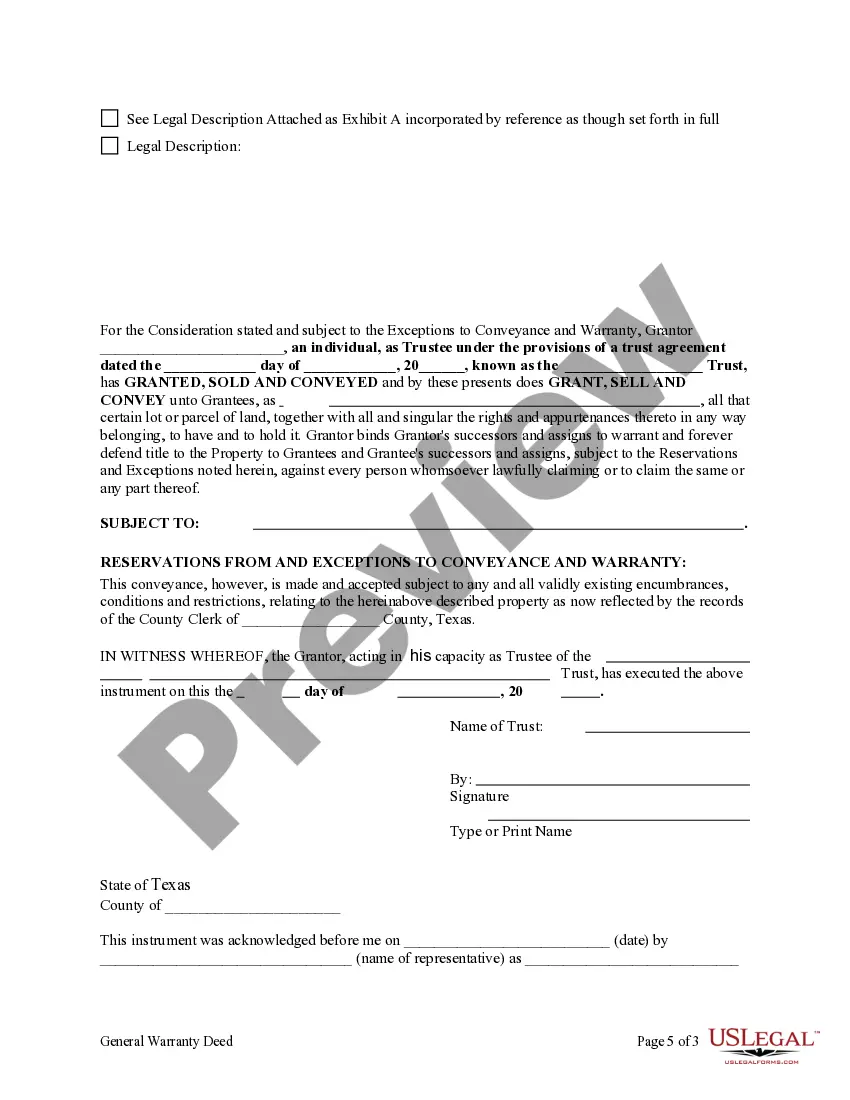

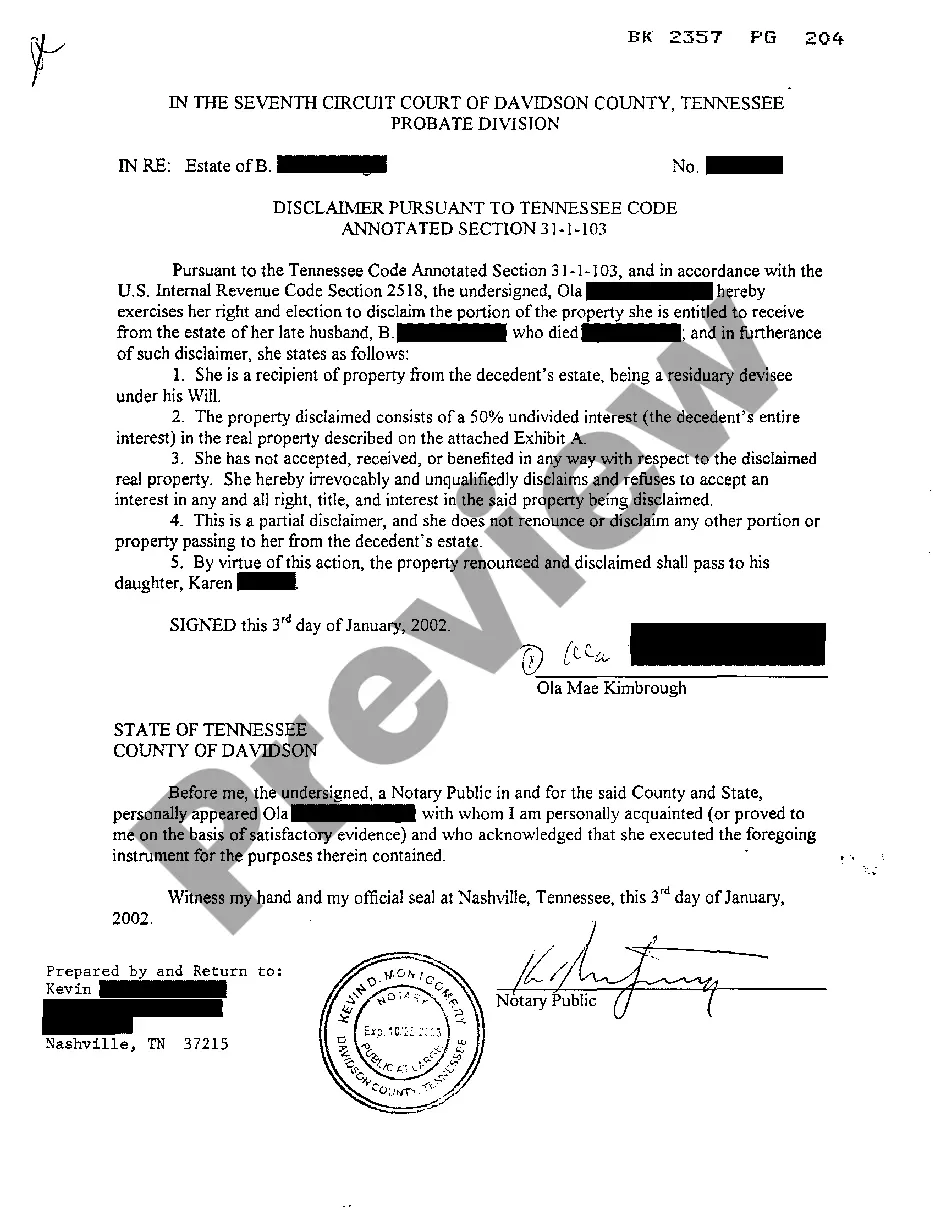

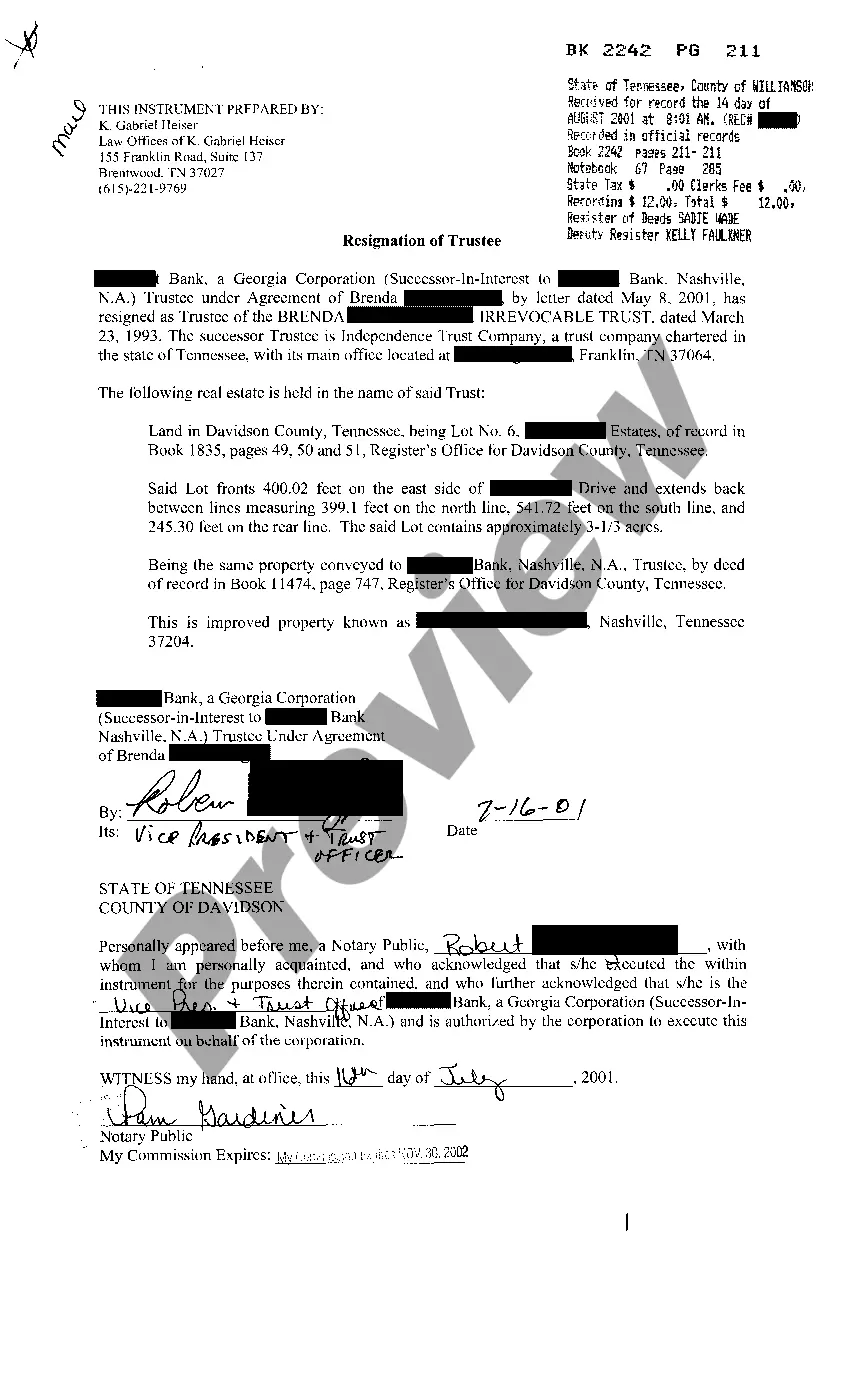

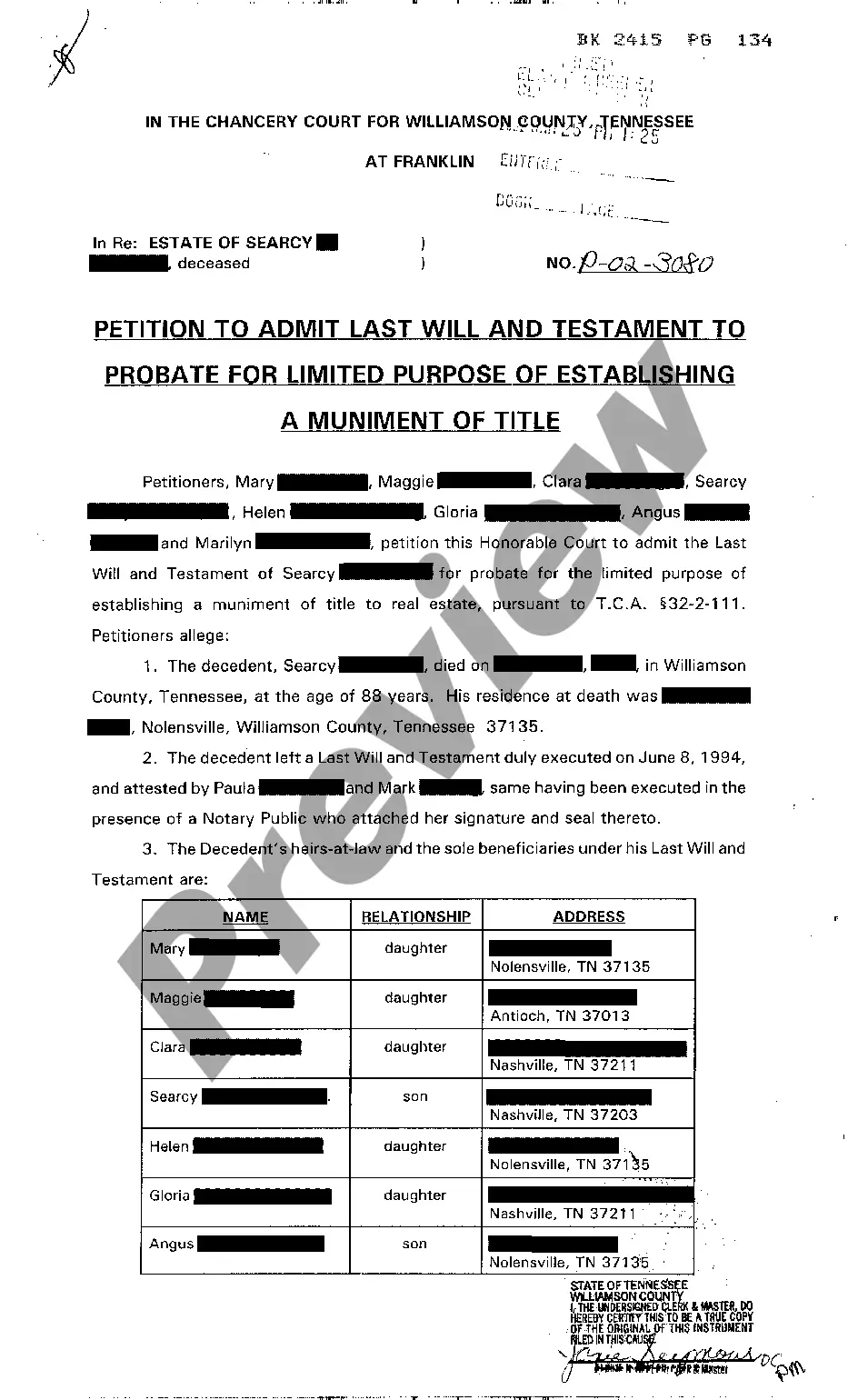

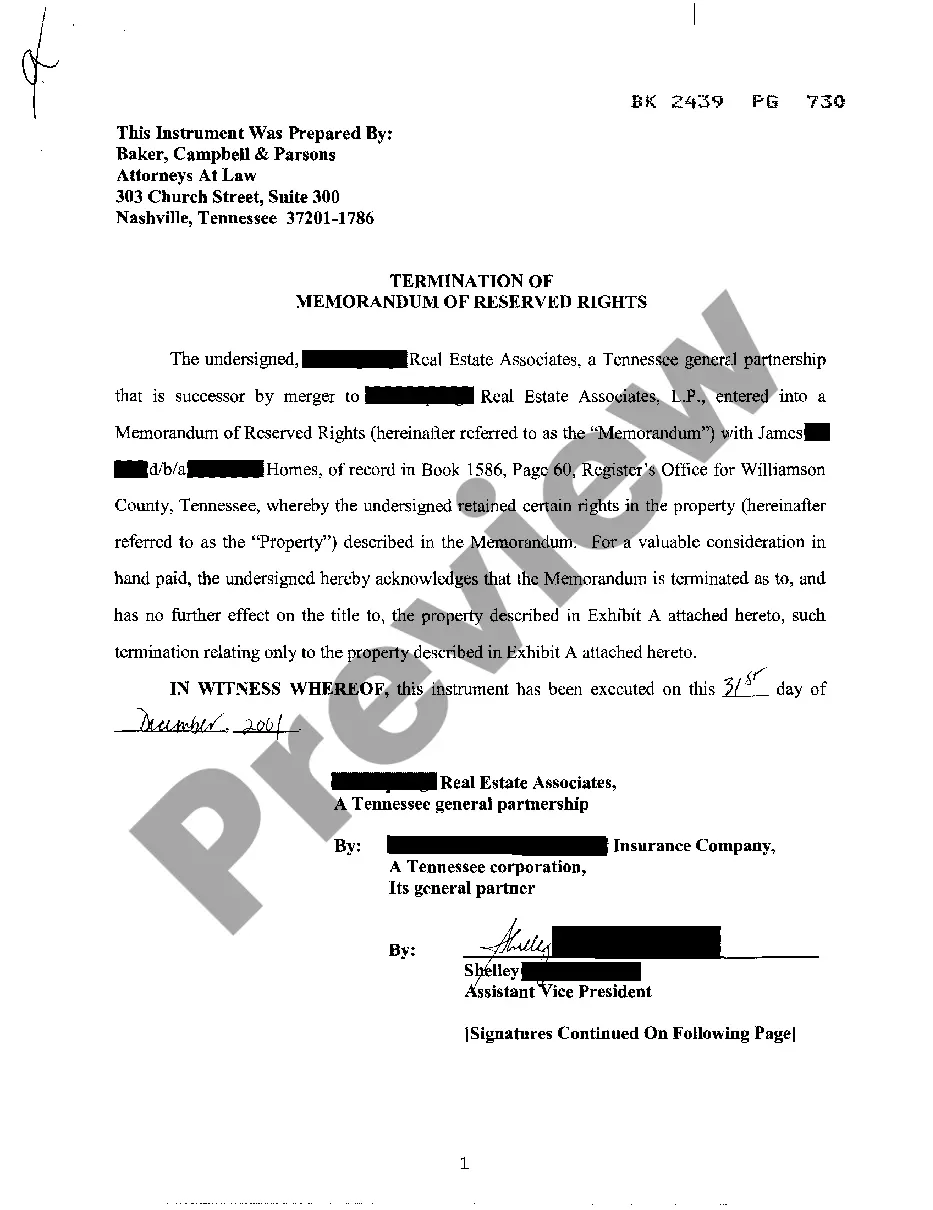

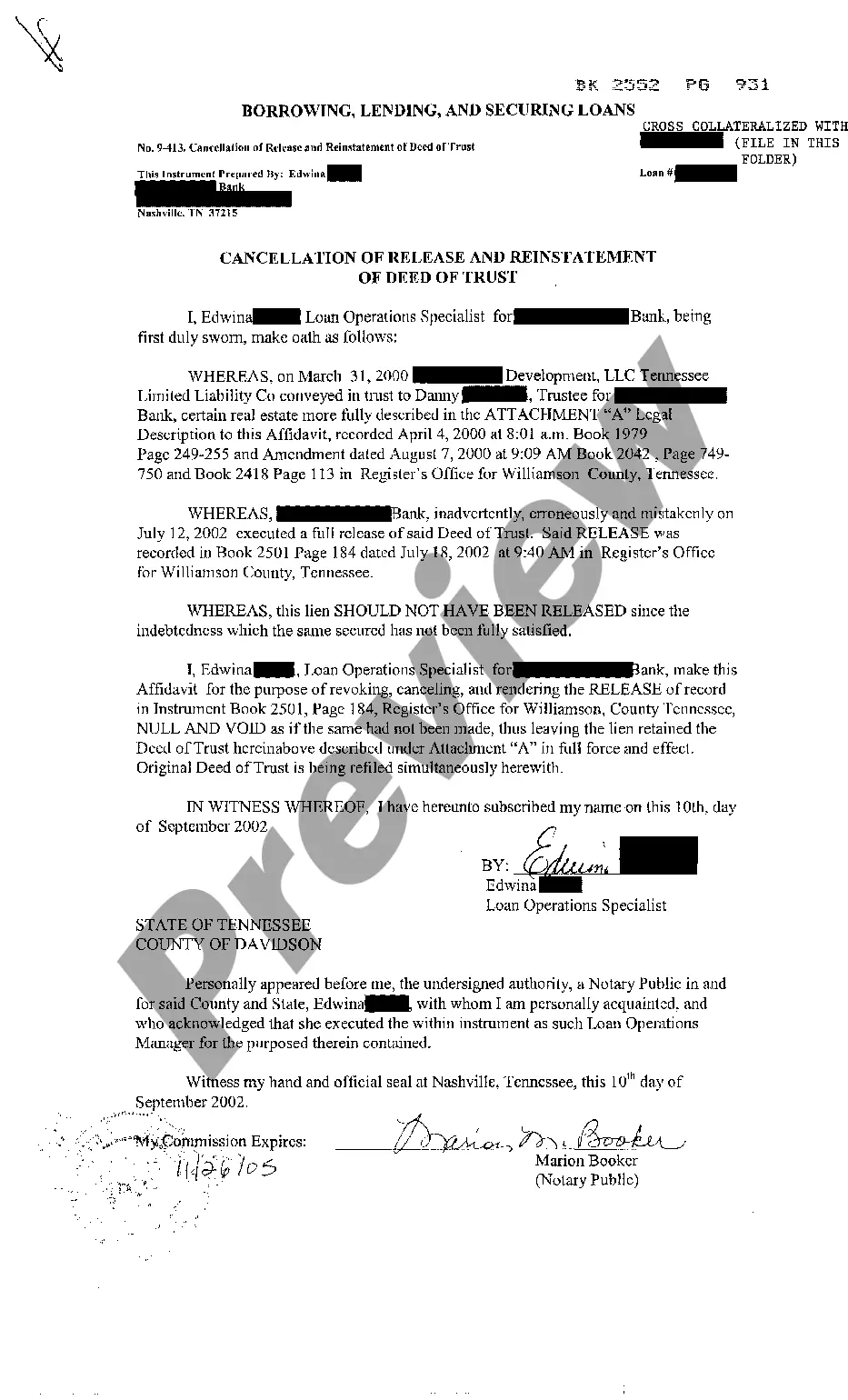

This form is a Warranty Deed where the Grantor is a Trust and the Grantees are two Individuals. Grantor conveys and warrants the described property to the Grantees. This deed complies with all state statutory laws.

Texas General Warranty Deed from Trust to Two Individuals

Description

How to fill out Texas General Warranty Deed From Trust To Two Individuals?

Access to high quality Texas General Warranty Deed from Trust to Two Individuals forms online with US Legal Forms. Prevent hours of wasted time looking the internet and dropped money on documents that aren’t up-to-date. US Legal Forms gives you a solution to exactly that. Get over 85,000 state-specific authorized and tax forms that you could save and complete in clicks within the Forms library.

To get the example, log in to your account and then click Download. The file will be saved in two places: on your device and in the My Forms folder.

For people who don’t have a subscription yet, look at our how-guide below to make getting started easier:

- Verify that the Texas General Warranty Deed from Trust to Two Individuals you’re looking at is appropriate for your state.

- Look at the sample utilizing the Preview function and browse its description.

- Visit the subscription page by clicking Buy Now.

- Choose the subscription plan to keep on to register.

- Pay by credit card or PayPal to finish making an account.

- Select a favored file format to save the document (.pdf or .docx).

Now you can open up the Texas General Warranty Deed from Trust to Two Individuals template and fill it out online or print it and do it yourself. Take into account giving the papers to your legal counsel to make sure all things are filled in properly. If you make a error, print and fill sample once again (once you’ve made an account all documents you download is reusable). Make your US Legal Forms account now and access much more forms.

Form popularity

FAQ

A warranty deed protects property owners from future claims that someone else actually owns a portion (or all) of their property, while trustee deeds protect lenders when borrowers default on their mortgage loans.

In the context of a California mortgage transaction, a trust deed also transfer ownership. Only this time, the title is being placed in the hands of a third-party trustee, who holds the property on behalf of the lender and the homeowner-borrower until the mortgage is paid.

Locate the deed that's in trust. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office.

Find the most recent deed to the property. It is best to begin with a copy of the most recent deed to the property (the deed that transferred the property to the current grantor). Create a new deed. Sign and notarize the deed. File the documents in the county land records.

A trustee deed offers no such warranties about the title.

California Property TaxesTransferring real property to yourself as trustee of your own revocable living trust -- or back to yourself -- does not trigger a reassessment for property tax purposes. (Cal. Rev. & Tax Code § 62(d).)

When you're ready to transfer trust real estate to the beneficiary who is named in the trust document to receive it, you'll need to prepare, sign, and record a deed. That's the document that transfers title to the property from you, the trustee, to the new owner.

A quitclaim deed can be used to transfer property from a trust, but a Special Warranty Deed seems to be a more common way to do this.

A deed conveys ownership; a deed of trust secures a loan.