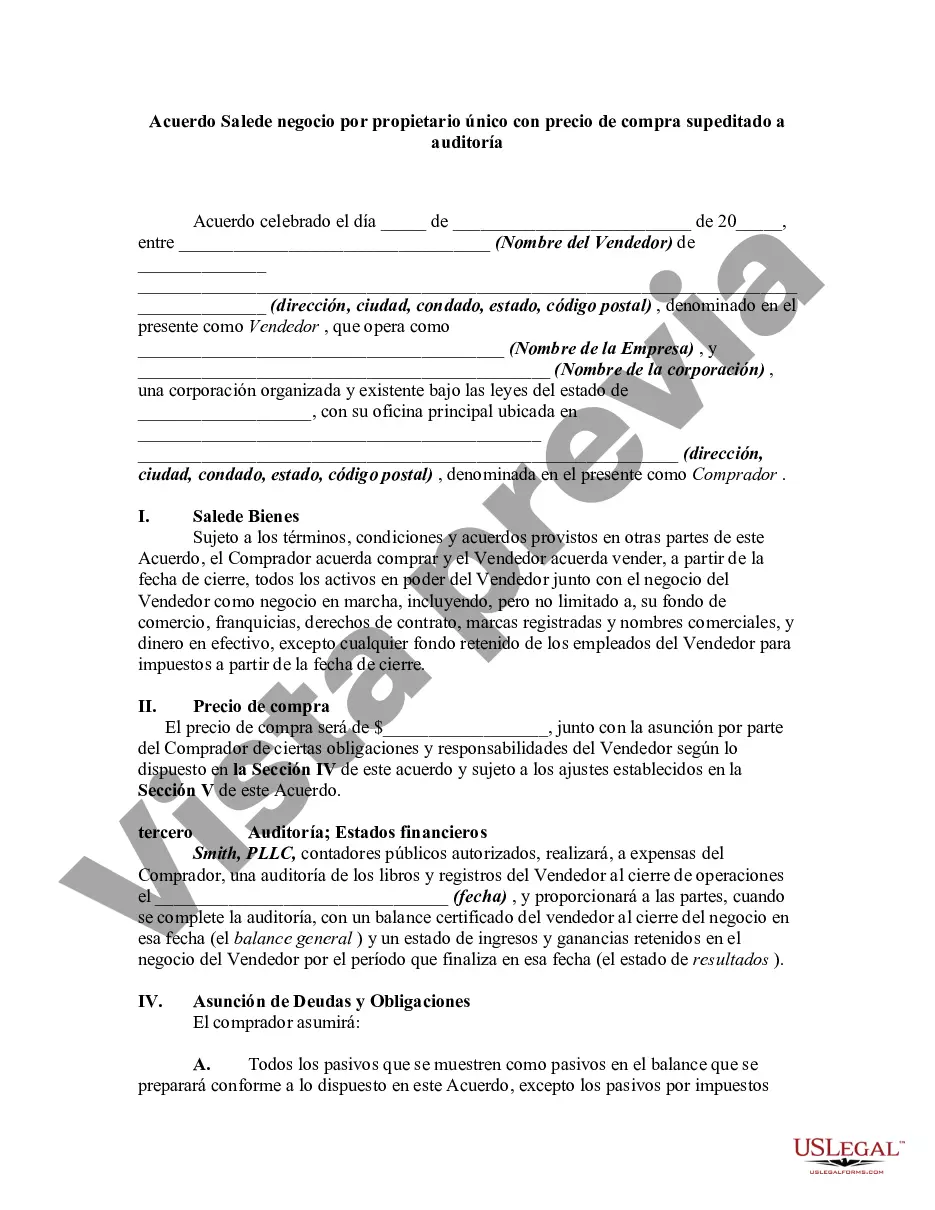

The Texas Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit is a legal document used when a sole proprietor intends to sell their business to a buyer and the purchase price is dependent on the results of an audit. This agreement outlines the terms and conditions under which the business will be transferred, including financial obligations, responsibilities, and buyer's rights. In Texas, there are two main types of agreements for the sale of business by sole proprietorship with purchase price contingent on audit: 1. Texas Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit — This agreement refers to a standard arrangement where the buyer and the sole proprietor agree to conduct a thorough audit of the business's financial records before finalizing the purchase price. This enables the buyer to assess the actual profitability and liabilities of the business, allowing them to make an informed decision about the purchase. 2. Texas Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit and Performance — This type of agreement includes an additional clause that not only relies on the audit results but also on the performance of the business during a specific period after the sale. The buyer may propose certain milestones or financial targets that the business must achieve to ensure the purchase price remains as initially agreed. If the business fails to meet these targets, the purchase price could be adjusted accordingly. Key elements that are typically included in the Texas Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit are: 1. Parties' Information: This section identifies the buyer and the sole proprietor, including their legal names, addresses, and contact details. 2. Purchase Price Contingencies: The agreement clearly states that the final purchase price will depend on the results of the audit or performance of the business, depending on the specific type of agreement chosen. 3. Audit Process: This section outlines the obligations and responsibilities of both parties during the audit, including access to financial records, the timeframe for completing the audit, and any limitations or conditions. 4. Adjustments to Purchase Price: In case the audit or performance results reveal discrepancies or targets are not met, this section specifies the mechanisms for adjusting the purchase price. It may include formulas, calculations, and negotiation procedures. 5. Representations and Warranties: The agreement includes a section where the sole proprietor represents that all the provided financial information is accurate and complete, and there are no undisclosed liabilities or obligations. 6. Confidentiality and Non-Compete: These provisions protect the buyer's interests by ensuring that the sole proprietor will not disclose confidential business information or engage in competitive activities that could harm the sold business. It's important to note that this content is a general description, and while it covers the main aspects, consulting with a legal professional is highly recommended when drafting or finalizing a Texas Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit, as each situation may have specific requirements or considerations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Texas Acuerdo de venta de negocio por propietario único con precio de compra sujeto a auditoría - Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit

Description

How to fill out Texas Acuerdo De Venta De Negocio Por Propietario único Con Precio De Compra Sujeto A Auditoría?

Finding the right lawful document web template can be a battle. Naturally, there are tons of layouts available on the net, but how do you get the lawful kind you want? Utilize the US Legal Forms site. The service delivers 1000s of layouts, such as the Texas Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit, that can be used for business and private demands. Every one of the varieties are checked by specialists and satisfy state and federal needs.

If you are presently registered, log in to the account and click the Download option to get the Texas Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit. Utilize your account to check through the lawful varieties you have purchased formerly. Proceed to the My Forms tab of your own account and have an additional version from the document you want.

If you are a fresh customer of US Legal Forms, listed below are easy guidelines for you to adhere to:

- Initially, ensure you have chosen the right kind for your area/county. It is possible to look through the shape while using Preview option and look at the shape information to make certain it will be the right one for you.

- In the event the kind will not satisfy your expectations, use the Seach discipline to obtain the proper kind.

- When you are sure that the shape is acceptable, select the Buy now option to get the kind.

- Opt for the rates prepare you want and enter in the needed information and facts. Design your account and pay for the order with your PayPal account or bank card.

- Choose the file formatting and down load the lawful document web template to the device.

- Full, edit and produce and indicator the attained Texas Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit.

US Legal Forms is definitely the biggest catalogue of lawful varieties for which you can see different document layouts. Utilize the service to down load appropriately-manufactured files that adhere to condition needs.