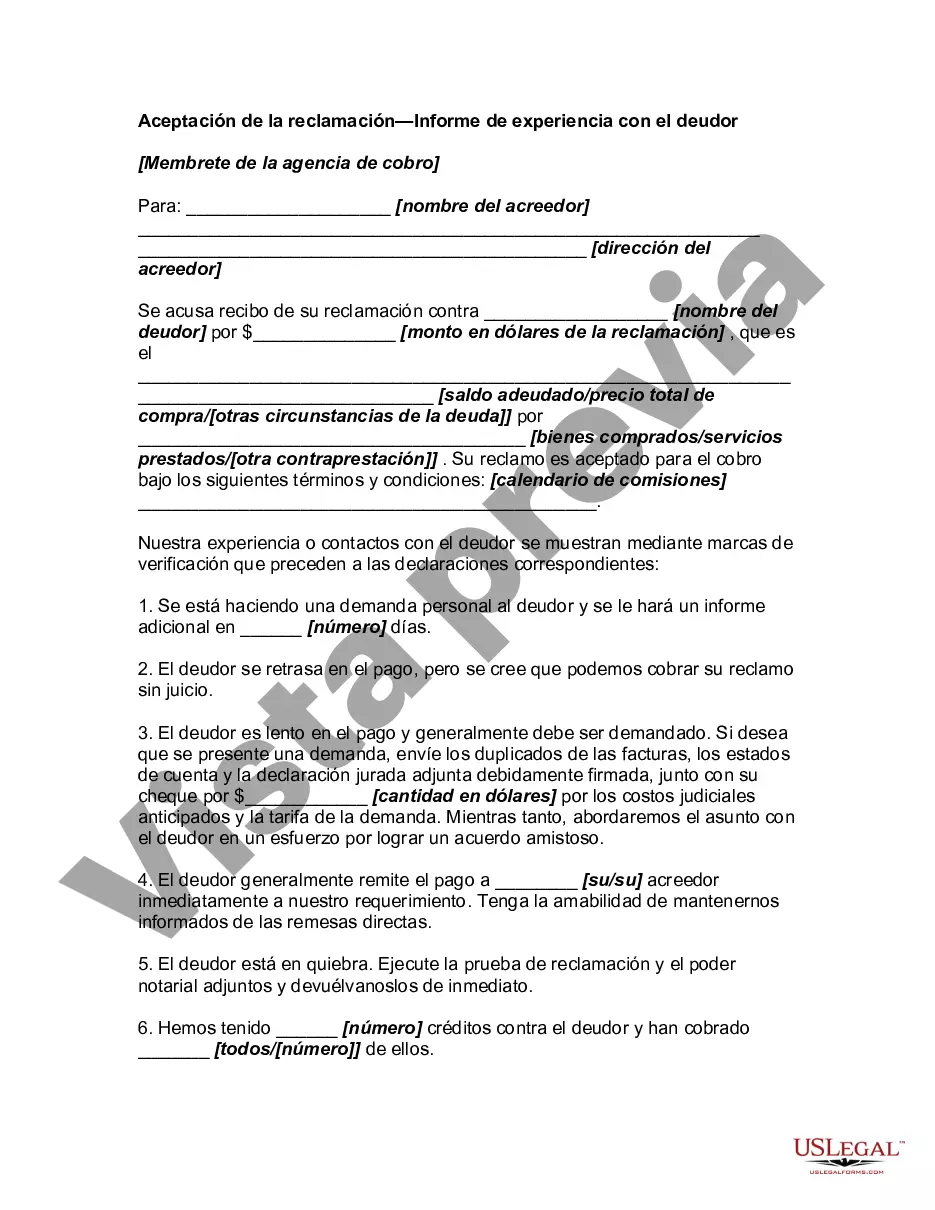

Tennessee Acceptance of Claim by Collection Agency and Report of Experience with Debtor refers to the process and documentation involved when a collection agency accepts a claim from a creditor in the state of Tennessee. It also includes reporting the agency's experience in dealing with the debtor. In Tennessee, when a creditor hires a collection agency to recover a debt, the agency must follow certain guidelines and submit an acceptance of claim to the creditor. This acceptance of claim serves as an acknowledgment that the agency has agreed to undertake the task of collecting the debt on behalf of the creditor. The acceptance of claim document typically includes: 1. Creditor Information: The collection agency should provide details of the creditor, including their name, address, contact information, and any relevant account or reference numbers associated with the debt. 2. Debtor Information: The document should also include the debtor's details, such as their name, address, contact information, and any available account or reference numbers. 3. Claim Details: The acceptance of claim should outline the specifics of the debt being claimed, including the amount owed, the original creditor, and any supporting documentation that proves the existence of the debt. 4. Collection Agreement: It is common for an acceptance of claim document to also include a collection agreement. This agreement outlines the terms and conditions of the collection process, including fees, commission rates, and any other relevant provisions. 5. Date and Signatures: The acceptance of claim must be dated and signed by both the collection agency representative and the creditor, establishing formal acceptance of the claim. Regarding the report of experience with the debtor, this generally refers to the collection agency's interactions and activities related to attempting to collect the debt. The report should provide a detailed account of every communication and action taken by the agency to recover the debt. The report may include: 1. Contact Attempts: Document each instance of attempted contact with the debtor, such as phone calls, letters, emails, and in-person visits. Include the date, time, method of contact, and a summary of the outcome. 2. Payment Arrangements: If any payment arrangements were proposed, accepted, or rejected by the debtor, they should be noted in the report, including dates and terms discussed. 3. Legal Actions: If the collection agency pursued legal actions against the debtor, such as filing a lawsuit or securing a judgment, this should be detailed in the report, including the outcomes or current status. 4. Collection Activity Log: Maintain a chronological record of all collection activities, including dates and brief descriptions of conversations or interactions with the debtor or their representatives. It is important to note that there may be specific variations or additional requirements for the Tennessee Acceptance of Claim by Collection Agency and Report of Experience with Debtor, and it is advisable to consult relevant Tennessee statutes, attorney guidance, or professional resources to ensure compliance with state regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Tennessee Aceptación de Reclamo por Agencia de Cobranza e Informe de Experiencia con Deudor - Acceptance of Claim by Collection Agency and Report of Experience with Debtor

Description

How to fill out Tennessee Aceptación De Reclamo Por Agencia De Cobranza E Informe De Experiencia Con Deudor?

Finding the right legal record web template could be a have difficulties. Needless to say, there are a lot of themes available online, but how can you find the legal form you want? Utilize the US Legal Forms website. The support provides a huge number of themes, for example the Tennessee Acceptance of Claim by Collection Agency and Report of Experience with Debtor, that you can use for company and private demands. Each of the forms are checked by specialists and fulfill state and federal demands.

If you are already listed, log in to your accounts and click the Down load switch to get the Tennessee Acceptance of Claim by Collection Agency and Report of Experience with Debtor. Use your accounts to check with the legal forms you may have purchased previously. Check out the My Forms tab of the accounts and get another version of the record you want.

If you are a brand new consumer of US Legal Forms, allow me to share basic directions that you should follow:

- Very first, make certain you have selected the right form to your town/county. You can look through the shape using the Preview switch and browse the shape explanation to make certain this is the best for you.

- If the form is not going to fulfill your preferences, make use of the Seach industry to discover the appropriate form.

- Once you are sure that the shape is acceptable, click the Purchase now switch to get the form.

- Choose the costs plan you need and type in the required information. Make your accounts and purchase your order with your PayPal accounts or charge card.

- Select the file file format and acquire the legal record web template to your product.

- Full, revise and produce and indicator the received Tennessee Acceptance of Claim by Collection Agency and Report of Experience with Debtor.

US Legal Forms will be the largest local library of legal forms for which you will find various record themes. Utilize the service to acquire professionally-created papers that follow express demands.