The Tennessee Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time is a legal document that allows individuals to transfer assets into a trust for the benefit of a future beneficiary, while allowing the trust or to receive income from the trust after a specified period. This type of trust provides several benefits, including asset protection, wealth preservation, and control over the distribution of assets. By establishing an irrevocable trust, the trust or can ensure that their assets are protected from creditors, lawsuits, and estate taxes. There are various types of Tennessee Irrevocable Trusts for the Future Benefit of Trust or with Income Payable to Trust or after a Specified Time. Some common types include: 1. Tennessee Special Needs Trust: This type of trust allows a trust or to provide for a disabled beneficiary while preserving their eligibility for government assistance programs. 2. Tennessee Charitable Remainder Trust: With this trust, the trust or can donate assets to a charitable organization while receiving income from the trust during their lifetime. After the specified time, the remaining assets are transferred to the chosen charity. 3. Tennessee Granter Retained Annuity Trust: This trust enables the trust or to transfer assets, such as a family home, while retaining the right to receive income from the trust for a specific period. After this time, the assets are transferred to the chosen beneficiary. 4. Tennessee Qualified Personnel Residence Trust: This trust allows the trust or to transfer their primary residence, while still retaining the right to live in it for a designated period. After this time, the property is passed to the chosen beneficiary. When establishing a Tennessee Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time, it is important to consult with an experienced attorney who specializes in estate planning and trusts. They can guide you through the process, help you choose the appropriate type of trust, and ensure that all legal requirements are met. In conclusion, the Tennessee Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time is a powerful estate planning tool that provides asset protection and control over the distribution of assets. Utilizing different types of irrevocable trusts, such as the Special Needs Trust, Charitable Remainder Trust, Granter Retained Annuity Trust, and Qualified Personnel Residence Trust, individuals can tailor their estate plan to meet their specific needs and provide for their loved ones in a tax-efficient manner.

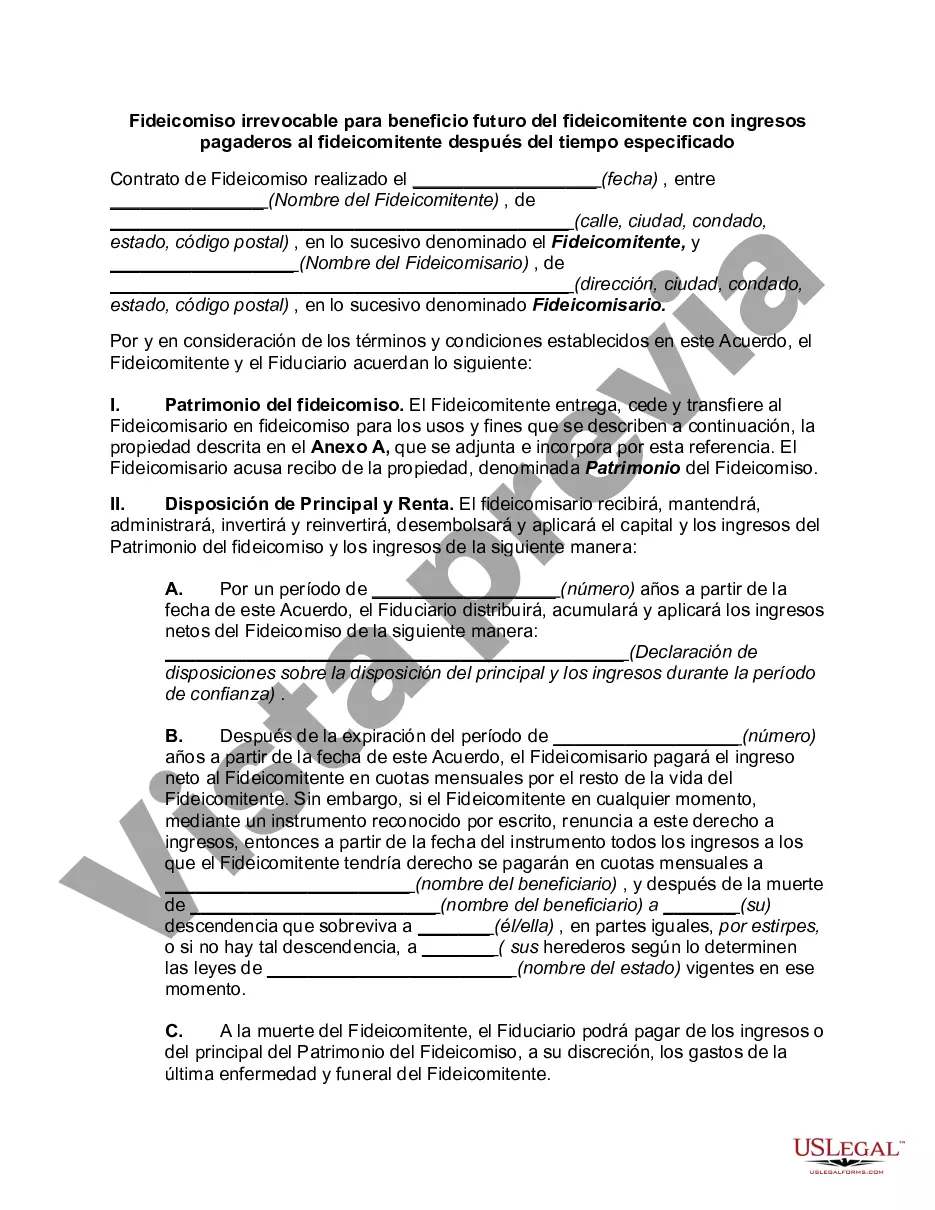

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Tennessee Fideicomiso irrevocable para beneficio futuro del fideicomitente con ingresos pagaderos al fideicomitente después del tiempo especificado - Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time

Description

How to fill out Tennessee Fideicomiso Irrevocable Para Beneficio Futuro Del Fideicomitente Con Ingresos Pagaderos Al Fideicomitente Después Del Tiempo Especificado?

Are you presently in the position where you need to have papers for both company or personal purposes almost every working day? There are a lot of legal file web templates available online, but finding types you can rely isn`t simple. US Legal Forms provides thousands of kind web templates, like the Tennessee Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time, which are created to satisfy federal and state demands.

Should you be previously familiar with US Legal Forms website and get your account, merely log in. After that, you can down load the Tennessee Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time template.

Unless you come with an accounts and wish to begin using US Legal Forms, abide by these steps:

- Discover the kind you need and make sure it is for that appropriate town/region.

- Take advantage of the Preview switch to analyze the form.

- Read the description to ensure that you have chosen the proper kind.

- In case the kind isn`t what you are trying to find, make use of the Lookup field to get the kind that fits your needs and demands.

- Once you obtain the appropriate kind, click on Buy now.

- Pick the rates program you need, fill in the necessary info to generate your money, and pay for the transaction with your PayPal or bank card.

- Decide on a handy document structure and down load your backup.

Get every one of the file web templates you might have bought in the My Forms menu. You can get a extra backup of Tennessee Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time whenever, if needed. Just click on the necessary kind to down load or produce the file template.

Use US Legal Forms, the most extensive collection of legal varieties, to save lots of time and stay away from mistakes. The assistance provides professionally produced legal file web templates which you can use for a variety of purposes. Make your account on US Legal Forms and commence producing your daily life easier.