The Tennessee Assignment Creditor's Claim Against Estate refers to a legal process initiated by a creditor seeking to collect a debt owed to them by an individual who has passed away. When a person dies, their assets and debts are typically distributed through a legal process known as probate. During this process, creditors have the opportunity to file a claim against the deceased person's estate to reclaim the money owed to them. In Tennessee, there are various types of Assignment Creditor's Claims Against Estate that creditors can pursue: 1. General Creditors' Claims: These claims are filed by creditors who have provided goods, services, or loans to the deceased individual and seek repayment from the assets of the estate. 2. Secured Creditors' Claims: Secured creditors hold a specific security interest, such as a mortgage or lien, against a property or asset owned by the deceased individual. They have the right to enforce their claim against the specific property securing the debt. 3. Priority Creditors' Claims: Certain creditors, such as the government (e.g., for taxes owed) or funeral expenses, may have priority over other creditors. These priority claims take precedence over general creditors' claims. To file an Assignment Creditor's Claim Against Estate in Tennessee, the creditor must follow specific procedures, including: 1. Filing the Claim: The creditor must file a written claim with the Probate Court handling the estate administration. This claim should include detailed information about the nature and amount of the debt owed. 2. Timing: Creditors must file their claims within four months of the date of the individual's death or within the earliest of the required notice's publication or mailing. Failing to file within this time frame may result in the claim being barred. 3. Notice to Personal Representative: The creditor must provide a copy of the claim to the personal representative of the deceased individual's estate. The personal representative is responsible for reviewing and validating claims against the estate. 4. Review and Validation: The personal representative reviews the claim and may approve or deny it based on its validity. If approved, the creditor may receive a portion of the assets from the estate as payment. If denied, the creditor may file a lawsuit to contest the decision within a specified timeframe. It is crucial for creditors to understand the Tennessee Assignment Creditor's Claim Against Estate process to ensure their rights to collect outstanding debts. Seeking the guidance of an experienced attorney specializing in probate and estate law can be beneficial in navigating this complex legal procedure.

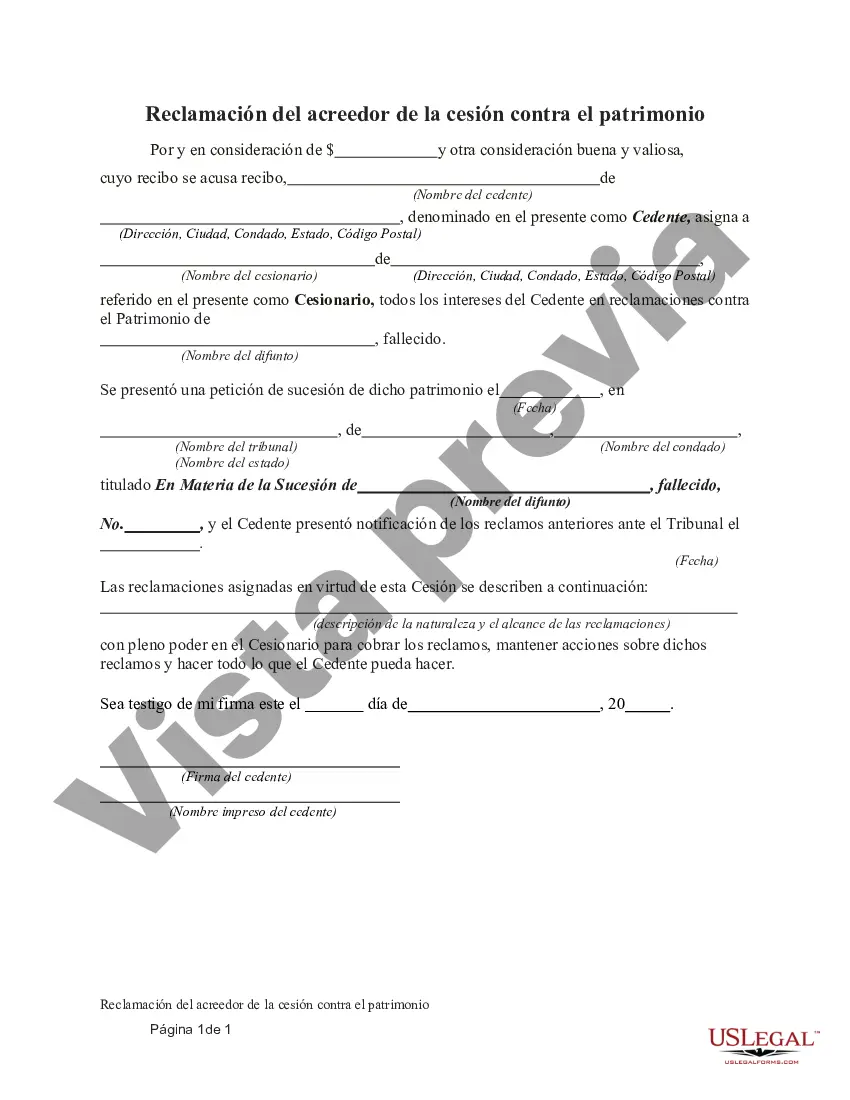

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Tennessee Reclamación del acreedor de la cesión contra el patrimonio - Assignment Creditor's Claim Against Estate

Description

How to fill out Tennessee Reclamación Del Acreedor De La Cesión Contra El Patrimonio?

Choosing the right legal papers design can be a struggle. Of course, there are plenty of layouts accessible on the Internet, but how will you find the legal form you require? Utilize the US Legal Forms site. The support delivers a large number of layouts, including the Tennessee Assignment Creditor's Claim Against Estate, that can be used for business and private requirements. All the forms are examined by professionals and fulfill federal and state requirements.

When you are already authorized, log in in your bank account and click on the Down load button to obtain the Tennessee Assignment Creditor's Claim Against Estate. Make use of your bank account to look with the legal forms you have bought formerly. Go to the My Forms tab of your own bank account and acquire another copy of your papers you require.

When you are a brand new end user of US Legal Forms, listed below are basic guidelines so that you can adhere to:

- First, be sure you have chosen the right form to your metropolis/county. You are able to check out the form while using Preview button and study the form information to ensure it is the right one for you.

- In the event the form fails to fulfill your requirements, take advantage of the Seach field to obtain the correct form.

- Once you are sure that the form would work, go through the Get now button to obtain the form.

- Opt for the costs plan you would like and type in the essential info. Build your bank account and pay money for your order using your PayPal bank account or Visa or Mastercard.

- Select the data file format and down load the legal papers design in your device.

- Total, edit and produce and indication the attained Tennessee Assignment Creditor's Claim Against Estate.

US Legal Forms is definitely the most significant local library of legal forms that you can discover various papers layouts. Utilize the company to down load skillfully-created paperwork that adhere to status requirements.