Title: Texas Letter to Creditors Notifying Them of Identity Theft of Minor for New Accounts Description: When it comes to protecting minors from identity theft, Texas has specific laws and regulations in place to safeguard their financial wellbeing. In the unfortunate event of identity theft targeted towards a minor, it becomes crucial to notify the creditors about the fraudulent activities. This description will provide a detailed overview of what a Texas Letter to Creditors Notifying Them of Identity Theft of Minor for New Accounts should include, while incorporating relevant keywords. Keywords: Texas, letter to creditors, identity theft, minor, new accounts, notification, fraud, prevention, financial protection 1. Texas Letter to Creditors: This type of letter is specifically designed for use within the state of Texas. It ensures compliance with state-specific regulations and laws concerning minors and identity theft. 2. Identity Theft of a Minor: This refers to the unauthorized use of a minor's personal information to open new accounts or engage in fraudulent activities. It can have severe consequences on a minor's future financial stability if left unaddressed. 3. Letter Content: The Texas Letter to Creditors Notifying Them of Identity Theft of Minor for New Accounts should contain essential information such as: a. Minor's Personal Information: Include the minor's full name, date of birth, and current address. b. Identity Theft Details: Detail the suspicious activities that led to the discovery of identity theft. Provide any relevant documentation, such as police reports or credit monitoring alerts. c. Account Information: If any fraudulent accounts have been opened, provide their specific details, such as account numbers, names of financial institutions, and dates of opening. d. Request for Action: Clearly state the purpose of the letter, which is to inform the creditors about the identity theft. Request their immediate action to freeze or close the fraudulent accounts associated with the minor. e. Supporting Documentation: Enclose copies of the minor's identification documents, police reports, and any relevant supporting materials to strengthen the identity theft claim. f. Contact Information: Provide contact information for further communication and clarification. 4. Fraud Prevention and Financial Protection: Emphasize the importance of taking immediate action to prevent further unauthorized activities. Mention the significance of protecting the minor's financial future by stopping the identity thief's access to accounts and credit. 5. Compliance with Texas Laws: Include information about Texas laws governing identity theft, specifically those related to minors. Highlight the legal responsibility of financial institutions to cooperate and provide assistance in resolving the matter. By utilizing the relevant keywords throughout your Texas Letter to Creditors Notifying Them of Identity Theft of Minor for New Accounts, you can effectively communicate the seriousness of the situation and prompt the necessary actions to secure the minor's financial well-being.

Texas Letter to Creditors Notifying Them of Identity Theft of Minor for New Accounts

Description

How to fill out Texas Letter To Creditors Notifying Them Of Identity Theft Of Minor For New Accounts?

Have you been in a placement in which you will need files for possibly enterprise or person reasons almost every day? There are plenty of legal record templates accessible on the Internet, but discovering versions you can rely on is not effortless. US Legal Forms delivers thousands of type templates, just like the Texas Letter to Creditors Notifying Them of Identity Theft of Minor for New Accounts, which can be created to fulfill state and federal demands.

When you are previously familiar with US Legal Forms internet site and also have your account, just log in. Next, you are able to down load the Texas Letter to Creditors Notifying Them of Identity Theft of Minor for New Accounts template.

Unless you provide an accounts and wish to begin using US Legal Forms, adopt these measures:

- Discover the type you need and make sure it is to the proper metropolis/county.

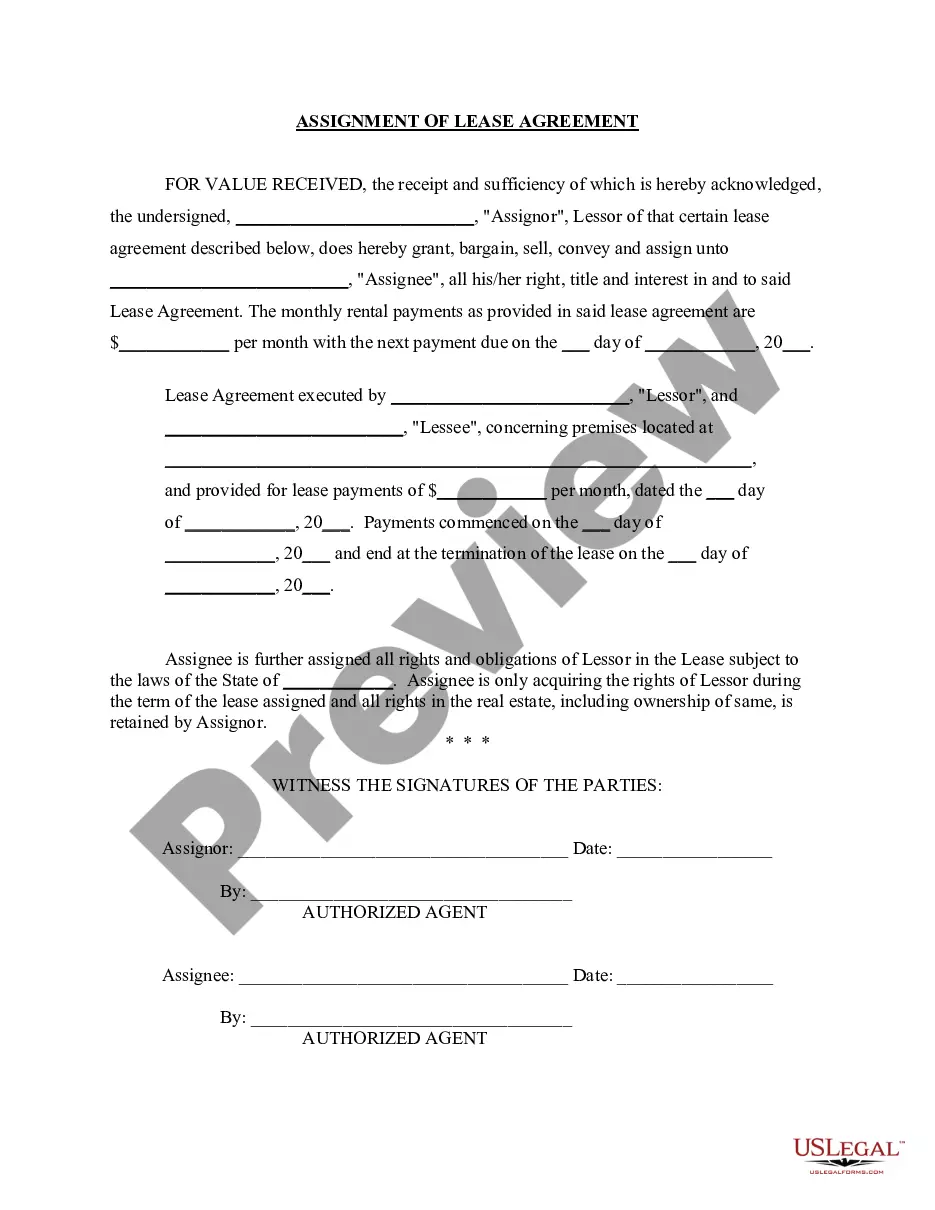

- Take advantage of the Preview switch to check the shape.

- See the explanation to ensure that you have selected the right type.

- In the event the type is not what you are seeking, make use of the Research field to obtain the type that suits you and demands.

- When you get the proper type, click Purchase now.

- Choose the prices prepare you desire, fill in the required information and facts to produce your account, and pay for the order using your PayPal or Visa or Mastercard.

- Decide on a hassle-free file format and down load your duplicate.

Get each of the record templates you may have bought in the My Forms food list. You can obtain a extra duplicate of Texas Letter to Creditors Notifying Them of Identity Theft of Minor for New Accounts any time, if necessary. Just select the required type to down load or print out the record template.

Use US Legal Forms, one of the most substantial collection of legal types, to conserve time as well as avoid mistakes. The service delivers professionally made legal record templates that can be used for a selection of reasons. Produce your account on US Legal Forms and commence making your daily life a little easier.