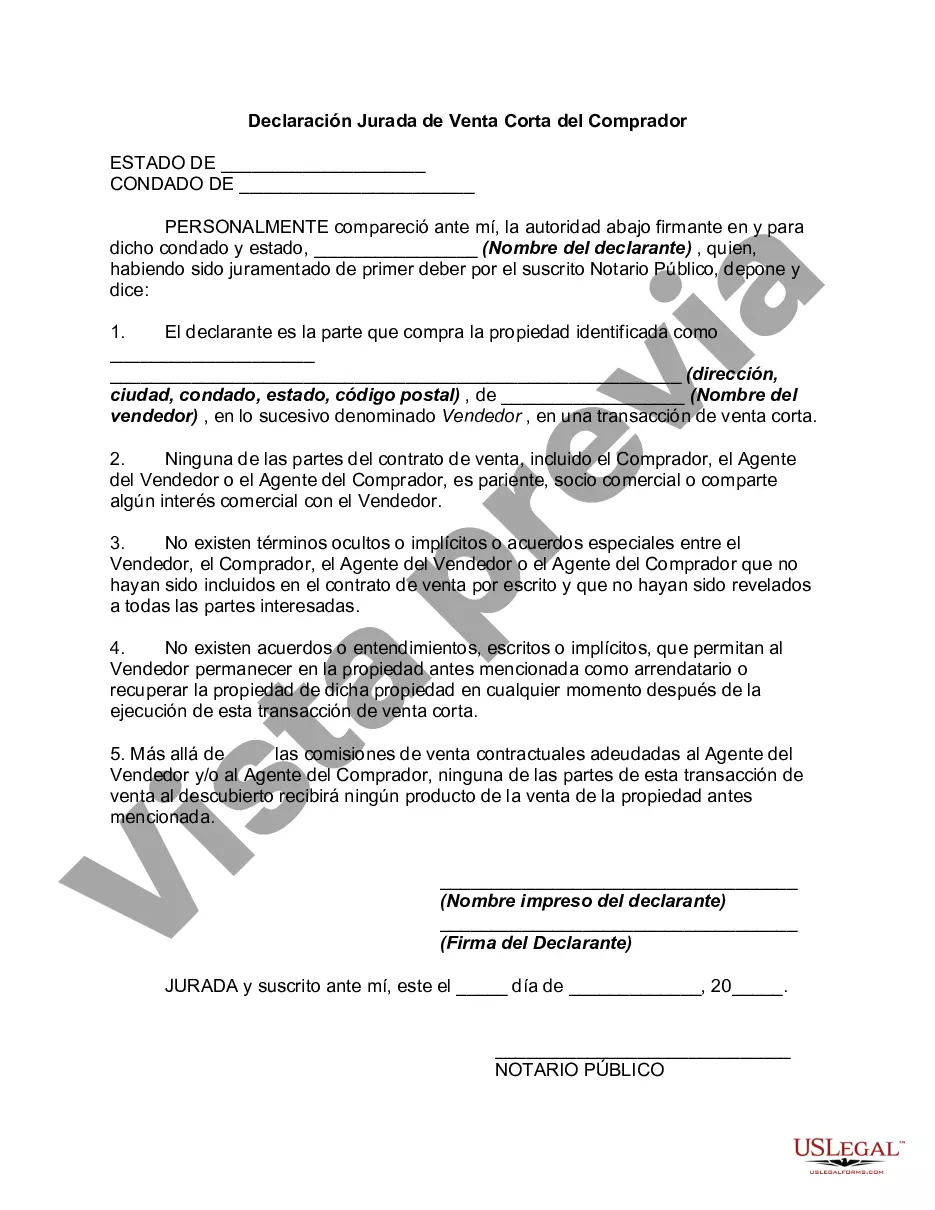

The Tennessee Short Sale Affidavit of Buyer is an essential document used in real estate transactions when purchasing a property that is undergoing a short sale in the state of Tennessee. This affidavit is a legally binding statement made by the buyer, affirming certain conditions and responsibilities they agree to in the short sale process. In a Tennessee short sale, the property is sold for an amount less than the outstanding mortgage balance. The affidavit serves as a means to protect the seller, lender, and buyer by ensuring that all parties are aware of the terms and conditions of the sale. The Tennessee Short Sale Affidavit of Buyer typically includes the following key elements: 1. Identification: The affidavit starts by identifying the buyer, including their full name, address, contact information, and social security number. 2. Acknowledgment of Short Sale Status: The buyer acknowledges that they are purchasing the property as a short sale transaction, understanding that it may take longer to reach closing due to the involvement of the mortgage lender. 3. Inspection and Acceptance of Property: The buyer confirms that they have inspected the property and accept it in its current condition, understanding that the seller is not responsible for any repairs or modifications. 4. Contingencies and Financing: The buyer specifies any contingencies attached to the offer, such as obtaining mortgage financing or successfully completing a home inspection within a specified timeframe. 5. Hardship Assistance: If the buyer is receiving any type of hardship assistance, such as a down payment or closing cost assistance, it needs to be disclosed in this affidavit. 6. Lender Approval: The buyer understands that the short sale transaction is subject to the approval of the lender(s) involved, and they agree to cooperate throughout the process. 7. Timelines and Closing Terms: The affidavit may outline specific timelines for the buyer's responsibilities, such as submitting necessary documentation and depositing earnest money. It may also contain details about the closing date, location, and any special conditions agreed upon. Different types or versions of the Tennessee Short Sale Affidavit of Buyer may exist based on specific requirements set by individual lenders or legal entities involved in the transaction. However, the key content remains generally consistent across variations. It is essential for buyers and sellers involved in a Tennessee short sale to carefully review and understand the Short Sale Affidavit of Buyer before signing it. Seeking legal advice or assistance from a real estate professional experienced in short sales is highly recommended ensuring one's rights and responsibilities are properly protected throughout the process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Tennessee Declaración Jurada de Venta Corta del Comprador - Short Sale Affidavit of Buyer

Description

How to fill out Tennessee Declaración Jurada De Venta Corta Del Comprador?

You can commit several hours online trying to find the authorized document template which fits the federal and state needs you will need. US Legal Forms offers thousands of authorized types that happen to be reviewed by pros. It is simple to acquire or printing the Tennessee Short Sale Affidavit of Buyer from the support.

If you have a US Legal Forms account, it is possible to log in and then click the Obtain option. Afterward, it is possible to complete, change, printing, or sign the Tennessee Short Sale Affidavit of Buyer. Every single authorized document template you purchase is the one you have forever. To obtain one more duplicate for any acquired develop, visit the My Forms tab and then click the related option.

If you work with the US Legal Forms site for the first time, stick to the easy guidelines listed below:

- First, be sure that you have chosen the best document template for the region/metropolis that you pick. See the develop explanation to make sure you have selected the appropriate develop. If readily available, take advantage of the Review option to look throughout the document template as well.

- If you want to get one more model of your develop, take advantage of the Lookup discipline to find the template that meets your needs and needs.

- Once you have located the template you desire, click Get now to proceed.

- Find the rates prepare you desire, type your references, and sign up for an account on US Legal Forms.

- Complete the transaction. You can use your Visa or Mastercard or PayPal account to purchase the authorized develop.

- Find the formatting of your document and acquire it to your product.

- Make adjustments to your document if needed. You can complete, change and sign and printing Tennessee Short Sale Affidavit of Buyer.

Obtain and printing thousands of document themes using the US Legal Forms web site, that offers the largest collection of authorized types. Use specialist and condition-distinct themes to take on your organization or individual demands.