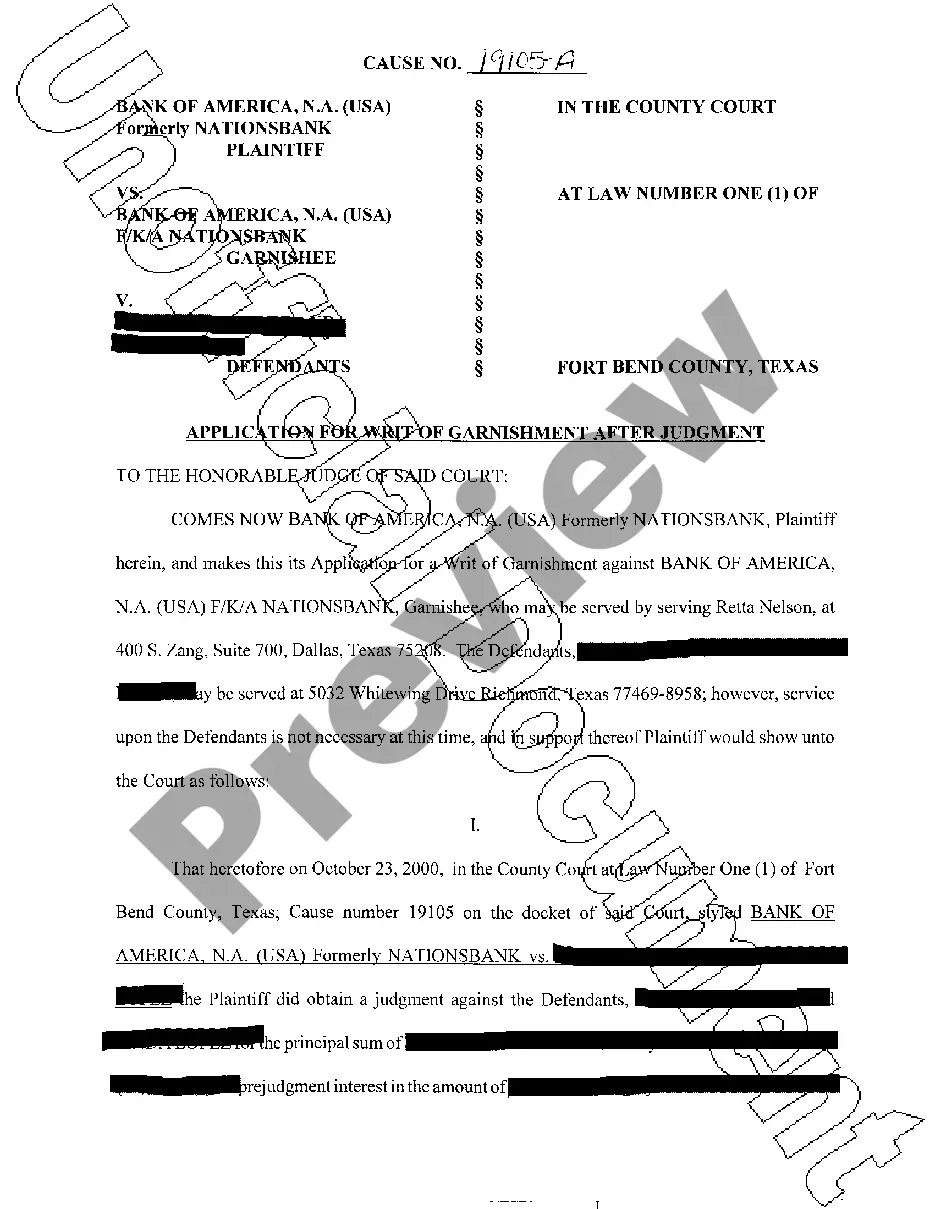

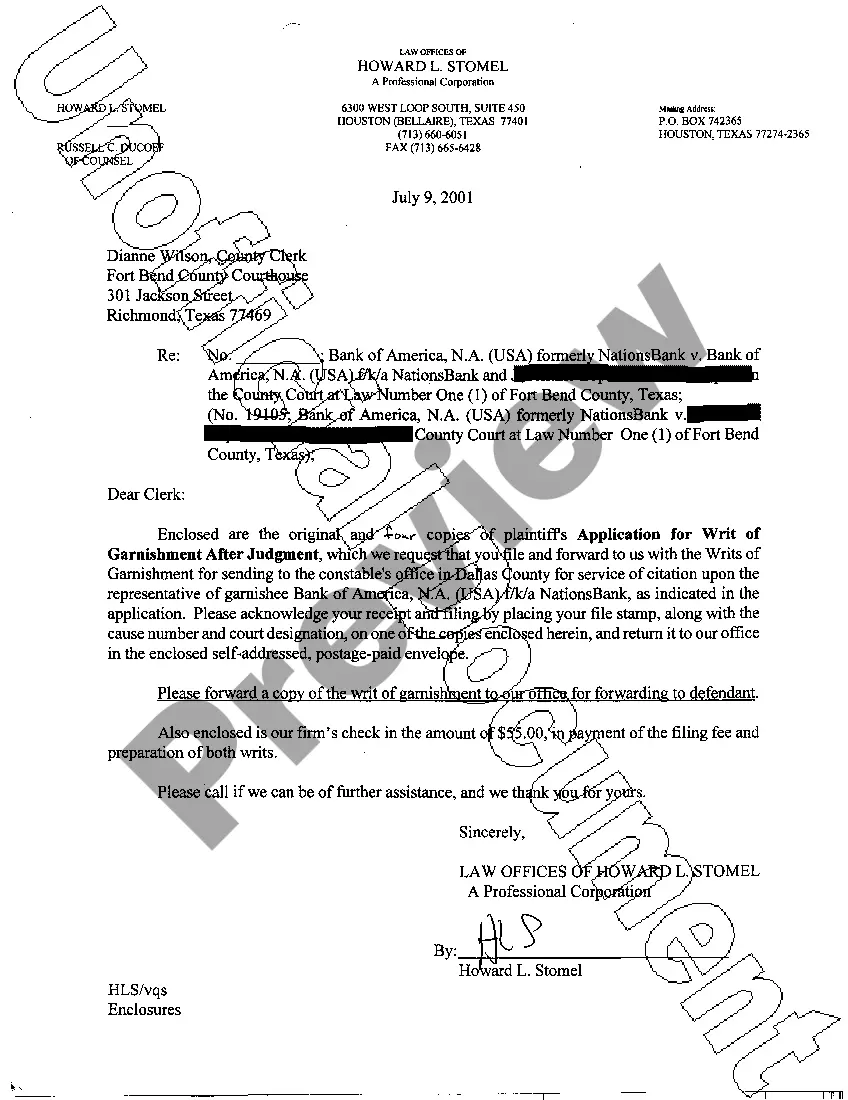

Texas Application for Writ of Garnishment

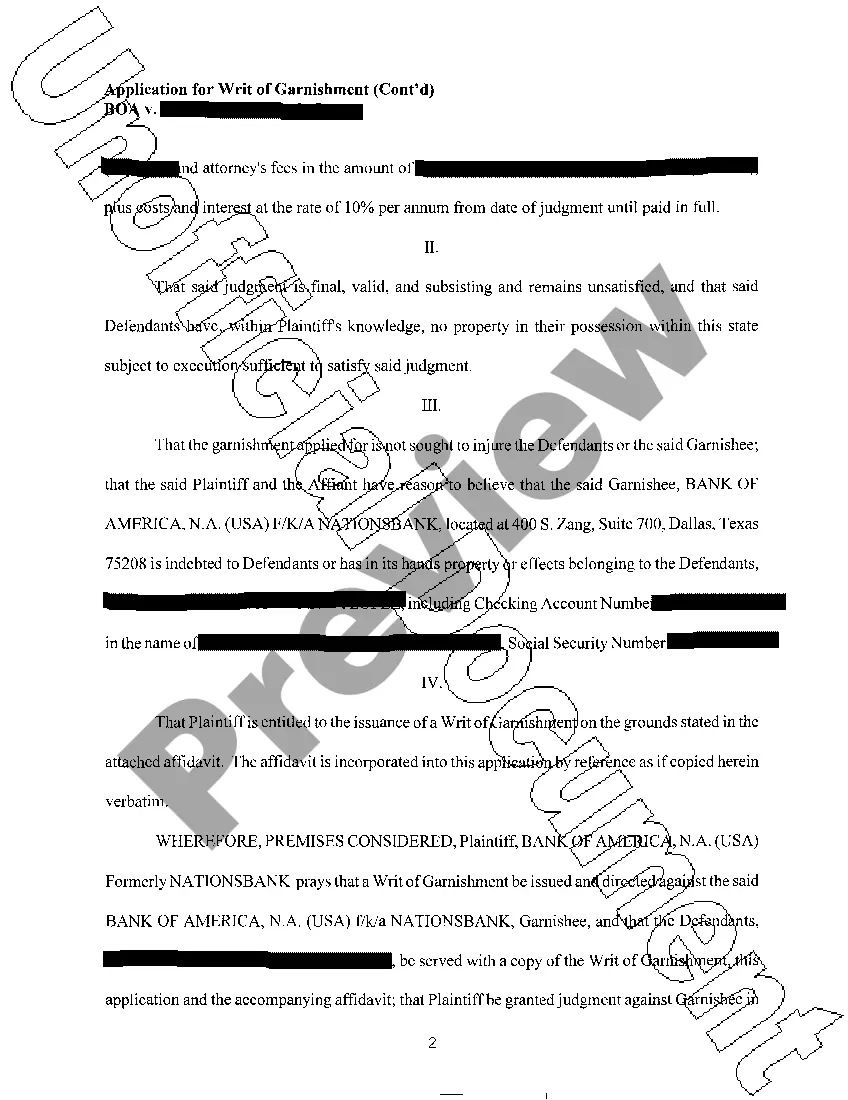

Description Garnishment Examples

How to fill out Texas Application For Writ Of Garnishment?

Access to top quality Texas Application for Writ of Garnishment samples online with US Legal Forms. Steer clear of days of wasted time seeking the internet and lost money on forms that aren’t updated. US Legal Forms offers you a solution to just that. Get over 85,000 state-specific authorized and tax templates you can download and submit in clicks within the Forms library.

To find the example, log in to your account and then click Download. The file will be stored in two places: on the device and in the My Forms folder.

For those who don’t have a subscription yet, check out our how-guide below to make getting started simpler:

- Check if the Texas Application for Writ of Garnishment you’re considering is appropriate for your state.

- View the form using the Preview function and browse its description.

- Visit the subscription page by clicking Buy Now.

- Select the subscription plan to continue on to sign up.

- Pay out by credit card or PayPal to finish making an account.

- Pick a preferred format to save the file (.pdf or .docx).

Now you can open the Texas Application for Writ of Garnishment sample and fill it out online or print it out and get it done yourself. Consider mailing the papers to your legal counsel to make certain things are filled in properly. If you make a mistake, print out and fill sample once again (once you’ve created an account every document you save is reusable). Create your US Legal Forms account now and get a lot more templates.

Form 8958 Required Form popularity

Who Is The Garnishee Other Form Names

FAQ

What you can do about wage garnishment.You have to be legally notified of the garnishment. You can file a dispute if the notice has inaccurate information or you believe you don't owe the debt. Some forms of income, such as Social Security and veterans benefits, are exempt from garnishment as income.

If you are served with a garnishment summons, do not ignore these documents because they do not directly involve a debt that you owe. Instead, you should immediately freeze any payments to the debtor, retain the necessary property, and provide the required written disclosure.

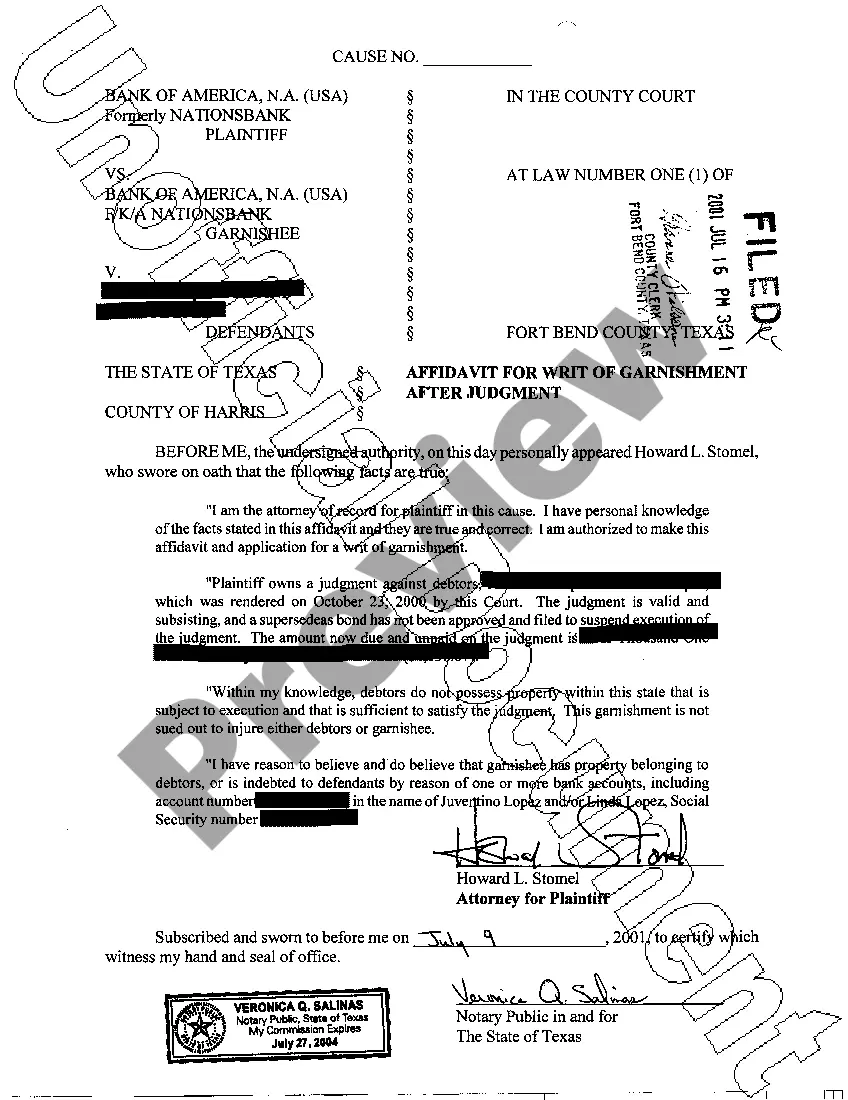

Once the judgment-creditor files a valid application for writ of garnishment, the court will issue a writ directed to the bank. The court typically provides the writ to the judgment-creditor for service. The judgment creditor must properly serve the writ. Only a constable or sheriff may serve a writ of garnishment.

The best way to avoid bank account garnishment is to make a payment arrangement with creditors, which can even lead to a negotiated balance.

The Writ of Execution is a proactive approach to post-judgment enforcement. 30 days after obtaining a final judgment, a creditor can request a Writ of Execution from the clerk of the court. The creditor or the creditor's attorney will fill out a Writ of Execution form available at any county courthouse.

Respond to the Creditor's Demand Letter. Seek State-Specific Remedies. Get Debt Counseling. Object to the Garnishment. Attend the Objection Hearing (and Negotiate if Necessary) Challenge the Underlying Judgment. Continue Negotiating.

The Order dissolves the existing writ of garnishment. It means that whatever was being garnished, wages or bank accounts, are no longer subject to the writ of garnishment.

The Writ of Execution is a proactive approach to post-judgment enforcement. 30 days after obtaining a final judgment, a creditor can request a Writ of Execution from the clerk of the court. The creditor or the creditor's attorney will fill out a Writ of Execution form available at any county courthouse.