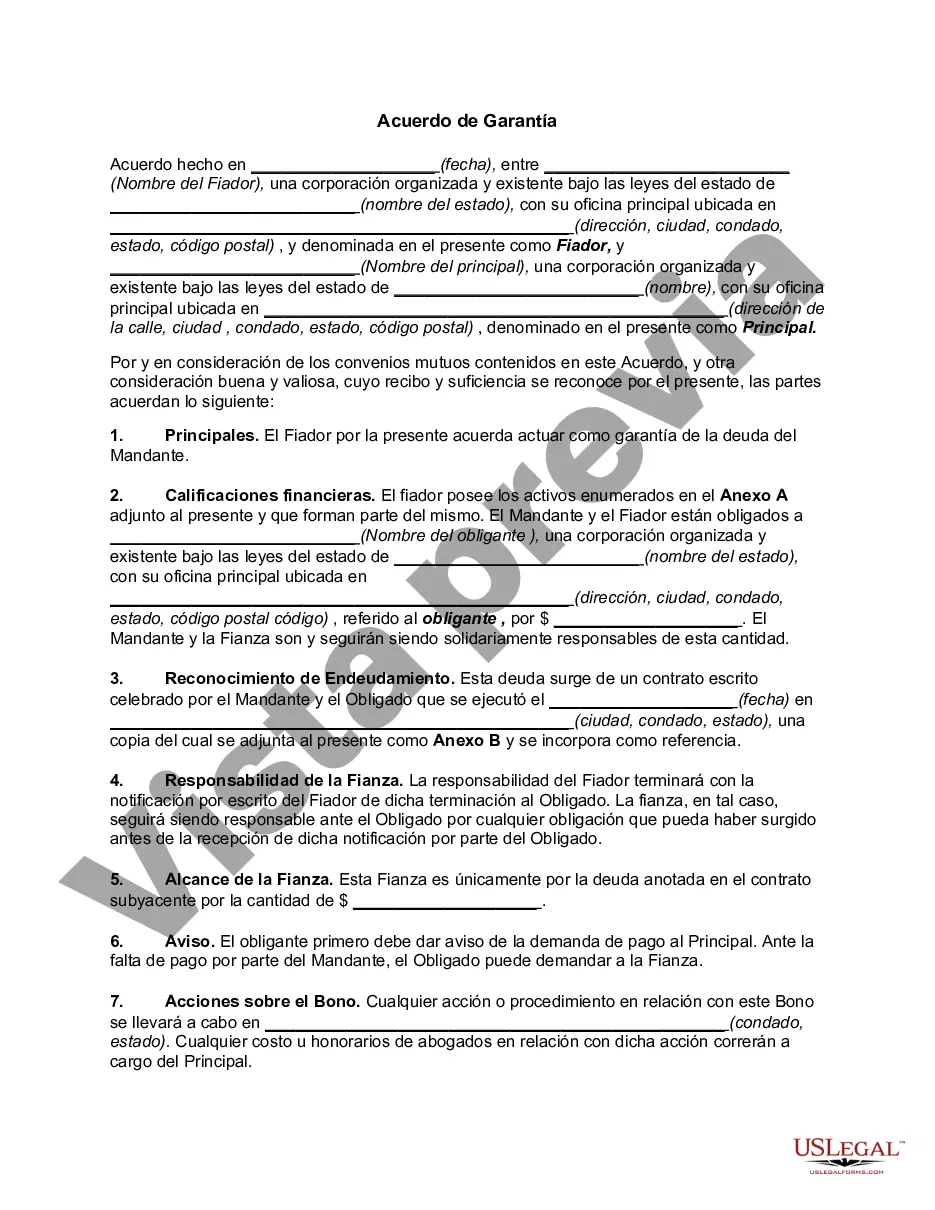

A Tennessee Surety Agreement is a legally binding contract that is used in the state of Tennessee to provide financial guarantee or assurance to one party (the obliged) by another party (the surety). This agreement ensures that the principal party (the debtor) fulfills their obligations, such as payment of a debt or performance of a contract, according to the terms and conditions set forth. In simple terms, a Tennessee Surety Agreement acts as a form of collateral or guarantee, where the surety agrees to bear the financial responsibility in case the principal party fails to fulfill their obligations. This agreement helps protect the interests of the obliged by providing a level of financial security. The Tennessee Surety Agreement can apply to various situations, including but not limited to: 1. Tennessee Performance Surety Agreement: This type of agreement is commonly used in construction projects, where the surety guarantees that the principal party (contractor) will complete the project as agreed upon in the contract. If the contractor fails to fulfill their obligations, the surety may step in and provide compensation to the obliged or may even substitute another contractor to complete the project. 2. Tennessee Payment Surety Agreement: This agreement ensures that the principal party (usually the contractor or supplier) will make payments to subcontractors, suppliers, or other parties involved in a project. In case of default or non-payment, the surety will compensate the obliged. 3. Tennessee Bail Bond Surety Agreement: This type of agreement is used in criminal cases where the surety guarantees the appearance of the defendant in court. The surety agrees to pay the court an agreed-upon amount if the defendant fails to appear, thereby ensuring that the defendant does not evade the legal process. 4. Tennessee License or Permit Surety Agreement: Certain industries require licenses or permits operating legally. This agreement provides a guarantee to the relevant licensing authority that the principal party will fulfill their obligations associated with the license or permit, such as payment of fees, compliance with regulations, etc. It is important to note that a Tennessee Surety Agreement is a legally binding contract, and the terms and conditions may vary depending on the specific agreement. The surety may require collateral or personal guarantees from the principal party to secure their obligations. Additionally, the surety may charge a premium or fee for assuming the financial risk involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Tennessee Acuerdo de Garantía - Surety Agreement

Description

How to fill out Tennessee Acuerdo De Garantía?

US Legal Forms - among the greatest libraries of lawful kinds in the United States - delivers a variety of lawful papers web templates it is possible to obtain or print. While using web site, you may get thousands of kinds for company and individual uses, sorted by types, claims, or search phrases.You will find the most up-to-date variations of kinds like the Tennessee Surety Agreement in seconds.

If you already possess a monthly subscription, log in and obtain Tennessee Surety Agreement from the US Legal Forms catalogue. The Obtain switch will show up on every single kind you view. You gain access to all earlier delivered electronically kinds in the My Forms tab of the profile.

If you want to use US Legal Forms the very first time, allow me to share basic guidelines to obtain began:

- Be sure you have chosen the correct kind for your town/region. Click the Preview switch to examine the form`s information. See the kind description to actually have chosen the appropriate kind.

- In case the kind doesn`t satisfy your needs, take advantage of the Lookup area at the top of the screen to get the the one that does.

- Should you be happy with the shape, affirm your choice by visiting the Get now switch. Then, select the pricing plan you like and give your accreditations to sign up for an profile.

- Method the financial transaction. Utilize your bank card or PayPal profile to finish the financial transaction.

- Pick the format and obtain the shape on the product.

- Make modifications. Fill up, edit and print and sign the delivered electronically Tennessee Surety Agreement.

Each design you added to your money lacks an expiry time and is also yours forever. So, if you wish to obtain or print yet another backup, just visit the My Forms portion and click around the kind you will need.

Get access to the Tennessee Surety Agreement with US Legal Forms, the most extensive catalogue of lawful papers web templates. Use thousands of expert and status-certain web templates that meet your small business or individual demands and needs.