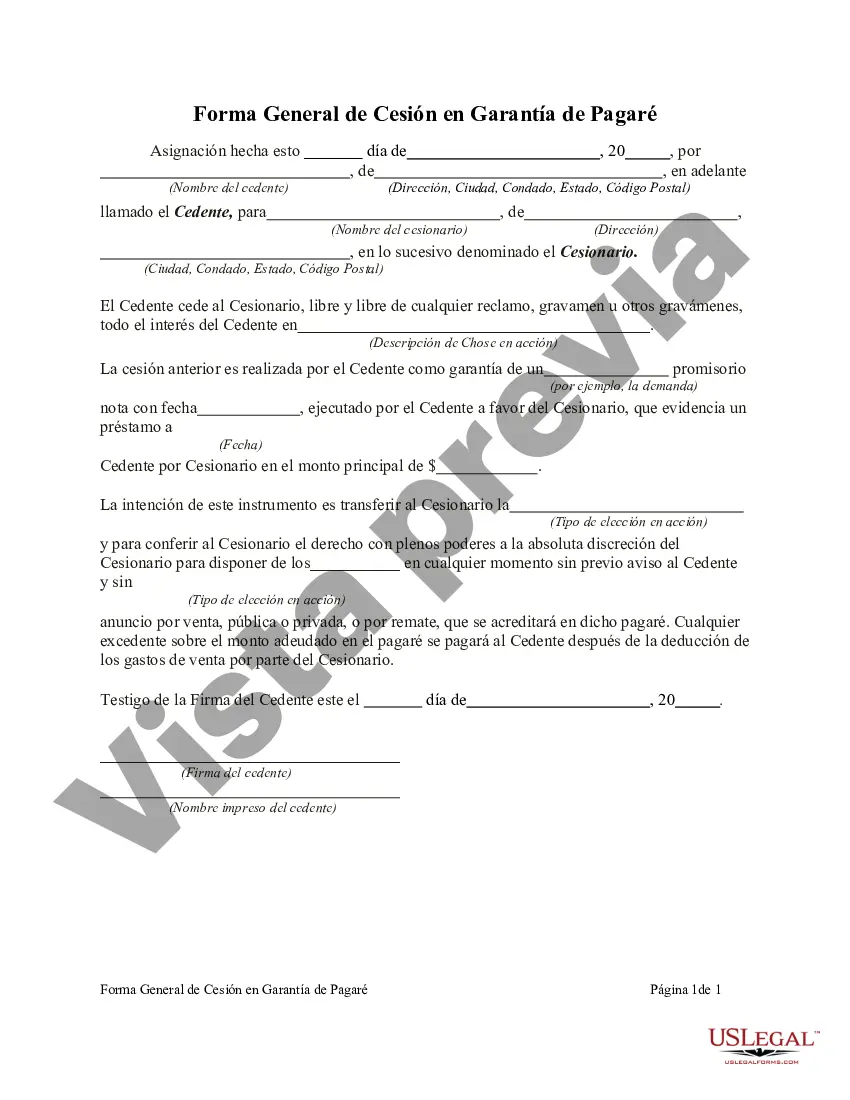

The Tennessee General Form of Assignment as Collateral for Note is a legal document used in the state of Tennessee to transfer ownership of a collateral property or asset to secure a promissory note. This form is crucial for lenders and borrowers as it protects their respective interests in a loan agreement. In the context of financial transactions, a collateral is an asset pledged by a borrower to a lender to guarantee repayment of a loan. If the borrower fails to fulfill their obligation, the lender has the right to seize and sell the collateral to recoup any losses. The Tennessee General Form of Assignment as Collateral for Note is used when a borrower assigns their interest in a specific collateral, typically real estate or personal property, to secure a loan. The general form serves as a written agreement between the borrower and lender, detailing the terms and conditions of the assignment. Key sections of the form typically include: 1. Parties: The form identifies the borrower, referred to as the assignor, and the lender, known as the assignee, involved in the transaction. 2. Collateral Description: This section provides a comprehensive description of the collateral being assigned, including details such as address, legal description, and any unique identifying numbers related to the asset. 3. Assignment Clause: The form includes an assignment clause that explicitly states the borrower's intent to assign the collateral, along with the conditions under which the assignment becomes effective. 4. Loan Details: The form may also include information about the promissory note associated with the collateral assignment, such as the principal amount, interest rate, repayment terms, and any default provisions. 5. Representations and Warranties: Both parties typically provide statements confirming that they have the legal authority to enter into the assignment, and that the collateral is free from any other claims or liens. 6. Governing Law: This section establishes that the assignment agreement is subject to the laws of the state of Tennessee, ensuring compliance with relevant statutes and regulations. It's worth noting that while the Tennessee General Form of Assignment as Collateral for Note provides a standardized framework for collateral assignments, there may be variations or specific forms for different types of collaterals. For instance: 1. Real Estate Collateral Assignment: This form specifically applies to assignments involving real property, such as land or buildings. It may contain additional sections addressing specific considerations related to real estate, such as zoning restrictions or title insurance. 2. Personal Property Collateral Assignment: In cases where the collateral being assigned is personal property, such as vehicles, equipment, or valuable assets like jewelry or artwork, a specialized form may be used. This form could include provisions regarding the condition and maintenance of the personal property. In conclusion, the Tennessee General Form of Assignment as Collateral for Note is a vital legal document used in loan agreements to secure repayment through the assignment of a collateral asset. While there may be different types of collateral assignments based on the nature of the asset, the general form provides a comprehensive framework for this process in Tennessee.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Tennessee Forma General de Cesión en Garantía de Pagaré - General Form of Assignment as Collateral for Note

Description

How to fill out Tennessee Forma General De Cesión En Garantía De Pagaré?

Choosing the right lawful papers format can be quite a have difficulties. Naturally, there are tons of themes accessible on the Internet, but how can you discover the lawful type you will need? Make use of the US Legal Forms web site. The support offers 1000s of themes, for example the Tennessee General Form of Assignment as Collateral for Note, that can be used for business and personal demands. Every one of the forms are checked by specialists and satisfy federal and state needs.

In case you are currently registered, log in in your bank account and click on the Obtain option to get the Tennessee General Form of Assignment as Collateral for Note. Use your bank account to look through the lawful forms you might have acquired earlier. Go to the My Forms tab of your respective bank account and acquire yet another duplicate of your papers you will need.

In case you are a new consumer of US Legal Forms, listed below are basic guidelines that you can comply with:

- First, be sure you have chosen the right type for your personal area/county. It is possible to examine the shape while using Preview option and browse the shape description to make certain it is the best for you.

- In case the type will not satisfy your requirements, take advantage of the Seach area to get the appropriate type.

- Once you are positive that the shape is proper, click on the Acquire now option to get the type.

- Opt for the rates prepare you would like and type in the needed info. Build your bank account and pay money for your order making use of your PayPal bank account or Visa or Mastercard.

- Pick the document formatting and acquire the lawful papers format in your system.

- Total, change and print and sign the obtained Tennessee General Form of Assignment as Collateral for Note.

US Legal Forms will be the greatest library of lawful forms that you can see numerous papers themes. Make use of the company to acquire appropriately-produced papers that comply with state needs.