A Texas Stock Sale and Purchase Agreement is a legally binding contract that outlines the terms and conditions for the sale and purchase of a corporation's stock between the seller, referred to as the "Vendor," and the buyer, known as the "Purchaser." This agreement is crucial in transactions involving the transfer of ownership and control of a company. The agreement typically includes important details such as the purchase price, payment terms, representations and warranties of both parties, post-closing obligations, and any specific conditions that must be met for the transaction to be completed successfully. It serves as a protective measure for both the seller and buyer to ensure a smooth transaction and avoid disputes or misunderstandings in the future. Keywords: Texas Stock Sale and Purchase Agreement, sale of corporation, stock purchase, Purchaser, Vendor, purchase price, payment terms, representations, warranties, post-closing obligations, transaction. There are different types of Texas Stock Sale and Purchase Agreements, distinguished based on specific circumstances or purposes. Some notable variations include: 1. Texas Stock Sale and Purchase Agreement — Asset Purchase: In this type of agreement, the Purchaser acquires only the specified assets of the corporation, rather than the entire stock. This might be preferable when the buyer is interested in particular assets but does not want to assume all liabilities or obligations of the company. 2. Texas Stock Sale and Purchase Agreement — Partial Stock Purchase: Unlike the complete purchase of stock, a partial stock purchase agreement involves acquiring less than 100% of the corporation's stock. This type of agreement is commonly used when there is a desire to maintain minority ownership or when there are multiple shareholders involved. 3. Texas Stock Sale and Purchase Agreement — Stock Redemption: This agreement is executed when the shareholders themselves agree to redeem a specific portion or all of their shares. It typically involves a predetermined price and conditions for the redemption, providing an exit strategy for shareholders or a means to reallocate ownership among existing shareholders. 4. Texas Stock Sale and Purchase Agreement — Merger or Acquisition: This type of agreement involves the acquisition of one corporation by another, typically resulting in the consolidation or absorption of the target company into the purchasing entity. It requires careful consideration of legal, financial, and operational aspects, making it one of the most complex types of agreements. In summary, a Texas Stock Sale and Purchase Agreement is an essential contract facilitating the transfer of a corporation's stock. It provides a framework for negotiations, defines the terms of the transaction, and protects the interests of both parties involved. With various types of agreements available, it is crucial to choose the most suitable one based on specific circumstances and objectives.

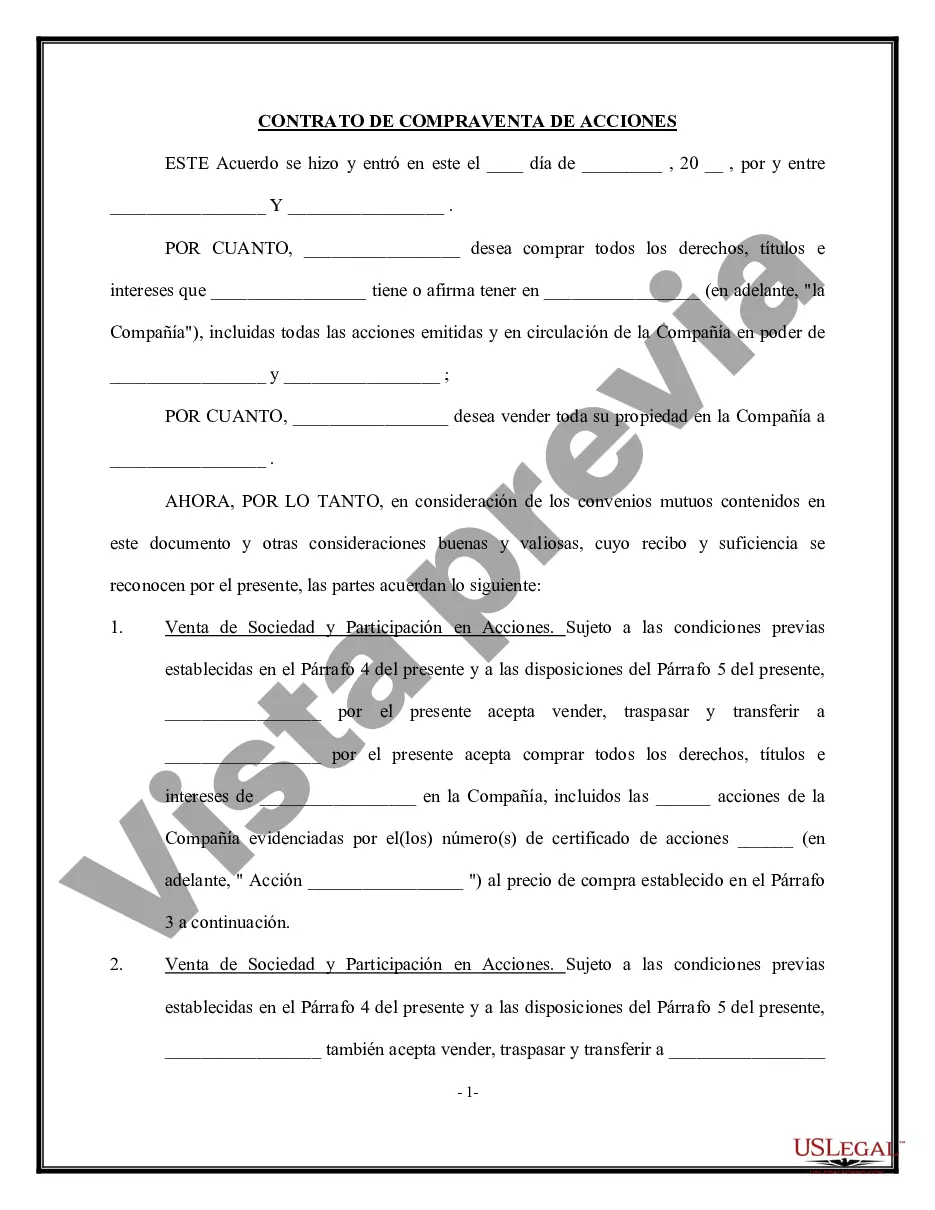

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Texas Acuerdo de compra y venta de acciones - Venta de la Corporación y todas las acciones al Comprador - Stock Sale and Purchase Agreement - Sale of Corporation and all stock to Purchaser

Description

How to fill out Texas Acuerdo De Compra Y Venta De Acciones - Venta De La Corporación Y Todas Las Acciones Al Comprador?

Are you within a placement the place you will need paperwork for both business or specific functions nearly every working day? There are tons of legal record themes available on the net, but getting kinds you can rely isn`t simple. US Legal Forms offers a large number of develop themes, much like the Texas Stock Sale and Purchase Agreement - Sale of Corporation and all stock to Purchaser, that happen to be composed to satisfy federal and state needs.

Should you be presently familiar with US Legal Forms internet site and have an account, simply log in. Afterward, you are able to down load the Texas Stock Sale and Purchase Agreement - Sale of Corporation and all stock to Purchaser template.

Should you not come with an profile and want to begin to use US Legal Forms, abide by these steps:

- Find the develop you require and make sure it is to the right city/county.

- Use the Review switch to check the form.

- See the description to ensure that you have selected the correct develop.

- If the develop isn`t what you`re searching for, make use of the Lookup industry to obtain the develop that suits you and needs.

- If you obtain the right develop, just click Acquire now.

- Pick the pricing plan you desire, fill out the specified information to make your money, and buy the transaction with your PayPal or bank card.

- Pick a handy file format and down load your version.

Locate all the record themes you possess purchased in the My Forms menus. You can aquire a extra version of Texas Stock Sale and Purchase Agreement - Sale of Corporation and all stock to Purchaser whenever, if possible. Just go through the required develop to down load or print out the record template.

Use US Legal Forms, the most comprehensive selection of legal types, in order to save efforts and avoid mistakes. The service offers expertly made legal record themes which can be used for a selection of functions. Make an account on US Legal Forms and commence producing your life a little easier.