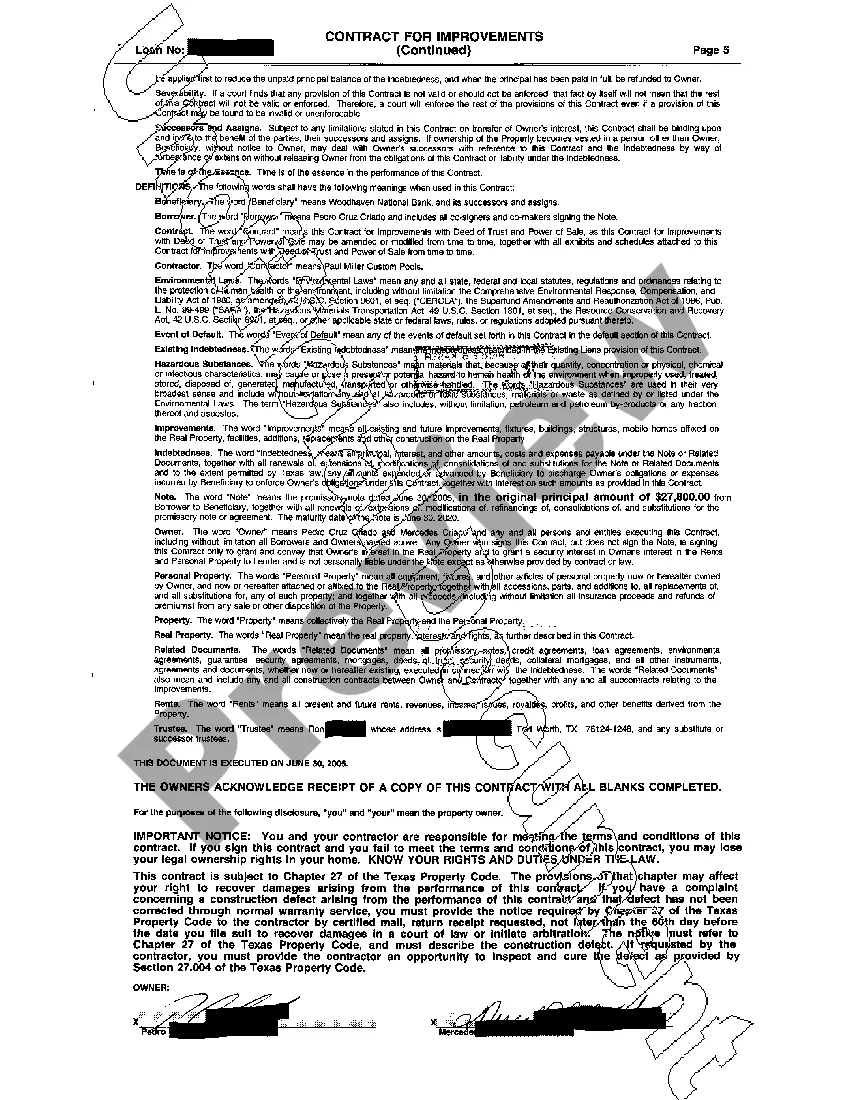

Texas Contracts for Improvements with Deed of Trust and Power of Sale

Description What Clause In The Deed Of Trust Allows The Trustee To Go To Sale Without Going To Court

How to fill out Texas Contracts For Improvements With Deed Of Trust And Power Of Sale?

Access to quality Texas Contracts for Improvements with Deed of Trust and Power of Sale samples online with US Legal Forms. Avoid hours of wasted time looking the internet and dropped money on forms that aren’t updated. US Legal Forms provides you with a solution to just that. Get around 85,000 state-specific legal and tax templates that you can save and submit in clicks in the Forms library.

To receive the example, log in to your account and click on Download button. The file is going to be stored in two places: on your device and in the My Forms folder.

For people who don’t have a subscription yet, check out our how-guide listed below to make getting started easier:

- Check if the Texas Contracts for Improvements with Deed of Trust and Power of Sale you’re considering is suitable for your state.

- View the sample making use of the Preview option and read its description.

- Check out the subscription page by clicking Buy Now.

- Choose the subscription plan to go on to register.

- Pay by card or PayPal to finish creating an account.

- Choose a preferred format to download the document (.pdf or .docx).

You can now open up the Texas Contracts for Improvements with Deed of Trust and Power of Sale template and fill it out online or print it out and get it done by hand. Consider sending the file to your legal counsel to be certain things are filled out properly. If you make a mistake, print and fill sample again (once you’ve made an account all documents you download is reusable). Make your US Legal Forms account now and get access to far more forms.

What Is A Contract For Improvements With Deed Of Trust And Power Of Sale Form popularity

Texas Contract For Improvements Other Form Names

FAQ

A second deed of trust serves the same purpose by allowing a trustee to hold a deed for a secondary loan in trust. A second deed of trust is recorded after a first deed of trust, which is usually for a more substantial loan amount used to finance a majority of the home's price.

The Deed of Trust (or Mortgage or Security Instrument) is a legal document that grants the lender the rights to take the property if the borrower goes into default and does not pay under the terms of the Note. The lender holds title to the property until the borrower has repaid the debt in full.

A point is 1% of the purchase price of the property being offered as security for the loan. In the event of a borrower's default, a subordination clause makes foreclosure easier by giving a lender the right to declare the entire debt due and payable.

If there's a deed of trust on a property, the lender can sell the property and pay off the loan. Whether your loan falls under the mortgage or deed of trust definition, you'll need to get approval from the lender before you sell your home for less than you owe.

The trustee's primary function is to hold and maintain a property title for the borrower and the lender for the duration of the loan. Therefore, it is the trustee who retains factual ownership and control of the property in question, not the lender.

A deed of trust involves three parties: the borrower, the lender, and the trustee.The trustee holds title to the property until the trustor has fully repaid the loan to the beneficiary, at which time the lender notifies the trustee, who then transfers full title of the property to the trustor.

In a deed of trust, the borrower is called the trustor and the lender is the beneficiary. The trustee holds title to the property until the trustor has fully repaid the loan to the beneficiary, at which time the lender notifies the trustee, who then transfers full title of the property to the trustor.

This may be referred to as the "power of sale" clause. This is the language that legally authorizes the trustee to sell the property outside of court if the buyer does not meet his or her obligations under the deed of trust and promissory note.