Tennessee Sample Letter transmitting Cancellation and Satisfaction of Promissory Notes

Description

How to fill out Sample Letter Transmitting Cancellation And Satisfaction Of Promissory Notes?

US Legal Forms - one of the largest compilations of legal documents in the United States - offers a variety of legal document templates that you can download or print.

By using the website, you can find numerous forms for business and personal purposes, categorized by type, state, or keywords. You can access the latest templates such as the Tennessee Sample Letter for transmitting Cancellation and Satisfaction of Promissory Notes in just a few minutes.

If you have a subscription, Log In and download the Tennessee Sample Letter for transmitting Cancellation and Satisfaction of Promissory Notes from the US Legal Forms library. The Download button will appear on each form you view. You can access all previously saved forms in the My documents tab of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the transaction.

Choose the format and download the form to your device. Edit it. Fill out, modify, print, and sign the saved Tennessee Sample Letter for transmitting Cancellation and Satisfaction of Promissory Notes. Each template you add to your account has no expiration date and is yours permanently. Therefore, if you wish to download or print another version, simply visit the My documents section and click on the desired form. Access the Tennessee Sample Letter for transmitting Cancellation and Satisfaction of Promissory Notes with US Legal Forms, the most extensive collection of legal document templates. Utilize a multitude of professional and state-specific templates that fulfill your business or personal needs and requirements.

- Make sure you have selected the appropriate form for your city/county.

- Click the Review button to examine the form's content.

- Read the form summary to confirm that you have chosen the correct form.

- If the form does not meet your needs, use the Search field at the top of the screen to find the right one.

- If you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Next, choose the pricing plan you want and provide your details to register for an account.

Form popularity

FAQ

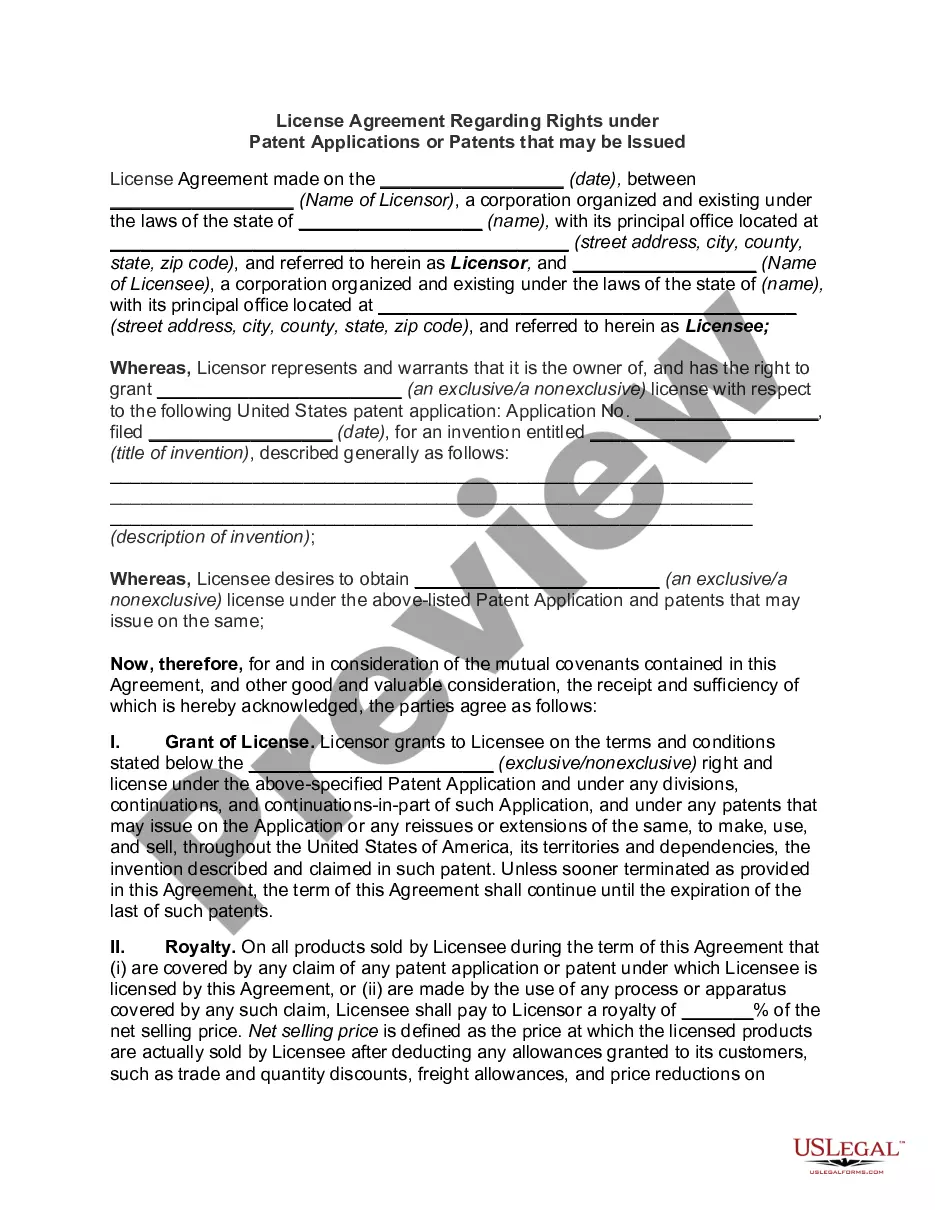

Detailed Information The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.

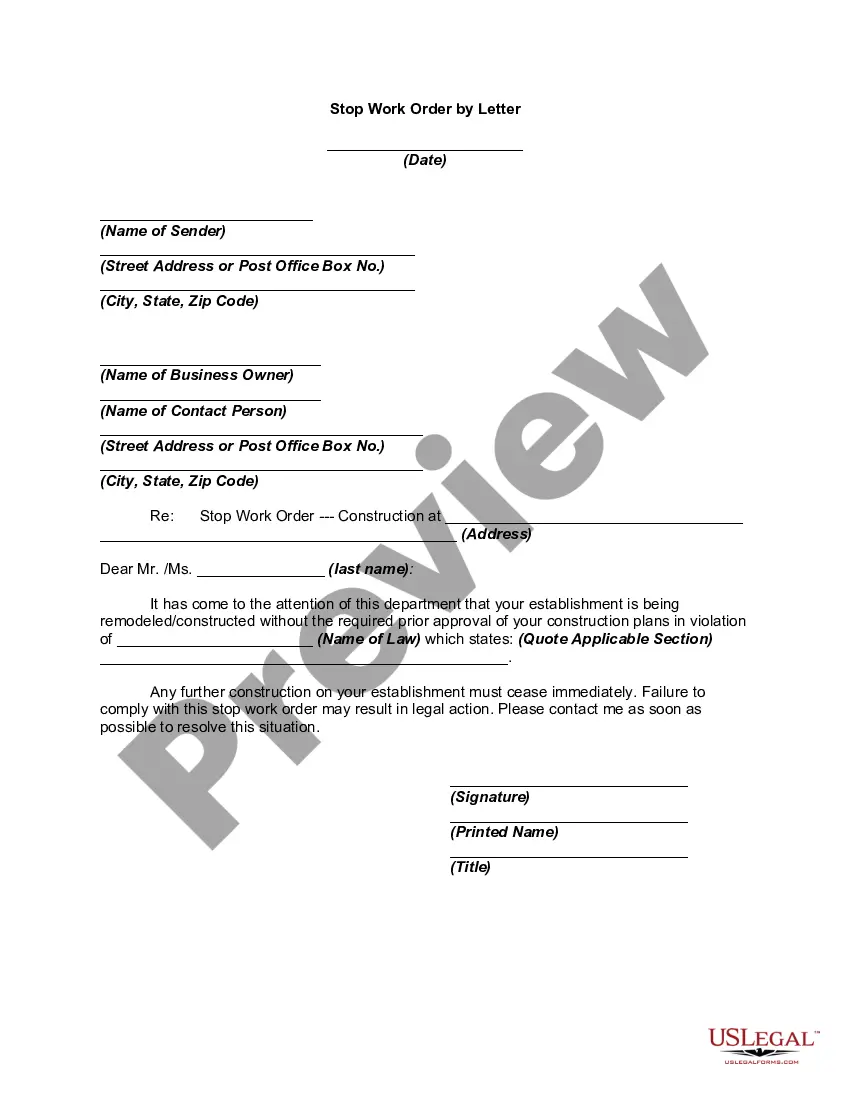

Before a promissory note can be canceled, the lender must agree to the terms of canceling it. A well-drafted and detailed promissory note can help the parties involved avoid future disputes, misunderstandings, and confusion. When canceling the promissory note, the process is referred to as a release of the note.

Even if you have the original note, it may be void if it was not written correctly. If the person you're trying to collect from didn't sign it and yes, this happens the note is void. It may also become void if it failed some other law, for example, if it was charging an illegally high rate of interest.

Give the borrower the original promissory note, with a notation on it that says CANCELLED or PAID IN FULL. Keep a copy of this note for your records.

A promissory note is a written agreement to pay someone essentially an IOU. But it's not something to be taken lightly. "It is a legally binding written document effectuating a promise to repay money," says Andrea Wheeler, a business attorney and owner of Wheeler Legal PLLC of Florida.

The debt owed on a promissory note either can be paid off, or the noteholder can forgive the debt even if it has not been fully paid. In either case, a release of promissory note needs to be signed by the noteholder.

How to Write a Promissory NoteDate.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

Write a "Cancellation of Promissory Note" letter or have the attorney write one for you. The note should include details of the original promissory note and also indicate that the original promissory note is canceled at the request of both parties. Have the promisee sign the document in the presence of a notary.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

Personal Loans and Promissory Notes Unless a creditor can prove a debtor acted fraudulently, money borrowed in exchange for a promissory note or other type of promise to pay is dischargeable in bankruptcy court.