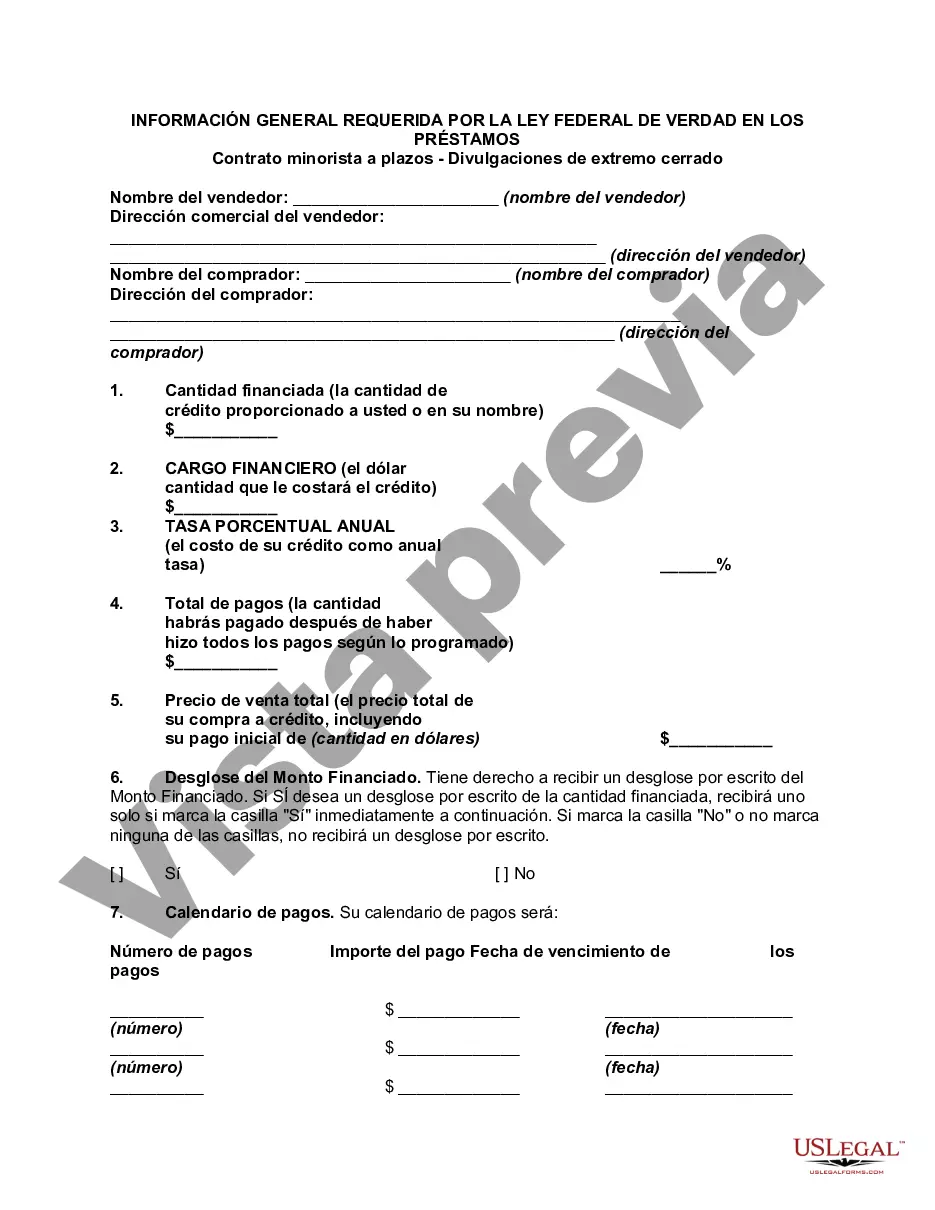

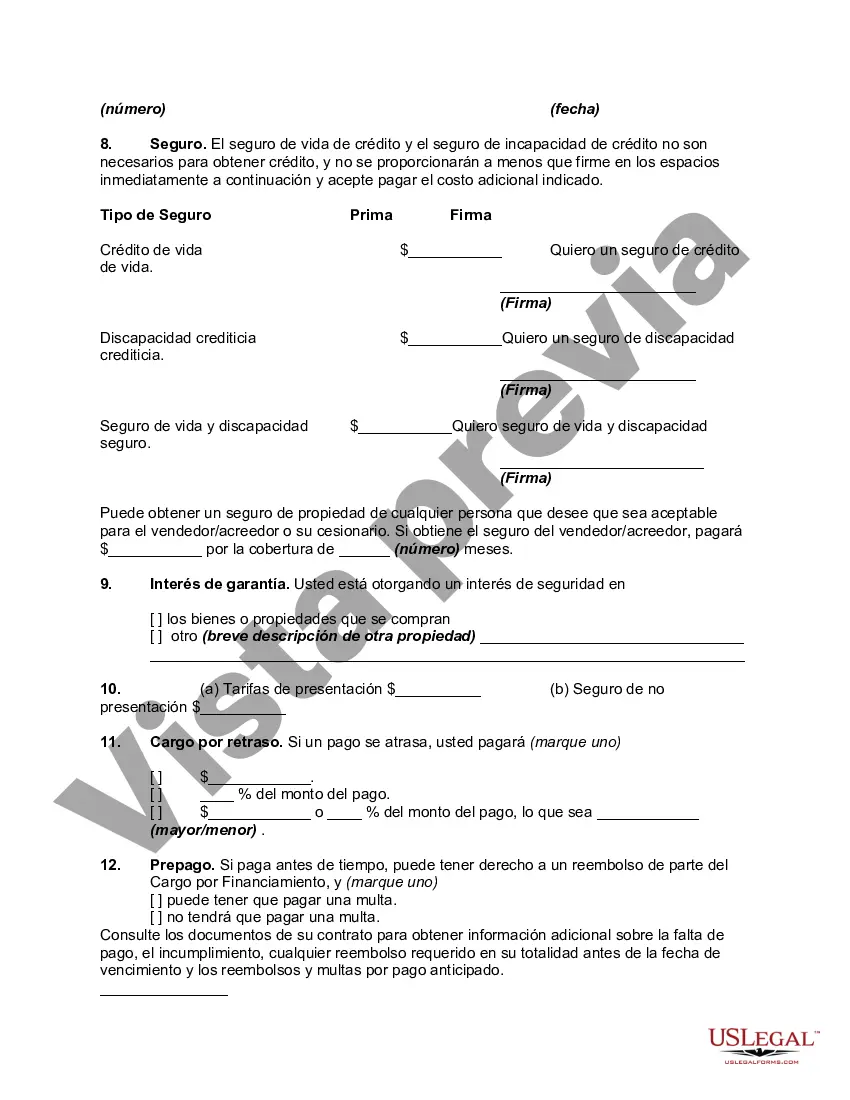

The Tennessee General Disclosures Required By The Federal Truth In Lending Act — Retail InstallmenContractac— - Closed End Disclosures are an essential part of consumer financial protection in the state of Tennessee. These disclosures aim to provide transparency and clarity to borrowers regarding the terms and conditions of their retail installment contracts for closed-end credit. By understanding these disclosures, consumers can make informed decisions when entering into financial agreements. There are various types of Tennessee General Disclosures that fall under the Federal Truth In Lending Act. Some significant types include: 1. Annual Percentage Rate (APR) Disclosure: This disclosure informs borrowers about the annual cost of borrowing, including both the interest rate and any applicable fees. It helps consumers compare different loan offers and understand the true cost of credit. 2. Finance Charge Disclosure: The finance charge is the total amount of interest and fees that the borrower will pay over the life of the loan. This disclosure ensures that consumers are aware of the total cost of credit before committing to a loan. 3. Amount Financed Disclosure: This disclosure specifies the total amount borrowed, excluding any prepaid finance charges. It allows borrowers to understand the exact funds they will receive and helps prevent any confusion about loan amounts. 4. Total of Payments Disclosure: This disclosure states the total amount that the borrower will repay over the life of the loan, including both the principal amount and the finance charge. It provides consumers with a clear overview of their repayment obligations. 5. Payment Schedule Disclosure: This disclosure outlines the number and timing of payments, along with the amounts due for each payment. It helps borrowers plan their finances and ensures they understand when and how much they need to pay. 6. Late Payment Fee Disclosure: If applicable, this disclosure informs borrowers about any fees or penalties that they may incur for late or missed payments. It encourages borrowers to make timely payments to avoid additional charges. 7. Prepayment Disclosure: This disclosure explains whether and under what conditions borrowers can prepay their loans without incurring any penalties. It helps borrowers understand their options for early repayment and saves them from unexpected costs. Overall, the Tennessee General Disclosures Required By The Federal Truth In Lending Act — Retail InstallmenContractac— - Closed End Disclosures play a vital role in promoting fair and transparent lending practices. They protect consumers by ensuring they have access to accurate and comprehensive information about their credit terms and costs. By knowing and understanding these disclosures, borrowers can make informed financial decisions and protect themselves from any potential pitfalls.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Tennessee Divulgaciones generales requeridas por la Ley Federal de Veracidad en los Préstamos - Contrato minorista a plazos - Divulgaciones cerradas - General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures

Description

How to fill out Tennessee Divulgaciones Generales Requeridas Por La Ley Federal De Veracidad En Los Préstamos - Contrato Minorista A Plazos - Divulgaciones Cerradas?

If you want to complete, download, or printing authorized papers themes, use US Legal Forms, the biggest assortment of authorized forms, that can be found on-line. Make use of the site`s basic and convenient research to get the papers you need. Numerous themes for enterprise and person purposes are categorized by classes and states, or keywords and phrases. Use US Legal Forms to get the Tennessee General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures with a handful of clicks.

Should you be already a US Legal Forms customer, log in to your accounts and click the Acquire switch to obtain the Tennessee General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures. You can even access forms you formerly saved within the My Forms tab of the accounts.

If you work with US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Be sure you have chosen the shape for that right metropolis/nation.

- Step 2. Make use of the Preview solution to look over the form`s content. Don`t forget about to read through the explanation.

- Step 3. Should you be not happy using the type, utilize the Research discipline on top of the display screen to find other variations from the authorized type template.

- Step 4. Once you have found the shape you need, go through the Purchase now switch. Select the costs program you prefer and include your accreditations to register for the accounts.

- Step 5. Procedure the purchase. You should use your bank card or PayPal accounts to perform the purchase.

- Step 6. Find the structure from the authorized type and download it in your device.

- Step 7. Full, modify and printing or indicator the Tennessee General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures.

Every single authorized papers template you get is your own permanently. You may have acces to every type you saved with your acccount. Go through the My Forms segment and pick a type to printing or download once more.

Contend and download, and printing the Tennessee General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures with US Legal Forms. There are thousands of skilled and status-certain forms you can utilize for the enterprise or person demands.