Texas First Amended Notice of Assessment Lien

Description

How to fill out Texas First Amended Notice Of Assessment Lien?

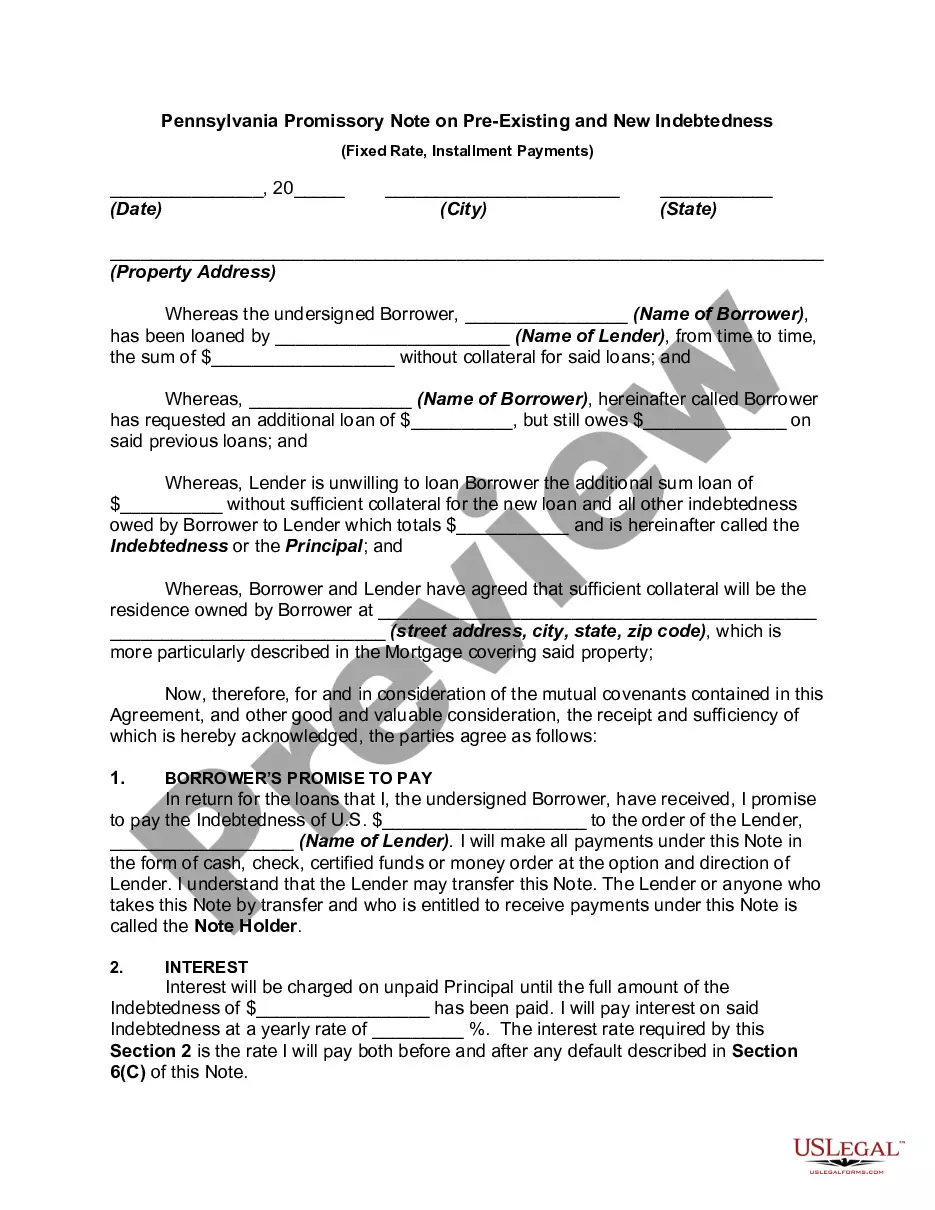

Get access to quality Texas First Amended Notice of Assessment Lien templates online with US Legal Forms. Prevent days of lost time seeking the internet and lost money on documents that aren’t updated. US Legal Forms offers you a solution to exactly that. Find more than 85,000 state-specific legal and tax forms you can download and fill out in clicks within the Forms library.

To get the example, log in to your account and then click Download. The file will be stored in two places: on the device and in the My Forms folder.

For those who don’t have a subscription yet, have a look at our how-guide below to make getting started simpler:

- Check if the Texas First Amended Notice of Assessment Lien you’re looking at is suitable for your state.

- See the form using the Preview option and browse its description.

- Check out the subscription page by clicking Buy Now.

- Select the subscription plan to keep on to register.

- Pay by card or PayPal to complete making an account.

- Pick a preferred format to save the document (.pdf or .docx).

Now you can open the Texas First Amended Notice of Assessment Lien sample and fill it out online or print it and do it yourself. Take into account sending the file to your legal counsel to make sure things are filled in properly. If you make a error, print out and fill sample again (once you’ve registered an account all documents you save is reusable). Create your US Legal Forms account now and get access to far more templates.

Form popularity

FAQ

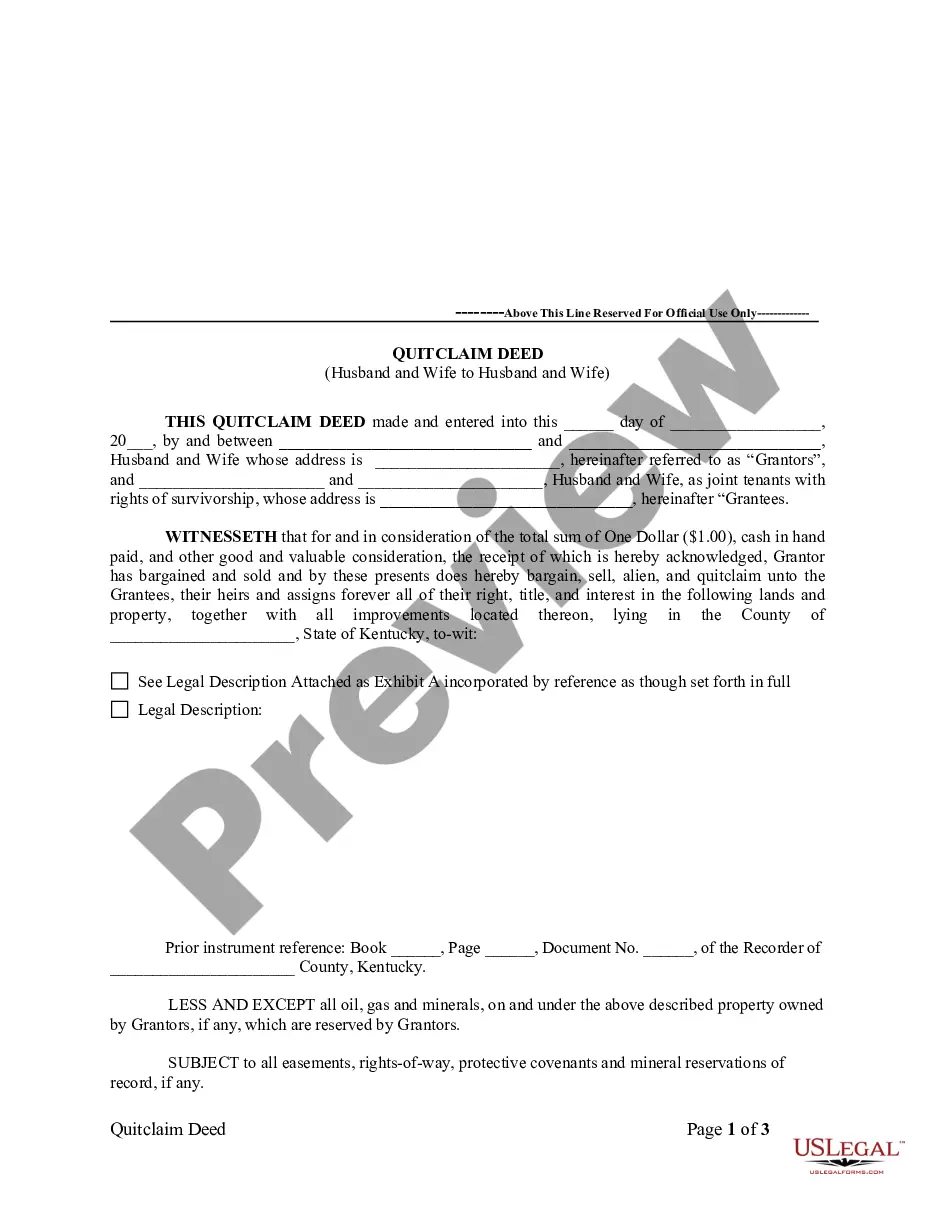

When a condo owner fails to pay any required fees and assessments, the HOA can take action to collect the delinquent payments, which includes filing a lien against the condo owner's property.

The lien gives the creditor an interest in your property so that it can get paid for the debt you owe. If you sell the property, the creditor will be paid first before you receive any proceeds from the sale. And in some cases, the lien gives the creditor the right to force a sale of your property in order to get paid.

The Bottom Line. All homeowners have liens on their homes until they pay off their mortgages. While these liens don't hurt you because they're voluntary, other liens can damage your finances and your credit rating.

How long does a judgment lien last in California? A judgment lien in California will remain attached to the debtor's property (even if the property changes hands) for ten years.

If an HOA has a lien on a homeowner's property, it may forecloseeven if the home already has a mortgage on itas permitted by the CC&Rs and state law. The HOA can foreclose either through judicial foreclosure or a nonjudicial foreclosure, depending on state law and the terms in the CC&Rs.

Assessment fees are payments the homeowners' association (HOA) collects from owners to cover expenses the HOA is responsible for, but that aren't covered in the regular monthly fees. Take lawn care, for example.The HOA board of directors may vote to impose an assessment fee to pay for that expense.

Pay off your debt. Fill out a release-of-lien form and have the lien holder sign it. Run out the statute of limitations. Get a court order. Make a claim with your title insurance company. Learn more:

Removal of Association's LienTo remove a lien on a property, homeowners must first satisfy the debt owed to the homeowners association. To pay off an HOA lien, the homeowner must make payment to the association in the amount of the delinquent assessments, plus interest and any applicable fees.

A lien gives an individual or entity a claim to a property until a debt is paid off.If the debt goes unpaid, they have the right to take it back.