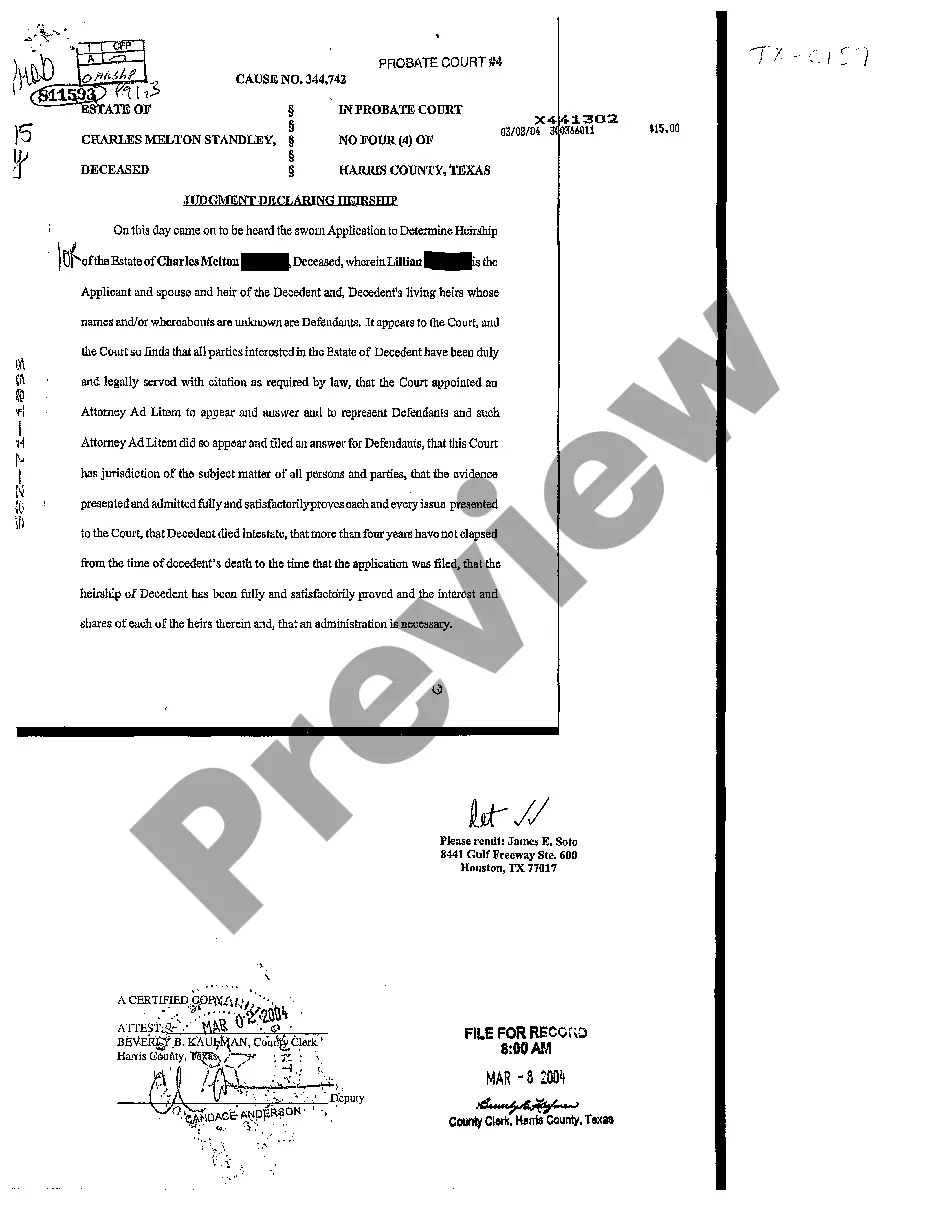

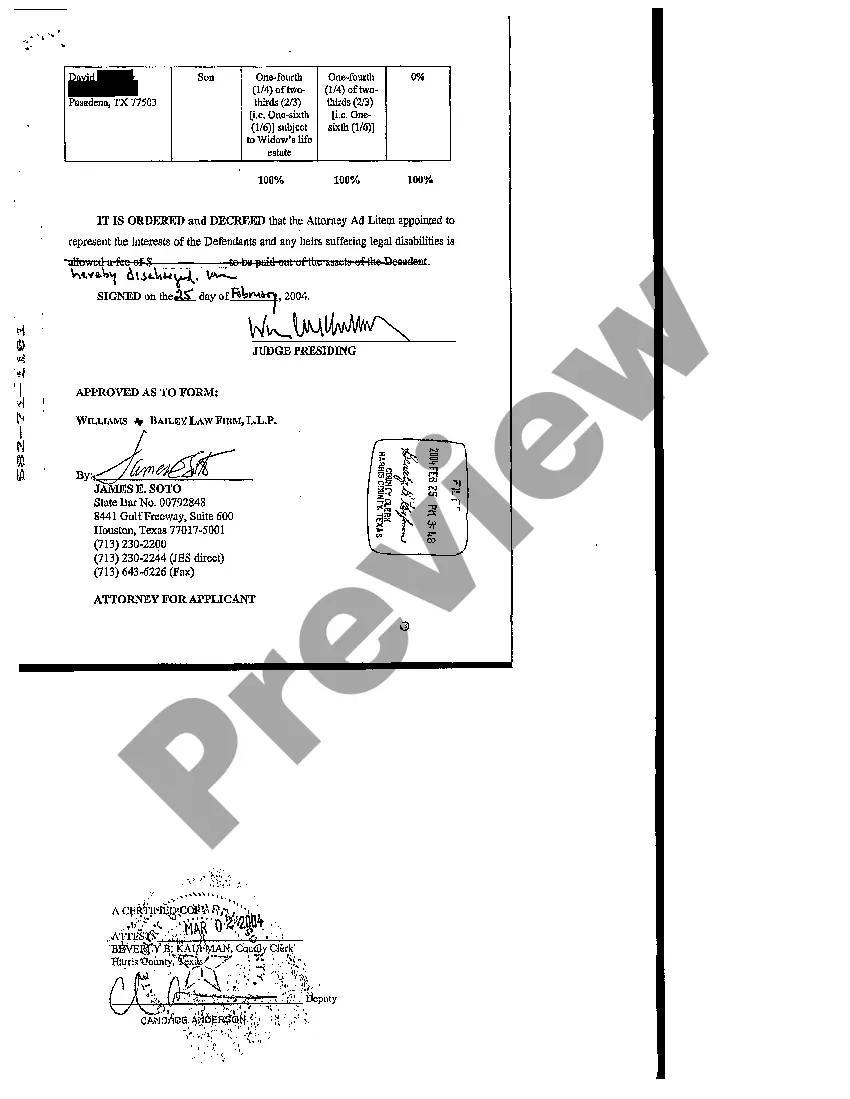

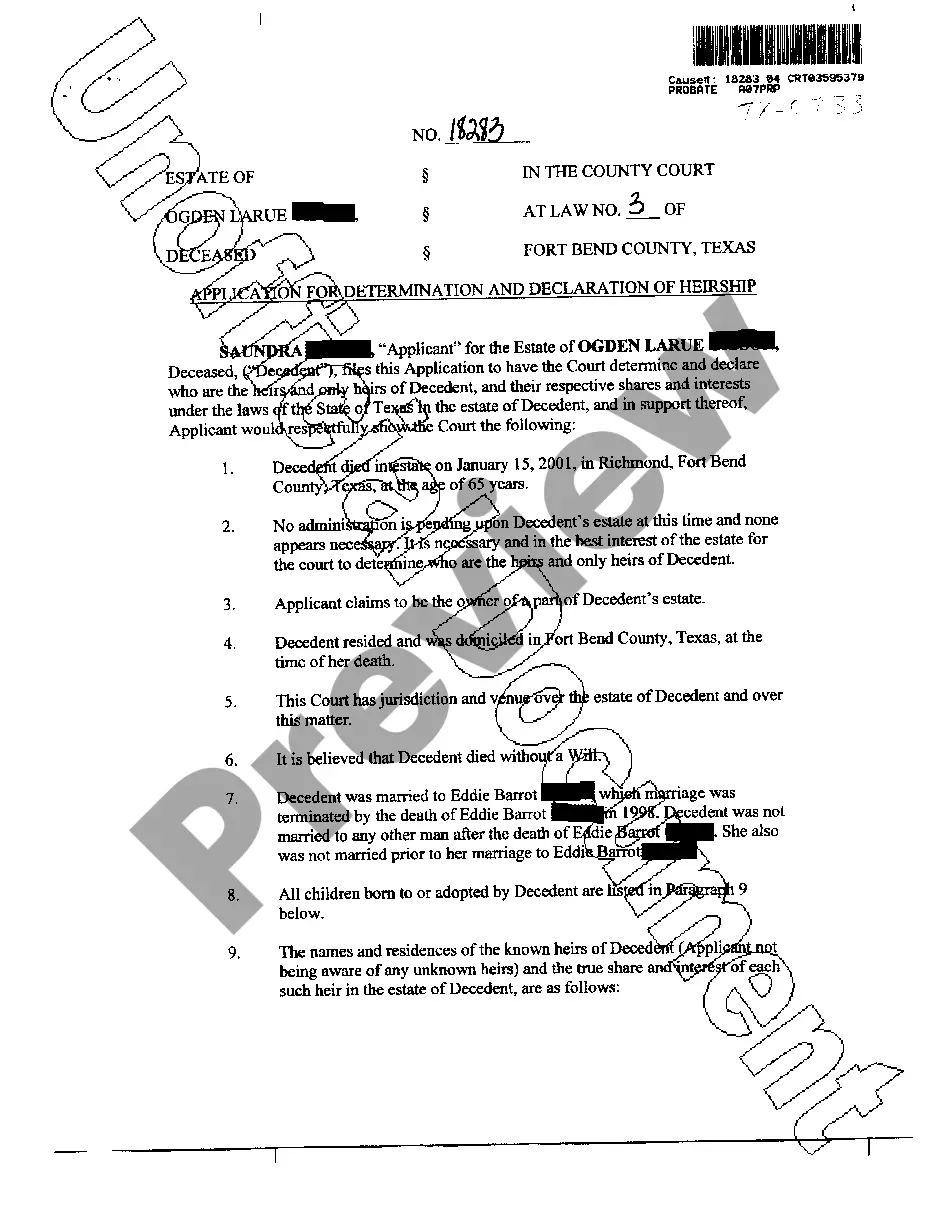

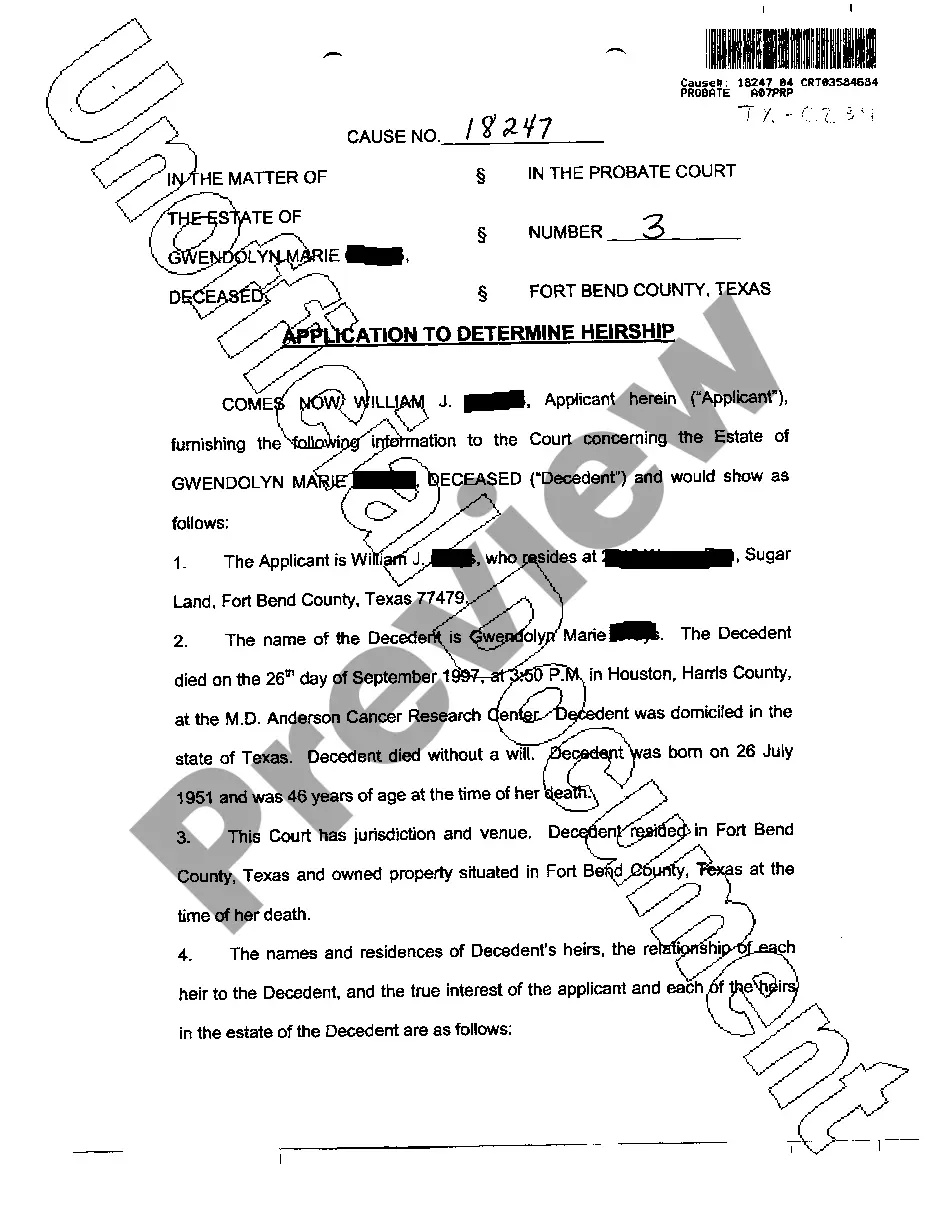

Texas Judgment Declaring Heirship or Descent

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Texas Judgment Declaring Heirship Or Descent?

Get access to top quality Texas Judgment Declaring Heirship or Descent samples online with US Legal Forms. Prevent hours of misused time searching the internet and lost money on files that aren’t up-to-date. US Legal Forms offers you a solution to just that. Find more than 85,000 state-specific authorized and tax samples you can download and complete in clicks in the Forms library.

To receive the example, log in to your account and click on Download button. The document is going to be saved in two places: on your device and in the My Forms folder.

For people who don’t have a subscription yet, have a look at our how-guide listed below to make getting started simpler:

- See if the Texas Judgment Declaring Heirship or Descent you’re looking at is appropriate for your state.

- See the form using the Preview function and browse its description.

- Go to the subscription page by clicking Buy Now.

- Select the subscription plan to go on to sign up.

- Pay by card or PayPal to finish making an account.

- Select a preferred format to download the document (.pdf or .docx).

You can now open the Texas Judgment Declaring Heirship or Descent template and fill it out online or print it out and do it yourself. Consider giving the file to your legal counsel to make sure things are completed appropriately. If you make a error, print and fill application again (once you’ve made an account all documents you download is reusable). Make your US Legal Forms account now and get access to much more samples.

Form popularity

FAQ

It does not transfer title to real property. However, Texas Estates Code chapter 203.001 says it becomes evidence about the property once it has been on file for five years. The legal effect of the affidavit of heirship is that it creates a clean chain of title transfer to the decedent's heirs.

An affidavit of heirship must be filed with the real property records in the county where the land is located. Call the county clerk and ask how much their filing fees are. The filing fees vary from county to county.

Heirship Proceedings in Texas An heirship proceeding is a court proceeding used to determine who an individual's heirs are.This process involves a court-appointed attorney who investigates the deceased individual's family history and confirms to the court the identity of the heirs.

The Determination of Heirship procedure is a court procedure that declares the identities the decedent's heirs and, if desired, allows an administrator to be appointed to administer the estate. The Determination of Heirship procedure is one of the most expensive procedures available to the decedent's heirs.

The price of the Affidavit of Heirship is $500. This price includes the attorneys' fees to prepare the Affidavit of Heirship and the cost to record in the real property records. You can save $75 if you record the Affidavit of Heirship yourself.

1. This form should be completed by someone other than an Heir. This person should be someone who is familiar with the family history of the deceased (decedent), and who will obtain no benefit from the Estate. The person who fills out the form is referred to as the AFFIANT.

Does an affidavit of heirship need to be recorded in Texas? Yes, after the affidavit is signed and executed, it must be filed with the county deed records where the decedent's real property is located.