Whether you're borrowing money or providing a loan to someone else, a Promissory Note is usually the best way to establish a record of the transaction and make sure that repayment terms, for example, are clear and fair.

However, an “IOU†is generally regarded as only an acknowledgment of a debt, not a promise to pay the debt. However, this form is a written promise to pay a debt.

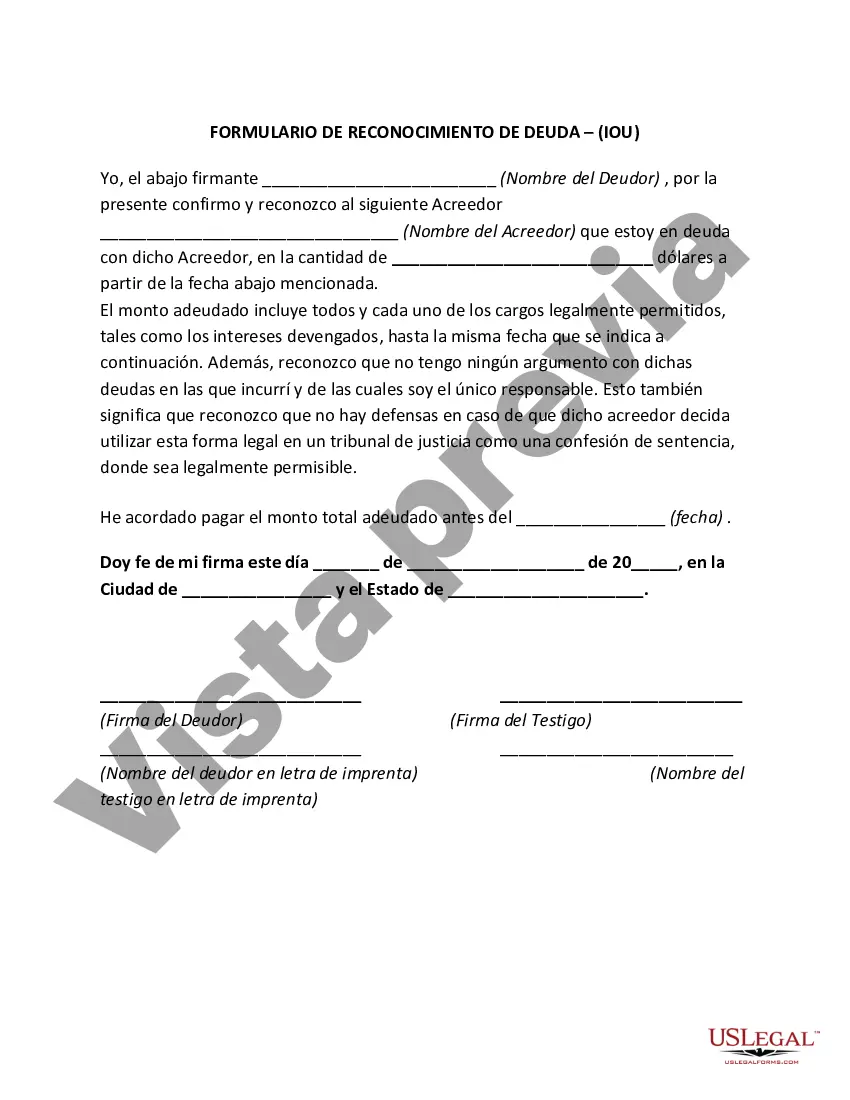

A Texas Debt Acknowledgment, also commonly referred to as an IOU (I Owe You), is a legal document that serves as evidence of a debt owed by one party to another. It is used when an individual or a business borrows money or receives goods or services on credit, creating a debtor-creditor relationship. The acknowledgment outlines the terms of the debt, including the amount borrowed, repayment terms, interest rate (if applicable), and other relevant information. The Texas Debt Acknowledgment carries legal weight and is often used to protect both the borrower and the lender in case of disputes or misunderstandings regarding the debt. It ensures that both parties are clear about the debt's existence and its terms, minimizing the potential for disagreements in the future. There are different types of Texas Debt Acknowledgment forms, each designed to cater to various debt scenarios: 1. Simple Debt Acknowledgment: This is the most basic form that outlines the amount owed, the terms of repayment, and any interest or penalties associated with the debt. 2. Promissory Note: A promissory note is a more formal type of debt acknowledgment that establishes a legal obligation to repay the debt. It includes detailed provisions such as the repayment schedule, interest rate, collateral (if any), consequences for default, and other specific terms agreed upon. 3. Installment Debt Acknowledgment: This type of acknowledgment is used when a debt is to be repaid in multiple installments over a specified period. It outlines the specific dates and amounts to be paid at each installment, ensuring clarity for both parties. 4. Business Debt Acknowledgment: This acknowledgment is specific to business transactions and outlines the terms of debt owed by one business to another. It includes details such as the purpose of the debt, repayment schedule, and any additional business-specific clauses. 5. Personal Debt Acknowledgment: This type of acknowledgment is commonly used between individuals and often relates to personal loans, informal borrowings, or family and friend agreements. It outlines the terms and repayment conditions agreed upon, establishing a legal obligation to repay the debt. Overall, the Texas Debt Acknowledgment — IO— - I Owe You is a legally binding document that ensures transparency and clarity in debt-related transactions. It protects the rights and interests of both the borrower and the lender, making it an essential tool in maintaining financial integrity and preventing potential disputes in the state of Texas.A Texas Debt Acknowledgment, also commonly referred to as an IOU (I Owe You), is a legal document that serves as evidence of a debt owed by one party to another. It is used when an individual or a business borrows money or receives goods or services on credit, creating a debtor-creditor relationship. The acknowledgment outlines the terms of the debt, including the amount borrowed, repayment terms, interest rate (if applicable), and other relevant information. The Texas Debt Acknowledgment carries legal weight and is often used to protect both the borrower and the lender in case of disputes or misunderstandings regarding the debt. It ensures that both parties are clear about the debt's existence and its terms, minimizing the potential for disagreements in the future. There are different types of Texas Debt Acknowledgment forms, each designed to cater to various debt scenarios: 1. Simple Debt Acknowledgment: This is the most basic form that outlines the amount owed, the terms of repayment, and any interest or penalties associated with the debt. 2. Promissory Note: A promissory note is a more formal type of debt acknowledgment that establishes a legal obligation to repay the debt. It includes detailed provisions such as the repayment schedule, interest rate, collateral (if any), consequences for default, and other specific terms agreed upon. 3. Installment Debt Acknowledgment: This type of acknowledgment is used when a debt is to be repaid in multiple installments over a specified period. It outlines the specific dates and amounts to be paid at each installment, ensuring clarity for both parties. 4. Business Debt Acknowledgment: This acknowledgment is specific to business transactions and outlines the terms of debt owed by one business to another. It includes details such as the purpose of the debt, repayment schedule, and any additional business-specific clauses. 5. Personal Debt Acknowledgment: This type of acknowledgment is commonly used between individuals and often relates to personal loans, informal borrowings, or family and friend agreements. It outlines the terms and repayment conditions agreed upon, establishing a legal obligation to repay the debt. Overall, the Texas Debt Acknowledgment — IO— - I Owe You is a legally binding document that ensures transparency and clarity in debt-related transactions. It protects the rights and interests of both the borrower and the lender, making it an essential tool in maintaining financial integrity and preventing potential disputes in the state of Texas.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.