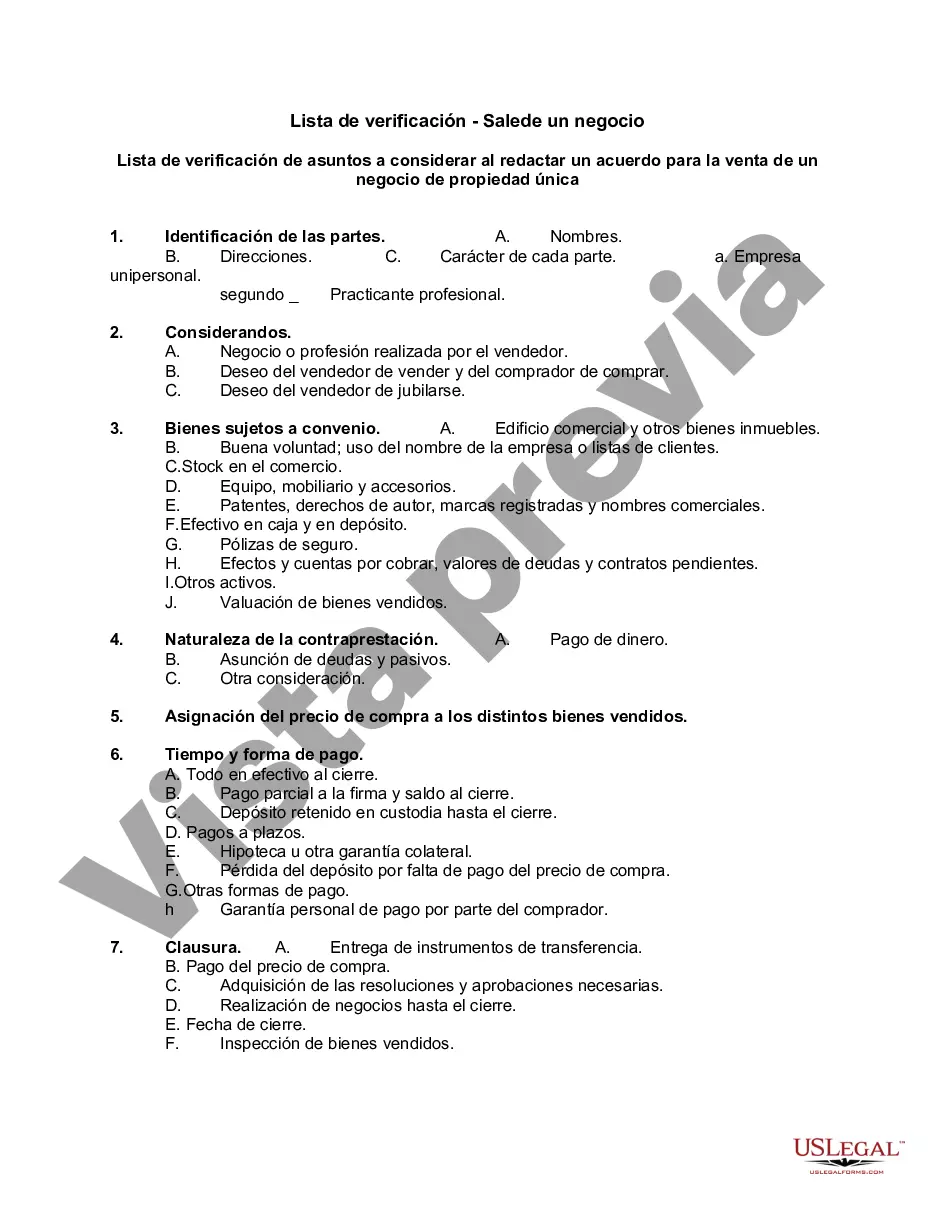

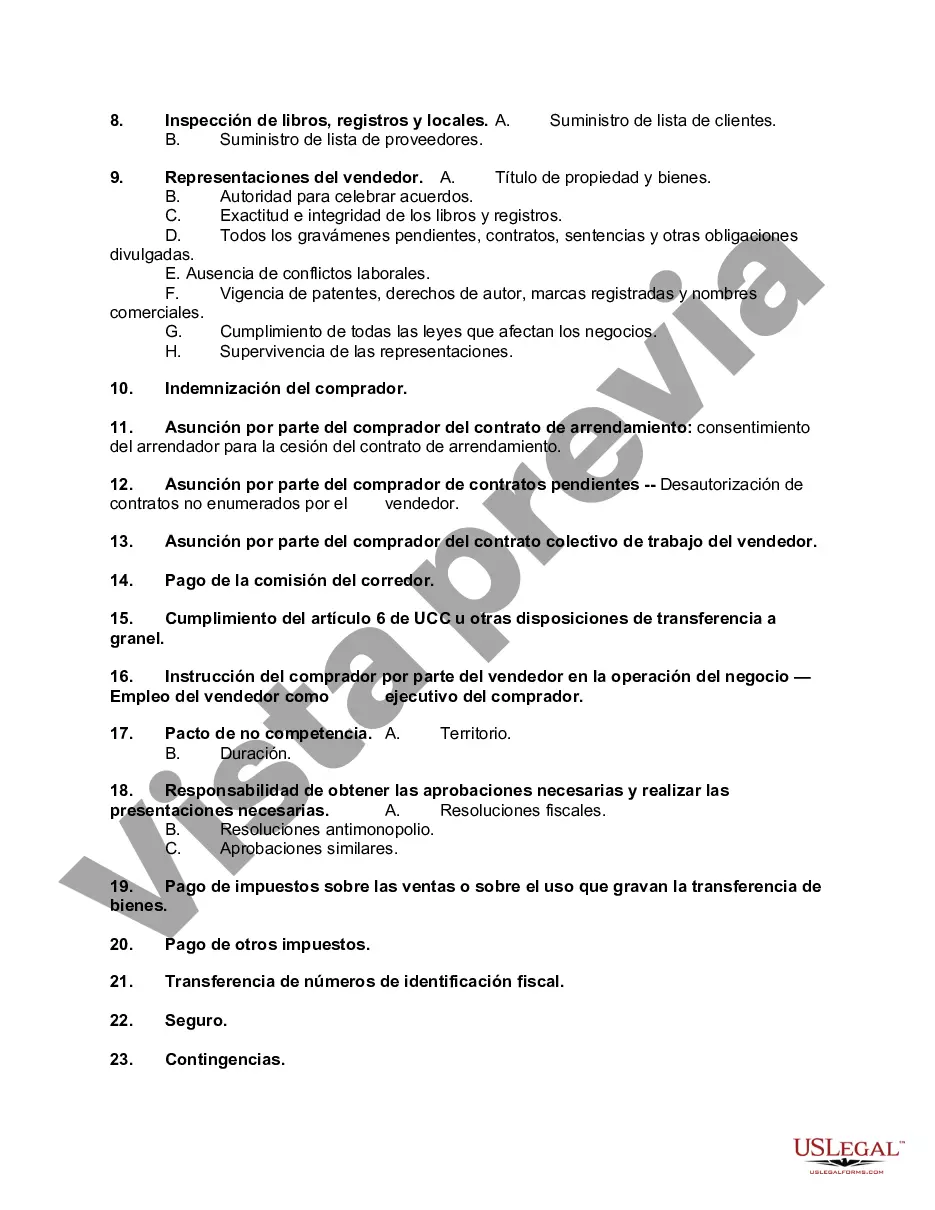

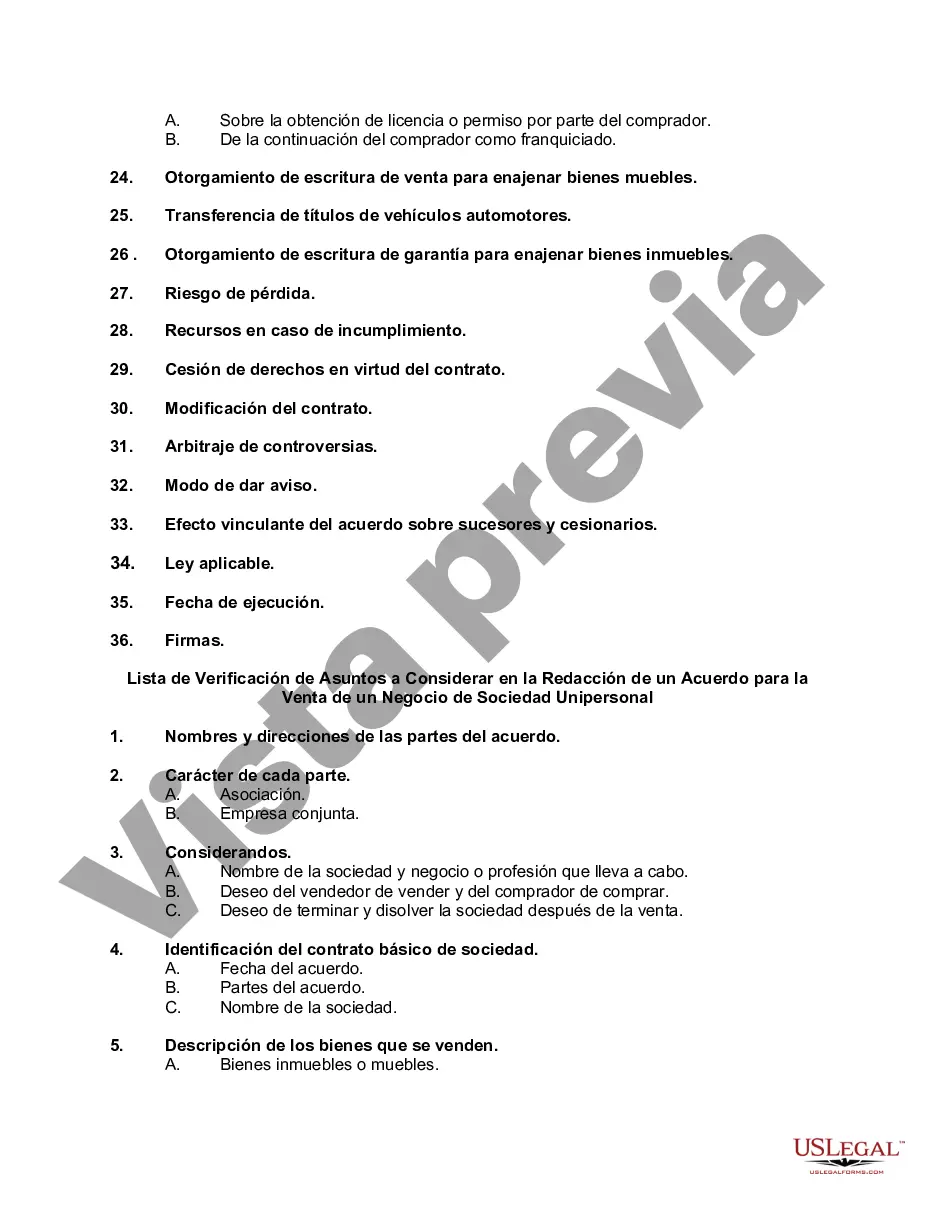

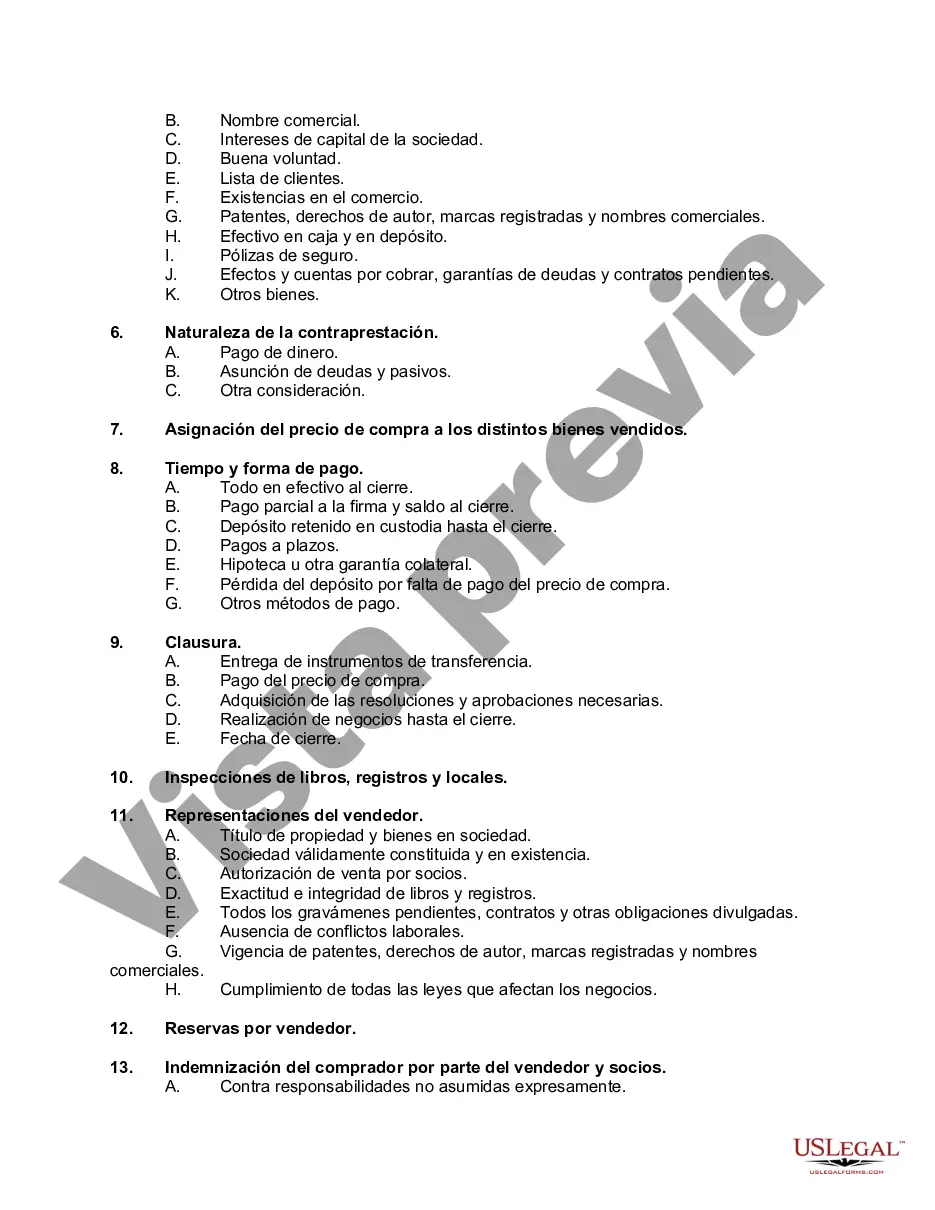

Tennessee Checklist — Sale of a Business: A Comprehensive Guide for a Smooth Transaction Are you planning to sell your business in Tennessee? Whether you're a seasoned entrepreneur or a first-time seller, it's crucial to have a detailed checklist to ensure a successful sale. In this article, we will provide a comprehensive overview of the Tennessee Checklist — Sale of a Business, including important keywords to guide you through the process. 1. Tennessee Business Sale Preparation Checklist: Before listing your business, it's essential to ensure all necessary aspects are in place. This checklist covers crucial steps like organizing financial statements, obtaining necessary licenses, and reviewing contracts and leases to maximize the value of your business. 2. Tennessee Business Valuation Checklist: Accurately assessing the value of your business is vital to attract potential buyers and negotiate a fair price. This checklist highlights key elements to consider, such as financial performance, market analysis, intellectual property valuation, and tangible asset evaluation. 3. Tennessee Business Listing Checklist: Once you've prepared your business for sale, it's time to create an enticing listing to attract prospective buyers. This checklist will guide you through creating a compelling description, gathering relevant documents, and utilizing marketing platforms to reach a wide audience of potential purchasers. 4. Tennessee Due Diligence Checklist: When buyers express interest in your business, they will likely conduct due diligence to evaluate its health and potential risks. This checklist outlines fundamental aspects to address during this phase, including financial records, customer contracts, employment agreements, intellectual property protection, and any operational processes unique to your business. 5. Tennessee Closing Checklist: Congratulations, you've found a buyer! Now it's time to finalize the sale and transfer the ownership. The closing checklist will outline essential actions such as drafting the purchase agreement, conducting a final walkthrough, settling outstanding debts, obtaining necessary approvals, and transferring licenses and permits. 6. Tennessee Tax and Legal Checklist: Selling a business involves tax implications and legal considerations. This checklist covers elements such as consulting with a tax advisor, addressing any outstanding liabilities, complying with state and federal regulations, and ensuring proper documentation for a smooth transition. By following the Tennessee Checklist — Sale of a Business, you can optimize your chances of a successful transaction and mitigate potential risks. Remember to consult with legal and financial professionals to ensure compliance with state laws and increase the likelihood of a seamless sale. Overall, the Tennessee Checklist — Sale of a Business aims to provide sellers with a comprehensive roadmap to navigate the complexities of selling a business in Tennessee. By adhering to these checklists, you can streamline the process, attract the right buyers, and achieve a successful sale that maximizes the value of your hard work and dedication.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Tennessee Lista de Verificación - Venta de un Negocio - Checklist - Sale of a Business

Description

How to fill out Tennessee Lista De Verificación - Venta De Un Negocio?

You are able to devote hrs on the Internet looking for the lawful file template which fits the state and federal demands you will need. US Legal Forms provides a large number of lawful varieties that happen to be examined by experts. It is possible to acquire or print out the Tennessee Checklist - Sale of a Business from my support.

If you currently have a US Legal Forms bank account, you may log in and click the Acquire key. Afterward, you may total, modify, print out, or sign the Tennessee Checklist - Sale of a Business. Each and every lawful file template you get is yours forever. To have one more duplicate for any purchased develop, proceed to the My Forms tab and click the corresponding key.

If you use the US Legal Forms internet site for the first time, follow the simple recommendations beneath:

- Initial, make sure that you have selected the proper file template for your county/city of your choice. Browse the develop information to ensure you have chosen the correct develop. If available, utilize the Review key to check from the file template too.

- In order to discover one more edition in the develop, utilize the Lookup discipline to get the template that suits you and demands.

- Upon having found the template you desire, just click Get now to carry on.

- Select the costs program you desire, key in your qualifications, and sign up for a merchant account on US Legal Forms.

- Total the financial transaction. You may use your charge card or PayPal bank account to purchase the lawful develop.

- Select the formatting in the file and acquire it to the system.

- Make modifications to the file if possible. You are able to total, modify and sign and print out Tennessee Checklist - Sale of a Business.

Acquire and print out a large number of file layouts making use of the US Legal Forms Internet site, which offers the biggest selection of lawful varieties. Use professional and status-distinct layouts to handle your organization or person requires.