Title: Tennessee Pledge of Personal Property as Collateral Security: Exploring Key Aspects and Different Types Introduction: In Tennessee, the Pledge of Personal Property as Collateral Security is an important legal concept that allows individuals and businesses to utilize personal property as collateral for loans or other financial obligations. This article will provide a detailed description of the Tennessee Pledge of Personal Property as Collateral Security, including its definition, usage, applicable laws, and variations. 1. Definition: The Tennessee Pledge of Personal Property as Collateral Security refers to the act of voluntarily granting a security interest in personal property to secure a debt or other obligations. This instrument allows lenders to secure their loans by gaining rights over the pledged personal property in case of non-payment or default. 2. Usage and Applicability: The Tennessee Pledge of Personal Property as Collateral Security is commonly utilized in commercial transactions, where businesses seek financing to support their operations or expansion efforts. Additionally, individuals may use this mechanism to secure personal loans, typically involving valuable assets such as vehicles, jewelry, or other personal possessions. 3. Legal Framework: The legal framework governing the Tennessee Pledge of Personal Property as Collateral Security primarily derives from the Uniform Commercial Code (UCC), particularly Article 9. The UCC outlines the rights and obligations of both secured parties (lenders) and debtors (borrowers) in pledging personal property as collateral security. 4. Types of Tennessee Pledge of Personal Property as Collateral Security: a) Traditional Pledge: This refers to the conventional form of personal property pledge, where the debtor directly transfers possession of the pledged property to the lender. Simultaneously, the lender holds the property as collateral until the debt is fulfilled or released. b) Chattel Mortgage: In this type, the personal property acts as collateral, but the debtor retains possession. The lender gains a security interest in the property by executing a chattel mortgage, providing the lender with the right to take possession if the debtor defaults. c) Equipment Financing: An increasingly common form of personal property pledge, this type pertains specifically to the financing of equipment or machinery required for business operations. The lender holds security interests in the equipment while providing financial support to ensure the purchase or lease of the equipment. Conclusion: The Tennessee Pledge of Personal Property as Collateral Security allows businesses and individuals to leverage their personal property for obtaining loans or financing. It is crucial to understand the legal implications and specific terms associated with this pledge. Consulting legal professionals and familiarizing oneself with applicable laws, including the UCC's Article 9, is advisable to ensure a smooth and mutually beneficial transaction for both parties involved.

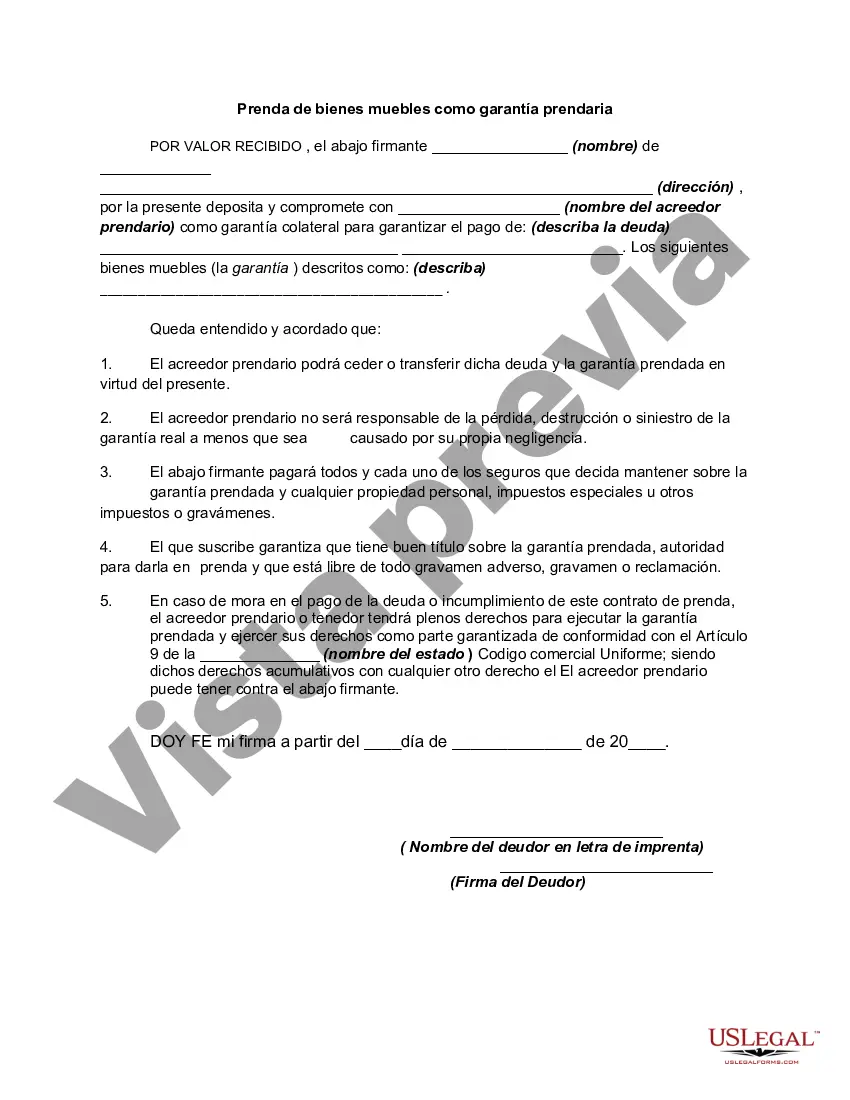

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Tennessee Prenda de bienes muebles como garantía prendaria - Pledge of Personal Property as Collateral Security

Description

How to fill out Tennessee Prenda De Bienes Muebles Como Garantía Prendaria?

You are able to spend time on the Internet attempting to find the lawful file template which fits the federal and state demands you require. US Legal Forms gives thousands of lawful varieties which can be reviewed by specialists. You can easily obtain or print out the Tennessee Pledge of Personal Property as Collateral Security from the services.

If you currently have a US Legal Forms bank account, you may log in and click the Acquire button. Following that, you may total, edit, print out, or sign the Tennessee Pledge of Personal Property as Collateral Security. Each and every lawful file template you purchase is the one you have forever. To get an additional version of any purchased type, proceed to the My Forms tab and click the corresponding button.

If you work with the US Legal Forms site for the first time, stick to the simple directions beneath:

- Initial, be sure that you have chosen the best file template for the region/metropolis of your liking. Browse the type explanation to ensure you have picked out the correct type. If offered, utilize the Review button to appear throughout the file template at the same time.

- If you wish to locate an additional model of the type, utilize the Lookup area to get the template that meets your needs and demands.

- After you have located the template you want, just click Purchase now to carry on.

- Pick the prices strategy you want, type your qualifications, and register for a free account on US Legal Forms.

- Comprehensive the deal. You can utilize your Visa or Mastercard or PayPal bank account to pay for the lawful type.

- Pick the file format of the file and obtain it for your system.

- Make modifications for your file if possible. You are able to total, edit and sign and print out Tennessee Pledge of Personal Property as Collateral Security.

Acquire and print out thousands of file web templates using the US Legal Forms website, that provides the biggest assortment of lawful varieties. Use expert and state-specific web templates to handle your small business or specific requirements.