Tennessee Aging Accounts Payable refers to the process and analysis of categorizing and tracking unpaid bills or financial obligations owed by individuals or organizations in the state of Tennessee. This essential accounting function plays a crucial role in managing and maintaining the financial health of businesses, government agencies, and other entities operating within Tennessee. The Tennessee Aging Accounts Payable system helps organizations keep a record of outstanding invoices, bills, or debts, along with the corresponding due dates. By monitoring these accounts receivables, entities can assess their financial standing, identify potential cash flow issues, and take necessary actions to ensure timely payments and avoid negative consequences such as interest charges or penalties. Specifically, the aging component of accounts payable in Tennessee refers to the categorization of outstanding debts based on the number of days they have been overdue. This classification helps organizations analyze their financial obligations in a more detailed and organized manner. The days past due are divided into predefined time frames, typically 30, 60, 90, and 120 days. Tennessee Aging Accounts Payable provides numerous benefits to businesses and government agencies, such as: 1. Improved Financial Planning: By analyzing the aging accounts payable, organizations can make informed financial decisions, budget adequately, and allocate resources effectively. 2. Enhanced Cash Flow Management: Tracking the aging of accounts payable allows for proactive steps to be taken to accelerate collections, negotiate favorable payment terms, or address any disputes promptly, ensuring a smoother cash flow. 3. Streamlined Vendor Relationships: Regularly reviewing aging accounts payable facilitates better relationships with vendors and suppliers by ensuring timely payments, fostering trust, and potentially offering opportunities for negotiation or discounts. It is important to note that Tennessee Aging Accounts Payable may vary slightly depending on the nature of the entity. For instance, there might be different types or categories of aging accounts payable specific to various industries or sectors such as construction, healthcare, manufacturing, or government agencies. However, the underlying principles and objectives of managing outstanding debts remain consistent across these industries, aiming to ensure financial stability and accountability.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Tennessee Antigüedad de cuentas por pagar - Aging Accounts Payable

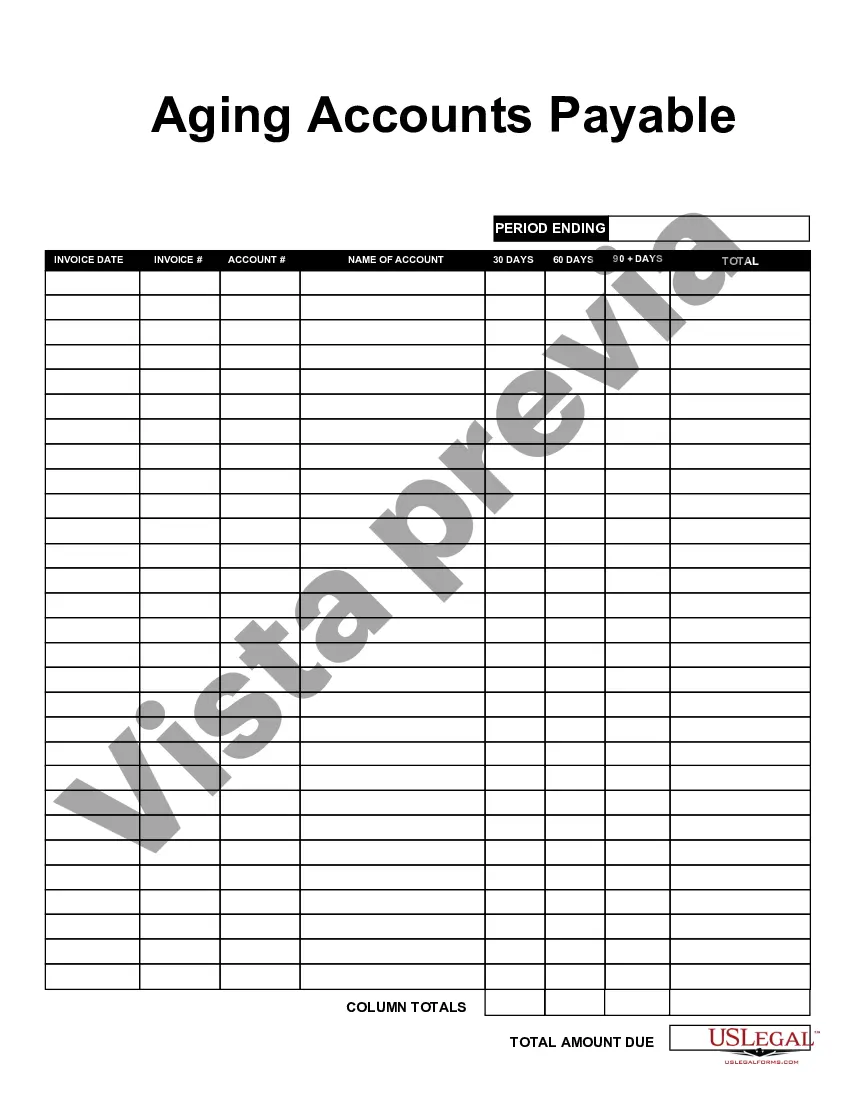

Description

How to fill out Tennessee Antigüedad De Cuentas Por Pagar?

Are you currently in a situation that you will need files for both business or individual purposes almost every day time? There are plenty of lawful papers web templates available on the net, but finding ones you can trust isn`t simple. US Legal Forms gives thousands of develop web templates, just like the Tennessee Aging Accounts Payable, that are written to satisfy federal and state needs.

When you are currently informed about US Legal Forms internet site and have a free account, simply log in. After that, you may download the Tennessee Aging Accounts Payable template.

Unless you come with an bank account and want to begin to use US Legal Forms, abide by these steps:

- Find the develop you want and ensure it is for that proper area/state.

- Use the Review key to review the shape.

- Browse the information to actually have chosen the correct develop.

- In case the develop isn`t what you are searching for, use the Lookup area to find the develop that fits your needs and needs.

- If you get the proper develop, click Get now.

- Select the prices strategy you would like, fill out the specified information to make your account, and pay for the transaction with your PayPal or Visa or Mastercard.

- Select a convenient document formatting and download your version.

Get all of the papers web templates you possess purchased in the My Forms menus. You can obtain a additional version of Tennessee Aging Accounts Payable any time, if necessary. Just select the needed develop to download or print out the papers template.

Use US Legal Forms, by far the most considerable collection of lawful types, to save efforts and stay away from errors. The assistance gives professionally manufactured lawful papers web templates that you can use for an array of purposes. Produce a free account on US Legal Forms and begin generating your daily life easier.