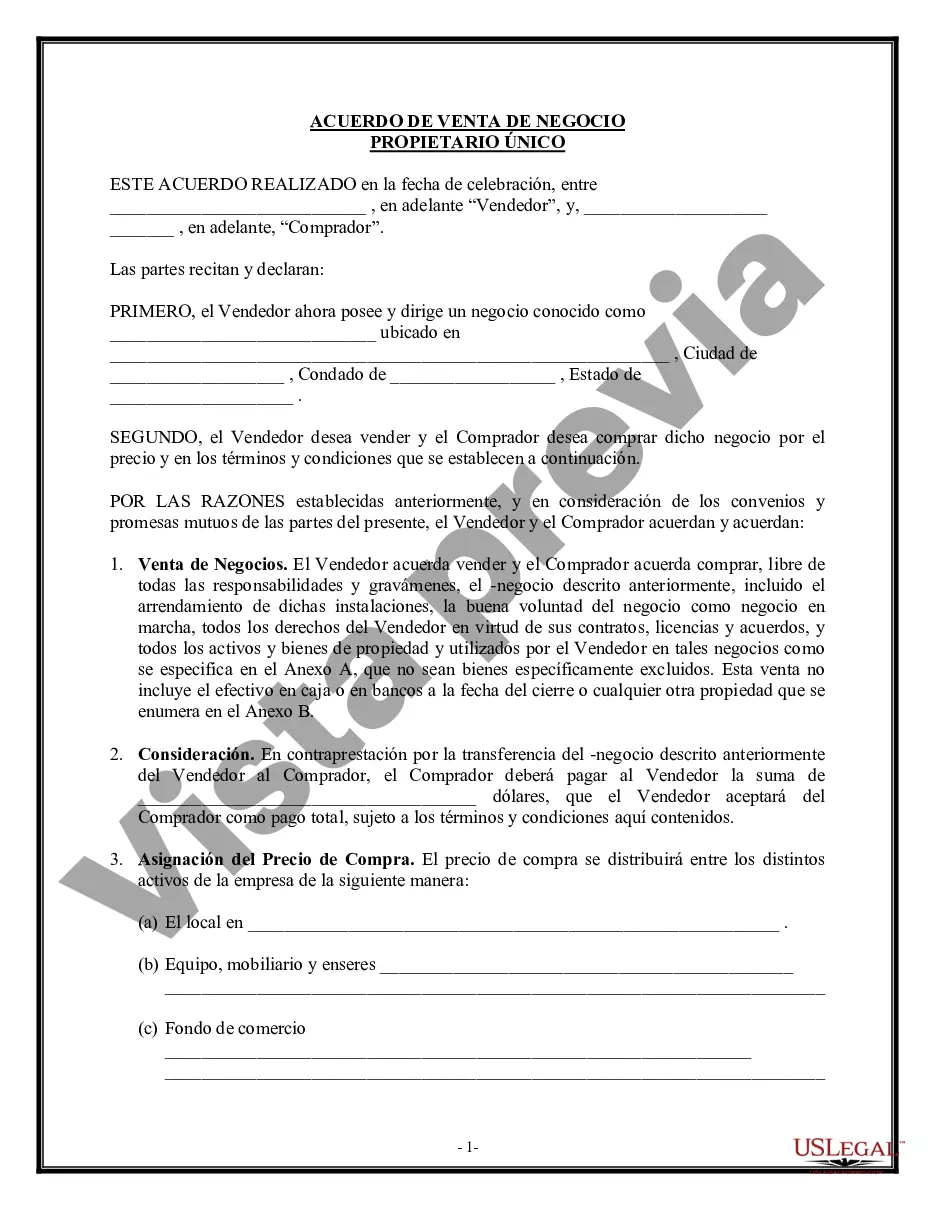

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Tennessee Acuerdo de Venta de Negocio - Empresa Unipersonal - Compra de Activos - Agreement for Sale of Business - Sole Proprietorship - Asset Purchase

Description

How to fill out Tennessee Acuerdo De Venta De Negocio - Empresa Unipersonal - Compra De Activos?

If you have to complete, download, or print out legitimate file web templates, use US Legal Forms, the largest selection of legitimate forms, that can be found on-line. Utilize the site`s easy and hassle-free lookup to discover the files you require. Different web templates for organization and individual uses are sorted by groups and states, or keywords. Use US Legal Forms to discover the Tennessee Agreement for Sale of Business - Sole Proprietorship - Asset Purchase in a few mouse clicks.

Should you be already a US Legal Forms customer, log in in your bank account and then click the Acquire switch to get the Tennessee Agreement for Sale of Business - Sole Proprietorship - Asset Purchase. You can also access forms you earlier acquired within the My Forms tab of the bank account.

Should you use US Legal Forms the first time, follow the instructions listed below:

- Step 1. Be sure you have selected the form for that appropriate town/country.

- Step 2. Make use of the Preview method to check out the form`s content material. Don`t overlook to learn the outline.

- Step 3. Should you be unsatisfied with the develop, utilize the Search field towards the top of the display to get other variations of the legitimate develop template.

- Step 4. When you have located the form you require, select the Get now switch. Choose the rates prepare you favor and add your qualifications to sign up for the bank account.

- Step 5. Process the transaction. You should use your bank card or PayPal bank account to complete the transaction.

- Step 6. Pick the file format of the legitimate develop and download it on your own product.

- Step 7. Full, revise and print out or signal the Tennessee Agreement for Sale of Business - Sole Proprietorship - Asset Purchase.

Each legitimate file template you buy is yours for a long time. You might have acces to every single develop you acquired inside your acccount. Go through the My Forms portion and choose a develop to print out or download again.

Contend and download, and print out the Tennessee Agreement for Sale of Business - Sole Proprietorship - Asset Purchase with US Legal Forms. There are thousands of skilled and condition-specific forms you can utilize for your organization or individual requires.