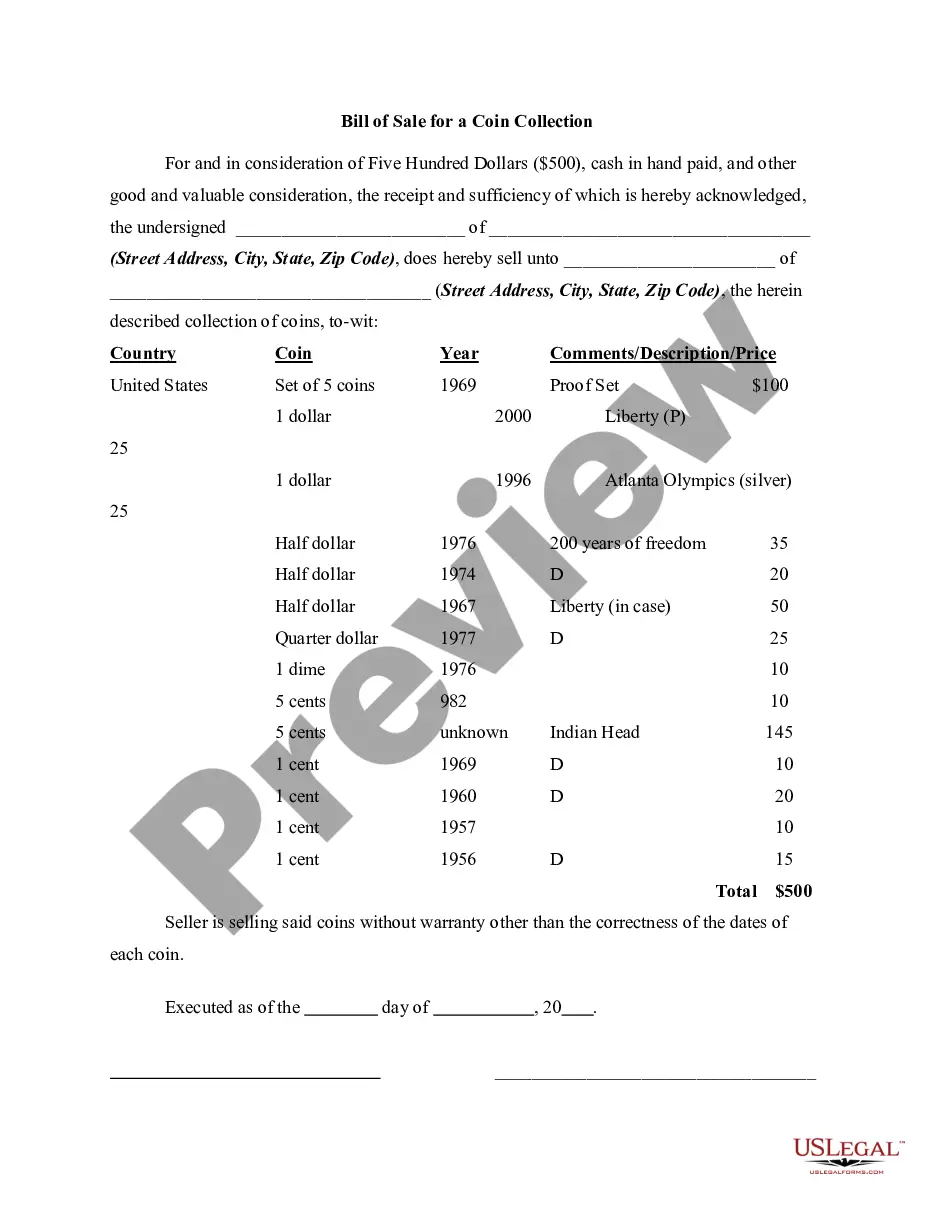

Texas Bill of Sale for a Coin Collection

Description

How to fill out Bill Of Sale For A Coin Collection?

Are you in a situation where you require documentation for both corporate or personal purposes almost daily? There are numerous legal document templates accessible online, but locating trustworthy versions can be challenging.

US Legal Forms offers thousands of document templates, including the Texas Bill of Sale for a Coin Collection, designed to meet federal and state requirements.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. After that, you can download the Texas Bill of Sale for a Coin Collection template.

- Locate the form you need and ensure it corresponds to your specific city/county.

- Use the Preview button to view the form.

- Check the description to verify that you have chosen the correct form.

- If the form is not what you’re looking for, utilize the Lookup field to find the form that fits your needs and requirements.

- Once you find the appropriate form, click Acquire now.

- Choose the pricing plan you prefer, enter the required information to create your account, and pay for the order using your PayPal or credit card.

- Select a convenient file format and download your copy.

Form popularity

FAQ

Yes, a handwritten bill of sale for a coin collection can be a legitimate document if it includes all necessary details. When creating your Texas Bill of Sale for a Coin Collection, ensure it contains the names of both the buyer and seller, a description of the coins, and the date of the transaction. This document serves as a vital record of the sale, offering protection for both parties involved. If you prefer a more structured format, consider using the templates available on the uslegalforms platform, which can simplify the process.

Yes, coin collections can be subject to taxes when sold for a profit. The IRS views them as collectibles, which means the gains from their sale must be reported. Keeping detailed records of your purchases and sales, including a Texas Bill of Sale for a Coin Collection, can simplify your tax obligations.

You may receive a 1099 form if you sell coins through a dealer or platform that reports these transactions to the IRS. The requirement generally applies if you earn over a certain threshold. Keep in mind that using a Texas Bill of Sale for a Coin Collection helps track your transactions, making tax reporting easier.

Yes, you must report income from selling collectibles, including coins, if you make a profit. The IRS considers these transactions taxable. It's important to keep records of both your purchases and sales to make reporting easier. Using a Texas Bill of Sale for a Coin Collection adds clarity and security to your records.

To have a coin collection appraised, seek out a certified appraiser or a reputable coin dealer with experience in valuing collections. They will evaluate your coins based on their condition, rarity, and current market demand. It's a good idea to document the appraisal with a Texas Bill of Sale for a Coin Collection, especially if you plan to sell.

Yes, a coin collection can be taxable. If you sell coins for a profit, you may owe taxes on the gains. Keeping detailed records of your purchases will help when reporting any profits on your tax return. Additionally, using a Texas Bill of Sale for a Coin Collection provides a clear record should you need to report the transaction.

Selling a coin collection safely involves several steps. Start by obtaining a proper appraisal to understand the value. Next, use secure payment methods and consider engaging a reputable dealer. Lastly, document the sale with a Texas Bill of Sale for a Coin Collection to safeguard your transaction.

To sell an inherited coin collection, first assess the collection's value. You can consult with a professional coin dealer or appraiser. Once you have a valuation, draft a Texas Bill of Sale for a Coin Collection to facilitate the sale. This document helps ensure that the transaction is legal and protects both parties.

Filling out a Texas Bill of Sale for a Coin Collection starts with gathering relevant information about both the seller and the buyer. Include names, addresses, and contact details, along with the sale date and amount. Describe the coin collection thoroughly so that both parties have a clear understanding of what is being sold. Using a reliable platform like uslegalforms can simplify this process by providing templates that guide you step-by-step.

Yes, a bill of sale can still be valid in Texas even if it is not notarized. While notarization can help verify identities and reduce the chance of fraud, the essential elements of the bill of sale are what truly determine its validity. When documenting your Texas Bill of Sale for a Coin Collection, focus on providing clear information to ensure validity regardless of notarization.