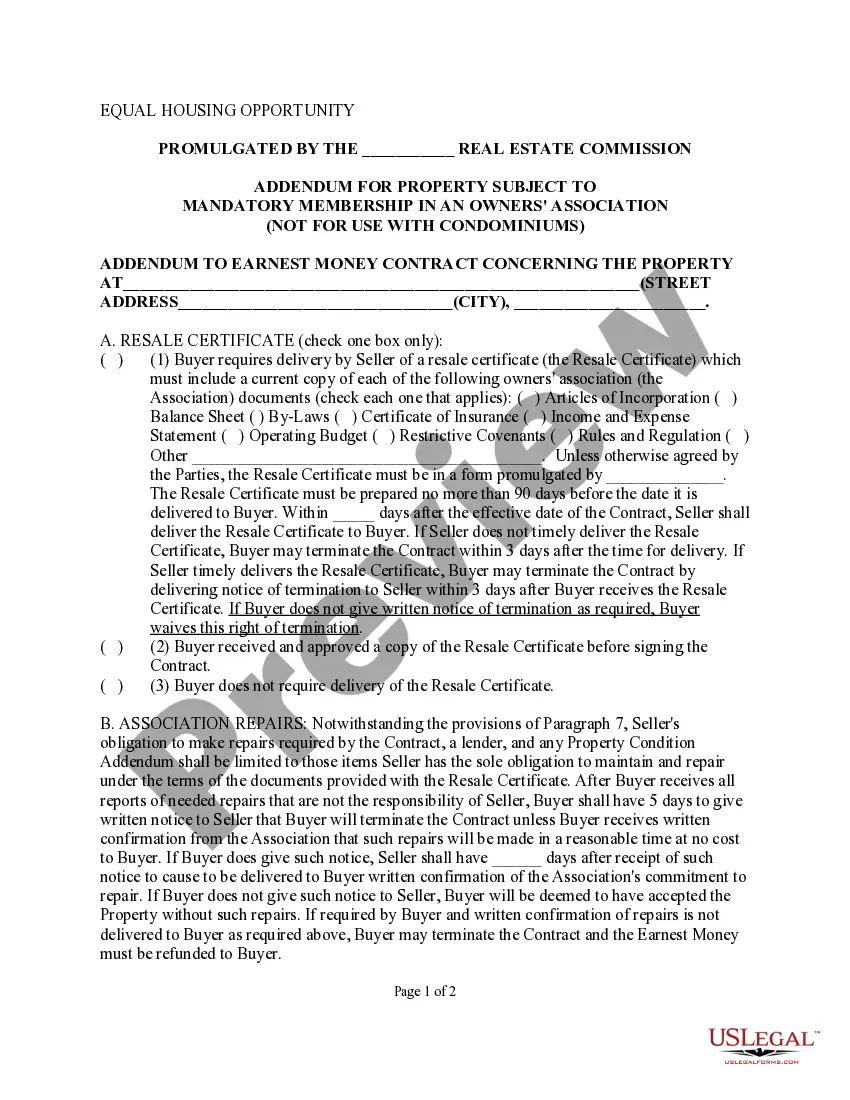

Texas Resale Certificate for Property Subject to Mandatory Membership in an Owners' Association

Understanding this form

The Resale Certificate for Property Subject to Mandatory Membership in an Owners' Association is a vital document required in Texas when selling a property that includes mandatory membership in an owners' association. This form discloses essential information about the property, such as assessments and pending legal issues, ensuring both buyers and sellers are informed about the property's standing within the association. Unlike other real estate forms, this certificate specifically addresses the association's impact on the property transfer process.

What’s included in this form

- Property details including address and any common elements.

- Assessment information noting current regular and special assessments.

- Outstanding balances owed to the owners' association.

- Approval of upcoming capital expenditures and reserves.

- Information on any pending legal suits against the association.

- Confirmation of insurance coverage provided by the association.

Common use cases

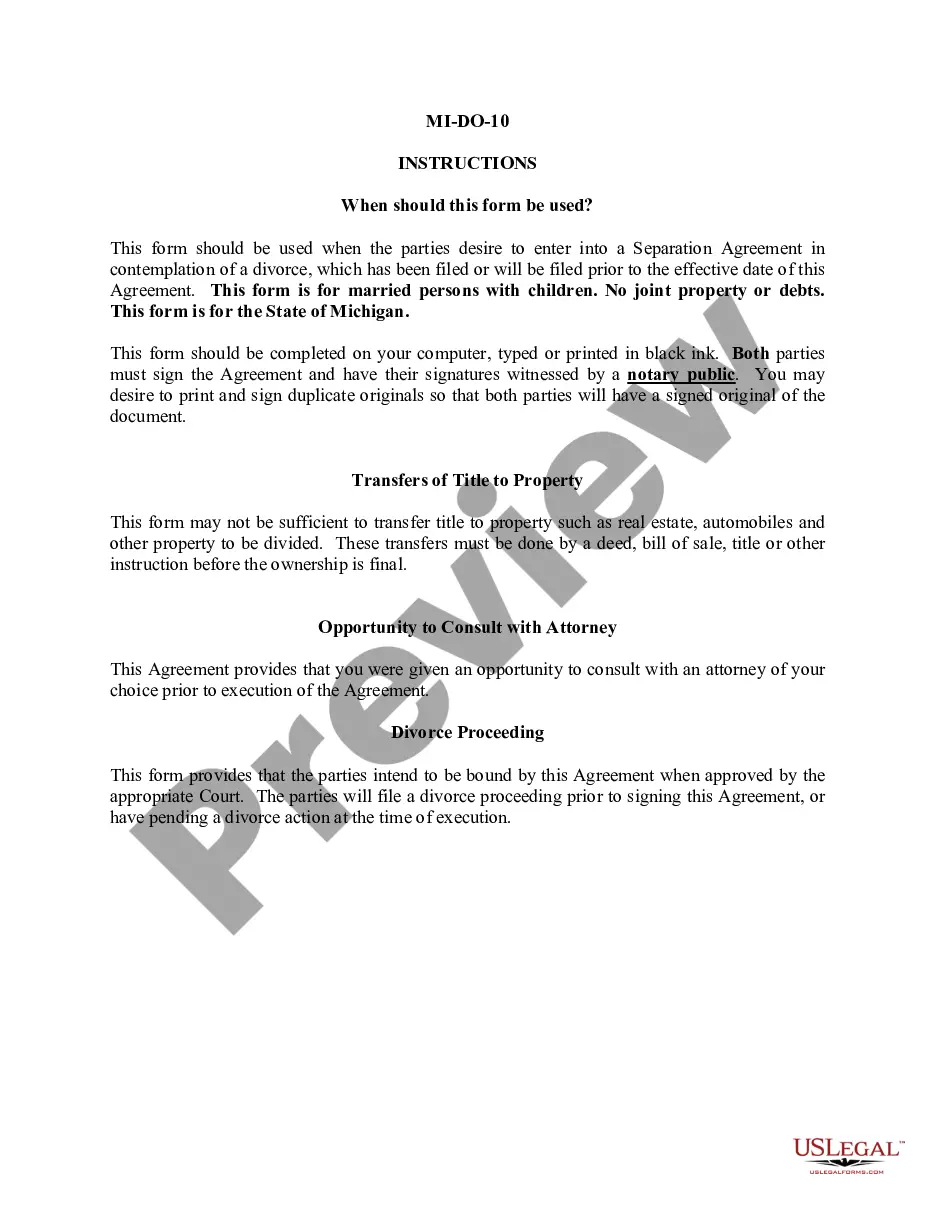

This form should be used when a property subject to mandatory owners' association membership is being sold. It is typically required by buyers or their agents to understand any financial obligations and potential risks associated with the property. Sellers must obtain and provide this certificate to fulfill their disclosure obligations under Texas law, ensuring a smooth transaction process.

Who should use this form

This form is intended for:

- Homeowners selling their property within an owners' association.

- Real estate agents facilitating the sale of such properties.

- Buyers seeking information on properties governed by an owners' association.

- Owners' association boards responsible for preparing the certificate.

How to complete this form

- Identify the property by entering the complete street address and county.

- Provide details on the owners' association's current assessments and any amounts owed by the property owner.

- Note any significant upcoming expenditures and legal suits involving the association.

- Confirm if the association provides insurance coverage for property owners.

- Complete all necessary signatures and dates to finalize the certificate.

Notarization requirements for this form

This form does not typically require notarization unless specified by local law. It is recommended to check any additional requirements of the specific owners' association involved.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to update the certificate within the required 90-day time frame before the sale.

- Not including all necessary attachments, such as bylaws or financial statements.

- Leaving blank sections that are crucial for the buyerâs understanding.

- Overlooking pending legal matters or current assessments that could affect the transaction.

Benefits of using this form online

- Convenient access to essential forms anytime.

- Editability allows customization to fit specific property details.

- Reliable formats ensure compliance with legal standards.

What to keep in mind

- This resale certificate is crucial for property sales involving mandatory owners' associations in Texas.

- It ensures transparency about fees and any pending issues with the property.

- Both buyers and sellers should be familiar with the certificate's details to facilitate a smooth transaction.

Looking for another form?

Form popularity

FAQ

In Texas, unlike in other states, resale certificates and sales tax permits are not interchangeable.You can also generally use a Texas resale certificate if you intend to buy items and then resell them across the border in Mexico.

You can apply for a Texas seller's permit online through the Texas Online Tax Registration Application or by filling out the Texas Application for Sales and Use Tax Permit (Form AP-201) and mailing it to the comptroller's office at the address listed on the form.

Why are resale certificates required? A taxable item that is purchased for resale is exempt from sales or use tax if the seller accepts a properly completed Form 01-339, Texas Sales and Use Tax Resale Certificate (PDF), instead of collecting the sales tax due.

4. How much does it cost to apply for a sales tax permit in Texas? It's free to apply for a Texas sales tax permit. A bond may be required but only after the application is filed and reviewed.