Texas Corporation - Transfer of Stock

Description

How to fill out Corporation - Transfer Of Stock?

Finding the appropriate legal document template can be challenging.

Certainly, there are numerous templates accessible online, but how do you acquire the legal form you need.

Utilize the US Legal Forms website. This service provides a vast array of templates, including the Texas Corporation - Transfer of Stock, which you can utilize for professional and personal purposes.

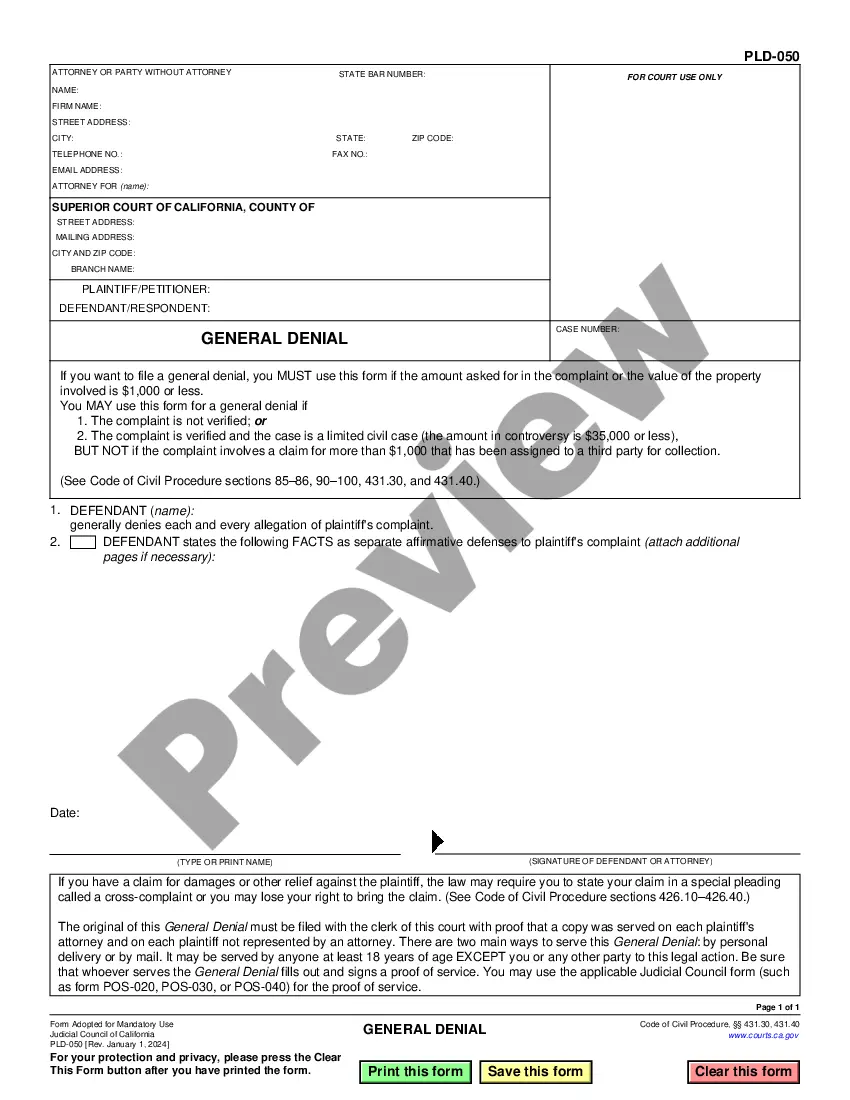

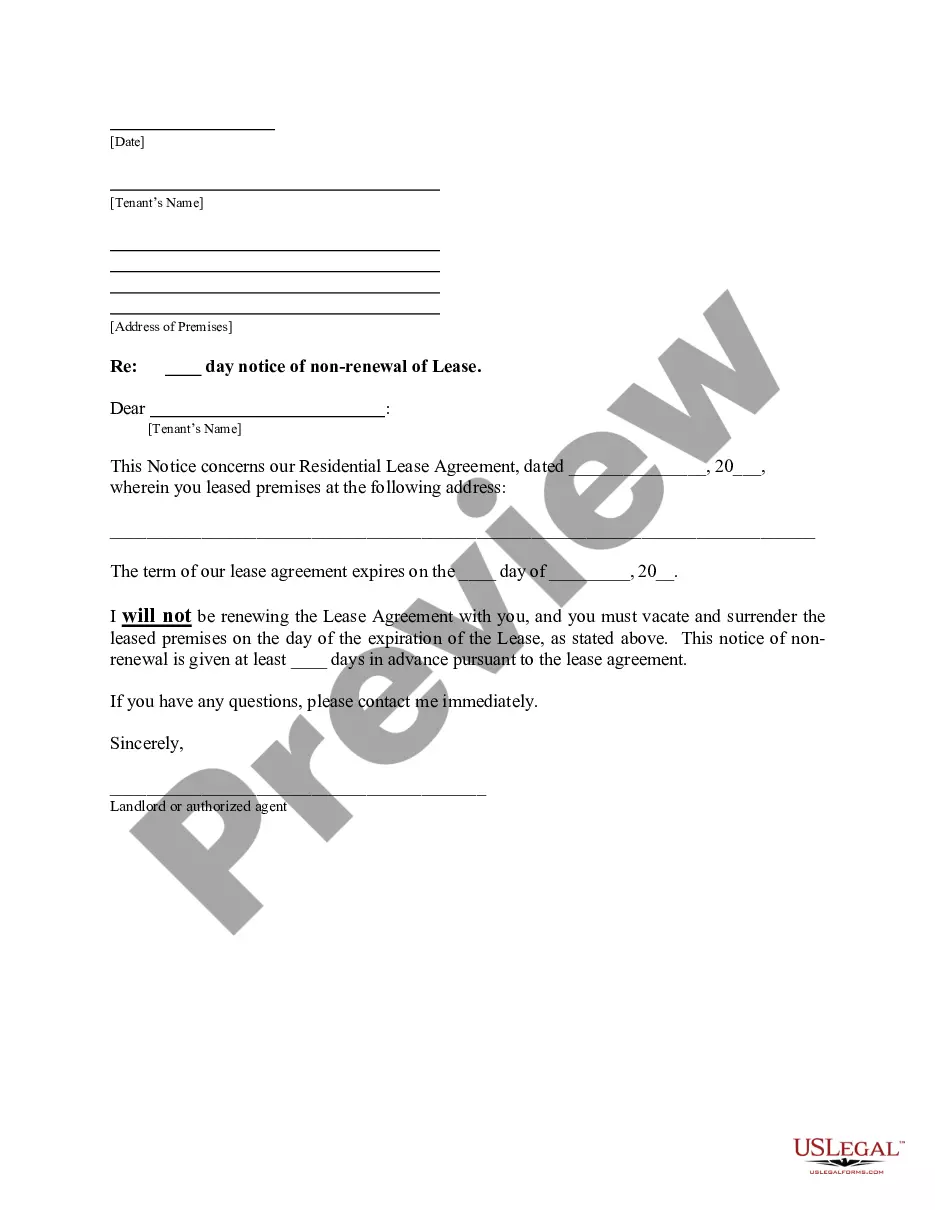

You can view the form using the Review option and check the form details to confirm it meets your requirements.

- All forms are reviewed by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to retrieve the Texas Corporation - Transfer of Stock.

- Use your account to browse the legal forms you have previously purchased.

- Visit the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are straightforward steps to follow.

- First, ensure you have selected the correct form for your city/region.

Form popularity

FAQ

To file form 424 with the Secretary of State in Texas, you will need to complete the application and gather any required documents, such as the stock transfer agreement. Once you have all necessary paperwork, submit it along with any applicable fees to the Secretary of State's office. This process ensures that your Texas Corporation - Transfer of Stock is officially recognized and compliant with state regulations.

Ownership in a corporation is not difficult to transfer when following the proper procedures. The structured nature of stock ownership makes the transition relatively simple compared to other business structures. Therefore, with a clear understanding and adherence to the Texas Corporation - Transfer of Stock regulations, you can effectively execute transfers without high complication.

Yes, corporations are generally much easier for transferring ownership through stock than other forms of business. The existence of shares allows for clear, defined transfers of ownership without disrupting the operational aspects of the business. Therefore, the Texas Corporation - Transfer of Stock process makes it straightforward to buy and sell shares, facilitating smooth transitions.

Article 2.21 of the Texas Business Corporation Act addresses the lawful and binding nature of stock transfers. It outlines the requirements for valid transfers, ensuring that all stock transactions comply with state law. Understanding this article provides important insights into how to handle Texas Corporation - Transfer of Stock transactions correctly and legally.

Stock ownership in a corporation is usually easier to transfer than ownership in other business structures, such as sole proprietorships or partnerships. Shares can be transferred with minimal paperwork, often just requiring a signed document and an update to the stock ledger. As a result, the Texas Corporation - Transfer of Stock process offers clear advantages for those looking to divest or acquire ownership.

Yes, transferring ownership in a corporation is generally easier compared to a sole proprietorship. In a sole proprietorship, the owner must sell the entire business, including assets and liabilities, which can be complicated. However, with a Texas corporation, you can easily transfer stock ownership without needing to change the underlying business. This flexibility is a key benefit of Texas Corporation - Transfer of Stock.

To transfer ownership of stock in a Texas corporation, you typically need to execute a stock transfer agreement. This document outlines the terms of the transfer and must be signed by both the buyer and the seller. After that, you should update the corporation's stock ledger to reflect the new ownership. Remember, completing the transfer properly ensures that the Texas Corporation - Transfer of Stock process goes smoothly.

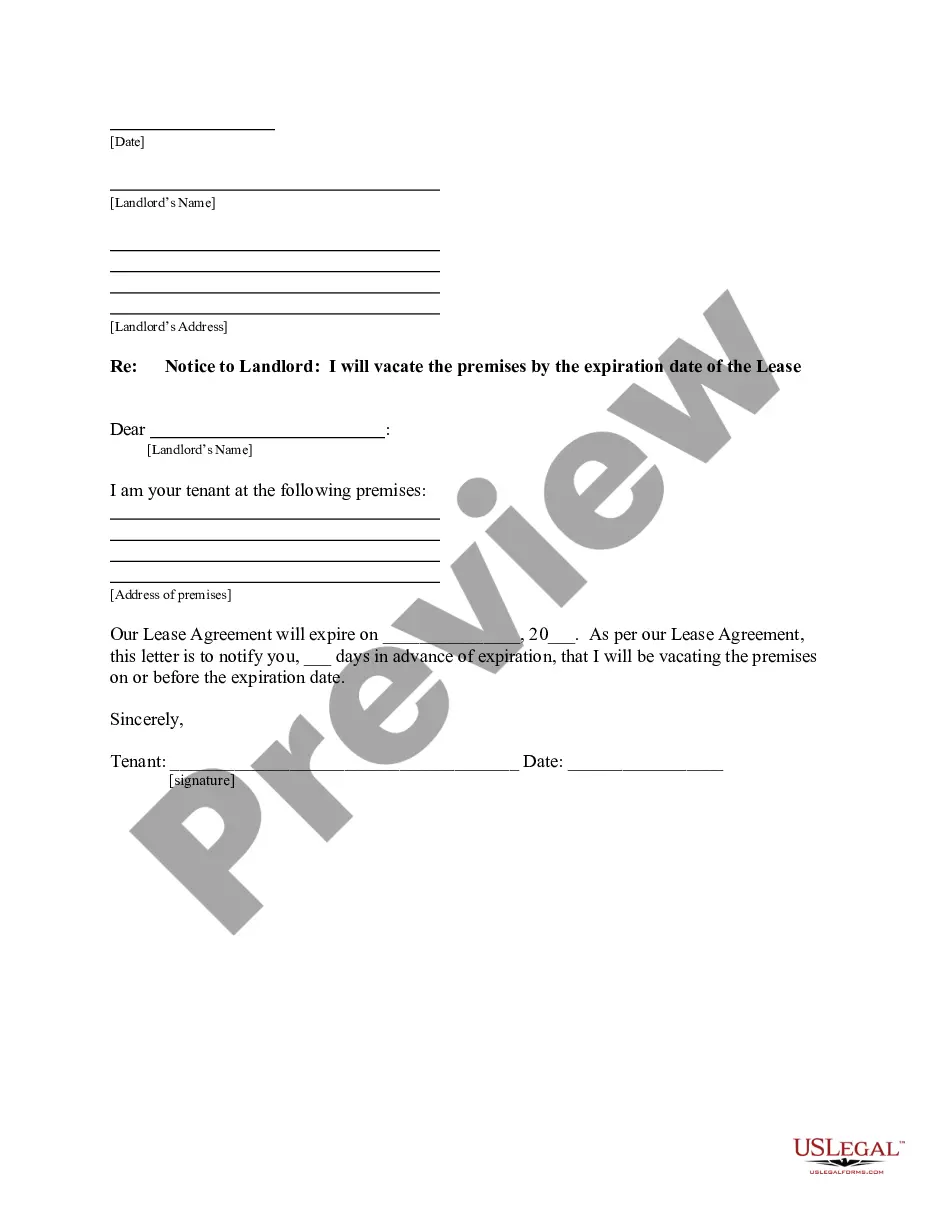

Transferring ownership of a company's shares requires a straightforward process. First, the current shareholder informs the corporation about the transfer and completes any necessary documentation, such as a stock transfer form. The company must then approve the transfer and issue a new stock certificate to the new owner. If you're looking for assistance with Texas Corporation - Transfer of Stock, US Legal Forms can provide the documents and support you need to streamline this procedure.

To transfer shares in a corporation, begin by reviewing the company’s governing documents, as they detail how stock transfers should be handled. Next, execute a stock transfer agreement that includes information about the shares and the parties involved. Finally, submit the agreement to the corporation for acknowledgment and the issuance of a new stock certificate. For a smooth experience, consider using resources like US Legal Forms, which offer templates specific to Texas Corporation - Transfer of Stock.

The procedure for transferring shares in a company includes notifying the corporation and obtaining any required approvals from the board of directors or shareholders. You will need to complete a stock transfer form and present it to the corporation for processing. After approval, the corporation reissues the stock certificate to reflect the new owner. Services such as US Legal Forms can help ensure you comply with the necessary legal requirements for Texas Corporation - Transfer of Stock.