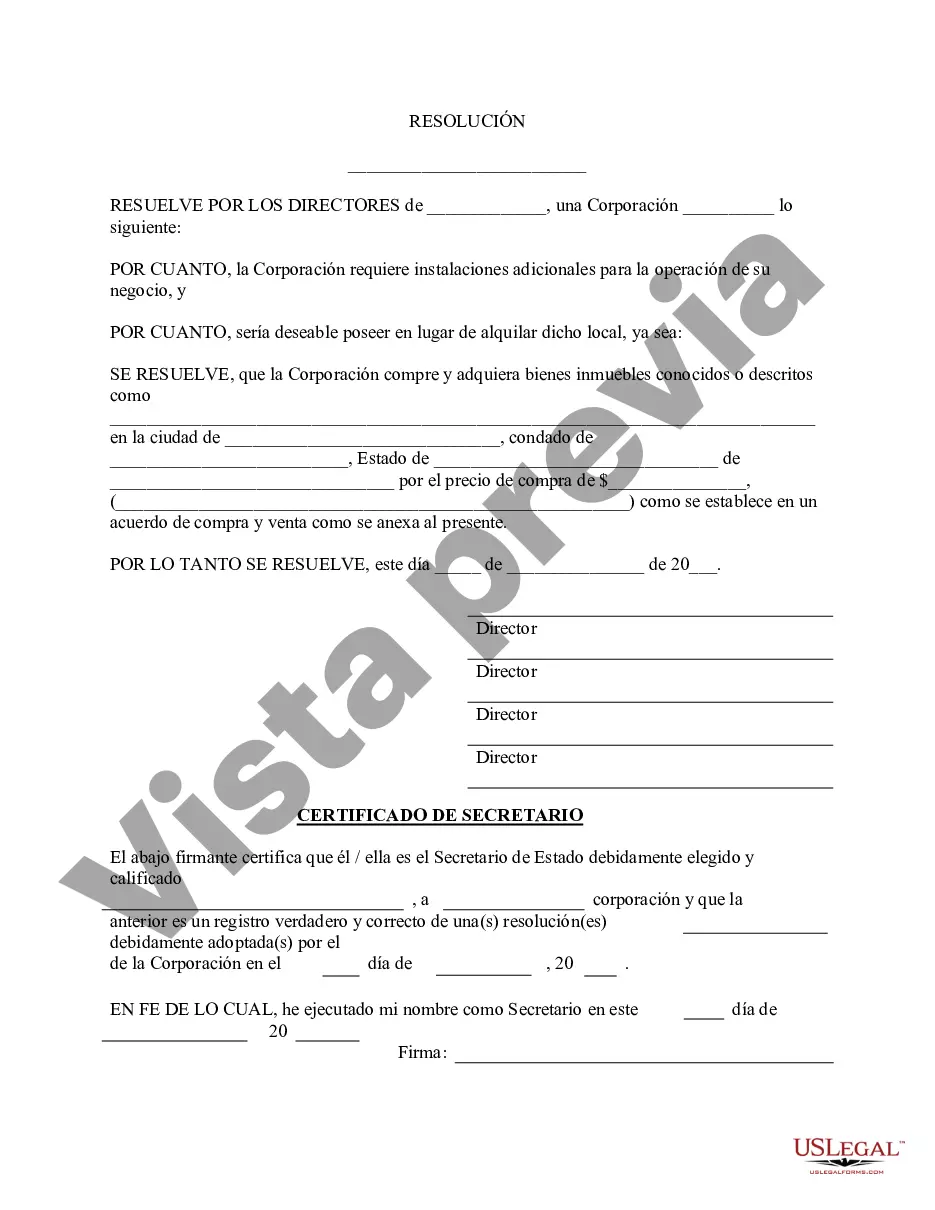

Texas Purchase Real Estate — Resolution For— - Corporate Resolutions is a legal document used by corporations in Texas to formally authorize the purchase of real estate. This form is crucial in ensuring that all necessary corporate approvals are obtained before entering into any real estate transactions. The Texas Purchase Real Estate — Resolution For— - Corporate Resolutions typically includes the following key elements: 1. Corporate information: The form begins by providing a space for the corporation's full legal name, its registered address, and its federal employer identification number (EIN). 2. Title of the resolution: This section outlines the purpose of the resolution, which in this case is the purchase of real estate. It specifies that the corporation intends to acquire a particular property and describes the expected terms of the transaction. 3. Identification of authorized parties: The resolution form includes a space to mention the individual(s) authorized to execute the transaction on behalf of the corporation. This ensures that only designated individuals can bind the corporation legally in the real estate purchase. 4. Board approval: This part of the form requires the board of directors to approve the real estate purchase. It may include space for recording the date of the meeting where the resolution was adopted and the names of directors present at the meeting. 5. Shareholder approval (if applicable): In certain situations, corporate bylaws or regulations may necessitate obtaining shareholder approval for significant real estate transactions. In such cases, this section of the form provides space to document the shareholders' consent and their voting percentages. Different types of Texas Purchase Real Estate — Resolution Form— - Corporate Resolutions can exist based on the specific requirements and circumstances of the corporation. Some potential variations may include: 1. Texas Purchase Real Estate — Resolution For— - Corporate Resolutions for LCS: Limited Liability Companies (LCS) may have a separate resolution form tailored to the unique organizational and governance structure of an LLC. 2. Texas Purchase Real Estate — Resolution For— - Corporate Resolutions for Partnerships: Partnerships, including Limited Partnerships (LPs) and Limited Liability Partnerships (Laps), may have their own version of this resolution form, considering their partnership agreements and any specific requirements. 3. Texas Purchase Real Estate — Resolution For— - Corporate Resolutions for Non-Profit Corporations: Non-profit corporations may require specific provisions, as they must adhere to applicable tax-exempt regulations and guidelines in their real estate transactions. It is important for corporations in Texas to ensure that the Texas Purchase Real Estate — Resolution For— - Corporate Resolutions is properly completed, signed, and maintained as part of their corporate records. This documents the necessary internal authorizations and helps protect the corporation's legal rights in real estate matters.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Texas Compra de Bienes Raíces - Formulario de Resolución - Resoluciones Corporativas - Purchase Real Estate - Resolution Form - Corporate Resolutions

Description

How to fill out Texas Compra De Bienes Raíces - Formulario De Resolución - Resoluciones Corporativas?

If you wish to complete, down load, or print out legal papers web templates, use US Legal Forms, the most important selection of legal types, that can be found on the web. Take advantage of the site`s easy and handy look for to discover the documents you want. Different web templates for enterprise and specific reasons are categorized by classes and states, or keywords. Use US Legal Forms to discover the Texas Purchase Real Estate - Resolution Form - Corporate Resolutions in just a few clicks.

In case you are presently a US Legal Forms buyer, log in to the bank account and click on the Download key to have the Texas Purchase Real Estate - Resolution Form - Corporate Resolutions. You can even gain access to types you in the past delivered electronically in the My Forms tab of your own bank account.

If you are using US Legal Forms the very first time, refer to the instructions below:

- Step 1. Be sure you have selected the shape for your proper town/country.

- Step 2. Use the Review method to look through the form`s content material. Don`t overlook to read through the description.

- Step 3. In case you are not happy using the form, take advantage of the Research industry towards the top of the display screen to find other models of the legal form template.

- Step 4. Upon having identified the shape you want, click on the Get now key. Opt for the rates strategy you like and add your credentials to sign up on an bank account.

- Step 5. Method the transaction. You can use your bank card or PayPal bank account to complete the transaction.

- Step 6. Find the format of the legal form and down load it in your product.

- Step 7. Total, change and print out or indicator the Texas Purchase Real Estate - Resolution Form - Corporate Resolutions.

Every legal papers template you acquire is yours for a long time. You might have acces to each and every form you delivered electronically with your acccount. Go through the My Forms segment and select a form to print out or down load yet again.

Contend and down load, and print out the Texas Purchase Real Estate - Resolution Form - Corporate Resolutions with US Legal Forms. There are thousands of professional and state-certain types you can utilize for your enterprise or specific requires.