Tennessee Living Trust with Provisions for Disability

Description

How to fill out Living Trust With Provisions For Disability?

Finding the correct valid document template can be a challenge. Naturally, there are numerous formats available online, but how do you acquire the appropriate document you require? Use the US Legal Forms website. This service provides thousands of templates, such as the Tennessee Living Trust with Provisions for Disability, which can be utilized for business and personal purposes. All forms are verified by experts and conform to both federal and state regulations.

If you are already registered, Log In to your account and then click the Obtain button to locate the Tennessee Living Trust with Provisions for Disability. Utilize your account to review the legal forms you have previously purchased. Navigate to the My documents section of your account to get another copy of the document you need.

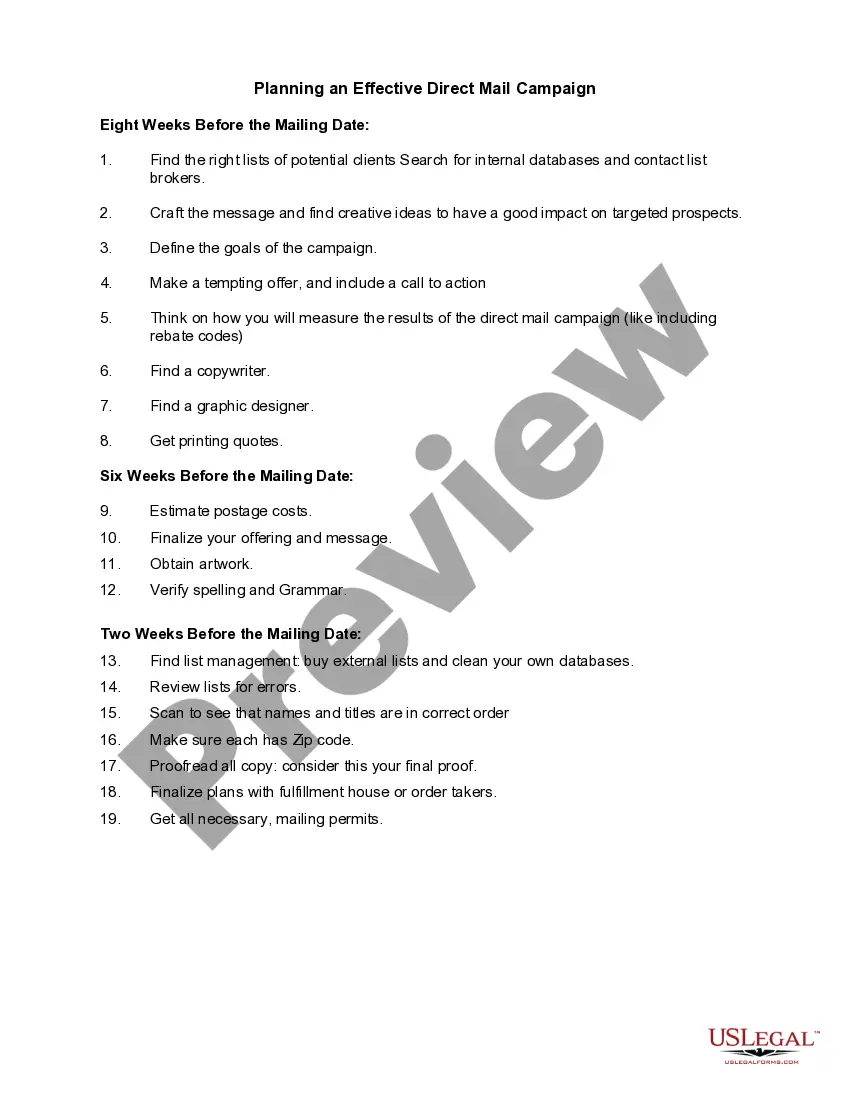

If you are a new user of US Legal Forms, here are simple steps you can follow: First, ensure you have selected the correct form for your locality/county. You can view the form using the Preview option and read the form description to confirm it is suitable for you. If the form does not meet your requirements, use the Search bar to find the correct form. Once you are confident that the form is accurate, click the Purchase now button to obtain the form. Select the pricing plan you want and enter the required information. Create your account and finalize the order using your PayPal account or credit card. Choose the format and download the legal document template to your device. Complete, modify, and print the Tennessee Living Trust with Provisions for Disability that you received.

- Make sure you have selected the right form for your locality/county.

- You can view the form using the Preview option.

- Read the form description to ensure it is suitable for you.

- Use the Search field to find the correct form if necessary.

- Click the Purchase now button to obtain the form.

- Select the pricing plan and enter the required information.

Form popularity

FAQ

The money simply replaces state-funding benefits and services until their fund drops below the excluded capital level, when they go back on to means-tested benefits. A Vulnerable Beneficiary Trust or Disabled Person's Trust can be a way of ringfencing the windfall so that means-tested benefits are not affected.

The first $20 of income received each month is not counted. In addition, with respect to earned income, the first $65 each month is not counted, and one-half of the earnings over $65 in any given month is not counted.

Disadvantages to SNTCost. Annual fees and a high cost to set up a SNT can make it financially difficult to create a SNT The yearly costs to manage the trust can be high.Lack of independence.Medicaid payback.

SSDI is not a needs-based benefit. If you are on that program for two years, you will also qualify for Medicare. Because SSDI is not needs-based, a special needs trust is not necessary to qualify for it.

A Trust can protect a disabled person who could otherwise be vulnerable to financial abuse or exploitation from others. The Trust offers a means of managing money or other assets for a disabled person, which is invaluable if they are unable to do this themselves.

Unlike SSI, there are no income or asset limits for SSDI eligibility. Instead, to qualify for SSDI, enrollees must have a sufficient work history (generally, 40 quarters) and meet the strict federal disability rules. SSA uses the same rules to determine disability for both the SSI and the SSDI programs.

The SSDI program does not limit the amount of cash, assets, or resources an applicant owns. An SSDI applicant can own two houses, five cars, and have $1,000,000 in the bank. And the SSDI program doesn't have a limit to the amount of unearned income someone can bring in; for instance, dividends from investments.

Assets That Can And Cannot Go Into Revocable TrustsReal estate.Financial accounts.Retirement accounts.Medical savings accounts.Life insurance.Questionable assets.

HOW DOES MONEY FROM A TRUST THAT IS NOT MY RESOURCE AFFECT MY SSI BENEFITS? Money paid directly to you from the trust reduces your SSI benefit. Money paid directly to someone to provide you with food or shelter reduces your SSI benefit but only up to a certain limit.

Money paid directly to you from the trust reduces your SSI benefit. Money paid directly to someone to provide you with food or shelter reduces your SSI benefit but only up to a certain limit.