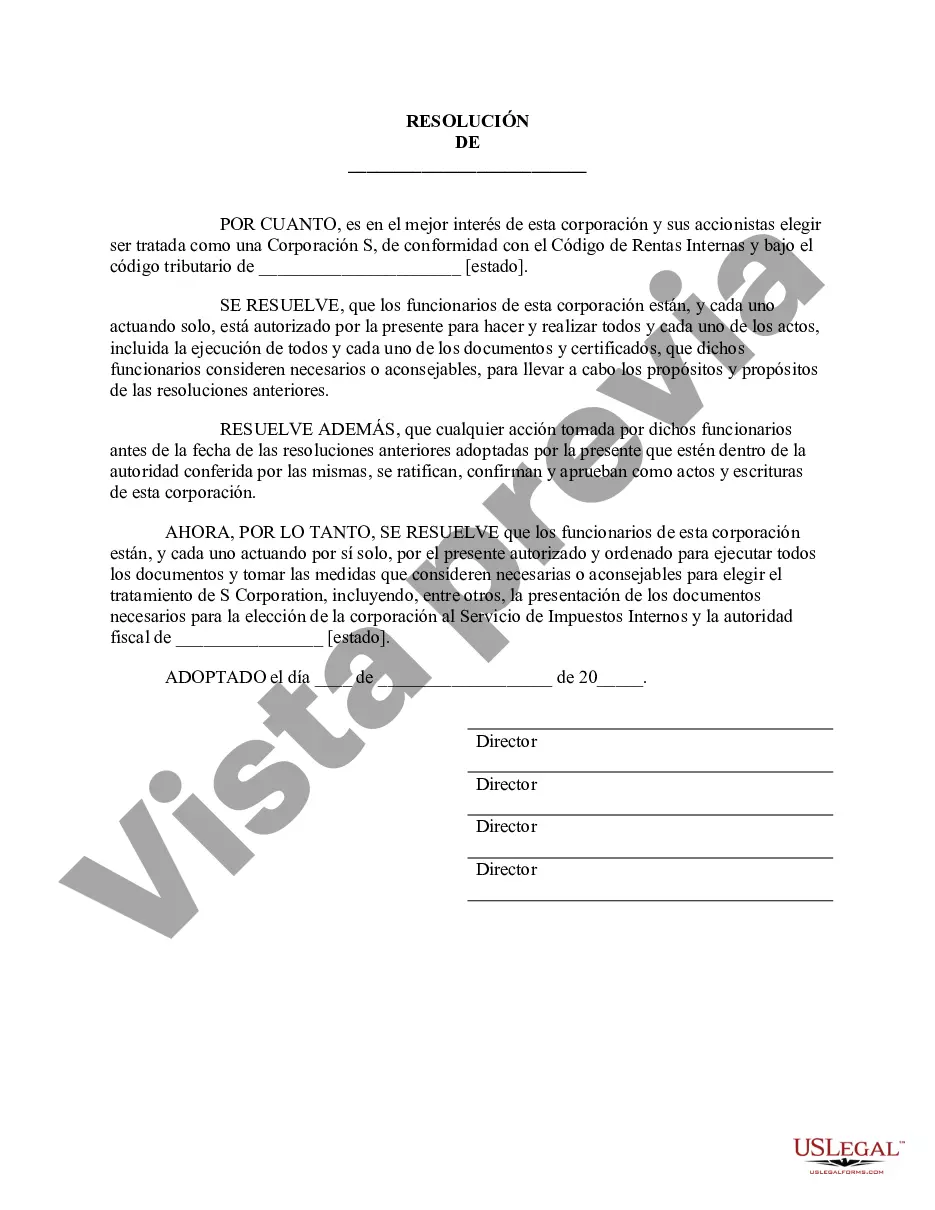

Texas Obtain S Corporation Status — Corporate Resolutions Forms refer to the legal documents required to establish an S Corporation in the state of Texas. An S Corporation is a type of corporation that offers certain tax advantages while maintaining the limited liability protection of a standard corporation. To obtain S Corporation status in Texas, several steps need to be followed, and various corporate resolutions forms are required to be filled out and submitted. These forms assist in outlining the decisions made by the corporation's board of directors or shareholders and serve as the official record of these decisions. The following are some common types of Texas Obtain S Corporation Status — Corporate Resolutions Forms: 1. Resolution to Elect S Corporation Status: This form includes a resolution passed by the board of directors or shareholders, indicating the decision to elect S Corporation status. It specifies the effective date of the election and confirms that the corporation meets the eligibility requirements set by the Internal Revenue Service (IRS). 2. Certificate of Formation: This form is submitted to the Texas Secretary of State and serves as the official document creating the S Corporation. It includes essential information such as the corporation's name, registered agent, and principal place of business. 3. Resolution for the Adoption of Bylaws: Bylaws are the internal rules guiding the corporation's operation. This resolution form includes the adoption of the bylaws, which outline the rights and responsibilities of the shareholders, directors, and officers, as well as procedures for meetings and decision-making. 4. Resolution to Appoint Officers: This form records the decision to appoint officers of the S Corporation, such as the President, Vice President, Secretary, and Treasurer. It specifies their roles and responsibilities within the organization. 5. Resolution to Authorize Stock Issuance: This form is used when authorizing the issuance of shares of stock to shareholders. It states the number of shares to be issued, their par value (if any), and any conditions attached to the issuance. 6. Resolution to Open Bank Accounts: This document authorizes the opening of bank accounts in the corporation's name. It typically includes details such as the name of the bank, the type of account, and the authorized signatories. By fulfilling the necessary requirements and submitting these relevant Texas Obtain S Corporation Status — Corporate Resolutions Forms, a corporation can successfully obtain S Corporation status, allowing it to take advantage of certain tax benefits while operating as a separate legal entity. However, it is essential to consult with an attorney or tax professional familiar with Texas business laws to ensure compliance with all legal obligations during this process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Texas Obtener el estado de S Corporation - Formularios de resoluciones corporativas - Obtain S Corporation Status - Corporate Resolutions Forms

Description

How to fill out Texas Obtener El Estado De S Corporation - Formularios De Resoluciones Corporativas?

Choosing the right lawful record format could be a have difficulties. Of course, there are tons of themes available on the net, but how will you get the lawful form you need? Take advantage of the US Legal Forms website. The service gives 1000s of themes, including the Texas Obtain S Corporation Status - Corporate Resolutions Forms, that you can use for company and personal demands. Every one of the forms are checked out by professionals and fulfill federal and state specifications.

When you are currently registered, log in in your profile and then click the Down load switch to obtain the Texas Obtain S Corporation Status - Corporate Resolutions Forms. Make use of your profile to look throughout the lawful forms you possess acquired earlier. Go to the My Forms tab of the profile and get another copy of your record you need.

When you are a brand new end user of US Legal Forms, allow me to share basic recommendations that you can stick to:

- First, make sure you have selected the right form for your personal city/region. You are able to check out the shape utilizing the Preview switch and read the shape outline to make sure it is the best for you.

- When the form does not fulfill your requirements, take advantage of the Seach area to find the correct form.

- Once you are certain the shape is suitable, select the Get now switch to obtain the form.

- Choose the pricing strategy you would like and type in the required details. Create your profile and purchase an order making use of your PayPal profile or charge card.

- Opt for the file formatting and obtain the lawful record format in your device.

- Complete, revise and print and sign the obtained Texas Obtain S Corporation Status - Corporate Resolutions Forms.

US Legal Forms will be the most significant catalogue of lawful forms that you can see a variety of record themes. Take advantage of the company to obtain expertly-manufactured files that stick to condition specifications.